1) Portfolio update Mar-end -

$ACTC $ADYEY $CCIV $CPNG $CRWD $CURI $DKNG $DOCU $GHVI $IPOE $MELI $OPEN $OZON $PINS $PLTR $RBLX $ROKU $RTP $SE $SFTW $SKLZ $SNOW $TWLO $UPST #NQ_F

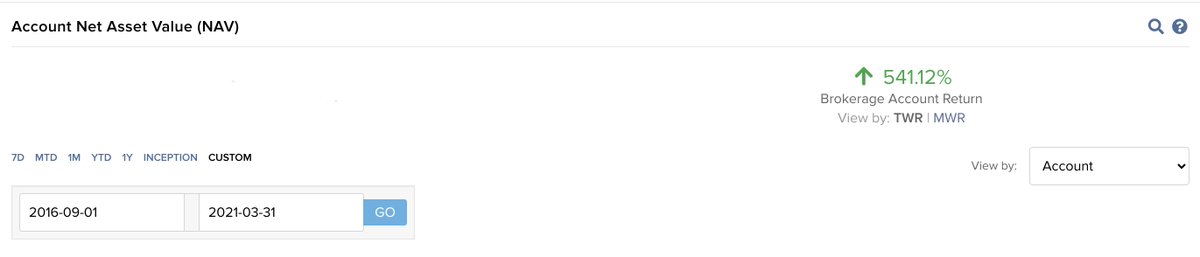

Return since 1 Sep'16 -

My a/c +541.12%

$ACWI +61.93%

$SPX +83.01%

$ACTC $ADYEY $CCIV $CPNG $CRWD $CURI $DKNG $DOCU $GHVI $IPOE $MELI $OPEN $OZON $PINS $PLTR $RBLX $ROKU $RTP $SE $SFTW $SKLZ $SNOW $TWLO $UPST #NQ_F

Return since 1 Sep'16 -

My a/c +541.12%

$ACWI +61.93%

$SPX +83.01%

2) CAGR since inception (1 Sep '16) -

Portfolio +50.03%

$ACWI +11.10%

$SPX +14.11%

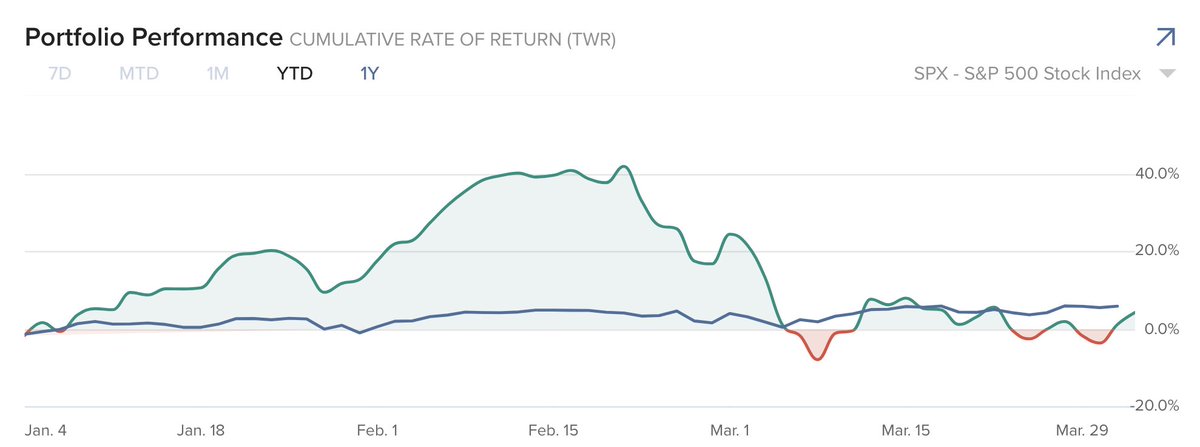

YTD return -

Portfolio +1.13%

$ACWI +4.88%

$SPX +5.77%

Cont...

Portfolio +50.03%

$ACWI +11.10%

$SPX +14.11%

YTD return -

Portfolio +1.13%

$ACWI +4.88%

$SPX +5.77%

Cont...

3) Biggest positions -

1) $MELI 2) $SE 3) $UPST 4) $CPNG 5) $OZON

Commentary -

Wow! What a month!

March turned out be a brutal month for growth stocks, consequently my portfolio suffered a large drawdown.

At the end of Feb, my YTD return was 16.94% and those gains...

1) $MELI 2) $SE 3) $UPST 4) $CPNG 5) $OZON

Commentary -

Wow! What a month!

March turned out be a brutal month for growth stocks, consequently my portfolio suffered a large drawdown.

At the end of Feb, my YTD return was 16.94% and those gains...

4) ...disappeared in March and I ended the month +1.13%YTD.

