1/

Long read for the Long weekend: Mega thread on $SKLZ

This isn’t an easy investment – one needs to take the high risk here into account.

To me, the risk-adj return here warrants a position. $SKLZ is now my 3rd largest position given higher conviction – 11.3% of portfolio

Long read for the Long weekend: Mega thread on $SKLZ

This isn’t an easy investment – one needs to take the high risk here into account.

To me, the risk-adj return here warrants a position. $SKLZ is now my 3rd largest position given higher conviction – 11.3% of portfolio

2/

Before I start, $SKLZ is a divisive name

I truly appreciate the different schools of thought.

We are allowed to have our own opinions – the difference in opinion is what creates a market

If we all had the same opinion, price would be crazy &there likely wouldn’t be a trade

Before I start, $SKLZ is a divisive name

I truly appreciate the different schools of thought.

We are allowed to have our own opinions – the difference in opinion is what creates a market

If we all had the same opinion, price would be crazy &there likely wouldn’t be a trade

3/

Differences in opinion are healthy….but arguments are not.

I do welcome an open constructive conversation, as at the end of the day, all our thesis, whether Bull or Bear, are built on assumptions.

However, I urge everyone to keep things civil :)

OK lets start.

Differences in opinion are healthy….but arguments are not.

I do welcome an open constructive conversation, as at the end of the day, all our thesis, whether Bull or Bear, are built on assumptions.

However, I urge everyone to keep things civil :)

OK lets start.

4/

To me, $SKLZ is PLATFORM, uniquely positioned somewhere between a pureplay PUBLISHER/DEVELOPER ($ZNGA, $GLUU) and an ENABLER (like $SHOP, $U).

To me, $SKLZ is PLATFORM, uniquely positioned somewhere between a pureplay PUBLISHER/DEVELOPER ($ZNGA, $GLUU) and an ENABLER (like $SHOP, $U).

5/

Similarity to ENABLERS in that it offers a PLATFORM connecting buyers to sellers but without taking content/creation risk:

- $SHOP - enables customers to monetize their (retail) product

- $U – enables developers to focus on development vs optimisation & monetisation

Similarity to ENABLERS in that it offers a PLATFORM connecting buyers to sellers but without taking content/creation risk:

- $SHOP - enables customers to monetize their (retail) product

- $U – enables developers to focus on development vs optimisation & monetisation

6/

$SHOP, $U, $SKLZ do not spend any funds on creation -> i.e. $SHOP does not make retail products, and neither $U nor $SKLZ spends money on game production.

In this sense, they all fall under broader “platform” category

$SHOP, $U, $SKLZ do not spend any funds on creation -> i.e. $SHOP does not make retail products, and neither $U nor $SKLZ spends money on game production.

In this sense, they all fall under broader “platform” category

7/

But there are key differences between them as well:

- ENABLER - $U & $SHOP -> suppliers = customers. Revenue based on ‘subscription’ or charges levied to the suppliers/publishers

- $SKLZ -> suppliers are developers and customers are individuals.

Different risk profile!

But there are key differences between them as well:

- ENABLER - $U & $SHOP -> suppliers = customers. Revenue based on ‘subscription’ or charges levied to the suppliers/publishers

- $SKLZ -> suppliers are developers and customers are individuals.

Different risk profile!

8/

Nor is $SKLZ a developer/publisher.

The main points of similarities between $SKLZ and a developer/publisher like $ZNGA or $GLUU are that:

(a) product is a ‘game’ and

(b) revenue generation relies on individuals rather than corporates..

Nor is $SKLZ a developer/publisher.

The main points of similarities between $SKLZ and a developer/publisher like $ZNGA or $GLUU are that:

(a) product is a ‘game’ and

(b) revenue generation relies on individuals rather than corporates..

9/

but these are v different companies by virtue of their revenue generation & cost structures:

- Pure developer -> Freemium/advertising + significant content/creation risk + need to spend on S&M

- $SKLZ -> Betting revenue + no content risk but has discretionary S&M risk

but these are v different companies by virtue of their revenue generation & cost structures:

- Pure developer -> Freemium/advertising + significant content/creation risk + need to spend on S&M

- $SKLZ -> Betting revenue + no content risk but has discretionary S&M risk

10/

Small developers prefer to work with $SKLZ due to its incentive alignment on revenue in addition to not having to worry about the fixed costs to generate such revenue.

This is why most of $SKLZ ’s suppliers are small developers.

Small developers prefer to work with $SKLZ due to its incentive alignment on revenue in addition to not having to worry about the fixed costs to generate such revenue.

This is why most of $SKLZ ’s suppliers are small developers.

11/

$SKLZ is therefore uniquely positioned somewhere in between a pure play developer (but no content risk) and enabler/platform.

It a platform with revenue skewed to the upside on success but without related content costs.

It is a true platform.

$SKLZ is therefore uniquely positioned somewhere in between a pure play developer (but no content risk) and enabler/platform.

It a platform with revenue skewed to the upside on success but without related content costs.

It is a true platform.

12/

A platform is a marketplace place where buyers and sellers interact.

The success of a platform therefore primarily lies in its ability to attract both buyers and sellers.

For $SKLZ:

- Sellers are ‘developers’ and product is the ‘game’

- Buyers are players

A platform is a marketplace place where buyers and sellers interact.

The success of a platform therefore primarily lies in its ability to attract both buyers and sellers.

For $SKLZ:

- Sellers are ‘developers’ and product is the ‘game’

- Buyers are players

13/

But with early stage platforms (like $SKLZ), its always a chicken-and-egg situation.

For higher quality sellers to place their product, they want to see enough buyers…and for buyers to come to your platform, they need to see enough ‘good’ products.

A virtuous cycle.

But with early stage platforms (like $SKLZ), its always a chicken-and-egg situation.

For higher quality sellers to place their product, they want to see enough buyers…and for buyers to come to your platform, they need to see enough ‘good’ products.

A virtuous cycle.

14/

Games don’t specifically have to be high quality games as such.

As $SKLZ focuses on monetization through competition, games just need to have the ability to instil the competitive spirit in its gamers.

Games don’t specifically have to be high quality games as such.

As $SKLZ focuses on monetization through competition, games just need to have the ability to instil the competitive spirit in its gamers.

15/

They don’t have to be high quality games per se.

A simple game like Solitaire or Virtual Pool does that job.

But as is always the case, a better product suite can bring on more buyers -> resulting in growth.

They don’t have to be high quality games per se.

A simple game like Solitaire or Virtual Pool does that job.

But as is always the case, a better product suite can bring on more buyers -> resulting in growth.

