With the $USD short squeeze underway, various parts of the stock market are correcting — some more than others.

We expect Emerging Markets $EEM to be under some serious pressure, considering the index doubled from March to March and traded as high as 33% above its 1-year mean.

We expect Emerging Markets $EEM to be under some serious pressure, considering the index doubled from March to March and traded as high as 33% above its 1-year mean.

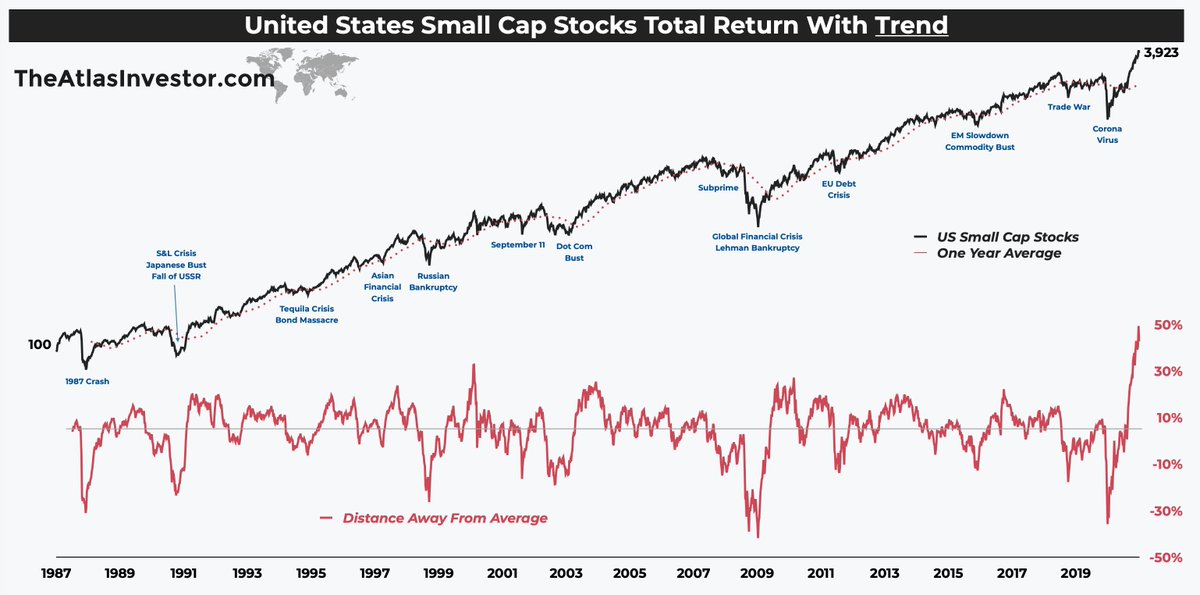

Another one worth watching is the S&P small caps. $IJR

Followers will remember our bullish call during the Covid panic.

The situation has completely changed!

The index traded almost 50% above the 1-year mean. We believe it will probably crash by 20 to 30% from here.

Followers will remember our bullish call during the Covid panic.

The situation has completely changed!

The index traded almost 50% above the 1-year mean. We believe it will probably crash by 20 to 30% from here.

Finally, focusing on the S&P Energy small caps. $PSCE

From October 2020 to March of this year is a rally for the history books.

The index rallied a staggering 90% above its 1-year mean.

Folks, markets are mean reverting and gravity is real. Expect some serious downside here.

From October 2020 to March of this year is a rally for the history books.

The index rallied a staggering 90% above its 1-year mean.

Folks, markets are mean reverting and gravity is real. Expect some serious downside here.

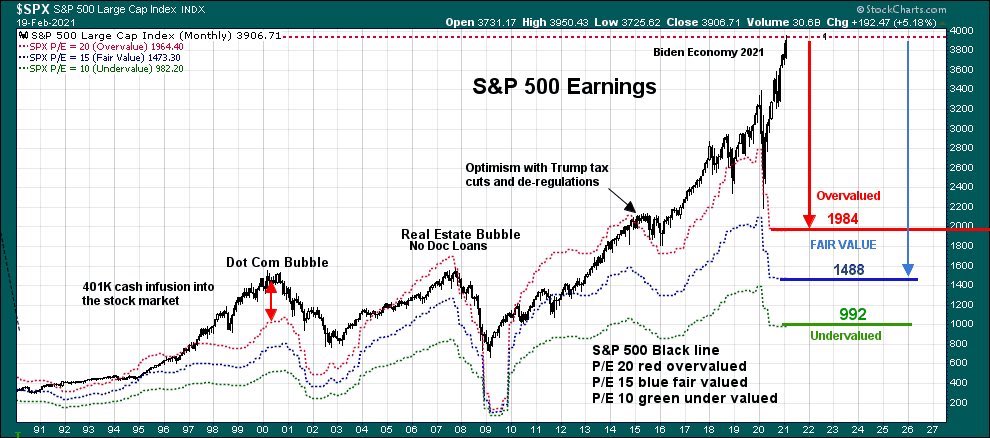

A lot of sectors could correct meaningfully after a fantastic run over the last 12 months. Broad stocks face several headwinds including:

