S-1 thread

@Zymergen( $ZY) surprised today w $100M Initial Public Offering. JPM, GS, BOA, Cowen

Last valued $1.75B

Word counts

"biofactur-": 173

Hyaline:140

"Nature" (capital N):39

#SyntheticBiology/#SynBio:26

#MachineLearning:24

@Amyris ( $AMRS):2

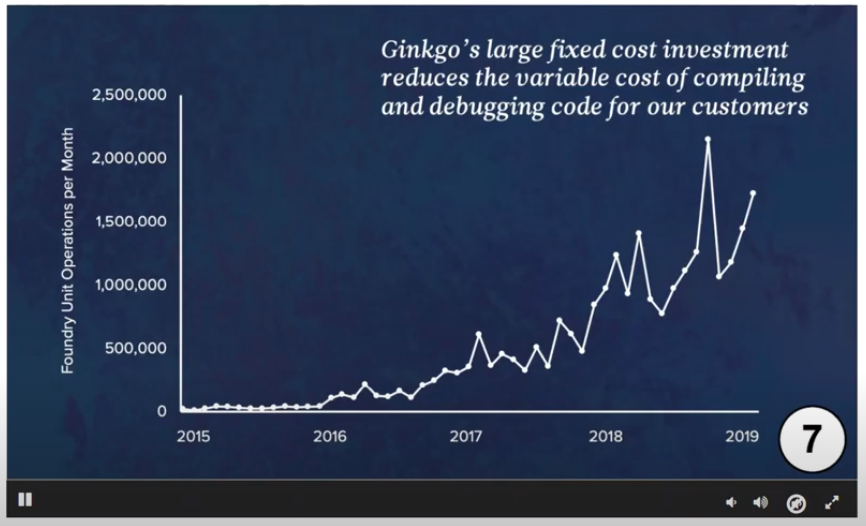

@Ginkgo:0

@Intrexon (RIP):0

@Zymergen( $ZY) surprised today w $100M Initial Public Offering. JPM, GS, BOA, Cowen