16/

The Bear Arguments on $SKLZ are:

(1) lack of quality games currently offered,

(2) studio/game concentration,

(3) stunted growth of MAUs,

(4) founder sales & dilution,

(4) has been tried before & failed,

(5) Casino not Esports

Will give my view on each of these in turn

The Bear Arguments on $SKLZ are:

(1) lack of quality games currently offered,

(2) studio/game concentration,

(3) stunted growth of MAUs,

(4) founder sales & dilution,

(4) has been tried before & failed,

(5) Casino not Esports

Will give my view on each of these in turn

17/

Bear Arg 1: lack of quality games.

View = AGREE.

Games on offer currently = NOT top notch

We aren’t talking about FIFA 2020 or GT Racing or any other title – it’s currently all about relatively basic games like Solitaire, Bingo, Virtual Pool etc.

Bear Arg 1: lack of quality games.

View = AGREE.

Games on offer currently = NOT top notch

We aren’t talking about FIFA 2020 or GT Racing or any other title – it’s currently all about relatively basic games like Solitaire, Bingo, Virtual Pool etc.

18/

But a few counter points:

A> $SKLZ doesn’t need top notch games to monetize – just those that instil a competitive spirit. The current product suite does a good job of it.

B> Despite the basic product suite, $SKLZ has done well to attract a decent # of ‘buyers’ …

But a few counter points:

A> $SKLZ doesn’t need top notch games to monetize – just those that instil a competitive spirit. The current product suite does a good job of it.

B> Despite the basic product suite, $SKLZ has done well to attract a decent # of ‘buyers’ …

19/

.. off of which it is monetizing – revenue has grown from $17m in FY17 to $230m in FY20 -> off ‘basic games’ -> that’s astounding growth.

To sell HQ games is easy but it isn’t easy to monetize basic ones.

To me, this proves EXECUTION CAPABILITY

.. off of which it is monetizing – revenue has grown from $17m in FY17 to $230m in FY20 -> off ‘basic games’ -> that’s astounding growth.

To sell HQ games is easy but it isn’t easy to monetize basic ones.

To me, this proves EXECUTION CAPABILITY

20/

C> Currently most (if not all) games available on the platform are single player games. These games were initially not built for the purpose of ‘competing’ – hence single player.

Monetizing single player games “through competition” was therefore not envisaged by developers.

C> Currently most (if not all) games available on the platform are single player games. These games were initially not built for the purpose of ‘competing’ – hence single player.

Monetizing single player games “through competition” was therefore not envisaged by developers.

21/

Most single player games rely on advertising for monetization (not as profitable). $SKLZ offers them an alt monetization. I see more & more single player game developers opting to work with $SKLZ due to this.

See tweet 42/43 – regarding Tether’s experience on Solitaire Cube

Most single player games rely on advertising for monetization (not as profitable). $SKLZ offers them an alt monetization. I see more & more single player game developers opting to work with $SKLZ due to this.

See tweet 42/43 – regarding Tether’s experience on Solitaire Cube

22/

D> The most competitive games are multiplayer – where you are competing in real-time. Best examples are Tennis, Multiplayer Racing, etc.

If $SKLZ is able to ‘adjust’ its tech/SDK to enable the ‘betting’ aspect on multi-player games – we will have a big winner.

D> The most competitive games are multiplayer – where you are competing in real-time. Best examples are Tennis, Multiplayer Racing, etc.

If $SKLZ is able to ‘adjust’ its tech/SDK to enable the ‘betting’ aspect on multi-player games – we will have a big winner.

23/

The key questions therefore that any potential investor has to ask is whether the $SKLZ tech will be able to deal with the

a. cumbersome requirements of a higher quality game even if single player?

b. Enabling of competition on multi-player games vs just single player?

The key questions therefore that any potential investor has to ask is whether the $SKLZ tech will be able to deal with the

a. cumbersome requirements of a higher quality game even if single player?

b. Enabling of competition on multi-player games vs just single player?

24/

For me, the answer to both is YES but as noted earlier, they may have to tweak their current SDK slightly to enable (b) here.

Interestingly $SKLZ was granted a software patent for “enabling team-based competitions for future titles” in 2018 – in other words, this is planned!

For me, the answer to both is YES but as noted earlier, they may have to tweak their current SDK slightly to enable (b) here.

Interestingly $SKLZ was granted a software patent for “enabling team-based competitions for future titles” in 2018 – in other words, this is planned!

25/

The QUALITY of games on offer does not matter, MONETIZATION does…and $SKLZ has shown that they are able to make it work with simple games.

EXECUTION CAPABILITY has been proven.

Secondly, as investors, we are driven to look at historical performance & predict the future.

The QUALITY of games on offer does not matter, MONETIZATION does…and $SKLZ has shown that they are able to make it work with simple games.

EXECUTION CAPABILITY has been proven.

Secondly, as investors, we are driven to look at historical performance & predict the future.

26/

While this look-back analysis works for the existing product suite, it is difficult to make any sort of assumptions on the monetizability of the updated product suite.

This is the most difficult part of investing in “early stage” platforms like $SKLZ

While this look-back analysis works for the existing product suite, it is difficult to make any sort of assumptions on the monetizability of the updated product suite.

This is the most difficult part of investing in “early stage” platforms like $SKLZ

27/

Monetization in early stage platforms is generally proven on the back of basic & often lower quality products, but to see the vision of what it could become, one needs to align here with the founder’s vision.

This is not easy but unfort, is necessary to invest in $SKLZ

Monetization in early stage platforms is generally proven on the back of basic & often lower quality products, but to see the vision of what it could become, one needs to align here with the founder’s vision.

This is not easy but unfort, is necessary to invest in $SKLZ

28/

Let me quickly remind you of a case where a basic platform morphed into a behemoth -> $AMZN -> from an online bookstore to a retail behemoth.

You would’ve laughed at the 1998 Bezos' vision for an integrated global retail platform. Did you really expect this transformation?

Let me quickly remind you of a case where a basic platform morphed into a behemoth -> $AMZN -> from an online bookstore to a retail behemoth.

You would’ve laughed at the 1998 Bezos' vision for an integrated global retail platform. Did you really expect this transformation?

29/

You probably think I’m crazy comparing $SKLZ to $AMZN

Ofc $SKLZ IS NOT $AMZN -> but what is similar is the ‘early stage’ platform concept.

One needs to be a visionary here to take this risk on.

You probably think I’m crazy comparing $SKLZ to $AMZN

Ofc $SKLZ IS NOT $AMZN -> but what is similar is the ‘early stage’ platform concept.

One needs to be a visionary here to take this risk on.

30/

Chances of failure at this early stage is high. And that’s why I started this thread talking about ‘high risk’ and ‘high risk reward’.

To me, the Execution Capability has been proven.

Typically, I’d expect a $SKLZ to go down the VC/PE route before IPOing…

Chances of failure at this early stage is high. And that’s why I started this thread talking about ‘high risk’ and ‘high risk reward’.

To me, the Execution Capability has been proven.