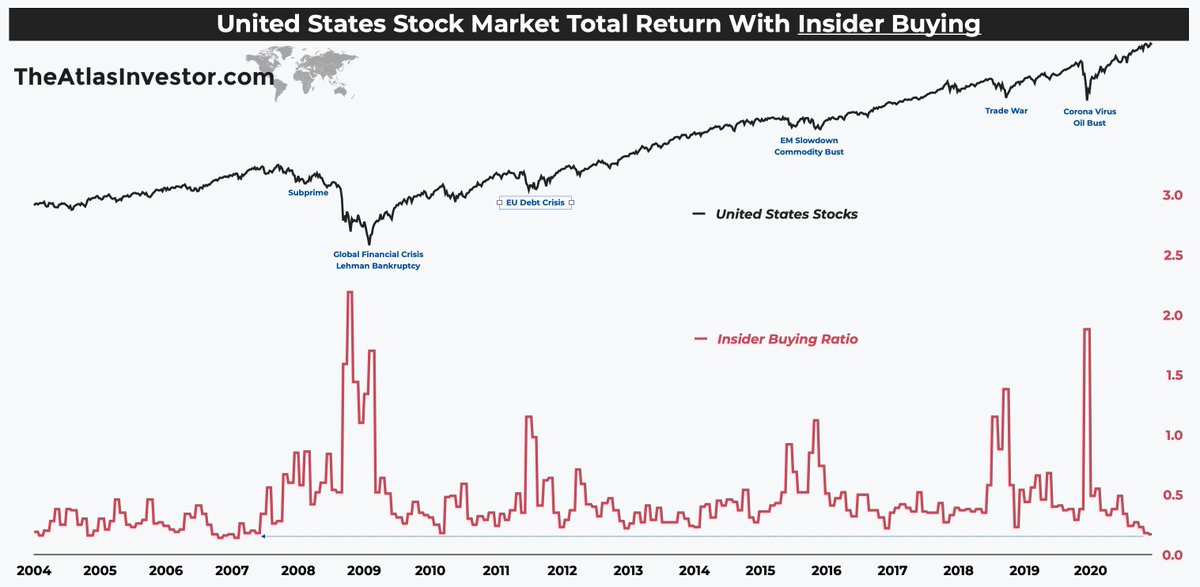

• strongest insider selling since 2007 top

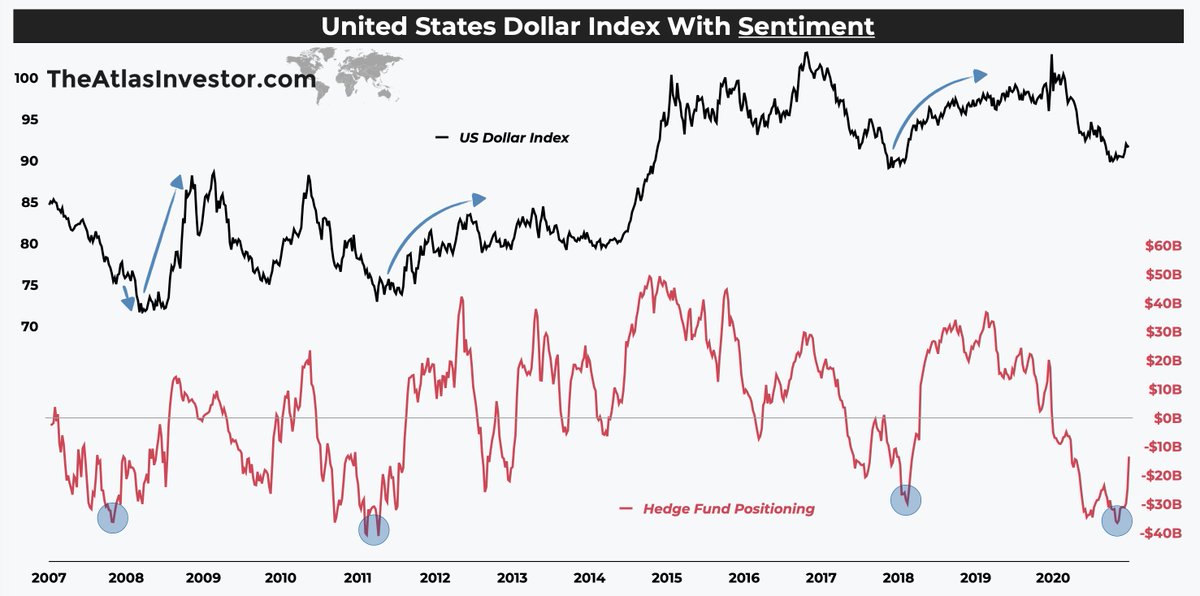

• US dollar short squeeze might bounce sharply

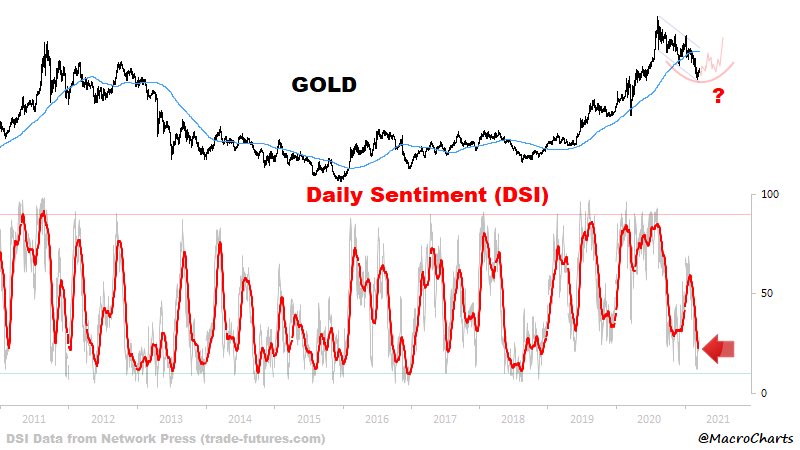

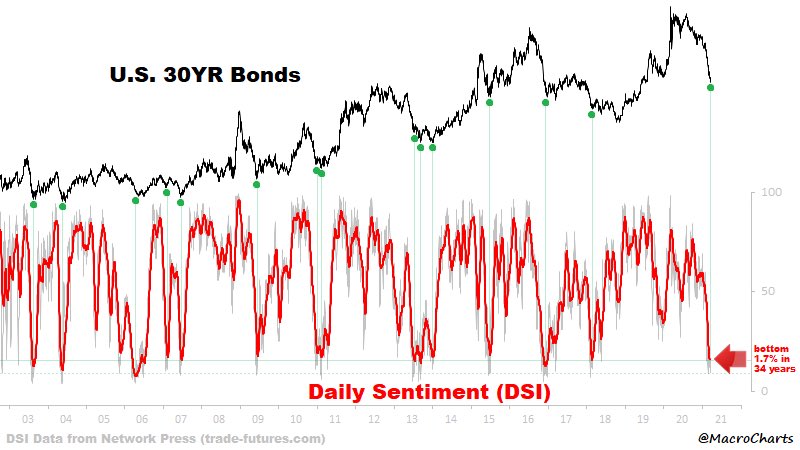

