Head of Product & Risk | @NexusMutualDAO

Advisor | @0xflatmoney

@safe Guardian 🔰

Researching risk in DeFi 🔎

How to get URL link on X (Twitter) App

https://twitter.com/BraveDeFi/status/1380218072439652353

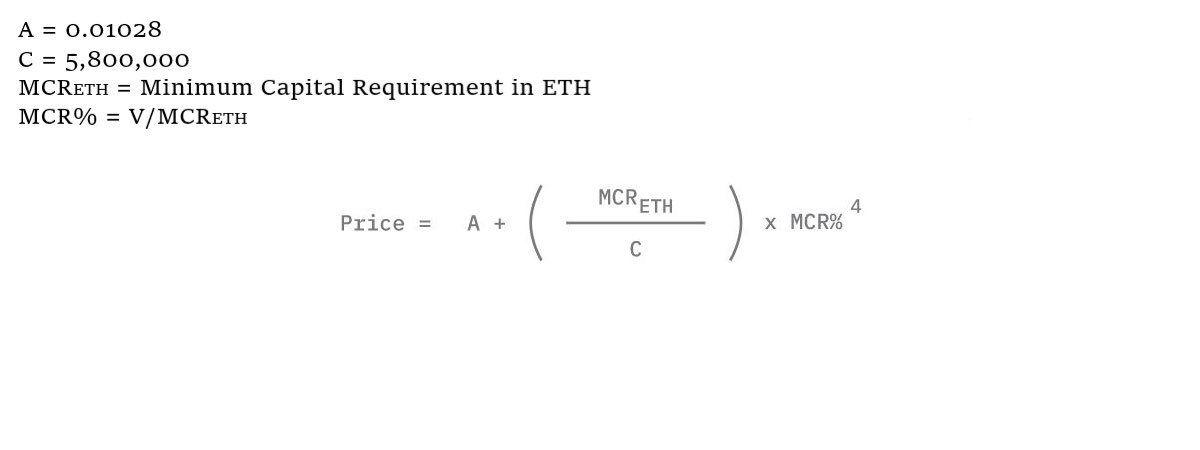

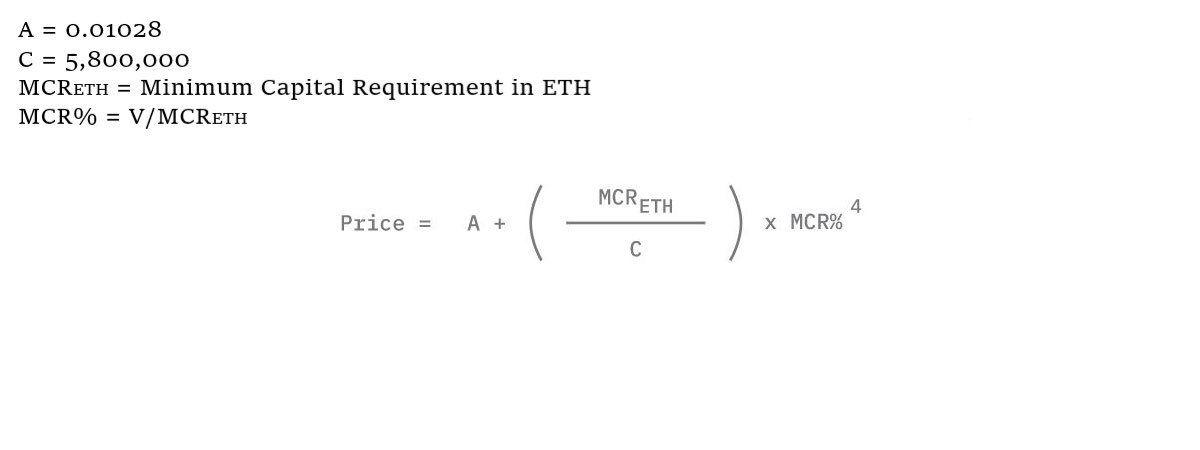

Funds flow into the capital pool when cover is purchased & when ETH is swapped for $NXM.

Funds flow into the capital pool when cover is purchased & when ETH is swapped for $NXM.

The graphic in the previous tweet is from the latest post Nexus put up on their Medium about the bonding curve. More on that here: (medium.com/nexus-mutual/o…)

The graphic in the previous tweet is from the latest post Nexus put up on their Medium about the bonding curve. More on that here: (medium.com/nexus-mutual/o…)

Nexus Mutual is a discretionary mutual, which means the mutual does not offer traditional insurance; instead, the mutual offers cover products.

Nexus Mutual is a discretionary mutual, which means the mutual does not offer traditional insurance; instead, the mutual offers cover products.