At the beginning of the month, we saw a sharp decline in growth stocks which culminated in a selling climax on 5 March. That was followed by a snapback rally and then another grinding re-test of the lows earlier...

At the beginning of the month, we saw a sharp decline in growth stocks which culminated in a selling climax on 5 March. That was followed by a snapback rally and then another grinding re-test of the lows earlier...

5)...in the week.

It is notable that although $ARKK and $IWO tested their early March low, $NDX stayed well above that level and $DIA and $SPX stayed either at or near their ATHs!

This price action suggests that we have simply experienced a brutal *rotation* within an...

It is notable that although $ARKK and $IWO tested their early March low, $NDX stayed well above that level and $DIA and $SPX stayed either at or near their ATHs!

This price action suggests that we have simply experienced a brutal *rotation* within an...

6)...ongoing bull-market (and not the start of a long lasting bear in the broad stock market).

You will recall that after the early March plunge, I increased my leverage to 150% and although was stopped out of my position mid-month, am now leveraged again and suspect...

You will recall that after the early March plunge, I increased my leverage to 150% and although was stopped out of my position mid-month, am now leveraged again and suspect...

7)...there is a good chance we've seen the lows of this brutal rotation. To be clear, this is just my considered opinion but I could be very wrong so nobody should rely on this view.

Turning to my portfolio, March was a very busy month for me as I sold most of my starter...

Turning to my portfolio, March was a very busy month for me as I sold most of my starter...

8) positions which were speculative in nature and used the weakness to my advantage and bought more shares of my highest conviction names.

During the month, I increased my positions in $PLTR, $SKLZ $SNOW and initiated new positions in $CPNG $RBLX $UPST

Finally, due to very...

During the month, I increased my positions in $PLTR, $SKLZ $SNOW and initiated new positions in $CPNG $RBLX $UPST

Finally, due to very...

9)...high valuations, I also sold my shares of $AFTPY and $SHOP

In terms of risk management, I put on two hedging trades - the first one was profitable and the second one turned out to be a whipsaw and handed me a 2% loss.

Right now, my gross exposure is ~150% and...

In terms of risk management, I put on two hedging trades - the first one was profitable and the second one turned out to be a whipsaw and handed me a 2% loss.

Right now, my gross exposure is ~150% and...

10)...I have no hedges in place.

Although anything can happen, am of the view that at the very least we are likely to see a multi-week rebound in the growth stocks but if things head south again, my hedges will kick in and my GTC sell stop on my #NQ_F will cut my leverage...

Although anything can happen, am of the view that at the very least we are likely to see a multi-week rebound in the growth stocks but if things head south again, my hedges will kick in and my GTC sell stop on my #NQ_F will cut my leverage...

11) Turning to my portfolio composition, over the past few weeks, many of you have asked me why I'm not selling my stocks and buying the cyclicals/value plays?

The reason is two-fold -

(i) Safety - My companies are fundamentally sound, they carry very little debt, are growing..

The reason is two-fold -

(i) Safety - My companies are fundamentally sound, they carry very little debt, are growing..

12)..rapidly, have large growth runways and are being run by very able management teams. So, the volatility notwithstanding, I know that my capital is in 'good hands'.

(ii) Given the large growth runways of my companies and the effects of compounding, I know that time will...

(ii) Given the large growth runways of my companies and the effects of compounding, I know that time will...

13)...bail me out and once these companies have grown into their valuations, their market caps (stocks) will start expanding again.

Unfortunately, the cyclicals/value names aren't long-term compounders and once the upward re-rating is complete and the fiscal high wears off...

Unfortunately, the cyclicals/value names aren't long-term compounders and once the upward re-rating is complete and the fiscal high wears off...

14) ...there will be a rush for the exits and I'm not smart enough to figure out when that'll happen.

This is why I'm staying invested in my long-term compounders.

There can be no doubt that March has been brutal for growth investors but I can assure you this won't be...

This is why I'm staying invested in my long-term compounders.

There can be no doubt that March has been brutal for growth investors but I can assure you this won't be...

15)...the last nasty pullback.

After all, growth stocks had tripled/quadrupled/quintupled in a year so a big sell-off was always on the cards. In any event, growth stocks are very volatile beasts and they do undergo vicious corrections every year or two.

Short-term...

After all, growth stocks had tripled/quadrupled/quintupled in a year so a big sell-off was always on the cards. In any event, growth stocks are very volatile beasts and they do undergo vicious corrections every year or two.

Short-term...

16)..gyrations notwithstanding, I am almost certain that the major secular trends (ecommerce, software, EVs, streaming, online gaming, sports betting, payments/fintech etc) won't be derailed by changes in interest rates, so we are swimming with the tide.

Hope this is helpful.

Hope this is helpful.

• • •

Missing some Tweet in this thread? You can try to

force a refresh