Typically, I’d expect a $SKLZ to go down the VC/PE route before IPOing…

31/

..as the investor base is not ideal to the execution risk & vision here.

That said, if picked right, there remains a lot of potential…with the opportunity to multiply your investment.

…HIGH RISK = HIGH REWARD

..as the investor base is not ideal to the execution risk & vision here.

That said, if picked right, there remains a lot of potential…with the opportunity to multiply your investment.

…HIGH RISK = HIGH REWARD

32/

Bear Arg 2: developer/studio & game concentration.

Big Run & Tether Studios = 87% of revenue and top 3 games = 79% of revenue. View: Higher risk but OVERPLAYED IMO.

But, it sounds scary.

Bear Arg 2: developer/studio & game concentration.

Big Run & Tether Studios = 87% of revenue and top 3 games = 79% of revenue. View: Higher risk but OVERPLAYED IMO.

But, it sounds scary.

33/

Ofc this is a RISK and bears are right to highlight it.

As noted earlier though - developers here are $SKLZ ’s suppliers.

Supplier risk is real– mostly due to supply chain disruption (reliance on 1 factory for eg) rather than product withdrawal.

Ofc this is a RISK and bears are right to highlight it.

As noted earlier though - developers here are $SKLZ ’s suppliers.

Supplier risk is real– mostly due to supply chain disruption (reliance on 1 factory for eg) rather than product withdrawal.

34/

Given these are tech companies, there isn’t really any ‘physical’ element to the supply chain disruption to be worried about.

Rather the worries would be around (a) developer withdrawal, and (b) developer bankruptcy.

Neither of which are to be worried about IMHO.

Given these are tech companies, there isn’t really any ‘physical’ element to the supply chain disruption to be worried about.

Rather the worries would be around (a) developer withdrawal, and (b) developer bankruptcy.

Neither of which are to be worried about IMHO.

35/

2 biggest studios here are (a) Big Run and (b) Tether.

Founded in Jun’19, Big Run is a small game dev-focussed company (25 employees).

Focus is clearly on remaking classic games which can be brought ‘quick to market’ by working with an ‘established platform’ like $SKLZ

2 biggest studios here are (a) Big Run and (b) Tether.

Founded in Jun’19, Big Run is a small game dev-focussed company (25 employees).

Focus is clearly on remaking classic games which can be brought ‘quick to market’ by working with an ‘established platform’ like $SKLZ

36/

Big Run have a good thing going here with $SKLZ – moving away would not be a risk worth taking given the lack of bigger team or budget to support their games.

In any case, developers like Big Run prefer to focus on game dev rather than user acq & monetization.

Big Run have a good thing going here with $SKLZ – moving away would not be a risk worth taking given the lack of bigger team or budget to support their games.

In any case, developers like Big Run prefer to focus on game dev rather than user acq & monetization.

37/

Also note that Big Run was founded in Jun’19 & signed agreement with $SKLZ in Oct’19. This is a c1.5yr partnership which is going strong.

All 5 games are currently offered exclusively via $SKLZ – Big Hearts, Big Run Solitaire, Farm Sweeper, Big Cooking and Blackout Bingo.

Also note that Big Run was founded in Jun’19 & signed agreement with $SKLZ in Oct’19. This is a c1.5yr partnership which is going strong.

All 5 games are currently offered exclusively via $SKLZ – Big Hearts, Big Run Solitaire, Farm Sweeper, Big Cooking and Blackout Bingo.

38/

Big Run raised $6.6m in 2020 and has since hired a CTO, Executive Producer and SVP to pretty much focus on development of new titles & enrich gameplay. No moves made to date suggest they are even considering leaving $SKLZ.

Again, this is a risk not worth taking for Big Run.

Big Run raised $6.6m in 2020 and has since hired a CTO, Executive Producer and SVP to pretty much focus on development of new titles & enrich gameplay. No moves made to date suggest they are even considering leaving $SKLZ.

Again, this is a risk not worth taking for Big Run.

39/

If anything, I’m impressed here by $SKLZ ’s ability to market Big Run games and make a success of it. Launching a Bingo or Solitaire game in a crowded market isn’t easy.

Again, EXECUTION CAPABILITY has been proven.

If anything, I’m impressed here by $SKLZ ’s ability to market Big Run games and make a success of it. Launching a Bingo or Solitaire game in a crowded market isn’t easy.

Again, EXECUTION CAPABILITY has been proven.

40/

The Big Run CEO was previously Exec.Producer @ WB Games (worked on Harry Potter: Wizards Unite) and Zynga (FarmVille, CastleVille: Legends, games for Zynga Casino).

Perhaps we will see more HQ & engaging games in the future esp given they have just raised $$s?

The Big Run CEO was previously Exec.Producer @ WB Games (worked on Harry Potter: Wizards Unite) and Zynga (FarmVille, CastleVille: Legends, games for Zynga Casino).

Perhaps we will see more HQ & engaging games in the future esp given they have just raised $$s?

41/

Tether Studios – founded in 2014 by ex Zynga co-founders - is another small dev-focussed biz with 11 employees.

Their profile states that they are a “small group of passionate developers..”focussed on bringing mobile sports/skill based games to broader audience”.

Tether Studios – founded in 2014 by ex Zynga co-founders - is another small dev-focussed biz with 11 employees.

Their profile states that they are a “small group of passionate developers..”focussed on bringing mobile sports/skill based games to broader audience”.

42/

Apparently, Tether initially had trouble getting organic growth for Solitaire Cube. Despite having ads, results were disappointing with just $0.02 Avg Rev per DAU (ARPDAU).

Apparently, Tether initially had trouble getting organic growth for Solitaire Cube. Despite having ads, results were disappointing with just $0.02 Avg Rev per DAU (ARPDAU).

43/

Post $SKLZ integration, ARPDAU inc substantially, by 20x, to $0.45 and Solitaire Cube saw better user retention as well - 64% players returned within 1 day, 50% returned by day 7 and 33% post 30 days.

Yes – churn remains high but customers do return as revenue clearly shows

Post $SKLZ integration, ARPDAU inc substantially, by 20x, to $0.45 and Solitaire Cube saw better user retention as well - 64% players returned within 1 day, 50% returned by day 7 and 33% post 30 days.

Yes – churn remains high but customers do return as revenue clearly shows

44/

This was just the proof required for Tether to partner with $SKLZ – again, looking at the team here, cant see a reason why Tether would revert back to solo. This is just better.

Also CEO Tim O’Neil has taken part in a few case studies & given testimonials promoting $SKLZ

This was just the proof required for Tether to partner with $SKLZ – again, looking at the team here, cant see a reason why Tether would revert back to solo. This is just better.

