Here just some of our thoughts on Franklin Covey Q2 earnings. We think the numbers really speak for themselves at the moment.

We wrote about FC 2 months ago here:

symmetry.dk/galleri/

We wrote about FC 2 months ago here:

symmetry.dk/galleri/

Remember the current H1 (until end of Feb) is 6 months that was heavily impacted by Covid, while the prior year wasn’t impacted (only some small initial China impact). We have heard comments like “the product is not really sticky, its still really cyclical,

subscribers will churn in a recession etc.”. Now the business have been through a perfect storm. Remember the backbone of the company and the “content” around the subscription business was all around filling 200 people into a conference room and having management training etc.

With heavy restrictions on group gatherings, socials distancing etc. at the same time as a lot of businesses is tightening their spending budgets and having layoffs Franklin Covey really have had the hardest test of its business model as can be imagined.

So how have they performed during this crisis?

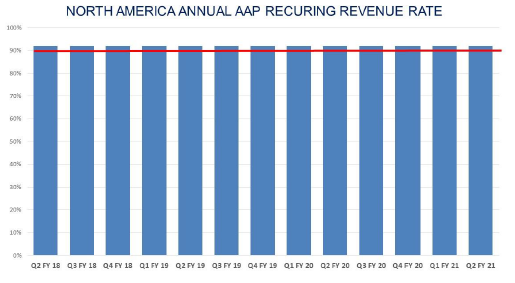

The first thing people was worried about was retention. But even during the worst of time FC managed to keep their annual revenue retention at +90 %.

The first thing people was worried about was retention. But even during the worst of time FC managed to keep their annual revenue retention at +90 %.

We sometime get the comment “but 90 % is okay, its not good”. We agree. But the company have never said it was 90 %. They have just said it has NEVER BEEN BELOW 90 %. The actual figure fluctuate between quarters but we think its averaging more like 95.

FC even had companies in hard-hit industries like Airlines and Hospitality renew and expand passes during Covid. With FC able to show such good retention rates even in a period where a lot of the services couldn’t be delivered really show the durability of the product to us.

Remember it’s not a small investment for companies. The initial AAP purchase is around 40.000 $ + add-on services etc. Some companies were using the AAP mainly for on-site tutorials etc. It would have been easy for those companies to just say

“listen we wont renew the pass now as we cant use the content”. Instead we saw companies renewing and expanding while heavily adopting all the online modalities.

Looking at revenue and bookings the company have kept showing consistently high growth and durability during this crisis. AAP revenue has been growing 15 % YoY even during this time.

And even more remarkable - AAP bookings growth in H1 2021 (in a heavy lockdown period) was 30 % ahead of H1 2020 (pre-covid).

Remember while the business is now 80 % subscription related in US/Canada the international business is still in the early part of that adoption and education is still hit by tightening school budgets (and access to schools):

So even in a period where FC still could see the revenue decline due to education/international they are transforming the business to the higher margin subscription business with EBITDA growing 26 % YoY on lower revenue.

But the underlying progress is even better. Because the company is transforming the business to subscriptions a lot of the bookings are not recognized upfront but instead goes to deferred revenue:

Look above how the company have significantly improved FCF with a delta of around 10 mio. $ YoY (again in a covid period compared to a non-covid period).

FC is on its way to generate 25 mio. $ in free cash flow in FY21 and +30 in FY22

FC is on its way to generate 25 mio. $ in free cash flow in FY21 and +30 in FY22

Based on how the business is performing we think its quite crazy this thing is still trading at 1,5x revenue (2-2,5 x recurring revenue) and 20x FY21 FCF and below 10x forward FCF.

We think its really rare to find a high quality subscription business that is also highly cash flow positive and at the same time trading a low multiples.

Disclaimer: Not investment advice. Do your own work. We own shares in FC and have been buying more after the Q2 report. Please read full disclaimer on our website.

DM or email me for feedback, always appreciated.

DM or email me for feedback, always appreciated.

• • •

Missing some Tweet in this thread? You can try to

force a refresh