Part Four

1/ Why does Avalanche $AVAX stand above the rest?

✅Security

✅Performance

✅Decentralisation

✅Customisability

✅Tokenomics

Next up is Customisability and how Avalanche compares to other platforms. 🧵👇

1/ Why does Avalanche $AVAX stand above the rest?

✅Security

✅Performance

✅Decentralisation

✅Customisability

✅Tokenomics

Next up is Customisability and how Avalanche compares to other platforms. 🧵👇

2/ Homogeneous blockchains offer very little in the way of customisation in the underlying platform, they offer a single solution using the same protocol. Examples include Ethereum, Solana, Near and Algorand. Whether it's a single chain, sharded or side chains, it's all the same.

3/ Each blockchain has their strengths and weaknesses through. A general purpose blockchain tries to cater for all requirements, but excels at none, resulting in developers having to compromise on a solution that best suits their overall needs rather than what is optimal.

4/ Avalanche is a heterogeneous platform of platforms ultimately consisting of thousands of subnets to form a heterogeneous interoperable network of many different blockchains, that takes advantage of the revolutionary Avalanche Consensus.

5// Like other heterogeneous platforms such as Cosmos and Polkadot, Avalanche abstracts the complexities of managing the network and consensus layers allowing developers to focus on the application layer, whilst also able to seamlessly interoperate with other blockchains.

6/ Rather than developers having to compromise on a single solution to try and meet all their needs, Avalanche enables the easy creation of application specific blockchains on the platform which can be tailor-made for that exact requirement.

medium.com/avalanche-hub/…

medium.com/avalanche-hub/…

7/ Want a blockchain that specialises in payments or the trading of assets? then a DAG with partial ordering provide the best performance with 4500 tps and sub second finality like the X-Chain. Want a blockchain that uses smart contracts? Then a totally ordered linear blockchain

8/ is best. Want a blockchain that's focused on privacy? A privacy VM can be used. Your application may require a combination of all 3 of the examples each designed to perform optimally for each individual task whilst also enabling seamless interoperability between them.

9/ New blockchain platforms with their own smart contract language / virtual machine can take years to build the tooling comparable to what Ethereum has built up today and as a result adoption of the platform is much slower.

10/ Avalanche’s C-Chain is a smart contract chain that uses the EVM and is 100% compatible with existing Ethereum tooling. Everything you can do on Ethereum you can do on the C-Chain with the added benefit of high throughput, sub-second finality and low fees.

11/ Existing Ethereum DAPPs can easily be ported over and use all the existing tooling such as Metamask / Truffle etc making it easy for existing Ethereum developers to build on Avalanche from day one rather than wait years for the developer and tooling

12/ Avalanche goes far beyond other platforms by being able to implement any custom VM on top of the platform as well. You can use any VM from other popular blockchains enabling integration with their existing tooling and developers to easily build on the platform as well.

13/ It’s not limited to just the EVM and migrating DAPPs from Ethereum though, any custom VM can be used. Allowing projects from any blockchain to ultimately be easily ported over and benefit from the performance, decentralisation, low fees and customisation Avalanche offers.

14/ Bitcoin and Bitcoin Cash subnets are planned to be created on Avalanche enabling the functionality of Bitcoin to be used in more than just a digital gold proposition but also an excellent payment system by providing high throughput, sub second finality, cheap fees, low energy

15/ consumption whilst even greater levels of decentralisation.

It will feature the Bitcoin Virtual Machine providing the full functionality of Bitcoin, scripting language, segwit, integration with existing Bitcoin tooling 👇

It will feature the Bitcoin Virtual Machine providing the full functionality of Bitcoin, scripting language, segwit, integration with existing Bitcoin tooling 👇

https://twitter.com/CryptoSeq/status/1369742430522793985

16/ Avalanche was built with serving financial markets in mind. It has native support for easily creating and trading digital smart assets with complex custom rule sets that define how the asset is handled and traded to ensure regulatory compliance.

17/ The assets could represent financial instruments such as equities, bonds, debt, real estate, or anything else. Offering the best place to build DeFi applications but also the traditional finance market, where the derivatives market alone is worth a staggering $1000+ trillion.

18/ These VMs can then be deployed on a custom blockchain network, called a subnet, which consist of a dynamic set of validators working together to achieve consensus on the state of a set of many blockchains where complex rulesets can be configured to meet regulatory compliance.

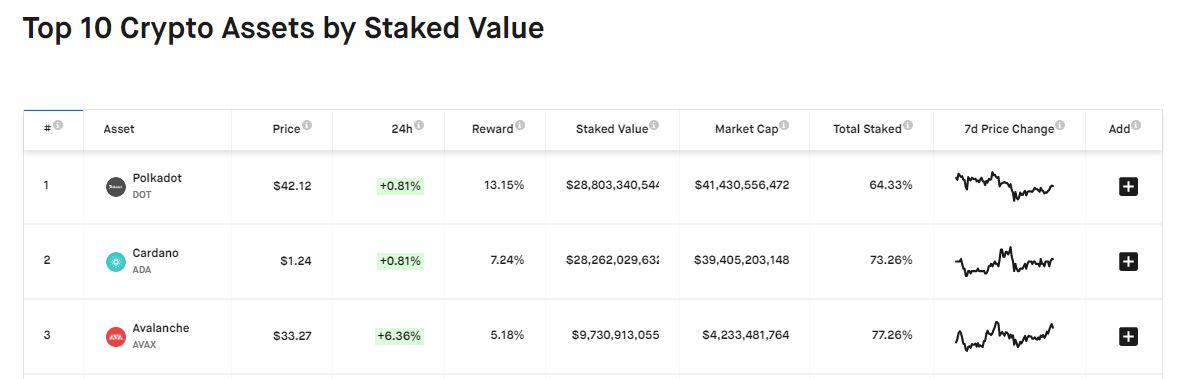

19/ Enterprises can choose to build a mix of permissioned and permissionless blockchains on Avalanche and interoperate between them without having to pay and hold huge amounts of a highly volatile asset whilst getting diluted 10% each year like with Polkadot.

20/ Regulatory compliance is going to be key to enable the thousands of trillions to migrate over. A subnet manages its own membership, and it may require that its validators have certain properties such as requiring them be located in a given country or holding a certain license

21/ So, you may have one subnet for validating a set of blockchains that deal with trading of securities in the US which requires validators be located in the US and hold certain licenses for example. Or located within the EU and comply with GRDP regulation etc.

22/ Avalanche offers an incredibly customisable platform that can cater for all requirements from DeFi to the 1000's of trillions of dollars in the traditional finance world.

It's future proof by enabling the integration of any custom VM enabling rapid adoption by using the

It's future proof by enabling the integration of any custom VM enabling rapid adoption by using the

23/ existing tooling and infrastructure of other platforms. DAPPs can easily be ported and benefit from the performance Avalanche offers without changes, enabling developers to expand across multiple blockchains without having to maintain two completely different repos.

24/ Whether developers want to build DAPPs on existing blockchains like the C-Chain, or create custom application specific blockchains, whether permissioned or permissionless, or the usage of any VM and smart contract language, Avalanche is the platform that enables all of that

25/ Whilst also offering incredible performance, sub second finality and unparalleled decentralisation with the revolutionary Avalanche consensus.

No need to compromise, Build Without Limits on Avalanche.

No need to compromise, Build Without Limits on Avalanche.

• • •

Missing some Tweet in this thread? You can try to

force a refresh