Also CEO Tim O’Neil has taken part in a few case studies & given testimonials promoting $SKLZ

45/

When researching into this, an interesting aspect I came across was ‘cross promotion of games’. In other words, studios can place ads within their games to promote the user to try other games. We have no data to see how successful this is – but I cant see a downside with this

When researching into this, an interesting aspect I came across was ‘cross promotion of games’. In other words, studios can place ads within their games to promote the user to try other games. We have no data to see how successful this is – but I cant see a downside with this

46/

The bigger risk in this point though is that 79% of revenue comes from 3 games. This is a BIG RISK– as this is more on the demand/customer side.

What happens if customers no longer find these games interesting?

The bigger risk in this point though is that 79% of revenue comes from 3 games. This is a BIG RISK– as this is more on the demand/customer side.

What happens if customers no longer find these games interesting?

47/

This one needs considering IMO as it is difficult to gain conviction. What I would say however is that $SKLZ has proven its ability to grow revenue consistently even if it is through new games.

Again, EXECUTION CAPABILTY has been proven.

This one needs considering IMO as it is difficult to gain conviction. What I would say however is that $SKLZ has proven its ability to grow revenue consistently even if it is through new games.

Again, EXECUTION CAPABILTY has been proven.

48/

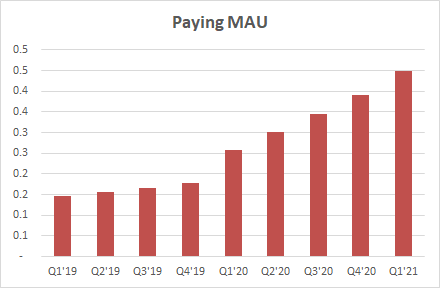

Bear Arg 3 -> “stunted growth of MAUs” although mngmt focuses on Paying MAUs than total MAUs.

As the chart below shows – MAU growth was elevated in Q1-Q3’20 but rebased in Q4’20.

I assume this ‘rebasing’ that we saw in Q4’20 was due to Covid normalization.

Bear Arg 3 -> “stunted growth of MAUs” although mngmt focuses on Paying MAUs than total MAUs.

As the chart below shows – MAU growth was elevated in Q1-Q3’20 but rebased in Q4’20.

I assume this ‘rebasing’ that we saw in Q4’20 was due to Covid normalization.

49/

Yes, $SKLZ got a nice boost off C19, on the back of which they came public and now we are seeing the MAUs normalizing as people have less free time to spend on gaming.

Ofc doesn’t look great - but I see no reason to worry here…

Yes, $SKLZ got a nice boost off C19, on the back of which they came public and now we are seeing the MAUs normalizing as people have less free time to spend on gaming.

Ofc doesn’t look great - but I see no reason to worry here…

50/

…because Paying MAU’s have contd growing. In other words, $SKLZ has been successful in keeping the paying subscribers engaged despite the overall MAUs rebasing.

…because Paying MAU’s have contd growing. In other words, $SKLZ has been successful in keeping the paying subscribers engaged despite the overall MAUs rebasing.

51/

Paying MAUs have increased both in Q4’20 and Q1’21 by 120% and 25% yoy ….and by 13% and 15% qoq.

Remember, Q1’21 has a tough comp against Q1’20 which benefitted from Covid & yet we saw +ive yoy growth – that’s good.

Paying MAUs have increased both in Q4’20 and Q1’21 by 120% and 25% yoy ….and by 13% and 15% qoq.

Remember, Q1’21 has a tough comp against Q1’20 which benefitted from Covid & yet we saw +ive yoy growth – that’s good.

52/

This impact of growing Paying MAUs is also directly visible in revenue growth, which has grown consistently and which I believe will still continue to.

This impact of growing Paying MAUs is also directly visible in revenue growth, which has grown consistently and which I believe will still continue to.

53/

Normalization post C19 is to be expected. I expect to see this trend in other WFH beneficiary names in their Q1 results

If user growth benefited as a result of being a covid beneficiary, it will normalize in FY21.

Nothing to worry about here though IMHO.

Normalization post C19 is to be expected. I expect to see this trend in other WFH beneficiary names in their Q1 results

If user growth benefited as a result of being a covid beneficiary, it will normalize in FY21.

Nothing to worry about here though IMHO.

54/

Also – the chicken & egg issue with platforms which I noted earlier – user & revenue growth are likely be “lumpy” here.

I do expect the revenue and user base to grow over time from existing product suite monetisation….BUT

Also – the chicken & egg issue with platforms which I noted earlier – user & revenue growth are likely be “lumpy” here.

I do expect the revenue and user base to grow over time from existing product suite monetisation….BUT

55/

…BUT onboarding of a new successful single player game (like we saw with Blackout Blitz) or alternatively tweaking of $SKLZ 's SDK to include multi-player games – will possibly result in a huge bump up to the revenue and user base.

Watch out for this big catalyst.

…BUT onboarding of a new successful single player game (like we saw with Blackout Blitz) or alternatively tweaking of $SKLZ 's SDK to include multi-player games – will possibly result in a huge bump up to the revenue and user base.

Watch out for this big catalyst.

56/

Financial performance-wise – I honestly do not see any reason to worry here either.

The figures below separates out the Sales & Marketing expense based on $SKLZ’s disclosures.

Engagement mkting spend – margin remains static yet we have seen paying MAU growth. Good result

Financial performance-wise – I honestly do not see any reason to worry here either.

The figures below separates out the Sales & Marketing expense based on $SKLZ’s disclosures.

Engagement mkting spend – margin remains static yet we have seen paying MAU growth. Good result

57/

Spend to acquire new users increased in FY20

I believe this contributed to the MAU spike seen in Q1’20 and continued growth through to Q3, off of which $SKLZ came to market.

But as we know MAU rebased in Q4’20 as covid restrictions eased.

Spend to acquire new users increased in FY20

I believe this contributed to the MAU spike seen in Q1’20 and continued growth through to Q3, off of which $SKLZ came to market.

But as we know MAU rebased in Q4’20 as covid restrictions eased.

58/

I’d expect FY21 to be another year of high User Acquisition spend and strongly believe we will see the fruits of this on QoQ MAU growth across Q2-Q4’21.

Concerns surrounding S&M expenses remaining high are fair …

I’d expect FY21 to be another year of high User Acquisition spend and strongly believe we will see the fruits of this on QoQ MAU growth across Q2-Q4’21.

Concerns surrounding S&M expenses remaining high are fair …

59/

This was the case esp in FY20, driven I assume, by increased spending due to covid restrictions and aim to inc users, which worked at least in the interim.

Whether spend level remains elevated relative to revenue needs to be closely monitored here.

This was the case esp in FY20, driven I assume, by increased spending due to covid restrictions and aim to inc users, which worked at least in the interim.

Whether spend level remains elevated relative to revenue needs to be closely monitored here.

60/

The prospectus dated Dec 16, 2020 notes that $SKLZ has an “estimated four-month end-user payback period in 2020” – if true, this is remarkable – but these stats are difficult to verify in often convoluted financials. Not a red flag per se given growth stage, but diff to see.