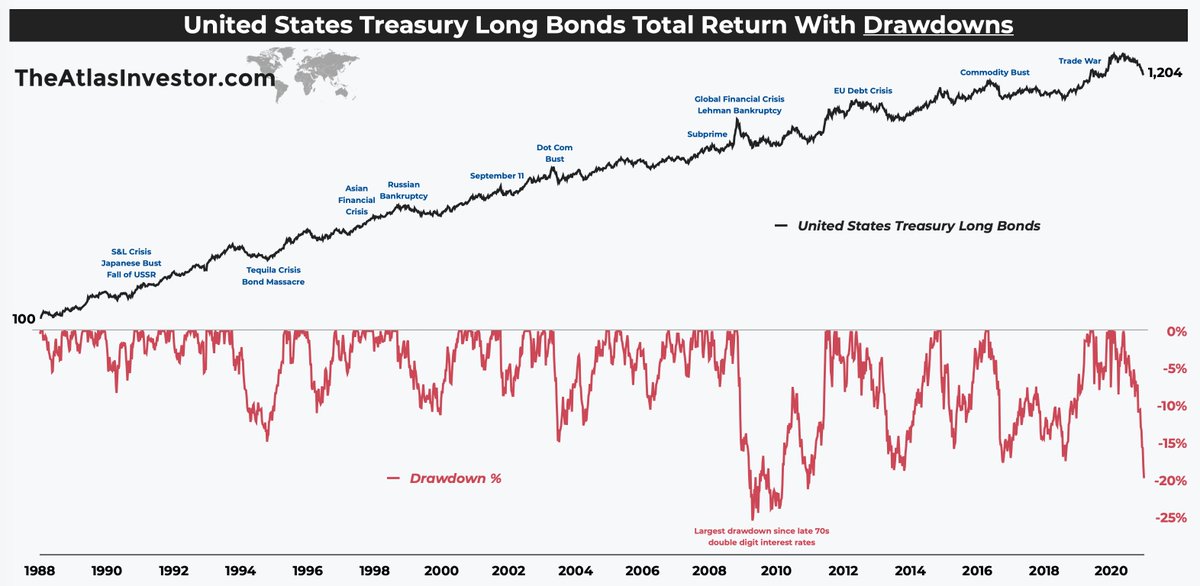

• oversold Treasuries might bounce sharply

• strongest insider selling since 2007 top

• US dollar short squeeze might bounce sharply

• oversold Treasuries might bounce sharply

• • •

Missing some Tweet in this thread? You can try to

force a refresh