Part Three

1/ Why does Avalanche $AVAX stand above the rest?

✅Security

✅Performance

✅Decentralisation

✅Customisability

✅Tokenomics

Next up is Decentralisation and how Avalanche compares to other platforms. 🧵👇

1/ Why does Avalanche $AVAX stand above the rest?

✅Security

✅Performance

✅Decentralisation

✅Customisability

✅Tokenomics

Next up is Decentralisation and how Avalanche compares to other platforms. 🧵👇

2/ Decentralisation is a key component to what sets blockchain apart from traditional solutions, it increases security, censorship resistance, enables trust and is more inclusive.

3/ However as many platforms seek higher performance, they are taking the easy route by sacrificing decentralisation.

At one extreme you have Binance Smart Chain which is operated by just 20 validators of which the majority are controlled by Binance.

At one extreme you have Binance Smart Chain which is operated by just 20 validators of which the majority are controlled by Binance.

4/ They can do whatever they want with the platform at any point, whether that be delisting projects, censoring transactions, changing the history of the chain, it's no different than traditional solutions. This also makes them a target for law enforcement to enforce any changes.

5/ CZ has termed the phrase "CeDeFi" for Centralised DeFi.

You can't have DeFi on a centralised blockchain

There can be no trust / immutability / censorship resistance without decentralisation.

You can't have DeFi on a centralised blockchain

There can be no trust / immutability / censorship resistance without decentralisation.

6/ Do you want the future of your project in complete control by a single entity? Or do you want to change the world and move away from the centralized systems we have today to a world which benefits all?

7/ There are platforms which not only have a small number of total nodes but an even smaller number of those holding the majority of stake. Polygon's (Matic) side chain has a single node controlled by Binance with 36% of the stake.

8/As this uses classical consensus it means Binance has control to halt the chain at any point either maliciously (they do have a competing chain) or through issues with their node. Other examples of this was the recent outage on Fantom where 2 nodes went offline halted the chain

9/ As it's classical consensus they can also take completely control the chain through a network partition, compromising the security of the chain.

This is why it's vital for users to choose carefully who they delegate to, particularly when limited to a small number of nodes.

This is why it's vital for users to choose carefully who they delegate to, particularly when limited to a small number of nodes.

10/ Other platforms select a small sample of the overall validator set to increase performance at the expense of decentralisation. Polkadot can have as little as 14 validators validating each parachain, with other examples including Algorand, Elrond and Near.

11/ Decentralisation can also be reduced through the distribution method. Rather than a distributed peer to peer model where nodes connect to each other, Algorand uses a central hub and spoke where all transactions have to pass through a permissioned set of relay nodes.

12/ Which performs signature verification / validity checks before forwarding them to nodes to vote. Leaving the potential for censorship of transactions flowing through the network. Whilst malicious nodes can't compromise security of the network, they can cause it to halt.

13/ Layer 2 Solutions such as Optimism's optimistic rollup will be a more centralised solution as initially everyone that is using the rollup sends their transactions to a single sequencer who then puts them into a batch and calculates the new state root to be posted on chain.

14/ The sequencer can choose to ignore transactions for a batch / include their own - to benefit from MEV / front running etc, , if however, they ignore it for a certain amount of time then the user can send it to the layer 1 chain.

15/ There is the potential that you could have just a single entity (maybe even nobody) checking the validity of a transaction by performing the computation offchain, whereas with Avalanche you have the full security of knowing its validated by everyone.

16/Whilst there are plans to introduce multiple sequencers in the future, the proposed plan is to do this with a MEV Auctions. MEV is a huge problem with $2.3 Million extracted through front running in the last 24 hours. See the below article for more info

coindesk.com/miners-front-r…

coindesk.com/miners-front-r…

17/ Avalanche Consensus is the biggest breakthrough since Nakamoto. It uses repeated random sub-sampling of the entire network to quickly achieve consensus with minimal overhead per node for incredible performance. See this article for more details

medium.com/avalanche-hub/…

medium.com/avalanche-hub/…

18/The number of messages each node has to handle per decision remains constant as the validator set increases, enabling it to be an inclusive consensus that can scale to millions of validators all participating in consensus to enable unparalleled levels of decentralisation.

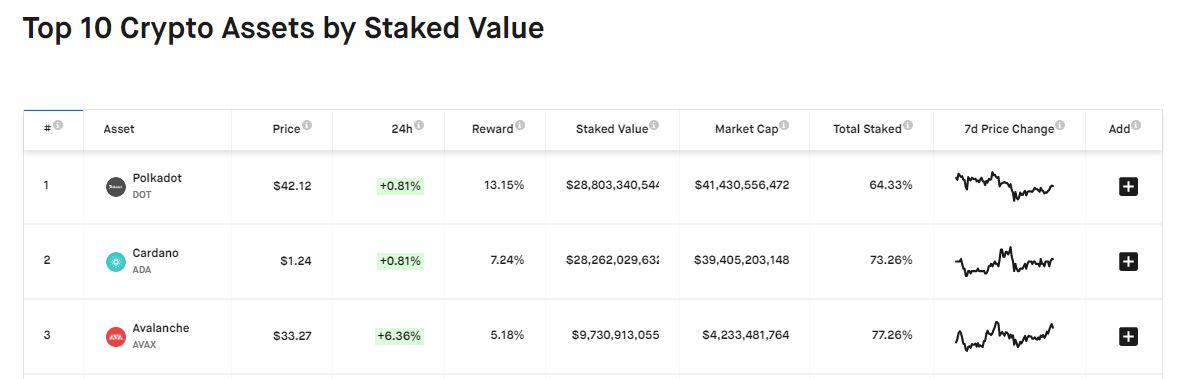

19/ To prevent single nodes like Exchanges from getting too much control and avoiding scenarios like Polkadot below where validators can control a large part of the stake without taking any risk themselves / own stake, limits were put in place.

https://twitter.com/CryptoSeq/status/1380862179797307399

20/ The maximum delegation amount is limited to 4x the validators owned stake to ensure they always have skin in the game and that one node can't take down the network

There are currently 920 Block producing validators and importantly all participate in consensus on a decision.

There are currently 920 Block producing validators and importantly all participate in consensus on a decision.

21/ Hardware requirements are minimal compared to other blockchains with just 2 cores, 4 GB Memory and 32 GB Hard Drive enabling anyone to run one. The minimum stake amount is due to be reduced significantly once governance is implemented shortly.

22/ Being a leaderless blockchain, not limited to a small no. of validators, combined with sub second finality makes MEV pretty much a non-issue compared to other platforms. So not only do you benefit from cheap fees and a decentralised secure network but also don't get front run

23/ The previous Rosetta Technical Lead at Coinbase deeply studied all Layer1s as part of his job and this thread linked👇 describes how Avalanche was the only solution that offered inclusive consensus. He has since joined the amazing team at Avalanche

https://twitter.com/_patrickogrady/status/1349771943650627587

24/ The Future is multi-chain, just as companies don't restrict themselves to one country and being overcrowded, they expand across multiple regions attracting more users. Avalanche doesn't take the easy route like others and compromise decentralisation.

https://twitter.com/CryptoSeq/status/1364508841895944192

25/ Projects built on Ethereum can expand their user base to a rapidly growing ecosystem with high throughput, sub second finality, low costs and crucially WITHOUT sacrificing decentralization!

Easily build Decentralized APPs on multiple ecosystems with 100% compatibility $AVAX

Easily build Decentralized APPs on multiple ecosystems with 100% compatibility $AVAX

• • •

Missing some Tweet in this thread? You can try to

force a refresh