The prospectus dated Dec 16, 2020 notes that $SKLZ has an “estimated four-month end-user payback period in 2020” – if true, this is remarkable – but these stats are difficult to verify in often convoluted financials. Not a red flag per se given growth stage, but diff to see.

61/

Prospectus also notes $SKLZ expects “normalized end-user acquisition costs, marketing expenses and relative size of its cost of operations [to] result in EBITDA margins over 30%” once fully scaled.

Would be great, but we'll need to wait & see. PATIENCE REQD.

Prospectus also notes $SKLZ expects “normalized end-user acquisition costs, marketing expenses and relative size of its cost of operations [to] result in EBITDA margins over 30%” once fully scaled.

Would be great, but we'll need to wait & see. PATIENCE REQD.

62/

The cashflow profile is also indicative of a growing company, with burn due to high S&M spend (discretionary spend, but reqd to drive rev & MAU growth).

Cash burn has been financed historically with a mixture of Pref Shares & Debt – as is the case with early stage biz.

The cashflow profile is also indicative of a growing company, with burn due to high S&M spend (discretionary spend, but reqd to drive rev & MAU growth).

Cash burn has been financed historically with a mixture of Pref Shares & Debt – as is the case with early stage biz.

63/

Bear Arg 4 -> Dilution given secondary sale & founder selling. I’ll give you this one - a real mess up, and a few ones too.

Secondary sale raised $392.4m -> this combined with $241m FY20 cash – means $SKLZ had $633m of pro forma cash.

Bear Arg 4 -> Dilution given secondary sale & founder selling. I’ll give you this one - a real mess up, and a few ones too.

Secondary sale raised $392.4m -> this combined with $241m FY20 cash – means $SKLZ had $633m of pro forma cash.

64/

Even if we assume a high $33m cash burn in Q1, $SKLZ is left with $600m cash a lot of firepower. I assume there is some sort of M&A transaction coming!?

Will come back to this shortly...but for now, let’s assume there is a transaction being envisaged here.

Even if we assume a high $33m cash burn in Q1, $SKLZ is left with $600m cash a lot of firepower. I assume there is some sort of M&A transaction coming!?

Will come back to this shortly...but for now, let’s assume there is a transaction being envisaged here.

65/

But why did the founders sell? This is a tricky one to answer with conviction.

First, neither @andrewparadise (CEO) nor @CChafkin (CRO) sold their stakes to $FEAC. It was rolled into new equity.

But why did the founders sell? This is a tricky one to answer with conviction.

First, neither @andrewparadise (CEO) nor @CChafkin (CRO) sold their stakes to $FEAC. It was rolled into new equity.

66/

In fact, if anything, $SKLZ management did not want more money than required from the $FEAC merger as they wanted to avoid greater dilution...but finally agreed to increase cash on balance sheet” by c$250m.

They wanted to hold their shares tight. That’s surely a good sign!?

In fact, if anything, $SKLZ management did not want more money than required from the $FEAC merger as they wanted to avoid greater dilution...but finally agreed to increase cash on balance sheet” by c$250m.

They wanted to hold their shares tight. That’s surely a good sign!?

67/

Post $FEAC - $SKLZ merger, per my calcs, Andrew held 18.4% (& 84.3% voting control) and Casey 3.7% stakes. Post their sale in Mar’21, Andrew now holds 16% stake & Casey 3.2%

..i.e. Andrew and Casey sold just a v small part (10%) of holdings. They still remain big investors

Post $FEAC - $SKLZ merger, per my calcs, Andrew held 18.4% (& 84.3% voting control) and Casey 3.7% stakes. Post their sale in Mar’21, Andrew now holds 16% stake & Casey 3.2%

..i.e. Andrew and Casey sold just a v small part (10%) of holdings. They still remain big investors

68/

Now we have no idea why they sold. Both bulls are bears can come up with reasons – but the fact is we don’t know. Let me give you both:

Now we have no idea why they sold. Both bulls are bears can come up with reasons – but the fact is we don’t know. Let me give you both:

69/

BEAR -> sale after short report; price is high; cash out at least some shares.

BULL -> perhaps they sold so that existing investors would not get more diluted than required? Float size increases, more liquidity?

Its easy to speculate. But the fact is – we don’t know.

BEAR -> sale after short report; price is high; cash out at least some shares.

BULL -> perhaps they sold so that existing investors would not get more diluted than required? Float size increases, more liquidity?

Its easy to speculate. But the fact is – we don’t know.

70/

But, while researching, I came across something that looked interesting – STOCK OPTIONS granted to Andrew and Casey as part of the $FEAC - $SKLZ merger.

Specifically, 9.96m shares granted to Andrew and 2.04m shares to Casey.

But, while researching, I came across something that looked interesting – STOCK OPTIONS granted to Andrew and Casey as part of the $FEAC - $SKLZ merger.

Specifically, 9.96m shares granted to Andrew and 2.04m shares to Casey.

71/

These shares vest in the following order:

A> 1/3rd @ $51/shr

B> 1/3rd @ $68/shre, and

C > rest @ $85/shre

These numbers are based on 3x, 4x and 5x of Volume Wgtd Avg Price of $FEAC price on 16 Dec – which I assume is $17

Pg 83/123 of Annual Report if anyone’s interested

These shares vest in the following order:

A> 1/3rd @ $51/shr

B> 1/3rd @ $68/shre, and

C > rest @ $85/shre

These numbers are based on 3x, 4x and 5x of Volume Wgtd Avg Price of $FEAC price on 16 Dec – which I assume is $17

Pg 83/123 of Annual Report if anyone’s interested

72/

Incentives are aligned here for Andrew & Casey. By my calcs, at these specific share prices, Andrew’s options are worth $675m and if all at $85/share, worth c$850m. That’s mental!

Now from $19/share today to $85 -> would be some gain.

Let’s just agree that founders are keen

Incentives are aligned here for Andrew & Casey. By my calcs, at these specific share prices, Andrew’s options are worth $675m and if all at $85/share, worth c$850m. That’s mental!

Now from $19/share today to $85 -> would be some gain.

Let’s just agree that founders are keen

73/

Now I’ll give a counter argument to give a balanced view.

Valuations nowadays for growth stage companies are based on rev – not EBITDA. This means that S&M can remain high to keep revenue growing.

Higher revenue = higher valuation = higher share price

Now I’ll give a counter argument to give a balanced view.

Valuations nowadays for growth stage companies are based on rev – not EBITDA. This means that S&M can remain high to keep revenue growing.

Higher revenue = higher valuation = higher share price

74/

You’d need to get comfortable that this isn’t the case, which I admit may be difficult for some.

