Heading into Coinbase's hotly anticipated listing, markets have been volatile, and there's been a lot of great trading to do if you know where to look.

Honestly, the trading has seemed almost ... *too* great? And pretty easy to predict.

A thread about efficiency.

Honestly, the trading has seemed almost ... *too* great? And pretty easy to predict.

A thread about efficiency.

https://twitter.com/FTX_Official/status/1382219864144715781

Let me first discuss this notion more generally -- efficiency. A market is called *efficient* if prices in the market consistently reflect some true fair value, based on all possible data at the time -- trade history, blockchain data, news, etc.

How efficient are crypto markets?

How efficient are crypto markets?

This shouldn't be a *giant* surprise, but the answer is: not really :P

A priori this might not be totally clear, but we've seen time and again the markets just not move in the obvious direction for what seems like an eternity:

A priori this might not be totally clear, but we've seen time and again the markets just not move in the obvious direction for what seems like an eternity:

Remember DOGE? It has actually just been possible to buy DOGE when Elon tweets (human timescale is fine here -- you've got minutes before the price really skyrockets) and sell an hour later. This is *not* efficient!

https://twitter.com/elonmusk/status/1357236825589432322?s=20

The market's super predictable response to each piece of news about XRP is an example as well; an efficient market would have priced future (predictable) news in as soon as any news happened.

https://twitter.com/AlamedaTrabucco/status/1349538928940892163?s=20

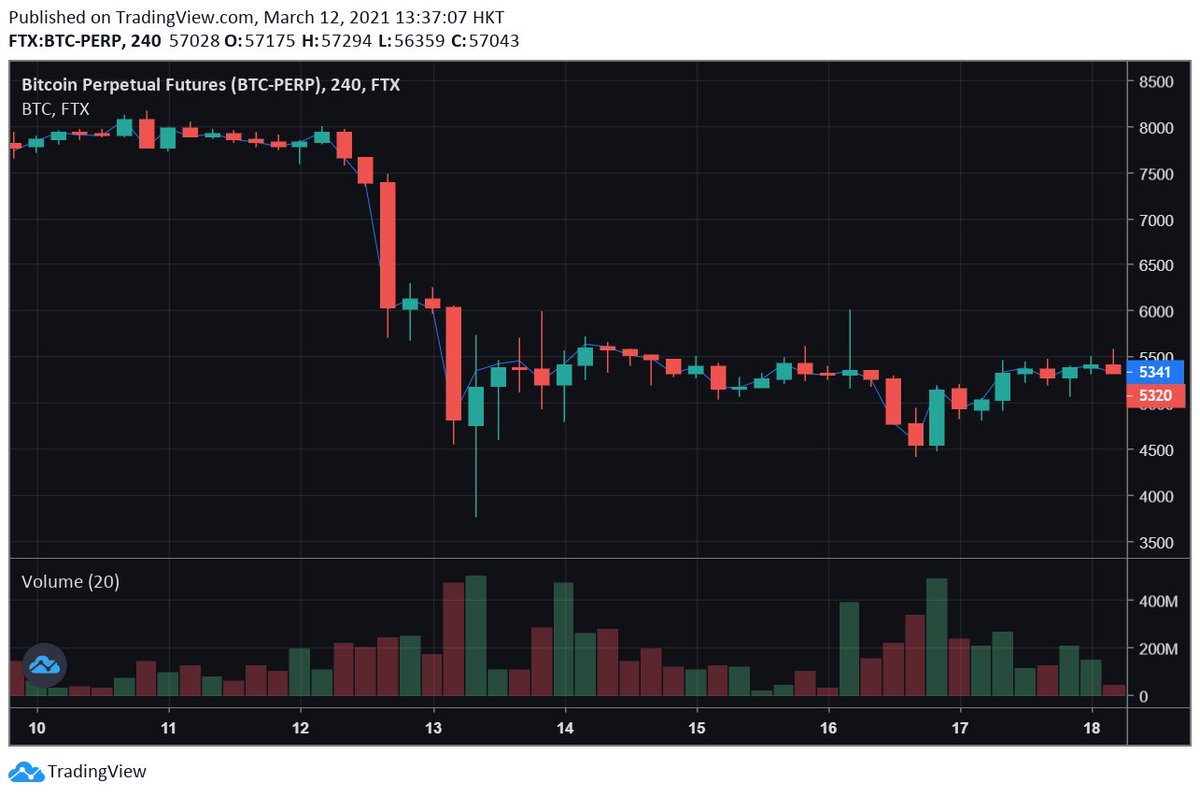

And let's just say the market kinda had no potential to be efficient on March 12, 2020 -- big traders were sort of "incapacitated" and prices were allowed to be all over the place. Smaller-scale versions of this happen all the time!

https://twitter.com/AlamedaTrabucco/status/1370273230586486786?s=20

So, we've seen time and again that crypto is really just not efficient. Which makes sense! Most established firms (with news desks and whatnot) are not trading it much, disjointed margin systems allow "arbs" to sit there, etc.

