The Arbitrary Nature of Economic Policy Preferences

1/ The vast majority of FinTwit / CrypTwit is consumed by the arbitrary application of preferred monetary policies. Constant tribalism between Keynesians/Austrians, De-/Inflationist, Centralists/Decentralists, Traders/Investors.

1/ The vast majority of FinTwit / CrypTwit is consumed by the arbitrary application of preferred monetary policies. Constant tribalism between Keynesians/Austrians, De-/Inflationist, Centralists/Decentralists, Traders/Investors.

2/ What are economic principles & "schools of thought" if not arbitrary ideological preferences as to how we as human beings relate to one another? Money & Value are distillations of our collective efforts & obligations to one another across space & time, humans serving humans.

3/ Our collective sense of organization via incentives distill down to the constituent physical elements that constitute our world, matter & energy. Consumption of matter & energy are abstracted into currencies, stores of value, assets, interest rates (time).

4/ On top of the substrate of "1:1 costs of all things" are the speculative & anticipatory costs/valuations of trying to measure an uncertain future. We rely on each other for market prediction based on collective real-time assessments. System complexity is an understatement.

5/ So given that we know this system to be dynamic, multi-variate, complex, indeterminate, probabilistic, stochastic, etc. it's shocking that anyone would take an ideological position on the way in which we use value at all. It seems absurd to encapsulate human relations this way

6/ Can you imagine a single policy prescription, monetary system, fiscal approach for all time, all people, & all expressions of human value? When you put it that way it's beyond hubris, it's delusional and/or ignorant. How can deep market thinkers anchor themselves this way?

7/ What does it even mean to be correct about a specific monetary theory? Does that mean that an approach to how humans relate to another in their value assessments & relative economies are an idealistic target or is it that we simply view the world through our biases?

8/ For example, antagonists of MMT rage against the machine for fear of inflation, arguing that purchasing power from irresponsible fiat printing will destroy civilization as we know it. Suddenly we have champions of "hard money", enter the deflationists, gold bugs, bitcoiners,..

9/ On the opposite end of the spectrum we have advocates that consider the possibility that at this stage in our evolution as a species we are somehow ready to eliminate all external incentives / competitive frameworks, which is equally extreme & worse temporal.

10/ The point of this thread is not to take a position for / against a specific monetary approach, economic system, idealization etc, but to point out that there is NO UNIQUE SET OF SOLUTIONS. In this variable space we find ourselves navigating, the only constant is humans.

11/ Consider for a moment that a unique set of policy solutions is really appropriate only for some statistical subset of the population, a finite amount of time, a sub-section of markets, etc. We find ourselves becoming optimizing agents rather than human beings, only reacting.

12/ There are trillion dollar markets being formed on top of conceptual walled gardens, which is frankly shocking. As an engineer all my life the one thing I've learned with certainty is that as the # of variables rises the local max/min valleys become traps, monetary minefields.

13/ Great thinkers, investors/traders, economists, policy makers, carving out personal comfort zones for their views, territories viscously defended w/ cherry-picked data sets & barbed words, valleys of thought becoming prisons to intellectual growth, sacred cows out to pasture.

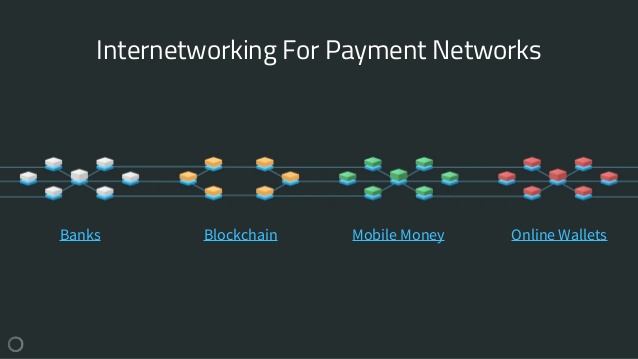

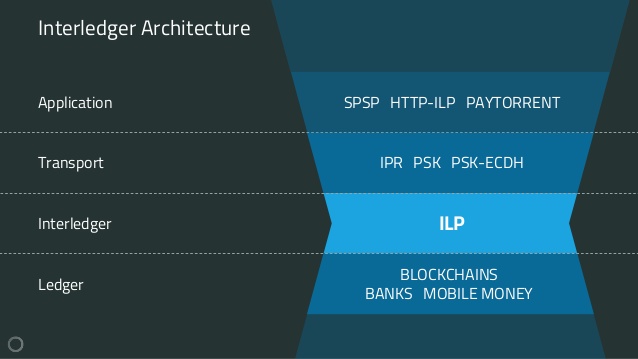

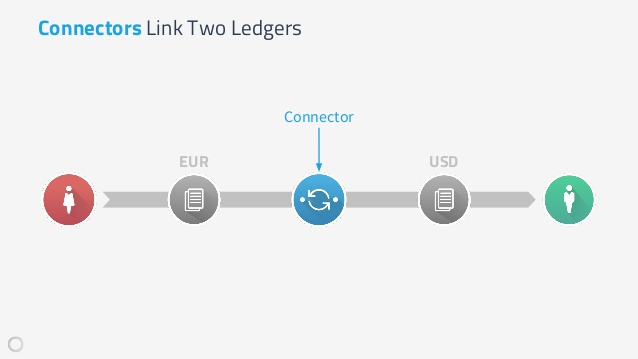

14/ The most interesting & exciting thing to me is the Internet of Value (interoperability between digitized assets, digital currencies, supra-national communities, etc.) The fragmentation of experimentation. Cambrian explosions of mutated failures with a few super mutants.

15/ Your spider sense should "tingle" whenever you hear definitive proclamations (the irony not-withstanding this thread). Be skeptical of "Truths", temporary victories in the never ending evolutionary war of value expression vis-a-vis human relations. Always zoom out.

16/ Humanity is at a technological turning point in which many of the constraints that forced the traditional economic positions are becoming moot. Seismic shifts in our service to one another as humans, at the root trust & enforcement of obligations. We need dynamism & courage!

17/ The ?s to ask yourself at all times is "why am I taking this position at this specific point in time?", "what could change in the world to make me change my position?", What is the probability of said occurrence(s)? Act according to flexible thinking & always challenge dogma.

18/ The next time you find yourself criticizing experimentation, turn inward & figure out what paradigm is being defending. Is the defense of that idea worth it? The hill you are willing to die on? Convictions breed rigidity & breed out adaptability. Beware radicalization.

• • •

Missing some Tweet in this thread? You can try to

force a refresh