For me, $SKLZ having generated $420m in cumulative revenue (FY17-FY20) off of just $128m of funding (ex SPAC) is impressive & again, shows Execution Capability

You’d need to get comfortable that this isn’t the case, which I admit may be difficult for some.

For me, $SKLZ having generated $420m in cumulative revenue (FY17-FY20) off of just $128m of funding (ex SPAC) is impressive & again, shows Execution Capability

75/

Bear Arg 5 -> Has been tried before & Failed.

I don’t think this is a strong argument – there are so many instances of counter-examples.

My arguments would be (a) Survival of the Fittest, and (b) shit happens – tech is sometimes far too ahead of time, dry funding mkts, etc

Bear Arg 5 -> Has been tried before & Failed.

I don’t think this is a strong argument – there are so many instances of counter-examples.

My arguments would be (a) Survival of the Fittest, and (b) shit happens – tech is sometimes far too ahead of time, dry funding mkts, etc

76/

Bear Arg 6 -> Casino not ESports

$SKLZ is a platform, not a casino as players are competing against each other not the house.

The games, though, are more akin to a casino – true.

Bear Arg 6 -> Casino not ESports

$SKLZ is a platform, not a casino as players are competing against each other not the house.

The games, though, are more akin to a casino – true.

77/

What about ESports? Is this an Esports company?

This is a difficult one I admit. But interestingly, I found a few points..but which are difficult to follow through.

There is an esports element to $SKLZ which could grow

What about ESports? Is this an Esports company?

This is a difficult one I admit. But interestingly, I found a few points..but which are difficult to follow through.

There is an esports element to $SKLZ which could grow

78/

One of short reports highlighted very few viewers for $SKLZ’s twitch account. But, it seems $SKLZ live streams through other accounts, not its own.

For eg – in Mar’17 - $SKLZ broadcast its first live streamed mobile esports charity tournament through “Doublelift” ...

One of short reports highlighted very few viewers for $SKLZ’s twitch account. But, it seems $SKLZ live streams through other accounts, not its own.

For eg – in Mar’17 - $SKLZ broadcast its first live streamed mobile esports charity tournament through “Doublelift” ...

79/

(top 10 streamer & prof “League of Legends” player)’s twitch acct, which attracted 140k+ views

The current SDK allows players to upload gameplay to Twitch, Youtube, Azubu

Seems $SKLZ is investing more in its product suite development – with a focus on esports & partnership

(top 10 streamer & prof “League of Legends” player)’s twitch acct, which attracted 140k+ views

The current SDK allows players to upload gameplay to Twitch, Youtube, Azubu

Seems $SKLZ is investing more in its product suite development – with a focus on esports & partnership

80/

An email sent to the $SKLZ developer community in Jan’21 seems to ask developers to bring ideas onto the table on the “esports and spectatorship” theme.

Let’s see how that works out – again, time will tell. PATIENCE.

An email sent to the $SKLZ developer community in Jan’21 seems to ask developers to bring ideas onto the table on the “esports and spectatorship” theme.

Let’s see how that works out – again, time will tell. PATIENCE.

81/

To be considered a true esports corp, I believe the product suite will have to improve & ideally have a multi-player component. Games like Counter Strike would be great for eg.

If such games come on to the platform, it’ll be a BOOM BOOM POW moment, I believe.

To be considered a true esports corp, I believe the product suite will have to improve & ideally have a multi-player component. Games like Counter Strike would be great for eg.

If such games come on to the platform, it’ll be a BOOM BOOM POW moment, I believe.

82/

$SKLZ currently has 13 esports patents. Some of the recent ones relate to

a. $SKLZ Arena (platform for hosting & broadcasting esports)

b. Tech for mobile video capture & streaming

c. Video data in streams

d. Software for enabling team-based competitions for future titles.

$SKLZ currently has 13 esports patents. Some of the recent ones relate to

a. $SKLZ Arena (platform for hosting & broadcasting esports)

b. Tech for mobile video capture & streaming

c. Video data in streams

d. Software for enabling team-based competitions for future titles.

83/

$SKLZ are cornering the mobile esports market which is still very much in the nascent stage in the West.

When this takes off, $SKLZ will be ready to monetize.

$SKLZ are cornering the mobile esports market which is still very much in the nascent stage in the West.

When this takes off, $SKLZ will be ready to monetize.

84/

If that does happen, then there are more than enough incremental revenue sources coming including a) event ticket sales, b) merchandising c) advertising, and d) broadcast licensing.

All nice adds on, but will be some time before we get there.

If that does happen, then there are more than enough incremental revenue sources coming including a) event ticket sales, b) merchandising c) advertising, and d) broadcast licensing.

All nice adds on, but will be some time before we get there.

85/

This I believe was part of the $FEAC sponsor thesis as the prospectus dated 1 Dec 2020 stated “$SKLZ unique position in facilitating the nascent competitive gaming market rather than being a game developer” as being key

This I believe was part of the $FEAC sponsor thesis as the prospectus dated 1 Dec 2020 stated “$SKLZ unique position in facilitating the nascent competitive gaming market rather than being a game developer” as being key

86/

Going back to platforms.

Just having good tech isn’t enough for a successful platform – you need to have 2 more things really

a) money, and

b) relationships

The success will also lie in the execution of the vision.

Going back to platforms.

Just having good tech isn’t enough for a successful platform – you need to have 2 more things really

a) money, and

b) relationships

The success will also lie in the execution of the vision.

87/

RELATIONSHIPs -> $SKLZ ’s USP currently involves offering small developers a monetization avenue without cost contribution.

But as we discussed earlier, the ability to attract big titles may be a game changer here.

RELATIONSHIPs -> $SKLZ ’s USP currently involves offering small developers a monetization avenue without cost contribution.

But as we discussed earlier, the ability to attract big titles may be a game changer here.

88/

$SKLZ has been up and running & monetization is now proven. Would $SKLZ look to scale this up further by targeting larger studios and titles/games?

To do that though, it’ll need strong relationships – and that’s why we should look at the board and investors in this company

$SKLZ has been up and running & monetization is now proven. Would $SKLZ look to scale this up further by targeting larger studios and titles/games?

To do that though, it’ll need strong relationships – and that’s why we should look at the board and investors in this company

89/

Harry Sloan – as a veteran in media community, Mr Sloan has excellent relationships which could potentially help bring more HQ titles to $SKLZ

Kent Wakeford – co-founder & Vice Chair of Gen. G E-sports, a prof esports org - the 6th most valuable esports company globally

Harry Sloan – as a veteran in media community, Mr Sloan has excellent relationships which could potentially help bring more HQ titles to $SKLZ

Kent Wakeford – co-founder & Vice Chair of Gen. G E-sports, a prof esports org - the 6th most valuable esports company globally

90/

Gen. G’s divisions include some v familiar games like (a) Counter-Strike, (b) Fortnite, (c) NBA 2K, (d) League of Legends, (e) Overwatch and (f) Clash Royale.

