“The euro would really do its work when crises hit, Mundell explained. Removing a government's control over currency would prevent nasty little elected officials from using Keynesian monetary and fiscal juice to pull a nation out of recession”

theguardian.com/commentisfree/…

theguardian.com/commentisfree/…

<“It puts monetary policy out of the reach of politicians," he said. "[And] without fiscal policy, the only way nations can keep jobs is by the competitive reduction of rules on business."

He cited labor laws, environmental regulations and, of course, taxes>

He cited labor laws, environmental regulations and, of course, taxes>

“All would be flushed away by the euro. Democracy would not be allowed to interfere with the marketplace – or the plumbing ...

Far from failing, the euro, which was Mundell's baby, has succeeded probably beyond its progenitor's wildest dreams”

Far from failing, the euro, which was Mundell's baby, has succeeded probably beyond its progenitor's wildest dreams”

“As Paul Krugman notes, the creation of the eurozone violated the basic economic rule known as "optimum currency area". This was a rule devised by Bob Mundell.

That doesn't bother Mundell. For him, the euro wasn't about turning Europe into a powerful, unified economic unit”

That doesn't bother Mundell. For him, the euro wasn't about turning Europe into a powerful, unified economic unit”

Krugman : “The creation of the euro involved, in effect, a decision to ignore everything economists had said about optimum currency areas ... erring only in understating the problems with a shared currency. And now that theory is taking its revenge”

krugman.blogs.nytimes.com/2012/06/24/rev…

krugman.blogs.nytimes.com/2012/06/24/rev…

Mundell : “In all the aspects in which it was expected economically to make an improvement, it has performed spectacularly”

👉 Ok, allora era proprio pirla

imf.org/external/pubs/…

👉 Ok, allora era proprio pirla

imf.org/external/pubs/…

<So why is Europe faring so miserably? Mundell insists that the euro “has performed spectacularly” and that the problem is reckless government spending and excessive deficits>

👉 Mundell cocainomane all’ultimo stadio

fortune.com/2012/08/09/two…

👉 Mundell cocainomane all’ultimo stadio

fortune.com/2012/08/09/two…

Infine, l’apoteosi : intervistona a Mundell del 2006 ... due anni prima di Lehman Brothers

aeaweb.org/articles?id=10…

aeaweb.org/articles?id=10…

Una perla. Mundell : “But in fact Europe has just as much labor mobility as it wants. The European Commission sends money to depressed regions so labor won’t have to emigrate”

“The countries that entered into the euro area, as well as making themselves better off, made a contribution to future European political stability ... After all, if the Europe of the 1930s had a democraticallyrun common currency in the 30s, there would have been no World War II”

Scusi, Mundell, oggi nel 2006 come vede le prospettive di medio-lungo termine de Leuro?

“MUNDELL: I think they are too good for Europe’s sake” 🎪

“MUNDELL: I think they are too good for Europe’s sake” 🎪

“the civilized countries of Europe were moving in the opposite direction, by creating the European Monetary System and moving toward f ixed exchange rates, culminating in the apotheosis 🎪 of fixed exchange rates, the single currency called the euro”

“Other nations have seen what a great success this is for Europe and are imitating it in other regions of the world”

Mundell : “My own view about the politics of the euro is that it will provide a catalyst for increased political integration in Europe ...

on economic grounds alone I believe the case for the euro is overwhelming”

on economic grounds alone I believe the case for the euro is overwhelming”

Mundell : “It ended uncertainty over exchange rates and destabilizing capital movements”

👉 Questo si faceva di droghe pesanti

👉 Un idiota. Un pazzo pericoloso

👉 Questo si faceva di droghe pesanti

👉 Un idiota. Un pazzo pericoloso

Mundell :

- “When the balance is in surplus, the money supply expands and that increases expenditure on goods and securities and that corrects its surplus ... it is how monetary policy works in the euro zone”

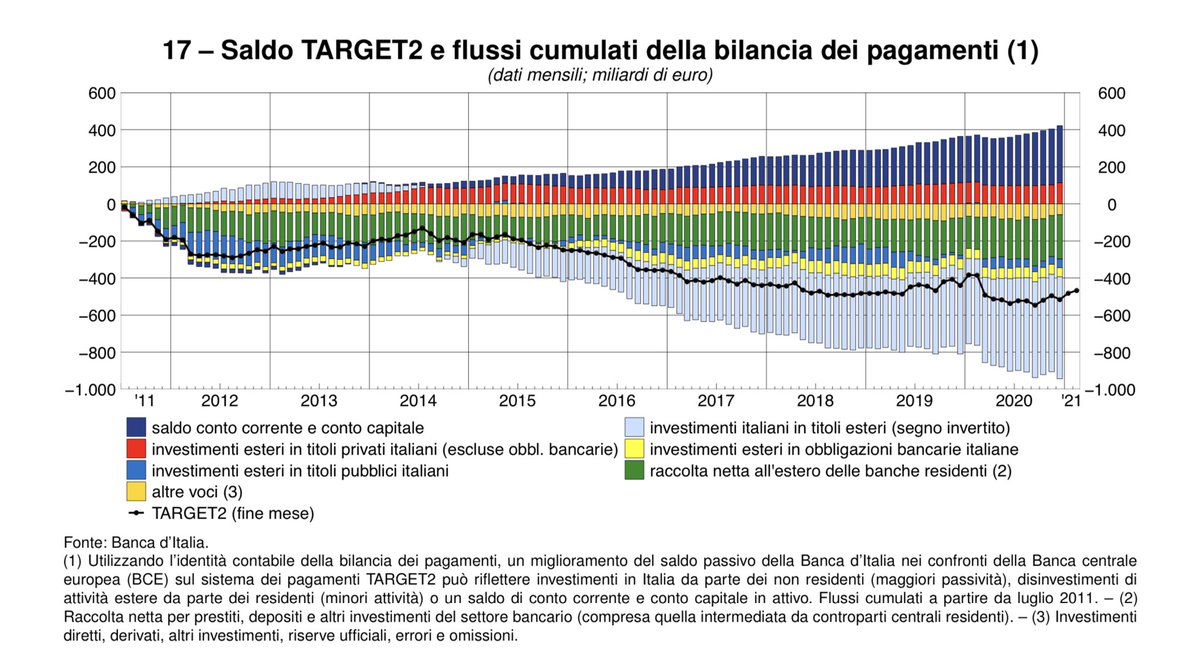

👉 E la nostra mostruosa fuga dei capitali⁉️

👉 Scemo come Prodi 🎪

- “When the balance is in surplus, the money supply expands and that increases expenditure on goods and securities and that corrects its surplus ... it is how monetary policy works in the euro zone”

👉 E la nostra mostruosa fuga dei capitali⁉️

👉 Scemo come Prodi 🎪

Il punto chiave di sto cassone era il seguente : “the exchange rate is almost never the best form of adjustment”

👉 Lui preferiva i tagli agli stipendi

👉 Lui preferiva i tagli agli stipendi

Eccolo :

“Exchange rate changes can never be a substitute for the vast number of changes in individual prices that have to be made in an efficient market ...

“Exchange rate changes can never be a substitute for the vast number of changes in individual prices that have to be made in an efficient market ...

... I believe that flexibility of individual prices will be fostered by the euro area and that, with exchange rate changes ruled out, policy makers will increasingly turn to deregulation and fewer controls”

Gli risponde Milton Friedman :

“If my aunt had wheels, she would be a bus” ❤️

“If my aunt had wheels, she would be a bus” ❤️

Succo : Mundell (come Monti, come Draghi che usa il #lockdown) vuole bilance commerciali in pareggio con zero inflazione. È di questo che a lui frega. Non dei conti pubblici. I conti pubblici rilevano solo in quanto strumenti per raggiungere quel fine. Costi quel che costi

Poi ci sono i Tedeschi, più intelligenti di Mundell, i quali hanno portato il gioco al piano superiore e non vogliono mai smettere

frontiere.me/luciano-barra-…

frontiere.me/luciano-barra-…

Infatti quel che stanno facendo i Tedeschi, Mundell non lo aveva previsto 👉 È il livello superiore

https://twitter.com/musso___/status/1379547248837660678

Ed è questo il fallimento di Mundell. Non sulla svalutazione interna, che c’è stata. Bensì sulle mancate conseguenze positive della medesima 👉 Qui Mundell fallisce

👉 Nemmeno Mundell saprebbe più difendere Leuro

👉 Nemmeno Mundell saprebbe più difendere Leuro

Si. La disciplina fiscale e salariale sono, per i Mundell, l’unica cosa che conta

La disciplina fiscale, non in quanto correttrice di deficit o debito, bensì come strumento di moderazione della crescita della domanda aggregata interna

È ciò che Draghi dice a Berlino

La disciplina fiscale, non in quanto correttrice di deficit o debito, bensì come strumento di moderazione della crescita della domanda aggregata interna

È ciò che Draghi dice a Berlino

https://twitter.com/italians4brexit/status/1379562978991869953

• • •

Missing some Tweet in this thread? You can try to

force a refresh