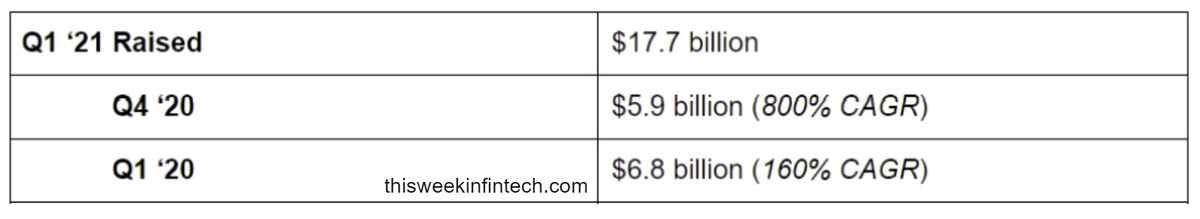

We all know that Q1 was a crazy quarter for fintech fundraising - but just how crazy was it?

Fintech companies raised *$17.7 BILLION* in Q1, more than 55% over the highest quarter we've ever tracked.

Fintech companies raised *$17.7 BILLION* in Q1, more than 55% over the highest quarter we've ever tracked.

The number of #fintech deals has been sharply ticking upwards:

- 130 funding rounds in Q1 '20

- Up to 211 rounds in Q4 '20

- Up to *301* rounds in the last quarter

- 130 funding rounds in Q1 '20

- Up to 211 rounds in Q4 '20

- Up to *301* rounds in the last quarter

Put differently, funding grew quarter-to-quarter at an 800% CAGR.

Against Q1 '20 (which itself was already showing signs of a frenzy...), venture funding into fintech has still grown at a 160% CAGR.

Against Q1 '20 (which itself was already showing signs of a frenzy...), venture funding into fintech has still grown at a 160% CAGR.

And there are many new and exciting product areas seeing new investment demand:

- Climate + Fintech

- Crypto + Fintech

- Business PFMs

- Charity Fundraising

- Creator Economy

The full writeup is available here -

thisweekinfintech.substack.com/p/signals-41-q…

- Climate + Fintech

- Crypto + Fintech

- Business PFMs

- Charity Fundraising

- Creator Economy

The full writeup is available here -

thisweekinfintech.substack.com/p/signals-41-q…

• • •

Missing some Tweet in this thread? You can try to

force a refresh