Powell and Yellen are dismissive of cryptos/DeFi. Dalio thinks it could be banned. Singer/Buffett think it's dangerous.

I fear all of this could lead to the US "sitting this out" as the rest of the world designs a new financial system. This would be a huge mistake ...

(1/8)

I fear all of this could lead to the US "sitting this out" as the rest of the world designs a new financial system. This would be a huge mistake ...

(1/8)

3B+ people in Asia, Africa, the Middle East, and Latin America that would happily embrace a DeFi as the world standard.

But can they?

The number of mobile phone subscriptions in these countries is more than 1 per person, similar to the US/Europe.

They have the tool.

(2/8)

But can they?

The number of mobile phone subscriptions in these countries is more than 1 per person, similar to the US/Europe.

They have the tool.

(2/8)

And they have no problem accessing services on these phones.

Americans have little idea how much better service is in the rest of the world, including much of the 3rd world.

The US is 27th in mobile download speeds, 95th in upload speeds

(3/8)

allconnect.com/blog/us-mobile…

Americans have little idea how much better service is in the rest of the world, including much of the 3rd world.

The US is 27th in mobile download speeds, 95th in upload speeds

(3/8)

allconnect.com/blog/us-mobile…

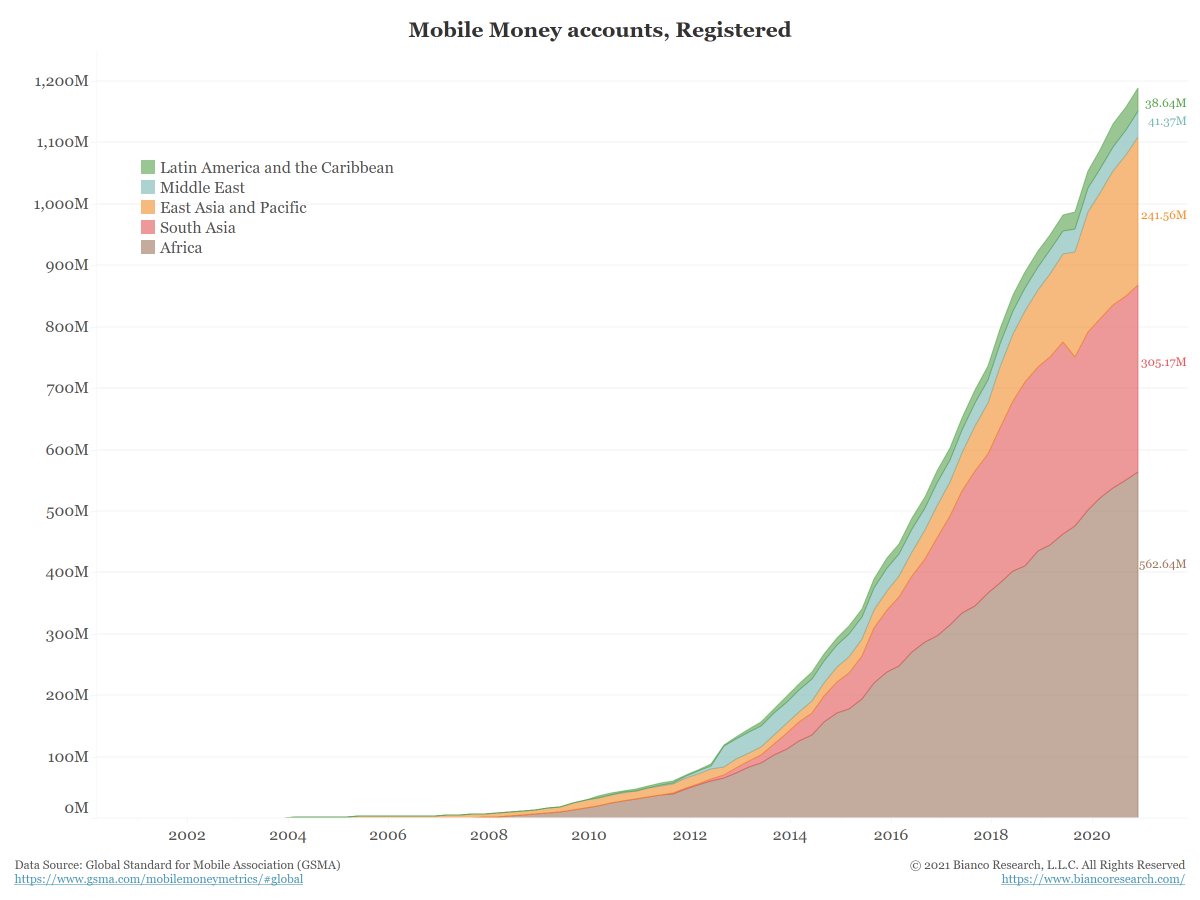

The Global Standard for Mobile Association (GSMA) estimates that at the end of 2020, Asia, Africa, the Middle East, and Latin America collectively had about 1.2 BILLION registered MOBILE money accounts.

Of these, over 425 million were used at least once in Q4 2020.

(4/8)

Of these, over 425 million were used at least once in Q4 2020.