What does that mean here?

What does that mean here?

Well, it means that the obvious trades are often pretty good -- what are the obvious trades?

For Coinbase, what are those obvious trades?

For Coinbase, what are those obvious trades?

In a "macro sense," the Coinbase listing is *huge* for crypto. Everyone's talking about it in both crypto and finance circles, it represents yet another step forward for U.S. adoption, and it just sort of clearly has good implications for crypto.

My first thought here was: well, crypto is already up because of the U.S. narrative, why should it go up more?

My second thought is: wait, right, crypto is inefficient, hype -> rally. And ...

My second thought is: wait, right, crypto is inefficient, hype -> rally. And ...

Side note: it took me YEARS to categorically get past the first thought there. My instincts all come from traditional finance where markets sort of are efficient, and "buy hype the day before an event the world knew about for weeks" is WAY less good as a result.

Cool, so BTC was predictably gonna go up. What else?

Remember all my talk about liquidations creating momentum? That's evolved a little.

Remember all my talk about liquidations creating momentum? That's evolved a little.

https://twitter.com/AlamedaTrabucco/status/1332036760939896832?s=20

BTC has mostly cleared out its short positions to liquidate on the way up, but some other coins have pretty large high-leverage OI compared to ADV, and have not had as much chance to liquidate them.

Enter XRP.

Enter XRP.

XRP is up a TON lately. It's at (essentially) its ATH, by a lot, and has gotten there super recently. AND, just a few months ago, people had HUGE incentive to short it aggressively -- there's a lot of OI just waiting to get liquidated.

And get liquidated it has.

And get liquidated it has.

Sadly I have to report that this price graph is not the result of organic buying. SOME organic buying, yes -- just the follow-through from the crypto rally. But mostly, XRP shorts have gotten liquidated WAY more than other coins ...

... which is just what you'd expect with every coin at its ATH and XRP having had more shorts opened recently. Similar story in DOGE, actually -- this graph is the result of some organic interest (moreso because Coinbase and Elon have some correlation), but mostly liquidations.

Another big effect you'd just naively expect: Coinbase is an exchange. With its valuation going up and excitement around it growing, won't other exchanges get some excitement, too?

Luckily, crypto exchanges mostly have tokens which act as proxies ...

Luckily, crypto exchanges mostly have tokens which act as proxies ...

... and those tokens are mostly the best performers of the past few weeks. BNB is outperforming BTC by like 100% since the start of April! There have actually been some liquidations there too, and also burn excitement, but it's mostly just been COIN follow-on.

And FTT is (happily :P) doing something analogous, and with less idiosyncratic stuff like burns and liquidations (though it does have some 🔥 of its own). This is a more direct piece of evidence that the world is valuing all exchanges higher amidst Coinbase excitement.

All these trades were the naively good thing to do, and all of them went exactly as expected. So what should we expect going forward?

It's a little more ambiguous, sadly. Many tech IPOs have a predictable pattern of getting over-hyped and then crashing -- if that does happen, *probably* that's bad for crypto in the predictable ways -- I'd definitely bet on that.

But, I am not sure if COIN's listing will follow that pattern -- it's sort of hard to exaggerate just how hyped this thing is, in a way which makes it seem possibly categorically different from the SNAPs* of the world.

*one of my first failed investments was SNAP back when I had recently graduated college, I wish I'd just been shitcoining a few years earlier instead.

The most important thing, I think, will be staying REALLY vigilant about how COIN is doing -- one place where efficiency CAN pop up is when the whole world is watching the same thing, and if COIN e.g. moons, the world will know to buy BTC.

The big lesson for me here has been: don't over-think what's obvious. Crypto is still evolving and part of that is that the clear trade is so often the good trade, and deciding to just accept that and put it on big is often enough. Less is more!

• • •

Missing some Tweet in this thread? You can try to

force a refresh