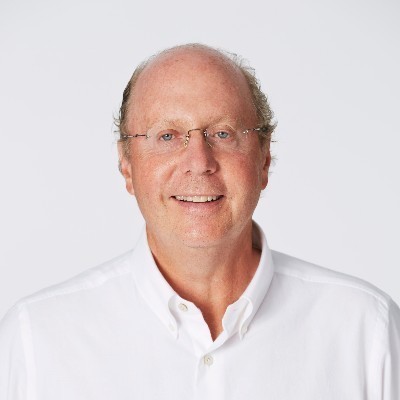

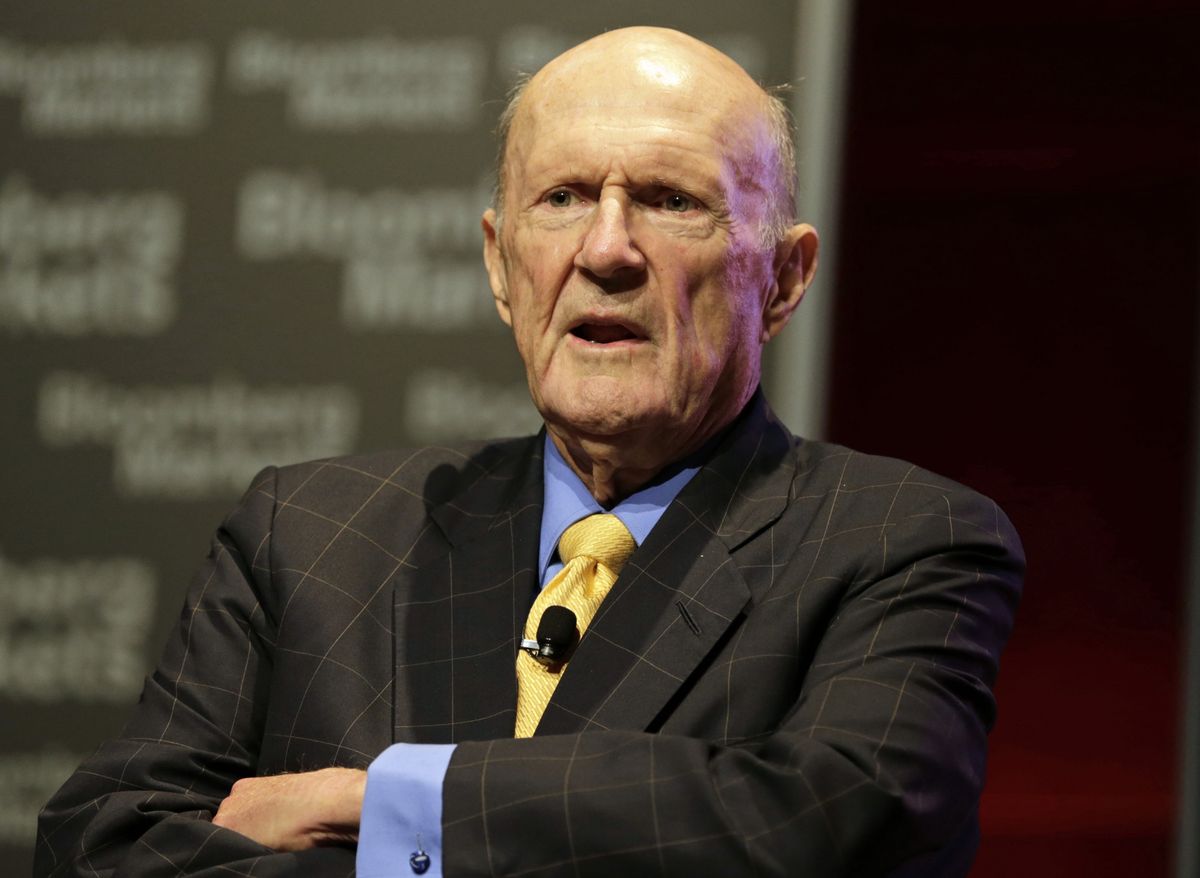

It seems we’ve come full circle. 21 years after Julian Robertson retired, one of his disciples is reshaping VC.

From inception in 1980 until the summer of 1998, Robertson’s Tiger had been one of the most successful hedge funds ever.

He was about to be tested like never before.

From inception in 1980 until the summer of 1998, Robertson’s Tiger had been one of the most successful hedge funds ever.

He was about to be tested like never before.

But trouble was brewing. AUM had grown from $9 million at inception to more than $20 billion leading to concentration and liquidity issues.

He was taking a concentrated bet in US Airways. Even Robertson conceded: “We probably own too much. We’ll have to sell some at some point.”

He was taking a concentrated bet in US Airways. Even Robertson conceded: “We probably own too much. We’ll have to sell some at some point.”

He was running macro trades in currencies and bonds on top of his long-short portfolio. Already he had been punished by a short Yen trade.

And his short book included tech names like Micron.

And his short book included tech names like Micron.

Still, it had been a good year.

In Robertson’s words: “Everybody here is overpaid, knows they are overpaid and is determined to continue to be overpaid.”

In Robertson’s words: “Everybody here is overpaid, knows they are overpaid and is determined to continue to be overpaid.”

In October 1998, Russia defaulted and hedge fund LTCM imploded. Tiger lost $2 billion, or 9%, on the Yen short in one day.

wsj.com/articles/SB907…

wsj.com/articles/SB907…

Just noticed the Journal immediately recycled the "mauled" headline..

