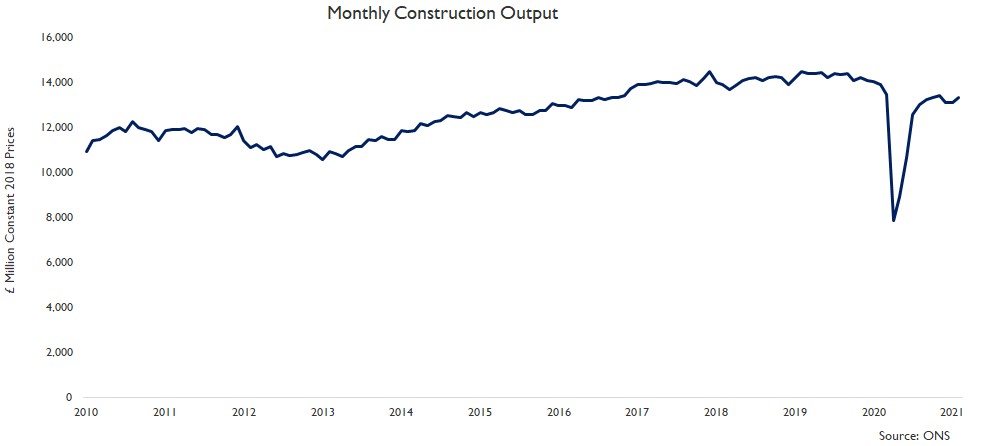

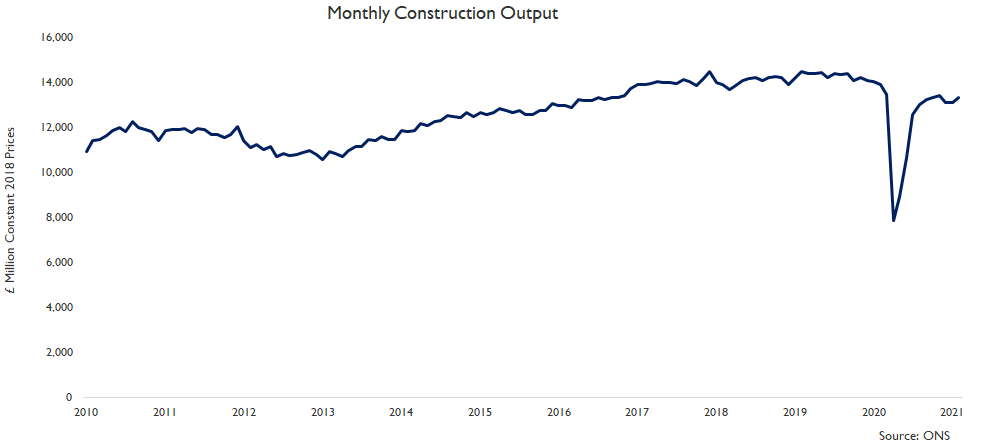

THREAD: It is broadly a 'V'-shaped recovery for the construction industry overall so far... Construction output in February 2021 was 1.6% higher than in January 2021.

#ukconstruction #construction

ons.gov.uk/businessindust…

#ukconstruction #construction

ons.gov.uk/businessindust…

Construction output in February 2021 rose by 1.6% compared with January as activity picked up after the usual Winter slowdown but growth was affected by persistent rain affecting outdoor site activity so expect significant growth in March as well.

#ukconstruction #construction

#ukconstruction #construction

Construction output in February 2021 remained 4.3% lower than one year ago (February 2020, the last month before the initial lockdown). Overall, it has broadly been a 'V'-shaped construction recovery but fortunes vary considerably by construction sector.