The access to Gen. G is very valuable to $SKLZ esp if it targets overseas expansion in Asia& esp China & South Korea

Gen. G’s divisions include some v familiar games like (a) Counter-Strike, (b) Fortnite, (c) NBA 2K, (d) League of Legends, (e) Overwatch and (f) Clash Royale.

The access to Gen. G is very valuable to $SKLZ esp if it targets overseas expansion in Asia& esp China & South Korea

91/

Although not part of the $SKLZ board, it is worth noting that the CEO of Gen. G, Mr Chris Park, was formerly the Exec VP of Global Marketing & Partnerships for Major League Baseball.

That’s a nice contact to have :)

Although not part of the $SKLZ board, it is worth noting that the CEO of Gen. G, Mr Chris Park, was formerly the Exec VP of Global Marketing & Partnerships for Major League Baseball.

That’s a nice contact to have :)

92/

Going back to the $SKLZ board, we have Vandana Mehta-Krantz.

As the former CFO & Board member of Bamtech Media, Vandana possibly has access to key individuals at Bamtech’s corporate owners including Major League Baseball, National Hockey League and Disney

Going back to the $SKLZ board, we have Vandana Mehta-Krantz.

As the former CFO & Board member of Bamtech Media, Vandana possibly has access to key individuals at Bamtech’s corporate owners including Major League Baseball, National Hockey League and Disney

93/

In addition, Vandana also worked on the preparation and launch of Disney+ as she was CFO of Disney Streaming Services business (Sep’17 to Aug’20)

Those are some very very interesting contacts that Vandana has :)

In addition, Vandana also worked on the preparation and launch of Disney+ as she was CFO of Disney Streaming Services business (Sep’17 to Aug’20)

Those are some very very interesting contacts that Vandana has :)

94/

Finally, Jerry Bruckheimer – who needs no introduction – joined the board recently. He was also a board member of gaming company Zenimax Media, whose chair was Kent Wakeford.

Perhaps connection helped, but assume Bruckheimer will also bring some good experience & contacts

Finally, Jerry Bruckheimer – who needs no introduction – joined the board recently. He was also a board member of gaming company Zenimax Media, whose chair was Kent Wakeford.

Perhaps connection helped, but assume Bruckheimer will also bring some good experience & contacts

95/

These are heavyweights. Heavyweights don’t joint a shitty board. They do their DD & work for the betterment of the product, $SKLZ.

Major League Baseball has been mentioned a few times – perhaps this is the next partnership, which I guess is within grasp?

These are heavyweights. Heavyweights don’t joint a shitty board. They do their DD & work for the betterment of the product, $SKLZ.

Major League Baseball has been mentioned a few times – perhaps this is the next partnership, which I guess is within grasp?

96/

A combo of MONEY and RELATIONSHIPS combined with proven execution capability is the ideal combination for a successful platform.

$SKLZ just raised an uber load of money and per my calcs, is now sitting on c$600m of cash which I assume will be spent on M&A?

A combo of MONEY and RELATIONSHIPS combined with proven execution capability is the ideal combination for a successful platform.

$SKLZ just raised an uber load of money and per my calcs, is now sitting on c$600m of cash which I assume will be spent on M&A?

97/

A number of job adverts on $SKLZ relate to building a “Corporate Development” team – 2 are live at present – “VP for Corp Dev & Strategy” and “Associate, Corp Dev”. Seems to suggest M&A is a key focus.

Specifically, the VP role’s responsibilities states..

A number of job adverts on $SKLZ relate to building a “Corporate Development” team – 2 are live at present – “VP for Corp Dev & Strategy” and “Associate, Corp Dev”. Seems to suggest M&A is a key focus.

Specifically, the VP role’s responsibilities states..

98/

- Support the development of M&A strategy, priorities and pipeline

- Research the mkt landscape to identify acq, JV, partnership, & strategic investment opps

- Source, evaluate, close, & integrate acq & inv opportunities in collaboration with key stakeholders

- Support the development of M&A strategy, priorities and pipeline

- Research the mkt landscape to identify acq, JV, partnership, & strategic investment opps

- Source, evaluate, close, & integrate acq & inv opportunities in collaboration with key stakeholders

99/

The “Head of Business Strategy & Planning, Revenue” job ad states

- “Develop an intl expansion strategy, inclusive of market prioritization and rollout / go to market planning.”

- “Given the extent of our goals, this may include evaluating potential partnerships….

The “Head of Business Strategy & Planning, Revenue” job ad states

- “Develop an intl expansion strategy, inclusive of market prioritization and rollout / go to market planning.”

- “Given the extent of our goals, this may include evaluating potential partnerships….

100/

, alliances, and acquisitions to advance our strategic agenda”

The “SVP of Revenue” role states “Oversee the company’s first international product launches”

…perhaps we will see an international acquisition in short order, perhaps in Asia where esports is huge??

, alliances, and acquisitions to advance our strategic agenda”

The “SVP of Revenue” role states “Oversee the company’s first international product launches”

…perhaps we will see an international acquisition in short order, perhaps in Asia where esports is huge??

101/

$SKLZ seems to be on a hiring spree as it targets grth through partnerships – having recently hired a few individuals from likes of $MSFT and TicketMaster.

Most ads seem to suggest ‘new partnerships & execution’ is a key part of growth.

More announcements to come, I bet.

$SKLZ seems to be on a hiring spree as it targets grth through partnerships – having recently hired a few individuals from likes of $MSFT and TicketMaster.

Most ads seem to suggest ‘new partnerships & execution’ is a key part of growth.

More announcements to come, I bet.

102/

Growth is the key focus as one job ad states that the

“Acquisition & Growth teams find ways to increase # of players on $SKLZ & work to deliver features that increase virality & reduce user acq costs“

including

“exciting events, social systems, & gamified interactions”

Growth is the key focus as one job ad states that the

“Acquisition & Growth teams find ways to increase # of players on $SKLZ & work to deliver features that increase virality & reduce user acq costs“

including

“exciting events, social systems, & gamified interactions”

103/

Other roles also suggest needing experience in ‘digital advertising’, ‘brand sponsorship’ & ‘brand licensing’.

The sponsorship & licensing seem to tie up with partnerships such as those announced with the NFL recently, but ‘digital media advertising’ was interesting to see

Other roles also suggest needing experience in ‘digital advertising’, ‘brand sponsorship’ & ‘brand licensing’.

The sponsorship & licensing seem to tie up with partnerships such as those announced with the NFL recently, but ‘digital media advertising’ was interesting to see

104/

A deeper dive revealed a new ‘monetization avenue’ email to developers in Dec’20. This will further spur revenue growth by helping monetize the non-paying MAU.

In other words, we should see MAU to Paying MAU conversion increasing.