(4/8)

But a DeFi system would not have consumer protections. This is largely a 1st world demand.

GSMA shows that Asia, Africa, the Middle East, and Latin America do not really enjoy these protections now.

The lack of AML/KYC rules are not holding them back from adoption.

(5/8)

GSMA shows that Asia, Africa, the Middle East, and Latin America do not really enjoy these protections now.

The lack of AML/KYC rules are not holding them back from adoption.

(5/8)

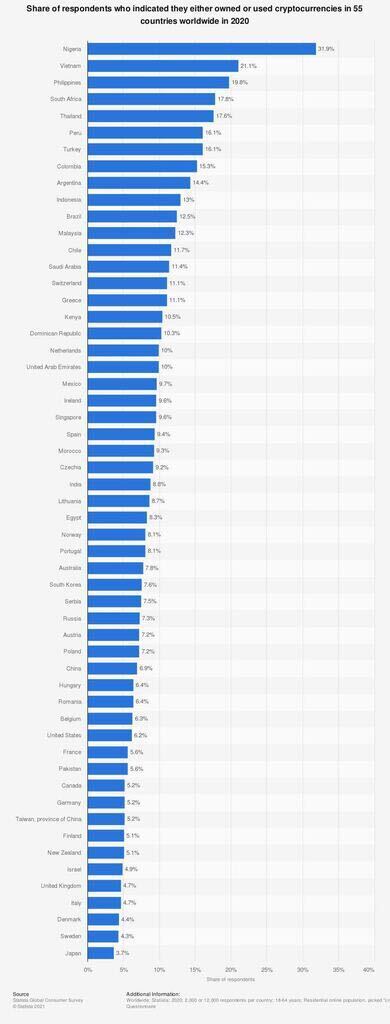

And they are already big players in the crypto space, according to this recent survey.

Note the coutnries at the top, and bottom, of this list.

(6/8)

statista.com/statistics/120…

Note the coutnries at the top, and bottom, of this list.

(6/8)

statista.com/statistics/120…

Sum it up and a new DeFi world is coming, with or without our involvement. CeFi is going to get disrupted in ways they cannot imagine.

Wall Street already knows this. For the last 25 years or so, bank stocks cannot beat 0% Tbill returns.

Taxis in a ride-share world

(7/8)

Wall Street already knows this. For the last 25 years or so, bank stocks cannot beat 0% Tbill returns.

Taxis in a ride-share world

(7/8)

But the wealth of the world is not in these countries. So, what can they do to force a DeFi standard?

They could demand that trade, including crude oil, industrial commodities, and finished products, be conducted in this new standard instead of to the U.S. dollar.

(8/8)

They could demand that trade, including crude oil, industrial commodities, and finished products, be conducted in this new standard instead of to the U.S. dollar.

(8/8)

• • •

Missing some Tweet in this thread? You can try to

force a refresh