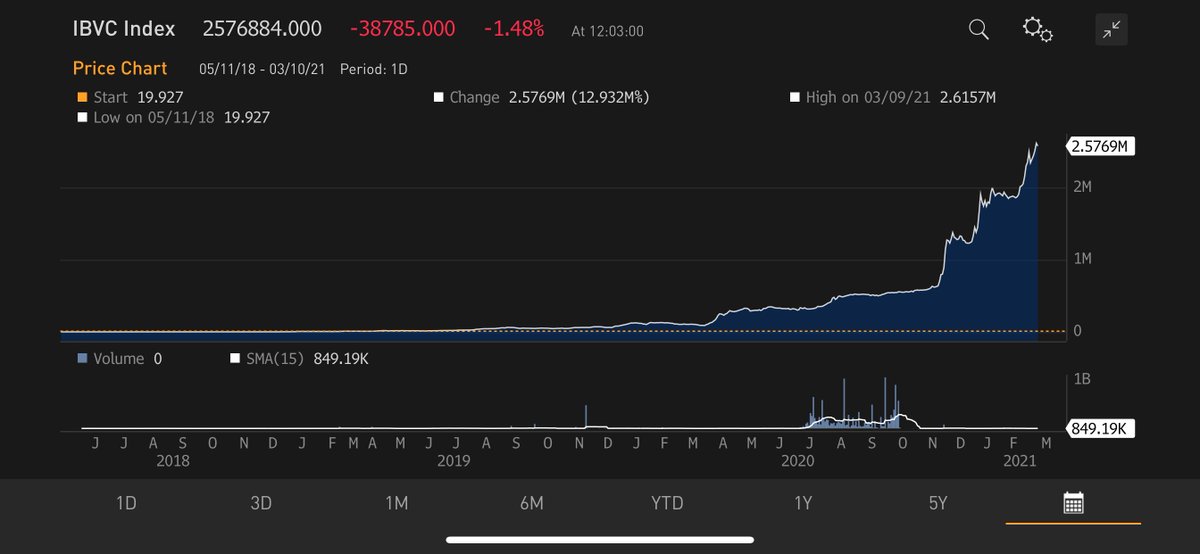

Cathie @CathieDWood, Not a chance was US stock market cap/GDP greater in the late 1800s and early 1900s than it is today. It was a FRACTION of today's level. It measured 90% at the stock market PEAK in 1929 and closed 2020 at a record 183%. Close to 200% now. Far less business 1/

https://twitter.com/CathieDWood/status/1381230136918433792

was done by public companies then v today. Absolute levels of global trade were on the order of 20% of today's levels. 1929's market cap was $93B on GDP of $103.7 billion. Of course the stock market then fell by 89%, despite all of the revolutionary technologies you mentioned. 2/

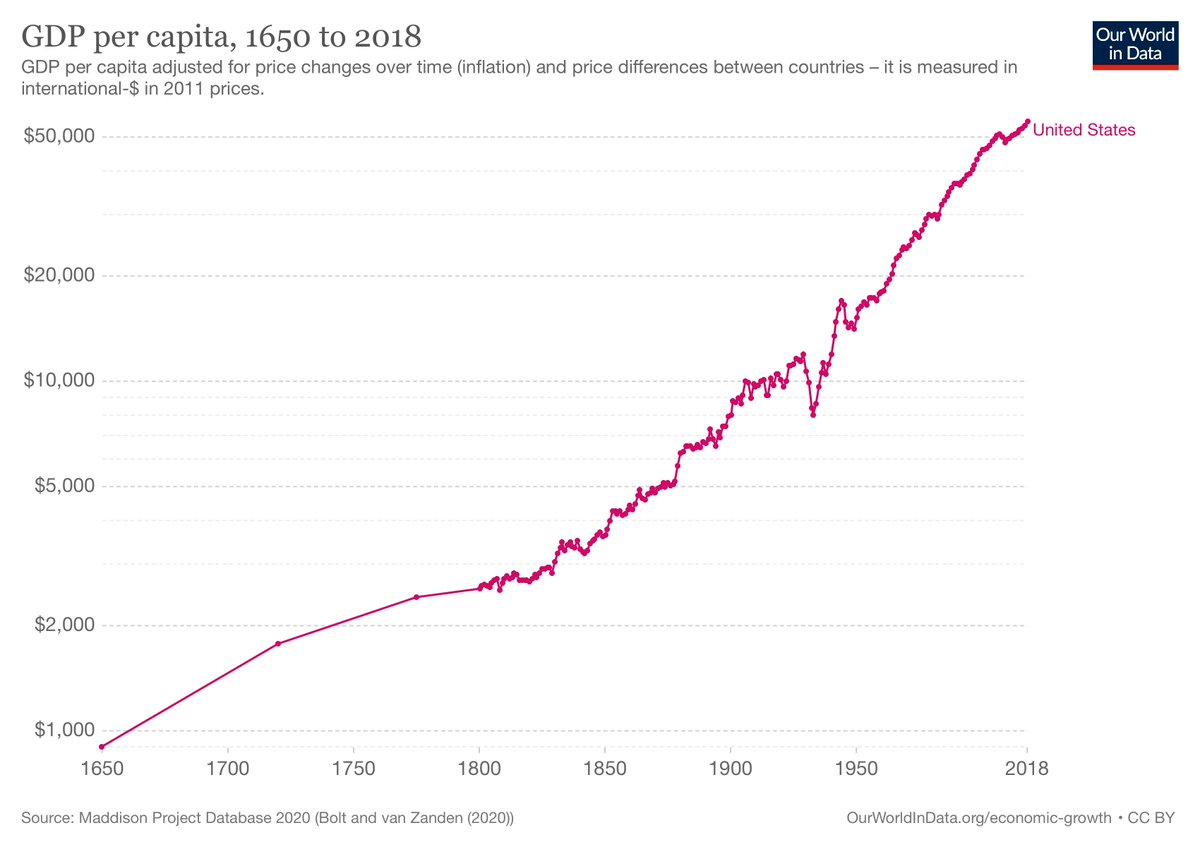

Families spent half of their income on food at the end of the 19th century. You are absolutely correct that electricity, the telephone and automobiles allowed transformative growth in income & output. However, your conclusion that "genomic sequencing, robotics, energy storage, 3/

artificial intelligence, and blockchain technology dwarf that of the late 1800s/early 1900s." is misguided. While disruptive, they will not be remotely more transformative than those from 1870 to the 1950s. The technologies you highlight, cool yes, will prove only incremental.4/

Canals, rails, electricity, telegraph/telephone, autos, vaccines & the airplane allowed for a move from a non-publicly traded agrarian economy. I suggest looking into how much more output per person, output per hour & hours worked per person have evolved over time & how little 5/

they change in modern times. I highly recommend you read Robert Gordon's The Rise and Fall of American Growth. You'll see how little technological change impacts the economy & our standard of life today. You will also see that more than adequate data exists to properly measure 6/

Mkt Cap, GDP, population, hours worked. Check BEA data. Just think about how odd it is suggesting market cap/GDP was 2x-3x today's levels in the late 1800s and early 1900s. At almost 200% today, you think the stock market could have measured 400% to 600% of GDP? Nope. 7/

Also, for future reference, note that the Chairman and CEO at Berkshire Hathaway, the conglomerate that's compounded at 20% annually since 1965, double the S&P 500 and with more profit than Tesla has revenues, spells his name with two ts. It's Mr. Buffett. Many make this mistake.

• • •

Missing some Tweet in this thread? You can try to

force a refresh