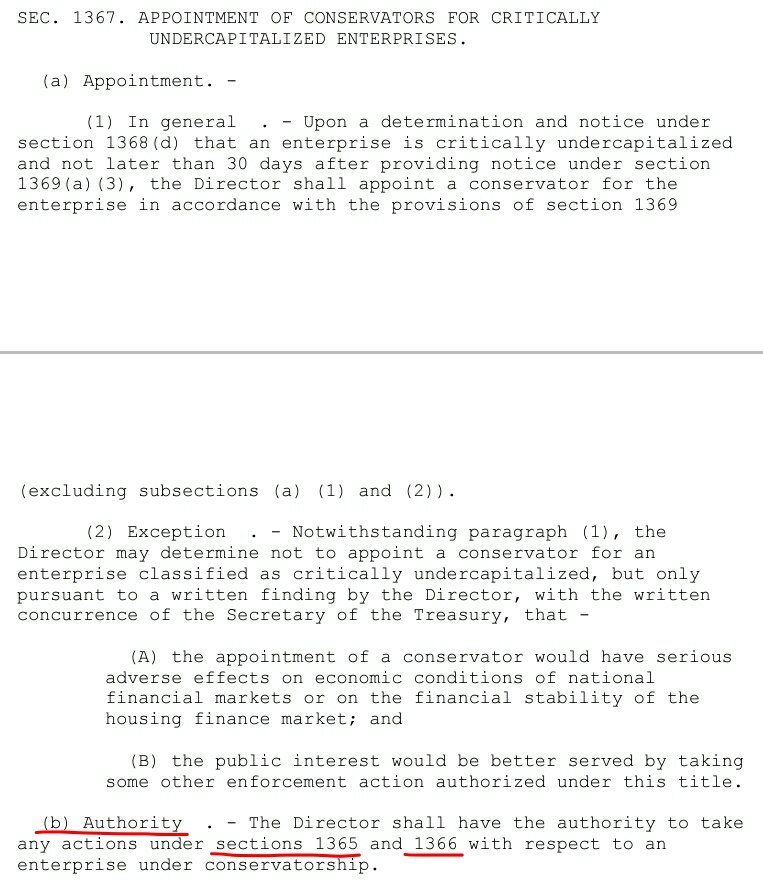

.@Scotus CAN ONLY RULE ON BREACH OF THE STATUTORY PROVISIONS

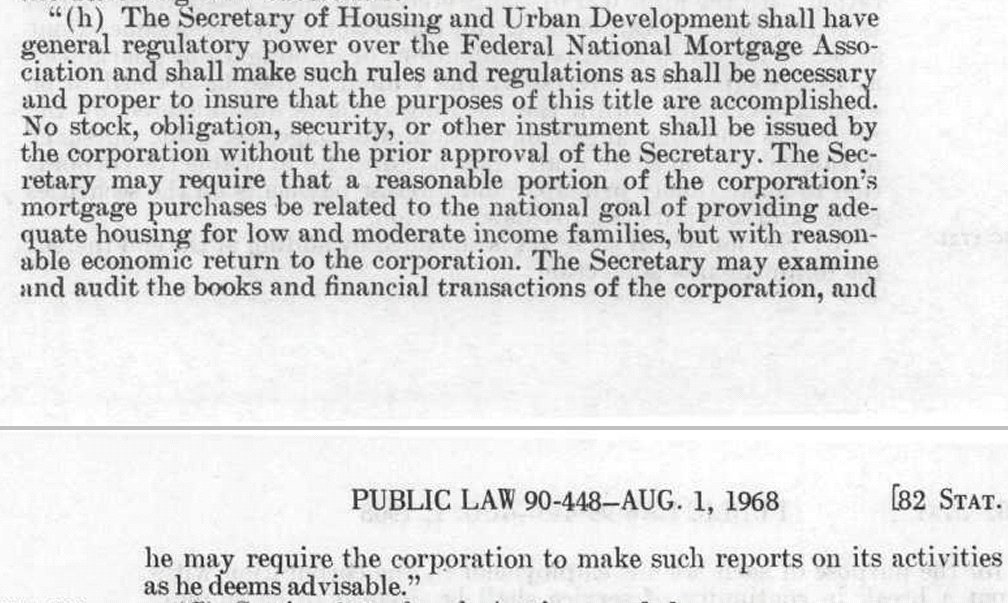

A Nationalization is legal, including during a Conservatorship, but FnF have to be in compliance with the law at the time,subsequently, the stocks trade at fair value. This is the Secret Plan.#Fanniegate @TheJusticeDept

A Nationalization is legal, including during a Conservatorship, but FnF have to be in compliance with the law at the time,subsequently, the stocks trade at fair value. This is the Secret Plan.#Fanniegate @TheJusticeDept

The Secret Plan was deliberately enabled by the @FHFA's 2011 CFR1237.12(1)for Recap,as SPS were about to be repaid under HERA's Restr On Capital Distrib exception B,the same FHFA did with the FHLBanks to repay the 1989 REFCORP fund.

GOAL: a depressed common stock for the assault.

GOAL: a depressed common stock for the assault.

There's no such thing as breaking a law & later require a court to declare Nationalization at a stock price that discounts the scenario w/ all the illegal actions in Conservatorship & under the Charter,regardless that the rogue people now call a Conservatorship "Nationalization".

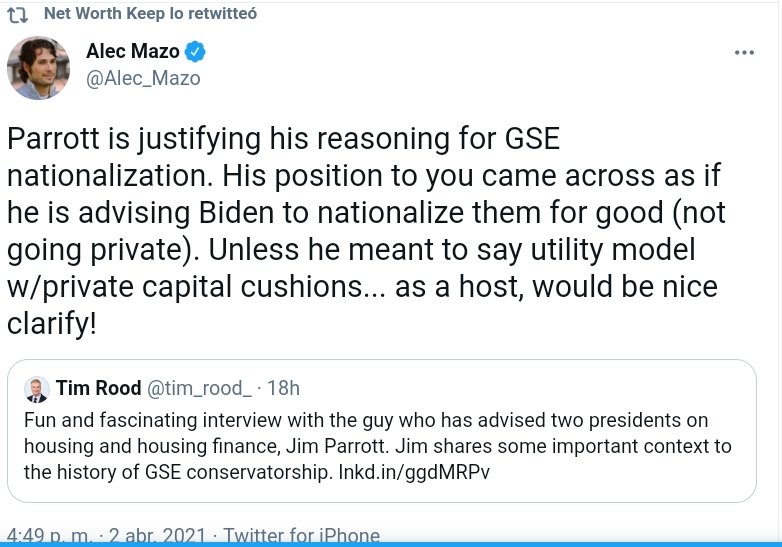

We see that the conspirators want Scotus to rule only on the NWS and remand the case to a lower court to continue this farce that the DOJ wants to bury pointing out that the @FHFA isn't a Federal Agency while in Conservatorship, according to this week's brief in the Appellate Ct.

• • •

Missing some Tweet in this thread? You can try to

force a refresh