A THREAD on . . . .

How @ITRADE191 selects strikes to trade in and how he follows risk management.

Short thread explained via pictures with the help of @niki_poojary.

How @ITRADE191 selects strikes to trade in and how he follows risk management.

Short thread explained via pictures with the help of @niki_poojary.

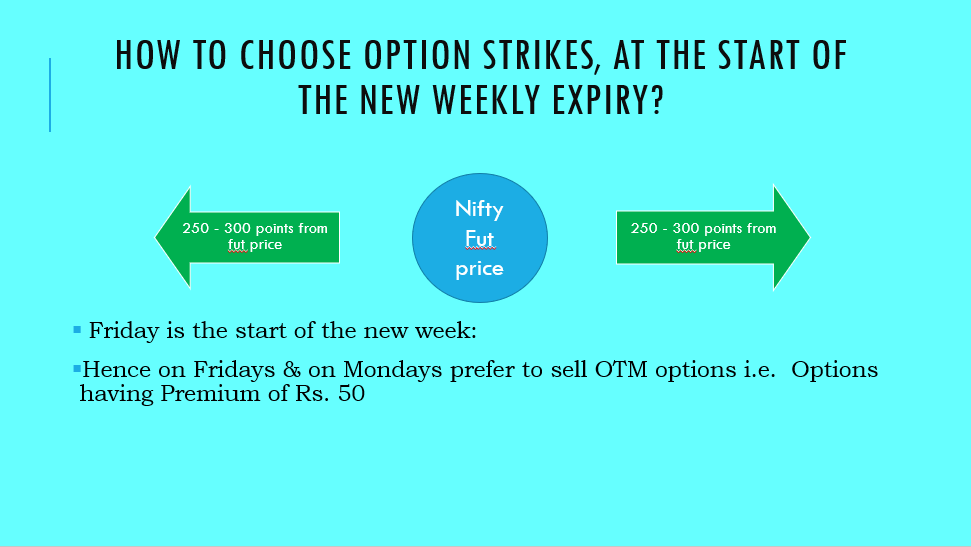

1. At the start of the week

i.e. on Friday and Monday, DJ Sir prefers to sell OTM options of 50 rs premium in Nifty.

- ATM options won't decay a lot at the beginning

- With this premium reward is good

- Since these strikes are 4-5 strikes away they are relatively safer

i.e. on Friday and Monday, DJ Sir prefers to sell OTM options of 50 rs premium in Nifty.

- ATM options won't decay a lot at the beginning

- With this premium reward is good

- Since these strikes are 4-5 strikes away they are relatively safer

2. On Tue/Wed/Fri

He prefers to trade in ATM or near OTM options.

- ATM options have the highest theta decay

- Since there are only 2-3 days to expiry options sellers by default have a higher probability of winning

- Huge reward if market stays flat

He prefers to trade in ATM or near OTM options.

- ATM options have the highest theta decay

- Since there are only 2-3 days to expiry options sellers by default have a higher probability of winning