A deeper dive revealed a new ‘monetization avenue’ email to developers in Dec’20. This will further spur revenue growth by helping monetize the non-paying MAU.

In other words, we should see MAU to Paying MAU conversion increasing.

105/

Advertising is certainly a way to incrementally grow revenue and I’m glad that $SKLZ is implementing this.

The “SVP Revenue” ad states “Successfully launch & scale new rev streams from brand sponsorship and advertising” as being a key responsibility.

In FY21 rev perhaps?

Advertising is certainly a way to incrementally grow revenue and I’m glad that $SKLZ is implementing this.

The “SVP Revenue” ad states “Successfully launch & scale new rev streams from brand sponsorship and advertising” as being a key responsibility.

In FY21 rev perhaps?

106/

There are many things to like and also to question here. And I hope I have been able to give a flavour of both sides, but ofc tilted to the BULL as I am a holder.

To me though - $SKLZ represents an attractive opportunity. RISK is high, but I find the risk-reward attractive.

There are many things to like and also to question here. And I hope I have been able to give a flavour of both sides, but ofc tilted to the BULL as I am a holder.

To me though - $SKLZ represents an attractive opportunity. RISK is high, but I find the risk-reward attractive.

107/

Doesn’t mean it may be one for you. I urge you to have a think. Unlike some of my other holdings, $SKLZ is NOT a val play – a more riskier play.

Given the risk involved here, I will look to reduce as (and if) the equity performs. The $SKLZ investment needs close monitoring

Doesn’t mean it may be one for you. I urge you to have a think. Unlike some of my other holdings, $SKLZ is NOT a val play – a more riskier play.

Given the risk involved here, I will look to reduce as (and if) the equity performs. The $SKLZ investment needs close monitoring

108/

Finally, a quick thanks to the @PoundingDaTable - @AnthonyOhayon and @AviNMash for introducing this one to me.

I liked what I heard (podcast), liked what I saw (investor preso), liked what I read (DD) and so, took a small position on the $FEAC $12.5 Dec’20 calls in Nov’20.

Finally, a quick thanks to the @PoundingDaTable - @AnthonyOhayon and @AviNMash for introducing this one to me.

I liked what I heard (podcast), liked what I saw (investor preso), liked what I read (DD) and so, took a small position on the $FEAC $12.5 Dec’20 calls in Nov’20.

109/

Needless to say, did v well and exited with a 200% profit.

Reinvested proceeds in $SKLZ post merger at $20. Moved from options and fully into shares given the risk here esp -

(a) small company size and

(b) high execution risk.

Needless to say, did v well and exited with a 200% profit.

Reinvested proceeds in $SKLZ post merger at $20. Moved from options and fully into shares given the risk here esp -

(a) small company size and

(b) high execution risk.

110/

Was amazed at the performance – so topped up recently at $24.2 post the recent secondary placing and again yesterday, at $19.94.

Currently it is 11.3% of my portfolio, my 3rd largest position.

Was amazed at the performance – so topped up recently at $24.2 post the recent secondary placing and again yesterday, at $19.94.

Currently it is 11.3% of my portfolio, my 3rd largest position.

@threadreaderapp unroll

Tagging some guys who I think will be interested in this

@MyBrokeInvestor @Soumyazen @AnthonyOhayon @AviNMash @PoundingDaTable @fit_deep @FromValue @Zen_Options @saxena_puru @rioneyppt @Matthew_Hibbing @bmk266 @restrinct @aadhansen @siyul @Curiousjorge65 @StockPrinter

@MyBrokeInvestor @Soumyazen @AnthonyOhayon @AviNMash @PoundingDaTable @fit_deep @FromValue @Zen_Options @saxena_puru @rioneyppt @Matthew_Hibbing @bmk266 @restrinct @aadhansen @siyul @Curiousjorge65 @StockPrinter

@richard_chu97 @AlexDemosthenes @RamBhupatiraju @jablamsky @dhaval_kotecha @Dividend_Dollar @cperruna @FalkorLucky @skaushi @HeroDividend @MarlonPieris @ParrotStock @JoTrader4 @plantmath1 @BullishAngel @CathieDWood @ARKInvest @agnostoxx @caleb_investTML @jeremymday @vetris_stocks

@PatternProfits

@ripster47

@mukund

@alphacharts365

@SeifelCapital

@StackInvesting

@JonahLupton

@RihardJarc

@Pharmdca

@Logos_LP

@Mr_Drone

@SpacGuru

@TheMarkCooke

@IncredibleTrade

@LiviamCapital

@cfromhertz

@StockMarketNerd

@Matt_Cochrane7

@TraderAmogh

@ripster47

@mukund

@alphacharts365

@SeifelCapital

@StackInvesting

@JonahLupton

@RihardJarc

@Pharmdca

@Logos_LP

@Mr_Drone

@SpacGuru

@TheMarkCooke

@IncredibleTrade

@LiviamCapital

@cfromhertz

@StockMarketNerd

@Matt_Cochrane7

@TraderAmogh

@MightySoldiers

@moon_shine15

@shivsharma_5

@BornInvestor

@BretKenwell

@TechStockMarket

@clueless_1337

@Ryan_Burgio

@qcapital2020

@IPOtweet

@RichardMoglen

@Bios_n_Techs

@dannyvena

@InvestiAnalyst

@BahamaBen9

@Trendspider_J

@LuoshengPeng

@gilgalanti

@moon_shine15

@shivsharma_5

@BornInvestor

@BretKenwell

@TechStockMarket

@clueless_1337

@Ryan_Burgio

@qcapital2020

@IPOtweet

@RichardMoglen

@Bios_n_Techs

@dannyvena

@InvestiAnalyst

@BahamaBen9

@Trendspider_J

@LuoshengPeng

@gilgalanti

@anandchokkavelu

@MazwoodCap

@hhhypergrowth

@chitchatmoney

@BluSuitDillon

@jaminball

@SEAjewce

@nazking15

@SatoshiAlien

@InvestmentTalkk

@BrianFeroldi

@IPOtweet

@JulianKlymochko

@willschoebs

@buysidebio

@TerraPharma1

@GetBenchmarkCo

@OJRenick

@TornikeLaghidze

@MazwoodCap

@hhhypergrowth

@chitchatmoney

@BluSuitDillon

@jaminball

@SEAjewce

@nazking15

@SatoshiAlien

@InvestmentTalkk

@BrianFeroldi

@IPOtweet

@JulianKlymochko

@willschoebs

@buysidebio

@TerraPharma1

@GetBenchmarkCo

@OJRenick

@TornikeLaghidze

Thought I'd tagged you on this thread @Crussian17 - this specific tweet mentions $SKLZ MAU rebasing despite pMAU growing.

Long thread but hopefully value add.

Long thread but hopefully value add.

• • •

Missing some Tweet in this thread? You can try to

force a refresh