#ukconstruction

#ukconstruction

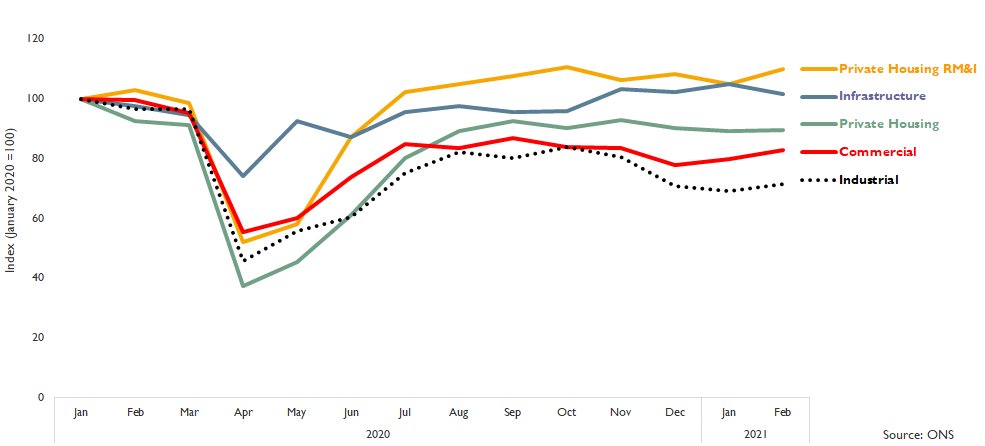

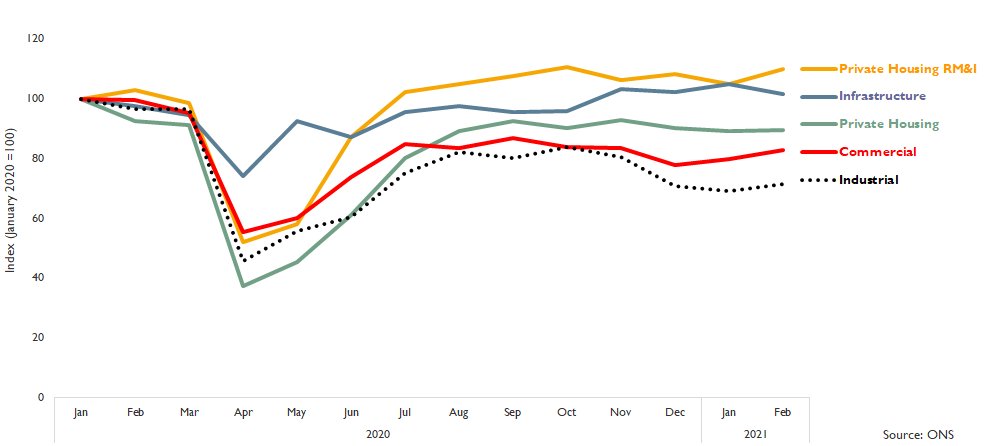

Looking at how key sectors have fared since January 2020, pre-Covid-19, activity in many sectors such as private housing rm&i & infrastructure recovered quickly after the initial lockdown & is already considerably above pre-Covid-19 levels whereas...

#ukconstruction #construction

#ukconstruction #construction

... construction activity in commercial (offices, retail, leisure & hotels) & industry (factories) during February 2021 unsurprisingly remained double-digit lower than in January 2020, pre-Covid-19...

#ukconstruction #construction

#ukconstruction #construction

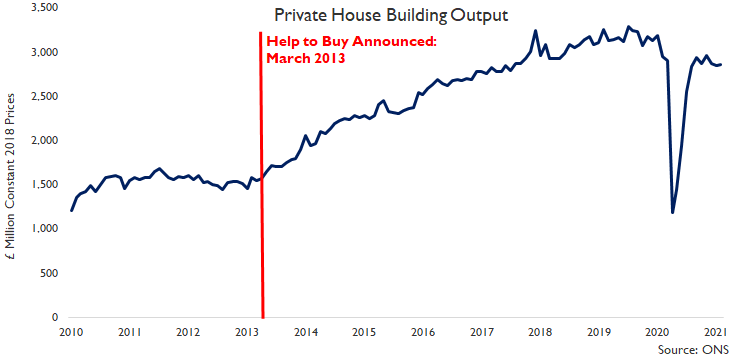

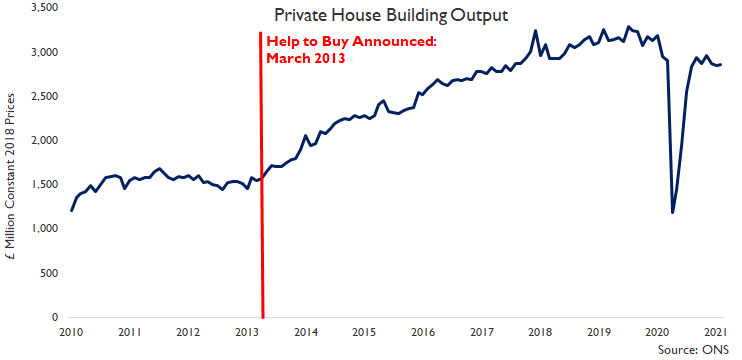

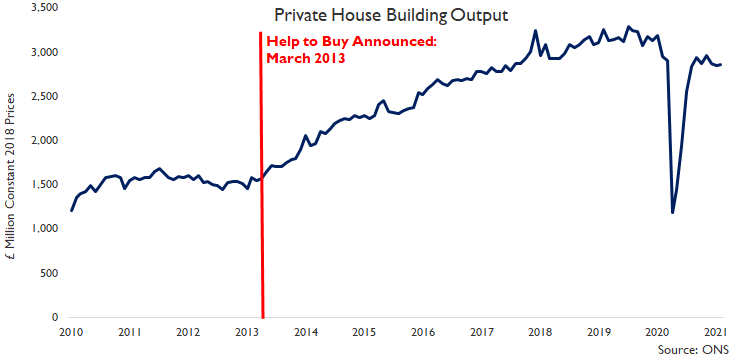

... whilst private housing output only rose 0.3% in February 2021 & remained 3.2% lower than a year ago despite rapid recovery in house building & the buoyant/overheating housing market, which sounds counter-intuitive but is because...

#ukconstruction #ukhousing

#ukconstruction #ukhousing

... housing starts & completions (which are higher than pre-Covid-19) cover only new build homes whilst private housing output also covers conversions (e.g. changing a house into flats) as well as changes in use (e.g. changing offices into flats) &...

#ukconstruction #ukhousing

#ukconstruction #ukhousing

... both conversions & changes in use to private homes in cities, particularly London, activity remains subdued whilst major housebuilders are currently building at or above pre-Covid-19 rates (although February activity was affected by poor weather).

#ukconstruction #ukhousing

#ukconstruction #ukhousing

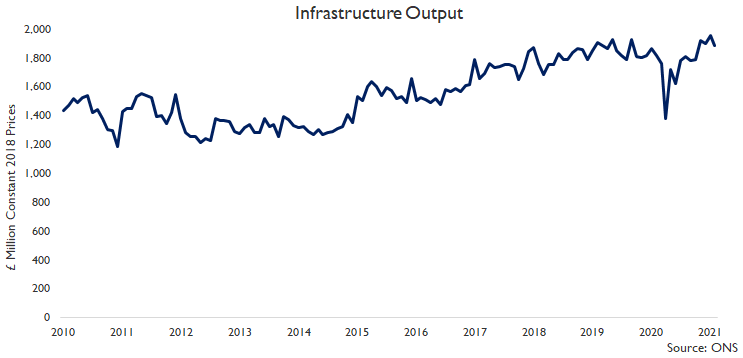

Infrastructure output fell 3.4% in February 2021 compared with January, largely due to persistent rain, but remains 4.0% higher than a year ago boosted by major projects (despite HS2 delays & cost overruns again) & regulated sector frameworks.

#ukconstruction #ukinfrastructure

#ukconstruction #ukinfrastructure

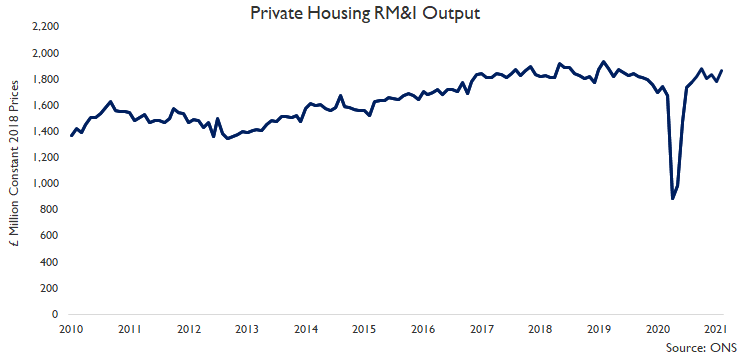

Private housing repair, maintenance & improvement output in February 2021 was 4.7% higher than in February & 6.7% higher than a year ago as homeowners that have maintained employment & incomes whilst increased saving due to...

#ukconstruction #ukhousing

#ukconstruction #ukhousing

... lower commuting costs for those working from home & an inability to spend on non-essential retail & leisure, have chosen to invest in their home, particularly given high demand for additional home office space & better quality outdoor space but...

#ukconstruction #ukhousing

#ukconstruction #ukhousing

... the key question going forward will be whether there is a shift away from private housing rm&i as social distancing restrictions ease & households move back towards normal spending patterns.

#ukconstruction #ukhousing

#ukconstruction #ukhousing

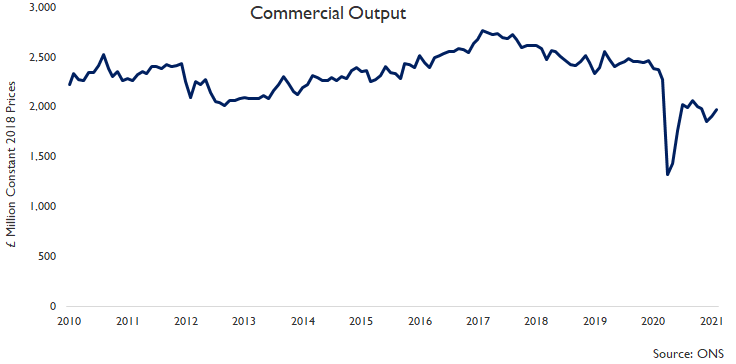

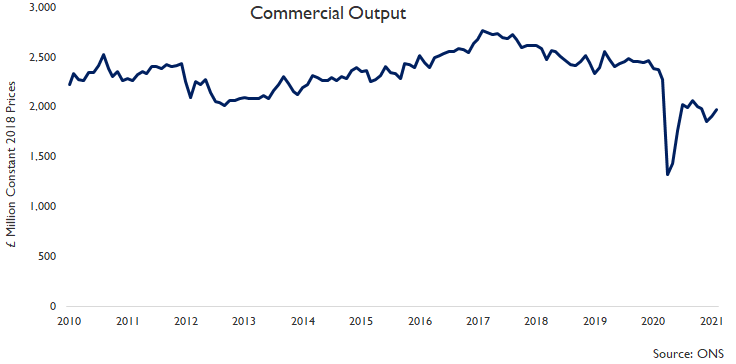

Whilst it has been a 'V'-shaped recovery in many sectors, for commercial (offices, retail, leisure) output it will be a 'W'-shaped at best. Commercial output in February 2021 was 4.0% higher than in January but remained 16.6% lower than a year ago...

#ukconstruction #ukcommercial

#ukconstruction #ukcommercial

... with February's activity benefitting from some fit-out activity in retail & leisure preparing for reopening & opening new units after social distancing restrictions to ease & March will benefit from this too...

#ukconstruction #ukcommercial

#ukconstruction #ukcommercial

... but the question for commercial is, after this flurry of small projects & after large projects started pre-Covid-19 complete, where will the major projects come from (particularly as it is high investment upfront for a long-term rate of return).

#ukconstruction #ukcommercial

#ukconstruction #ukcommercial

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh