Thread on Tata Consumer Products🧵

Market cap: 58,030 crores

Revenues: 9,637 crores

P/E: 79.90

P/B: 4.14

P/S: 6.02

Here we go 👇

1/24

Market cap: 58,030 crores

Revenues: 9,637 crores

P/E: 79.90

P/B: 4.14

P/S: 6.02

Here we go 👇

1/24

India tea and salt form TCL's core and are steady high single-digit growth businesses:

In salt, TCL is the only national player with ~30% market share;

Furthermore, with a capacity not a constraint anymore, salt volume growth could accelerate;

2/24

In salt, TCL is the only national player with ~30% market share;

Furthermore, with a capacity not a constraint anymore, salt volume growth could accelerate;

2/24

The standalone business houses the India branded consumer products contributed ~62% to revenues and ~65% to EBIT in FY20;

On net income, the contribution of standalone is higher, at ~78%;

The core for the standalone business is packaged tea and branded salt,-

3/24

On net income, the contribution of standalone is higher, at ~78%;

The core for the standalone business is packaged tea and branded salt,-

3/24

-which form 90% of standalone sales and nearly 100% of standalone profits.

New food businesses and Starbucks are long-term prospects:

Branded pulses and spices have high growth potential as the branded share is very low at 1% for pulses and 30% for spices.

4/24

New food businesses and Starbucks are long-term prospects:

Branded pulses and spices have high growth potential as the branded share is very low at 1% for pulses and 30% for spices.

4/24

India tea, salt form TCL's core -profitable and stable:

The India tea and salt business contribute ~68% to TCL's EBITDA;

The key driver for tea and salt is share gain from loose consumption and smaller brands which form the majority of these categories;

5/24

The India tea and salt business contribute ~68% to TCL's EBITDA;

The key driver for tea and salt is share gain from loose consumption and smaller brands which form the majority of these categories;

5/24

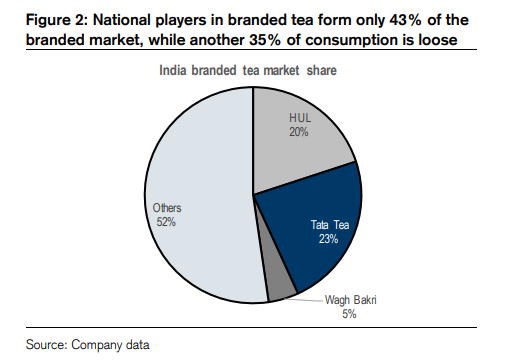

In tea, ~35% of the market is loose tea and ~58% of the branded market is not with national players;

Capacity constraints which were in the past an impediment for growth in salt, have been taken care of with planned capacity expansion over FY19-24 at

~8% CAGR.

6/24

Capacity constraints which were in the past an impediment for growth in salt, have been taken care of with planned capacity expansion over FY19-24 at

~8% CAGR.

6/24

The branded packaged share is ~1% for pulses and ~30% for spices;

TCL's reported ROCE is low at 5%, however adjusting for the goodwill and intangible assets, the operational ROIC is 25% in FY20.

The tea category overall has very high penetration and may not grow at more than

TCL's reported ROCE is low at 5%, however adjusting for the goodwill and intangible assets, the operational ROIC is 25% in FY20.

The tea category overall has very high penetration and may not grow at more than

low single digits;

However, packaged tea is expected to grow faster and national brands are likely to grow even faster than packaged tea.

The following are the growth drivers for national brands:

Conversion of loose to branded tea,

Movement from local brands to

8/24

However, packaged tea is expected to grow faster and national brands are likely to grow even faster than packaged tea.

The following are the growth drivers for national brands:

Conversion of loose to branded tea,

Movement from local brands to

8/24

national players, and premiumization. National brands hold only ~42% share in the branded tea market.

The duopoly of national players- TCL lost market share in FY19 to HUL but regained the initiative in FY20:

TCL has a slightly larger volume market share, while HUL has

9/24

The duopoly of national players- TCL lost market share in FY19 to HUL but regained the initiative in FY20:

TCL has a slightly larger volume market share, while HUL has

9/24

a larger value share; TCL is stronger in north India while HUL is stronger in south India.

Green tea an emerging opportunity for TCL:

Green tea is a small segment of Rs 4bn within the large Rs 250bn packaged tea category in India;

10/24

Green tea an emerging opportunity for TCL:

Green tea is a small segment of Rs 4bn within the large Rs 250bn packaged tea category in India;

10/24

It contributes less than 2% to the overall tea market in India, compared to ~25% of the tea market globally;

While it is small, the segment experienced more than a 20% CAGR over FY15-20;

TCL has a market share of ~25% in green tea through the Tetley brand & is expected

11/24

While it is small, the segment experienced more than a 20% CAGR over FY15-20;

TCL has a market share of ~25% in green tea through the Tetley brand & is expected

11/24

to gain from the long-term growth of this segment.

Tata salt- Business restructuring sets the stage for faster growth:

Tata is the most dominant national brand with ~65% share within a branded players.

12/24

Tata salt- Business restructuring sets the stage for faster growth:

Tata is the most dominant national brand with ~65% share within a branded players.

12/24

Advertising and retailer advantage:

Matching Tata on advertising spend to create a similar brand image would entail several years of low profitability for a competitor;

Tata's brand pulls in turn generate significant leeway with retailers.

13/24

Matching Tata on advertising spend to create a similar brand image would entail several years of low profitability for a competitor;

Tata's brand pulls in turn generate significant leeway with retailers.

13/24

TCL has guided for 2-3% of revenues as synergy gains from the merger of the salt and tea businesses. The key sources of the synergy benefits are: (1) better absorption of fixed costs on a larger India turnover and (2) gains on distribution efficiencies and scale of procurement.

International businesses- slow-growing, but steady cash flows:

The International business consists of 3 main parts- US coffee, UK tea, and Canada Tea;

These are slow-growing as they are in developed markets and the black tea category is not a growth category in these markets;

The International business consists of 3 main parts- US coffee, UK tea, and Canada Tea;

These are slow-growing as they are in developed markets and the black tea category is not a growth category in these markets;

US Coffee-

TCL's key brand is 'Eight O'clock', EOC largely plays in the bag segment of the US coffee market, where it has more than a 10% share on the East coast, this business is very profitable and generates an EBITDA margin of ~18%;

16/24

TCL's key brand is 'Eight O'clock', EOC largely plays in the bag segment of the US coffee market, where it has more than a 10% share on the East coast, this business is very profitable and generates an EBITDA margin of ~18%;

16/24

UK and Canada Tea-

In the UK, has a ~30% market share of black tea and in Canada it has a ~50% share, TCL's share in the non-black tea market is much lower in both markets; the black tea market is not a growth market in these countries and thus growth rates are likely

17/24

In the UK, has a ~30% market share of black tea and in Canada it has a ~50% share, TCL's share in the non-black tea market is much lower in both markets; the black tea market is not a growth market in these countries and thus growth rates are likely

17/24

to be in the low single digits.

Distribution expansion a major low hanging driver from the TCL merger:

Tata sampann reaching merely 40,000 outlets compared to the direct reach of 700,000 outlets for TCL's tea business.

18/24

Distribution expansion a major low hanging driver from the TCL merger:

Tata sampann reaching merely 40,000 outlets compared to the direct reach of 700,000 outlets for TCL's tea business.

18/24

Spices are a more value-added profitable market, but TCL may need the inorganic route to scale up rapidly:

Unlike pulses, where there is relatively little differentiation in the end product, getting consistency in the end-product spices at scale is of significant value to

19/24

Unlike pulses, where there is relatively little differentiation in the end product, getting consistency in the end-product spices at scale is of significant value to

19/24

the consumer.

Tata Starbucks- a long-term prospect, Covid-19 hit in FY21 sets it back by a year:

It has more than doubled its stores from 85 to 180 over FY17-20;

Revenue has had a CAGR of 25% over the past 3 years and was ~5.6bn in FY20.

20/24

Tata Starbucks- a long-term prospect, Covid-19 hit in FY21 sets it back by a year:

It has more than doubled its stores from 85 to 180 over FY17-20;

Revenue has had a CAGR of 25% over the past 3 years and was ~5.6bn in FY20.

20/24

Sunil D'souza, the new CEO of Tata consumer, has been the managing director of Whirlpool India for 4 years, and prior to that had 15 years of experience at Pepsi; He thus comes with a good mix of leadership experience and FMCG food experience.

21/24

21/24

Strong competitive advantages in Tea/salt,

👉Production process

👉Distribution and packaging

👉Advertising and retailer advantage

Challenges in pulses:

👉Product is a wash-and-use one.

👉High price volatility and production skewed towards one season.

👉Long supply chain

22/24

👉Production process

👉Distribution and packaging

👉Advertising and retailer advantage

Challenges in pulses:

👉Product is a wash-and-use one.

👉High price volatility and production skewed towards one season.

👉Long supply chain

22/24

👉Competition from modern trade private labels

Positives including merger benefits include:

👉Distribution expansion a major low hanging driver from the TCL merger

👉Spices are a more value-added profitable market, but TCL may need the inorganic route to scale up rapidly

23/24

Positives including merger benefits include:

👉Distribution expansion a major low hanging driver from the TCL merger

👉Spices are a more value-added profitable market, but TCL may need the inorganic route to scale up rapidly

23/24

👉Potential entry into more food categories a long-term driver.

👉Scale benefits on fixed costs.

👉Scale benefits on procurement and terms of trade.

👉Revenue synergies from distribution and cross selling

End of thread 🧵

24/24

👉Scale benefits on fixed costs.

👉Scale benefits on procurement and terms of trade.

👉Revenue synergies from distribution and cross selling

End of thread 🧵

24/24

• • •

Missing some Tweet in this thread? You can try to

force a refresh