A thread on possible clotting risks, elevated D-Dimer and Long Covid.

Disclaimer - this is not medical advice. In health matters speak to a doc. You do have a right to ask your doc though on things you read about, it is your health after all

1/n

Disclaimer - this is not medical advice. In health matters speak to a doc. You do have a right to ask your doc though on things you read about, it is your health after all

1/n

D-dimer Wiki

en.wikipedia.org/wiki/D-dimer

In addition, it is used in the diagnosis of the blood disorder disseminated intravascular coagulation.[1] A four-fold increase in the protein is a strong predictor of mortality in those suffering from COVID-19.

2/n

en.wikipedia.org/wiki/D-dimer

In addition, it is used in the diagnosis of the blood disorder disseminated intravascular coagulation.[1] A four-fold increase in the protein is a strong predictor of mortality in those suffering from COVID-19.

2/n

D-dimer test is prescribed nowadays in acute phase to be sure that there is no clotting risk. I do not hear of it as much for most patients post-Covid (after few months).

I have heard of at least a few cases of sudden strokes/pulmonary embolism events 2-3 mths after recovery

3/n

I have heard of at least a few cases of sudden strokes/pulmonary embolism events 2-3 mths after recovery

3/n

Some research paper data excerpts:

1. Prolonged elevation of D-dimer levels in convalescent COVID‐19 patients is independent of the acute phase response

ncbi.nlm.nih.gov/pmc/articles/P…

Participants were assessed at a median of 80.5 (range 44–155) days after initial diagnosis.

4/n

1. Prolonged elevation of D-dimer levels in convalescent COVID‐19 patients is independent of the acute phase response

ncbi.nlm.nih.gov/pmc/articles/P…

Participants were assessed at a median of 80.5 (range 44–155) days after initial diagnosis.

4/n

For reference values, in lab reports I have seen <0.6 microgram/ml as the reference level for normal. Here in chart, it is in nanogram/ml (divide it by 1000). They have marked an upper boundary at 0.5 microgram/ml.

5/n

5/n

See number of observations above the normal level even after 2-3 months.

6/n

6/n

One more:

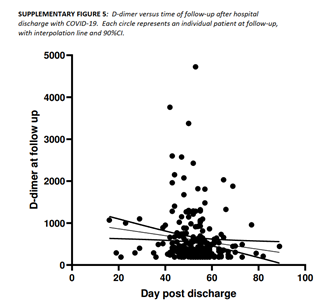

‘Long-COVID’: a cross-sectional study of persisting symptoms, biomarker and imaging abnormalities following hospitalisation for COVID-19

thorax.bmj.com/content/76/4/3…

7/n

‘Long-COVID’: a cross-sectional study of persisting symptoms, biomarker and imaging abnormalities following hospitalisation for COVID-19

thorax.bmj.com/content/76/4/3…

7/n

Similarly see - a fraction of the people have elevated levels after even 2 months.

9/n

9/n

Those who have had Covid may want to show this to your docs.

Wish everyone good health.

n/n

Wish everyone good health.

n/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh