Tassal Group $TGR $TGR.AX are a Tier 1 #ASX aquaculture firm. Having been the most shorted stock on the ASX at ~14%, the tide has turned as global salmon prices have run +50%. Is it too late to get on the Fish?

Time to update our deep dive. 👇

Time to update our deep dive. 👇

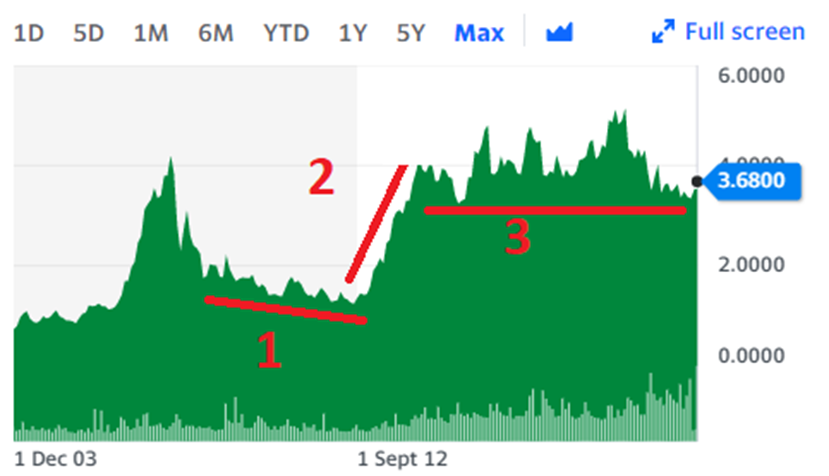

1. This link is to the original deep dive (required reading), which wasn’t that long ago. At that time, the stock price was still falling (~$3.35) while the fundamentals perhaps had just started to stabilize. The 1H21 report came out shortly after.

https://twitter.com/DownunderValue/status/1354966396195598345

2. Tassal’s Performance: 1H21 had significant headwinds – lower global salmon prices, increased costs of exporting. Despite solid salmon sales and resilient EBITDA, the NPAT was smashed and dividends followed. But the devil is in the detail..

3. There are three salmon distribution channels. Exports (volatile prices), domestic retail (e.g. supermarkets, large volume moderate margins), domestic wholesale (e.g. restaurants, high margins, mainly fresh with higher margins)

4. Covid impacts: This was felt more in exports (-54% to 0.83/KG EBITDA margins), while domestic remained resilient (+3% to $3.98/KG EBITDA margins) despite wholesale / restaurant closures.

5. Covid-flexible sales mix: As the #1 brand, Tassals could shift sales to higher margins domestic retail (vol +10%). A lot of shopping moved online, so brand awareness for click-and-collect is very important.

6. Secure supply: As a Top10 global producer, big supermarkets like Coles $COL.AX $COL and Woolworths $WOW.AX $WOW use Tassal for their ‘home brand salmon’ and have significant shelf space to their branded smoked & fresh salmon. This may increase with new markets for Aldi.

7. Low reliance on exports: Relative to Huon $HUO $HUO.AX or NZ King Salmon $NZK $NZK.AX or Petuna (Nissui, $1332 $1332.T), Tassals only export ~25% volume or ~10% EBITDA.

Compared to Huon's -$18m NPAT, $113m asset impairments.. ouch!

Compared to Huon's -$18m NPAT, $113m asset impairments.. ouch!

8. 16th of February 2021. The results are released, and.. Not so bad? Compare to the rest of the Salmon exporting industry including Norway and Chile, Tassal experienced merely a flesh wound.

9. Shorts continued to increase on dropping share price in February and March. Sellers kept on coming out of the woodwork, driving the price down to ~40% from 2019 peak to $3.17 and shorts up to ~14% making it #1 shorted stock on ASX.

10. Mispriced asset with negative sentiment: I continued to average down to a nail-biting ~25% of my portfolio now in salmon stocks. My hope is that it is non-consensus and right 🎯

... and kind of hoping that the Gamestop $GME short squeeze would come to the #ASX

... and kind of hoping that the Gamestop $GME short squeeze would come to the #ASX

11. Changing tide (pun intended). The stock market is forward looking, so let’s review the growth prospects of Tassals. This isn’t a turnaround or a cyclical, the investment thesis is remains a mispriced stalwart at bargain prices.

12. NASDAQ Global Salmon Index : Through 2020 the price was ~40-45NOK, which is about the cost of production for Norwegian salmon producers. Since then it’s been on a tear, with most recent price 68.6NOK or +50% / 12 weeks supported by rising volumes.

13. Fish Pool Forward Prices: Not only have these been rebounding, but they’re now holding up quite strongly into FY23 at ~60NOK (5 year long term average).

14. Prawns today. In 1H21 the prawn biomass grew, but sales are slow in 1H so only ~$1mEBITDA on 238t. Expect in 2H for +3,500t at higher margin (say ~$5/KG EBITDA) to result in +$18m EBITDA. Most of this will go directly to NPAT.

15. Scuttlebutt Challenge: Go and do a blind tasting of Tropico’s black tiger prawns with your friends and family. This will be Australia’s first secure supply of high-quality prawns. After devouring 2kg at Christmas, I doubled down with $TGR and gout.

16. Prawns tomorrow. Long term growth remains in place, with 20,000t planned by 2030. Much of this will be growing the market and import substitution, so EBITDA/KG is strong. Overall expecting revenue for Tassals to double by 2027 largely due to prawns.

17. CAPEX Headwind. Recent investments are starting to payoff. While ROIC dropped from ~11% to ~8% due to upfront capital costs, CAPEX will reduce (i.e. Prawn lands and hatcheries now in place) by ~$50m p/a from FY22 creating an NPAT tailwind.

18. Expectations in 2H21: Salmon exports are likely to +$10m EBITDA, and Prawns +$18m EBITDA. Net EBITDA +40%, and much of this will got to NPAT perhaps +66% / +$19m. Enough for dividends to rebound to +9c/share, and with no re-rating share price target increases to $4-$4.50.

19. Exhausting the sellers. The share price has rallied 10% in the past week, and 17% from the bottom. Shorts have unwound to ~10%. It feels that the sellers are exhausted, and the covering of shorts could create a tailwind (estimate 5-7c per `% unwind).

20. Share re-rating. I dont invest for multiple expansion, but it tends to move in “step-wise” manner. 1) heavy investment in salmon production; 2) market realized the value to earnings (price x3 in 14 months); 3) heavy investments in prawns. Are we approaching a 4th wave?

21. Visioning TGR in FY27, Salmon vol will grow ~3% CAGR and investments in optimization will drive EBITDA/KG by +5% CAGR to ~$240m EBITDA. 20,000t of prawns will contribute $140m EBITDA. CAPEX will have reduced by $50m p/a from FY22. Aim: x2 revenue, x3 EBITDA and x4 NPAT.

Overall, while aquaculture is a slow-growing sector, Tassal has proven a dynamic capital allocator focused on long term growth with strong management in place. Short term challenges seem to have abated, and I find this an asymmetric bet with good long-term potential payoffs.🍤

If you enjoyed this, bash the like / retweet / follow buttons.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR.

Disclaimer, I'm long TGR.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR.

Disclaimer, I'm long TGR.

@cqfood You folks know your way around a fish and prawn, love to know what your thoughts are particularly on the quality of Tropico's black tiger prawns at the markets?

• • •

Missing some Tweet in this thread? You can try to

force a refresh