Last valued $1.75B

Word counts

"biofactur-": 173

Hyaline:140

"Nature" (capital N):39

#SyntheticBiology/#SynBio:26

#MachineLearning:24

@Amyris ( $AMRS):2

@Ginkgo:0

@Intrexon (RIP):0

https://twitter.com/Varro_Analytics/status/1303468138072285184

S-1 bit.ly/31b1qhl

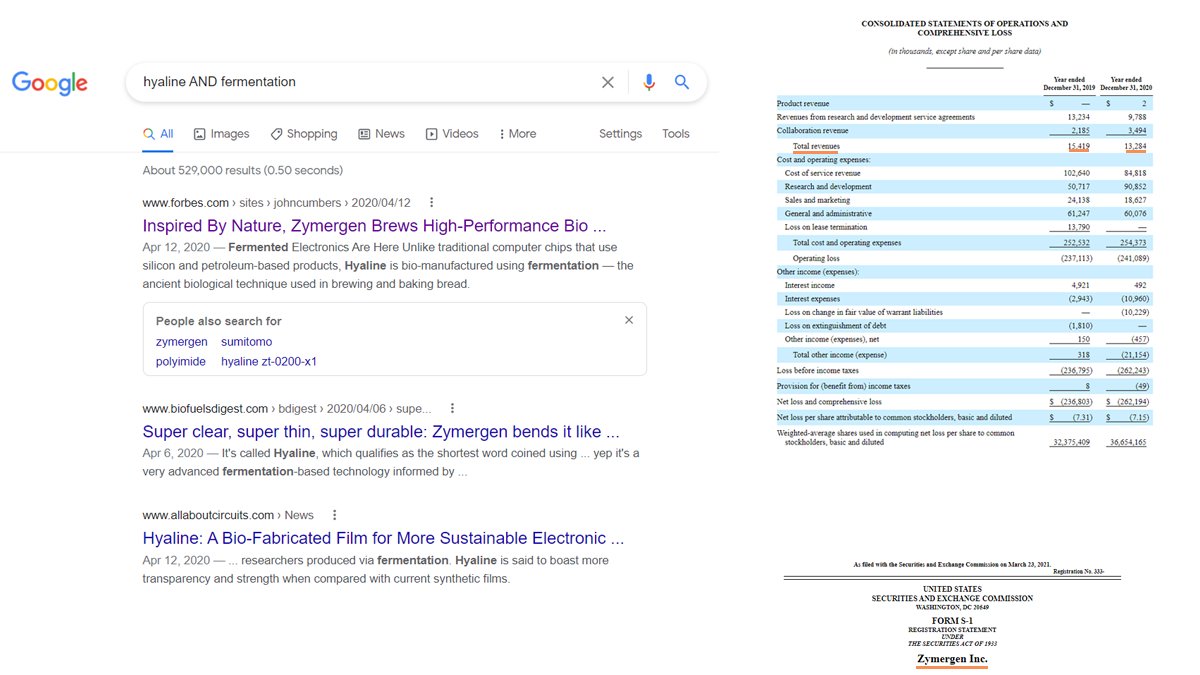

$13M in R&D/collab revenue in 2020

$ZY spent "5 years & $50 million" to "launch" (w/o product rev) lead product Hyaline (electronic screen film)

Early version made w chem synthesis, NOT fermentation (#synbio), but plans to ferment later (lower COGS)

$13M in R&D/collab revenue in 2020

$ZY spent "5 years & $50 million" to "launch" (w/o product rev) lead product Hyaline (electronic screen film)

Early version made w chem synthesis, NOT fermentation (#synbio), but plans to ferment later (lower COGS)

^Hyaline chem synth underscores challenge of $ZY's biz model

$ZY trying to simultaneously design/build/test organisms AND market end products

Chem synth gets products into customer hands earlier than $XON/ $AMRS, but might improve top-line focusing on design/build/test w JV's

$ZY trying to simultaneously design/build/test organisms AND market end products

Chem synth gets products into customer hands earlier than $XON/ $AMRS, but might improve top-line focusing on design/build/test w JV's

^ Benefit of a #synbio company creating a joint venture (JV) w a Fortune500 company is that it doesn't have to focus on selling end products. Then the #synbio co can focus its human & financial capital on its core competency (engineering microbes), and still share in risk/reward

^ By specializing in being a "go-to" #synbio intellectual property "fab" with JV model, it can also rack up more revenue-generating deals and satisfy investors

Fortune500 co's also recognize how disruptive #synbio already is in disrupting supply chains, and will pay to get ahead

Fortune500 co's also recognize how disruptive #synbio already is in disrupting supply chains, and will pay to get ahead

There is also a Perceptive Advisors debt covenant subplot that was not apparent until $ZY filing

Had previously just assumed Perceptive only held $ZY equity

The Sept 2020 press release made mention of "growth financing" from Perceptive

prnewswire.com/news-releases/…

Had previously just assumed Perceptive only held $ZY equity

The Sept 2020 press release made mention of "growth financing" from Perceptive

prnewswire.com/news-releases/…

^ Sept 2020 Perceptive / $ZY "growth financing" was actually $100M credit facility

By YE20, $ZY was unable to comply w debt covenant, but got waiver

If $ZY defaults, Perceptive gets "SUBSTANTIALLY ALL assets, including IP"

So $ZY has an immediate interest in doing a $100M IPO

By YE20, $ZY was unable to comply w debt covenant, but got waiver

If $ZY defaults, Perceptive gets "SUBSTANTIALLY ALL assets, including IP"

So $ZY has an immediate interest in doing a $100M IPO

^ The $ZY S-1 document makes it clear that at least a portion of the $100M offering proceeds will go towards the Perceptive credit facility

$AMRS $XON

#SynBio

$AMRS $XON

#SynBio

$ZY priced at around $3B cap

97,450,901 shares * $31

$31 was the high end

#SynBio

$AMRS $CDXS $NVZMY $ABCL

$TWST $BLI

97,450,901 shares * $31

$31 was the high end

#SynBio

$AMRS $CDXS $NVZMY $ABCL

$TWST $BLI

https://twitter.com/IPOBoutique/status/1385181193541464069

• • •

Missing some Tweet in this thread? You can try to

force a refresh