“Clayton’s family gets millions of dollars in annual dividends from WMB Holding”

His family got $4 million per year in dividends. To receive that much 💰 in dividends is equivalent to owning a $200 million in stocks that pay 2% in dividends.

wallstreetonparade.com/2018/01/wall-s…

His family got $4 million per year in dividends. To receive that much 💰 in dividends is equivalent to owning a $200 million in stocks that pay 2% in dividends.

wallstreetonparade.com/2018/01/wall-s…

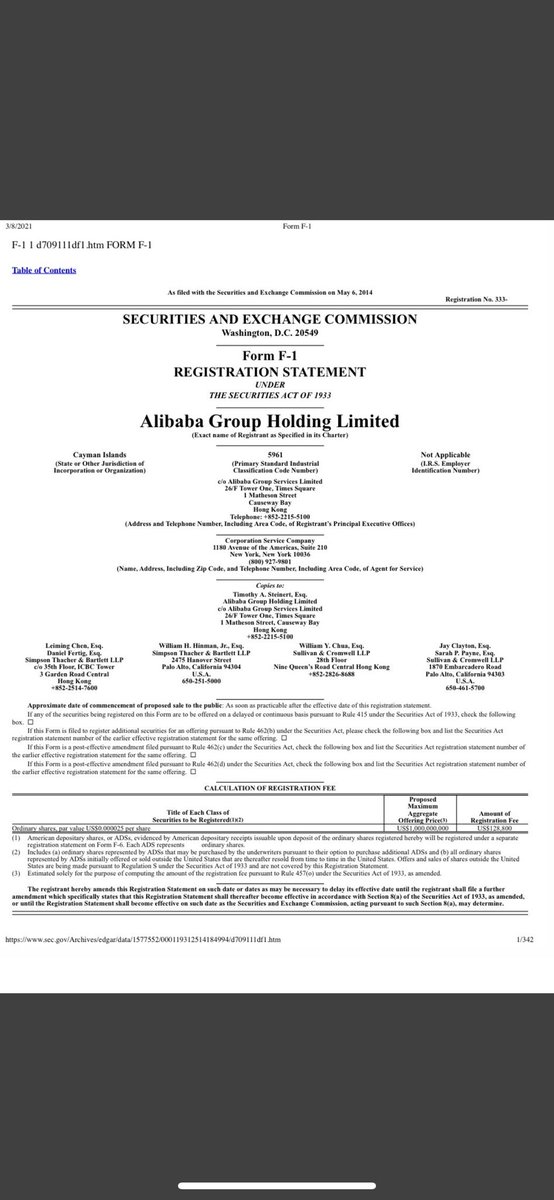

Clayton’s wife is Gretchen Butler Clayton. The B in WMB stands for Butler. WMB owns CSC. Clayton’s father-in-law is Daniel Butler, who served as CSC’s CEO from 1975-1998. WMB and CSC share the same address.

Multiple other units of Goldman Sachs are using the same address.

Multiple other units of Goldman Sachs are using the same address.

Clayton’s wife was a V.P. at Goldman Sachs for 17 years when Clayton became SEC Chairman.

“There are thousands of businesses using CSC as their registered agent and using CSC’s address as their legal address.”

“There are thousands of businesses using CSC as their registered agent and using CSC’s address as their legal address.”

See below:

CSC becomes the First Foreign-Owned Company to Receive Domain Registrar License in China 🇨🇳

Im sure an arm of the Chinese Government granting this lucrative license to Clayton’s family is nothing to look at.

cscglobal.com/service/csc/pr…

CSC becomes the First Foreign-Owned Company to Receive Domain Registrar License in China 🇨🇳

Im sure an arm of the Chinese Government granting this lucrative license to Clayton’s family is nothing to look at.

cscglobal.com/service/csc/pr…

CSC acts as a “conduit for creating shell corporations and other sketchy vehicles used in tax evasion and money laundering.”

I won’t even get into how Clayton represented Lehman Bros during the financial crisis but showed up the next day representing Barclays who was buying it.

I won’t even get into how Clayton represented Lehman Bros during the financial crisis but showed up the next day representing Barclays who was buying it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh