The mutual’s capital pool is held in ETH. Below you can see a graphic that shows how funds flow through the capital pool when cover is purchased. (1/7)

Funds flow into the capital pool when cover is purchased & when ETH is swapped for $NXM.

When capital levels in the pool are low, the price of $NXM lowers to encourage token purchases, which add funds to the capital pool. (2/7)

When capital levels in the pool are low, the price of $NXM lowers to encourage token purchases, which add funds to the capital pool. (2/7)

Each member has contributed to the capital pool as represented by their $NXM holdings.

When more members purchase cover to protect assets, the capitalization level increases.

As the capitalization level increases, the MCR% goes up, too, since MCR% = V/MCReth. (3/7)

When more members purchase cover to protect assets, the capitalization level increases.

As the capitalization level increases, the MCR% goes up, too, since MCR% = V/MCReth. (3/7)

Members can choose to hold their $NXM but the real benefits come from participating in the mutual: in Governance, as a Risk Assessor, or as a Claims Assessor.

Risk Assessors stake NXM against protocols and/or custodians they believe are trustworthy and secure. (4/7)

Risk Assessors stake NXM against protocols and/or custodians they believe are trustworthy and secure. (4/7)

When a platform has more $NXM staked against it, it creates more available cover for other members to purchase.

As more cover is purchased, the capital pool increases in size.

Members are able to cover their deposited assets and earn NXM by acting as a Risk Assessor. (5/7)

As more cover is purchased, the capital pool increases in size.

Members are able to cover their deposited assets and earn NXM by acting as a Risk Assessor. (5/7)

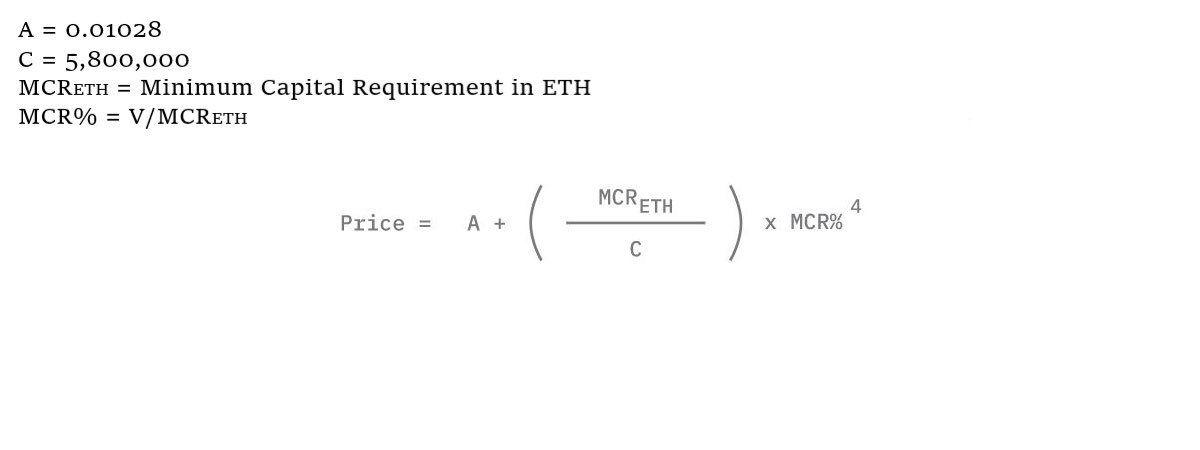

The bonding curve, MCR%, and capital pool are all intertwined.

Bonding curve: correctly incentives buys/sells of $NXM depending on capitalization level.

MCR%: if <=100%, $NXM sells are prohibited so the mutual is very sure claims can be paid. (6/7)

Bonding curve: correctly incentives buys/sells of $NXM depending on capitalization level.

MCR%: if <=100%, $NXM sells are prohibited so the mutual is very sure claims can be paid. (6/7)

This is the general overview of how the $NXM token, bonding curve, MCR%, and capital pool relate to each other and function.

That’s it for today’s all-things-Nexus threads.

Tomorrow, I’ll cover the process of purchasing $NXM and filing a claim (in the event of a loss). (7/7)

That’s it for today’s all-things-Nexus threads.

Tomorrow, I’ll cover the process of purchasing $NXM and filing a claim (in the event of a loss). (7/7)

• • •

Missing some Tweet in this thread? You can try to

force a refresh