So far, auction indications have been a bit lower than I think the market was expecting (e.g. where it was trading on FTX earlier).

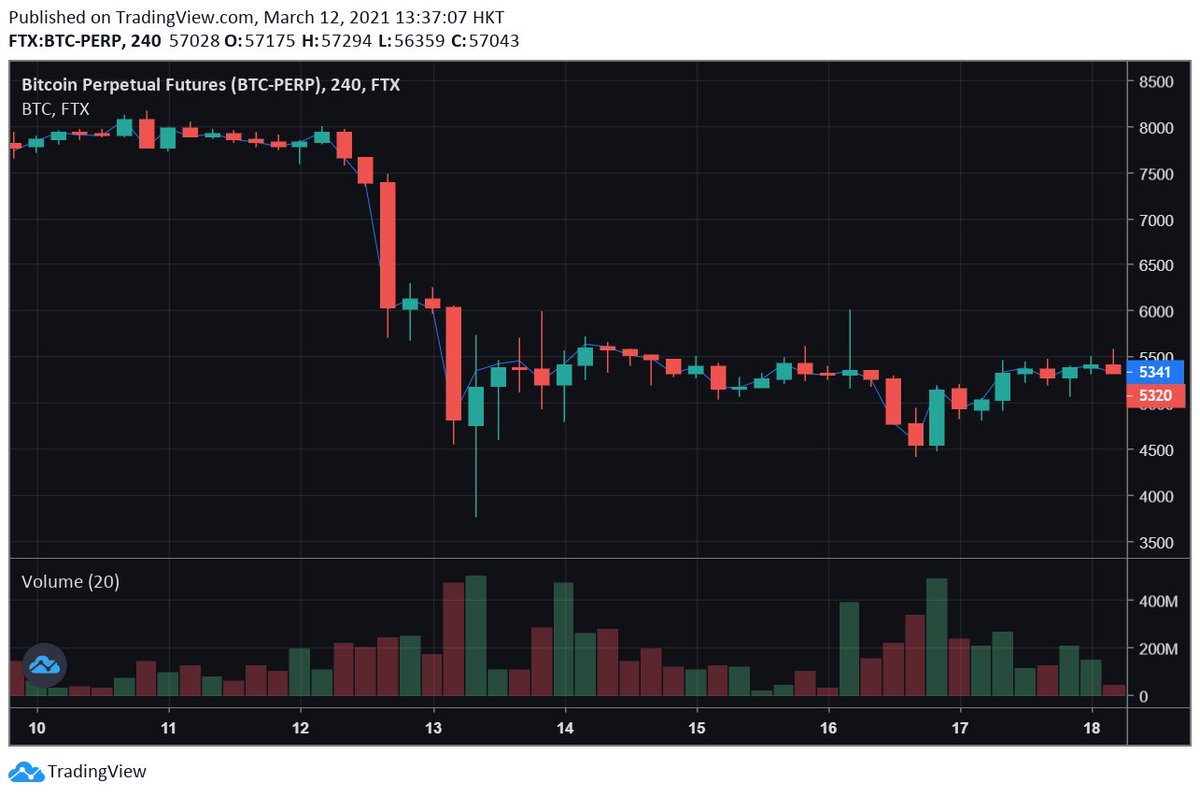

On FTX, it's fallen to close to that indic price:

On FTX, it's fallen to close to that indic price:

https://twitter.com/AlamedaTrabucco/status/1382244132022755329

The crypto market is reacting broadly basically how I thought -- the world is all watching this, the world all expects BTC to be correlated to COIN right now (since Coinbase's success is seen as something of a proxy for success of BTC in the US), so crypto is crashing.

And the worst performers of all? The likes of BNB and other exchange tokens, who are seen as *especially* correlated with COIN and Coinbase more generally. When the indics first started crashing, BNB *really* underperformed -- it's recovered some but not totally vs. BTC.

We'll see what happens when this thing finally lists! I'm expecting more of the same -- if the market thinks COIN is doing well, crypto / EXCH will follow, and vice-versa.

I'd forgotten how painfully slow traditional market listings are, crypto has me spoiled.

I'd forgotten how painfully slow traditional market listings are, crypto has me spoiled.

• • •

Missing some Tweet in this thread? You can try to

force a refresh