- Huge reward if market stays flat

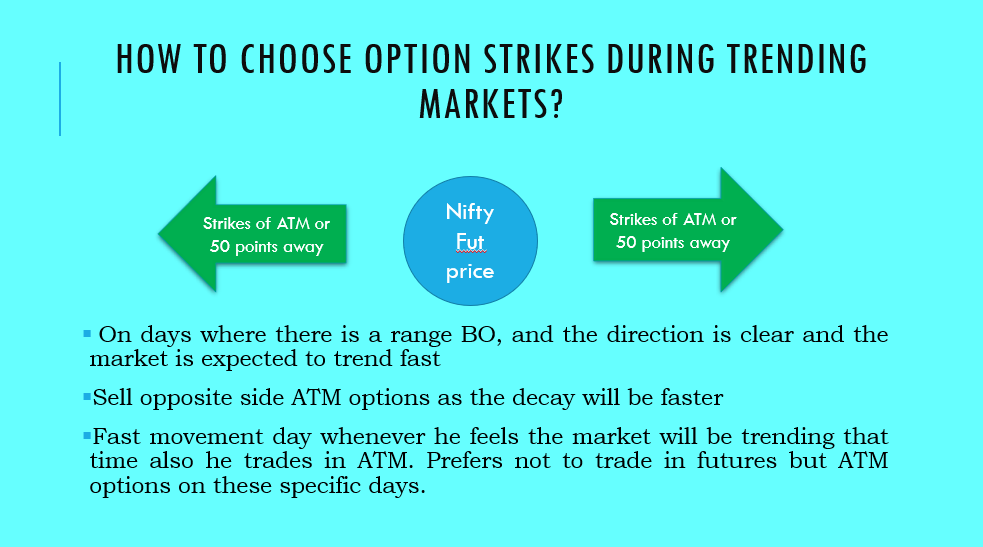

3. Directional/Trending days

- Capture huge profit via ATM option selling

- Futures only where he has good conviction

- Even if doesn't trend much decay will be huge

- Only on days Tuesday to Thursday

- Capture huge profit via ATM option selling

- Futures only where he has good conviction

- Even if doesn't trend much decay will be huge

- Only on days Tuesday to Thursday

4. Which series to trade options in?

- INTRADAY trades option selling is ONLY in weekly expiry

- Option buying for hedging is done MAJORLY in next week/monthly expiry

- This way we have time to adjust

- Theta decay slower than weekly

- INTRADAY trades option selling is ONLY in weekly expiry

- Option buying for hedging is done MAJORLY in next week/monthly expiry

- This way we have time to adjust

- Theta decay slower than weekly

5. Positional trades of @ITRADE191

- Collects huge premiums in monthly options

- Lesser adjustments compared to weekly

- Better focus on Intraday trades in weekly

- Lot of time to be proved right/wrong in our trad

- Collects huge premiums in monthly options

- Lesser adjustments compared to weekly

- Better focus on Intraday trades in weekly

- Lot of time to be proved right/wrong in our trad

6. Target achieved/Loss Limit achieved

- If the target is fulfilled and he doesn't want to cut the position

- He books 70-80% of his profits and

- Keeps the remaining 20% or

- Just books all and sells safer options

- For higher probability on his side

- If the target is fulfilled and he doesn't want to cut the position

- He books 70-80% of his profits and

- Keeps the remaining 20% or

- Just books all and sells safer options

- For higher probability on his side

7. First Trade

- Always should be a very high accuracy trade

- Resulting in a cushion in terms of profit

- Better psychology to take risk in other trades

- Always should be a very high accuracy trade

- Resulting in a cushion in terms of profit

- Better psychology to take risk in other trades

8. What does he do with his Intraday trades EOD?

- Books whatever profit/loss

- Wants to take a fresh position the next day

- No wasting time firefighting

- Books whatever profit/loss

- Wants to take a fresh position the next day

- No wasting time firefighting

9. Biggest Secret/Strength

- Divides risk per day into 4 parts/trades

- When first trade in profit put sl at cost

- Again 4 lifelines restored

- Keep repeating with further trades

His primary focus is on his capital protection & secondary focus is on profit protection

- Divides risk per day into 4 parts/trades

- When first trade in profit put sl at cost

- Again 4 lifelines restored

- Keep repeating with further trades

His primary focus is on his capital protection & secondary focus is on profit protection

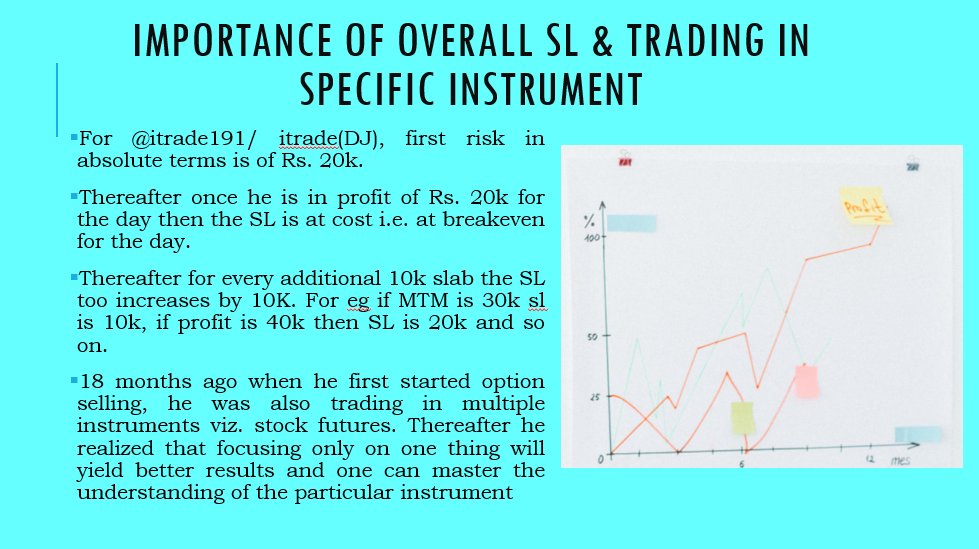

10. Uses portfolio stop loss

- Beginning risk appetite is of 20k loss

- When in 20k profit then sl is at cost

- For every 10k profit increase raise your sl by 10k

For eg, when in 30k profit stop loss is shifted to 20k (our target). When 40k then sl is 30k and so on. . .

- Beginning risk appetite is of 20k loss

- When in 20k profit then sl is at cost

- For every 10k profit increase raise your sl by 10k

For eg, when in 30k profit stop loss is shifted to 20k (our target). When 40k then sl is 30k and so on. . .

11. Focus on one instrument only

1 and a half year ago when he started option selling that time he was trying to trade multiple instruments but later he realized that focusing on one instrument yields better results and understanding of the instrument also increases a lot.

1 and a half year ago when he started option selling that time he was trying to trade multiple instruments but later he realized that focusing on one instrument yields better results and understanding of the instrument also increases a lot.

12. Hope this helps you in

- Choosing strikes

- Improving Risk Management

- Managing stop losses

- Focusing

Share if you learned something from this thread so that everyone can benefit.

___________________________________________________

THE END

- Choosing strikes

- Improving Risk Management

- Managing stop losses

- Focusing

Share if you learned something from this thread so that everyone can benefit.

___________________________________________________

THE END

• • •

Missing some Tweet in this thread? You can try to

force a refresh