TVL reached an ATH over $4.7b, comprising almost 10% of the ~$48b locked on all DeFi-related platforms.

Uniswap V3 (slatted for May 5) will further improve DEX functionality in a variety of ways.

+ Concentrated liquidity: the ability for liquidity providers to make markets within customized price ranges, creating individual price curves.

+ Concentrated liquidity: the ability for liquidity providers to make markets within customized price ranges, creating individual price curves.

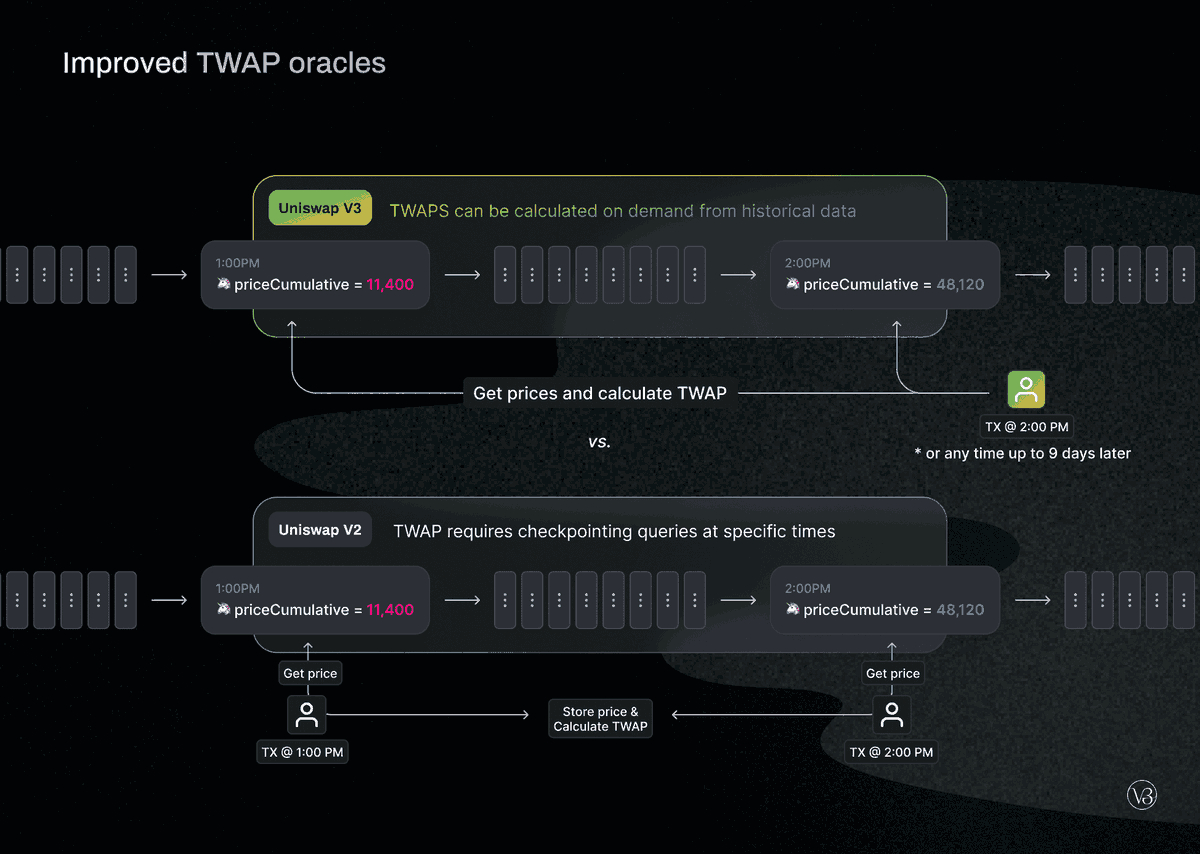

Updates for Oracles:

+ Making it possible to calculate TWAP with a single on-chain call, and making it easier and cheaper to create more advanced oracles.

+ Making it possible to calculate TWAP with a single on-chain call, and making it easier and cheaper to create more advanced oracles.

Updated fee tiers:

+ Instead of the original 0.30% flat fee, there are now three tiers of fees for each pool - 0.05%, 0.30% and 1%.

+ Instead of the original 0.30% flat fee, there are now three tiers of fees for each pool - 0.05%, 0.30% and 1%.

Uniswap V3 is a significant improvement to AMMs and will likely have far-reaching implications. Read more in @rahul_rai121's recent report messari.io/article/uniswa…

• • •

Missing some Tweet in this thread? You can try to

force a refresh