Tiger lost some 18% that month and dipped into the red for the year.

Robertson had to defend his use of leverage compared to LTCM: "Our business is no more like theirs than it is like a high-volume, low-margin supermarket."

money.cnn.com/1998/11/02/com…

Robertson had to defend his use of leverage compared to LTCM: "Our business is no more like theirs than it is like a high-volume, low-margin supermarket."

money.cnn.com/1998/11/02/com…

"The question might be asked as to what Tiger is going to change in light of the hue and cry over leverage. The answer is nothing. The credit we are using on our macro positions is just a small fraction of what is available to us."

In 1999, Business Week called him “Tiger in a tailspin,” and that the “pressure was on to stem a tide of losses”

Long-time LP @MarkYusko at UNC called it "a firm under siege right now"

Long-time LP @MarkYusko at UNC called it "a firm under siege right now"

Robertson was exiting his macro bets to focus on stocks - with an emphasis on value. US Airways and Waste Management were his biggest positions.

Investors started exiting and Tier saw some $3.5 billion in redemptions.

Investors started exiting and Tier saw some $3.5 billion in redemptions.

In December 1999, the NYT wrote “Tiger fights to reclaim his old roar”

Macro was out. ''We decided primarily to return to what brought us to the party”

“He remains committed to other practices, notably ‘value’ investing, which has been out of favor lately.”

Macro was out. ''We decided primarily to return to what brought us to the party”

“He remains committed to other practices, notably ‘value’ investing, which has been out of favor lately.”

And shorting had been a disaster: "Trying to sell short in this market is like being run over by a train that's going to derail a mile down the road"

Worse: value was extremely cheap but refused to perform:

''Some of these companies are selling at literally five and six times earnings and selling at two and three times cash flow,'' he said. "It's just wild."

''Some of these companies are selling at literally five and six times earnings and selling at two and three times cash flow,'' he said. "It's just wild."

By early 2000, Robertson threw his hands up. It was over.

His big holdings US Airways and Federal Mogul had been “completely obliterated”

His big holdings US Airways and Federal Mogul had been “completely obliterated”

After two bad years and a bad start to 2000, Robertson admitted “these results stink.”

His long-term track record was still strong. But the past years had taken their toll.

His long-term track record was still strong. But the past years had taken their toll.

In his goodbye letter he minced no words:

"The result of the demise of value investing and investor withdrawals has been financial erosion, stressful to us all. And there is no real indication that a quick end is in sight."

"The result of the demise of value investing and investor withdrawals has been financial erosion, stressful to us all. And there is no real indication that a quick end is in sight."

And what do I mean by, ''there is no quick end in sight''? What is “end” the end of? “End”' is the end of the bear market in value stocks.

"The difficulty is predicting when this change will occur and in this regard, I have no advantage.”

"The difficulty is predicting when this change will occur and in this regard, I have no advantage.”

“What I do know is that there is no point in subjecting our investors to risk in a market which I frankly do not understand."

I have great faith though that, ''this, too, will pass.'' We have seen manic periods like this before.”

I have great faith though that, ''this, too, will pass.'' We have seen manic periods like this before.”

"The current technology, Internet and telecom craze, fueled by the performance desires of investors, money managers and even financial buyers, is unwittingly creating a Ponzi pyramid destined for collapse."

Robertson closed his fund and seeded a number of of his analysts to start their own funds, the so-called Tiger Cubs.

institutionalinvestor.com/article/b15135…

institutionalinvestor.com/article/b15135…

Today, one of his protégés is reshaping the technology and venture investing world with an aggressive, fast-paced investment style.

randle.substack.com/p/playing-diff…

randle.substack.com/p/playing-diff…

Robertson closed out at the peak of the bubble. Of course he had no way of knowing that.

It's likely he would have absolutely killed it in the dotcom bust (like many value shops).

tilsonfunds.com/VII&SIIexcerpt…

It's likely he would have absolutely killed it in the dotcom bust (like many value shops).

tilsonfunds.com/VII&SIIexcerpt…

"In the first quarter of 2000, Robertson was short a wide range of high-flying Internet companies such as eToys, Priceline and Lycos, which means he would have made another 50-60% on the short side."

H/t to @unlevered for the Tilson piece and Viking performance, highlighting what could have been if Robertson had kept at it.

This is from Jan 2008. Suffice it to say, Robertson's family office was doing well.

Short subprime: "My gosh, this has been the most extraordinary period of my career as an investor. I think this is the best month I've ever had. It's got to be."

money.cnn.com/2008/01/28/new…

Short subprime: "My gosh, this has been the most extraordinary period of my career as an investor. I think this is the best month I've ever had. It's got to be."

money.cnn.com/2008/01/28/new…

"I wanted to continue to have some young people around. I didn't want to go from age 70 to Methuselah. So we kept the space, which seemed sort of silly at the time, and we seeded a few guys who had worked for us in starting new hedge funds."

"This has succeeded beyond my wildest dreams. It's been an unbelievable success. And it's happened because of them. We selected good people, but they are the ones that have manufactured the record not me."

"I get a nice chunk of their action, of their 20%, and it's a very good system - particularly for me, at my time in life," he says. "I've gotten re-energized. It's wonderfully fun."

"Two of the "Tiger Seeds" with the longest and best records are Bill Hwang of Tiger Asia and Chase Coleman of Tiger Global"

😬

😬

• • •

Missing some Tweet in this thread? You can try to

force a refresh