1. Why your 401k, 403B and Traditional IRA's suck Part 1 of 2

With math.

We have a client that is 25 and she makes about $40,000 a year.

She's currently putting $12,000 a year into her 403b and has $50,000 in it already.

Which is awesome.

With math.

We have a client that is 25 and she makes about $40,000 a year.

She's currently putting $12,000 a year into her 403b and has $50,000 in it already.

Which is awesome.

2. But moving forward, we're making some changes.

Let me show you why:

She works for a city, so in CA she gets the Public Employees Retirement, which is much better than Social Security.

Because she started young, she'll like retire in her early 50's.

Let's say 55.

Let me show you why:

She works for a city, so in CA she gets the Public Employees Retirement, which is much better than Social Security.

Because she started young, she'll like retire in her early 50's.

Let's say 55.

3. Now, IF she NEVER puts one more dime into her 403b and it earns 7% net over the next 30 years,

She'll have $380,613.

However, most people don't just pull their retirement accounts out all at once, they pull them over their lifespan.

She'll have $380,613.

However, most people don't just pull their retirement accounts out all at once, they pull them over their lifespan.

4. So, if she earns 6%, she can pull $27,651 for 30 years, until she's 85.

This does NOT account for ups and downs in the market, I'm just trying to illustrate the tax hit on the account.

On top of this, she will have her PERS, which is going to be 80 or 90% of her income.

This does NOT account for ups and downs in the market, I'm just trying to illustrate the tax hit on the account.

On top of this, she will have her PERS, which is going to be 80 or 90% of her income.

5. Now, let's do some math.

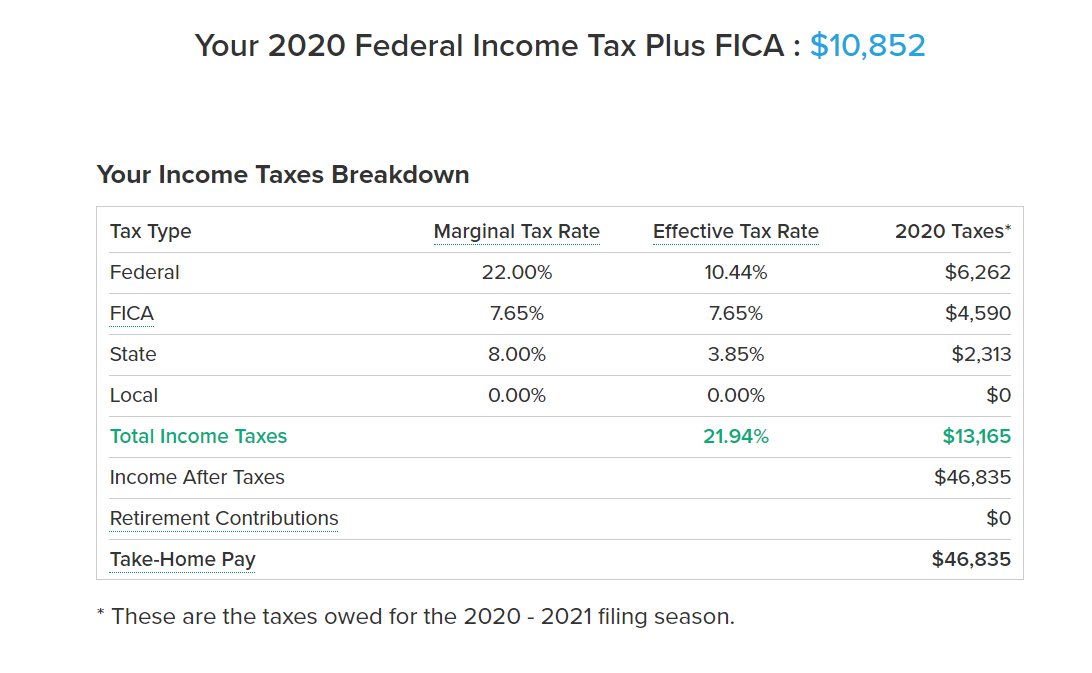

By postponing paying taxes on $12,000 a year, she 'saves' almost $2,000 a year in taxes.

More specifically: $517 in state, and $1,440 in federal for a grand total of $1,957 a year, or $163 a month.

So....

By postponing paying taxes on $12,000 a year, she 'saves' almost $2,000 a year in taxes.

More specifically: $517 in state, and $1,440 in federal for a grand total of $1,957 a year, or $163 a month.

So....

6. She's basically done this for 4 years, so she has 'saved' $7,828 in taxes so far.

Which everybody tells her is 'great'.

But.........

Which everybody tells her is 'great'.

But.........

7. She has a tax liability not on the $50,000 she deferred,

but the $380,613 it GREW to.

If she pulls it all out at once, assuming a 25% combined state and federal amount,

She immediately owes $95,153. (!!!)

Which would YOU rather pay: $7,828 now OR $95,153 later?

but the $380,613 it GREW to.

If she pulls it all out at once, assuming a 25% combined state and federal amount,

She immediately owes $95,153. (!!!)

Which would YOU rather pay: $7,828 now OR $95,153 later?

8. But, like I mentioned earlier, she will likely pull it over 30 years at the $27,651 a year I mentioned earlier.

So, that means she's pulling out AND PAYING TAX on $829,530.

At 25%, THAT means she pays $207,382 or 4 TIMES what she put in in the first place.

So, that means she's pulling out AND PAYING TAX on $829,530.

At 25%, THAT means she pays $207,382 or 4 TIMES what she put in in the first place.

9. Remember, the original tax 'saved' was $7,828 vs $207,382.

Or 26.5 times MORE tax.

Seriously, why do YOU think the government keeps pushing 401ks and IRAs through their puppets?

Or 26.5 times MORE tax.

Seriously, why do YOU think the government keeps pushing 401ks and IRAs through their puppets?

10. And, don't forget, if she wants to touch that money before she's 59 1/2, she has to pay the tax and a penalty (or she can borrow it, IF they let her)

So she's lost control of that money for the next 35 years.

So she's lost control of that money for the next 35 years.

11. AND, she HAS to start taking it out by age 72 or she owes and even BIGGER penalty.

And, if taxes go higher that 25%, which they are very likely to, then she'll owe even more.

Finally, because it's a 403b, she doesn't even get a match on any contributions.

And, if taxes go higher that 25%, which they are very likely to, then she'll owe even more.

Finally, because it's a 403b, she doesn't even get a match on any contributions.

12. If it was me, in this situation, I wouldn't contribute one dime more.

So what DID I recommend?

Part 2 coming in the next couple of days.

/end for now.

So what DID I recommend?

Part 2 coming in the next couple of days.

/end for now.

• • •

Missing some Tweet in this thread? You can try to

force a refresh