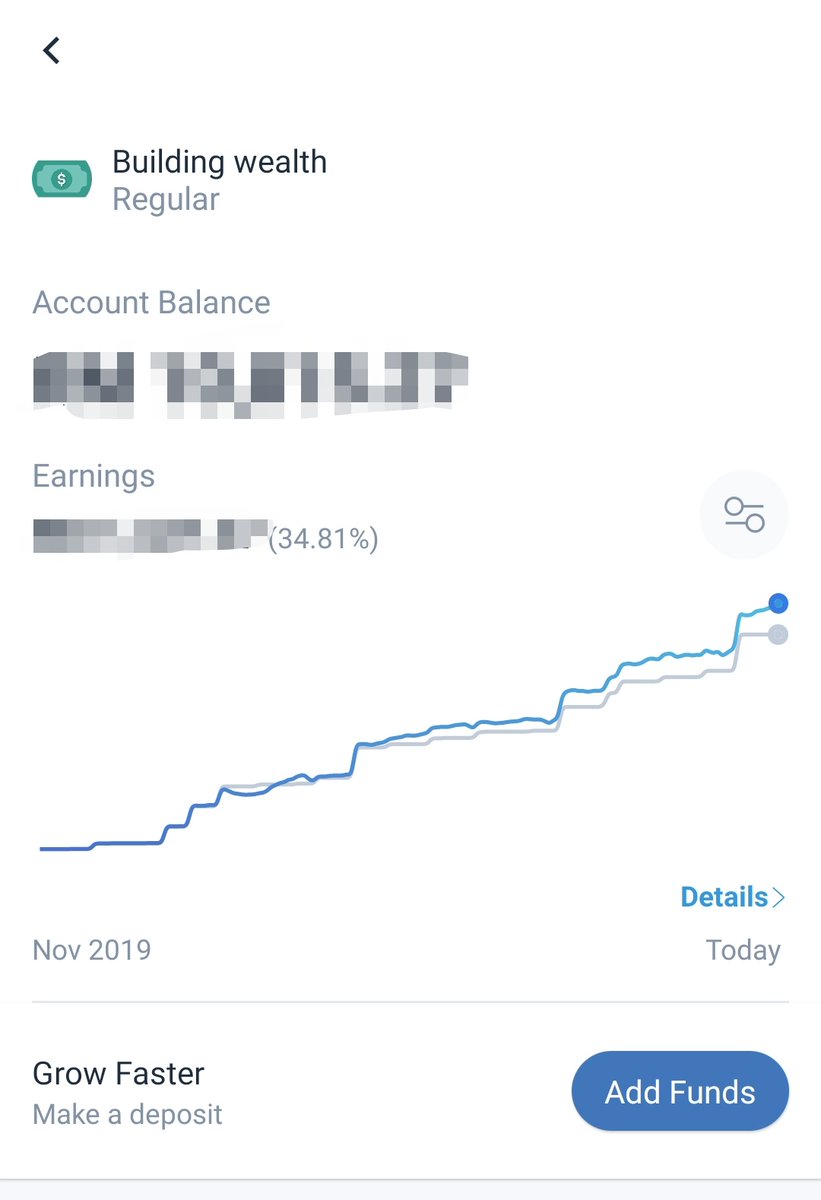

34.81% return from Wahed Invest after one year and a half.

Thread ini saya nak ceritakan briefly setiap portfolio yang ada di Wahed dan bagaimana cara nak dapatkan pulangan yang optimum.

#wahedinvest

Thread ini saya nak ceritakan briefly setiap portfolio yang ada di Wahed dan bagaimana cara nak dapatkan pulangan yang optimum.

#wahedinvest

Wahed Invest ada 7 portfolio :

1. Gold

2. Very conservative

3. Moderately conservative

4. Moderate

5. Moderately aggressive

6. Aggressive

7. Very aggressive

Setiap portfolio ada peranan berbeza. Kita cuba details kan ke mana duit kita dilaburkan untuk setiap portfolio.

1. Gold

2. Very conservative

3. Moderately conservative

4. Moderate

5. Moderately aggressive

6. Aggressive

7. Very aggressive

Setiap portfolio ada peranan berbeza. Kita cuba details kan ke mana duit kita dilaburkan untuk setiap portfolio.

1. Gold

97.50% duit kita dilaburkan di gold. Jadinya portfolio ni tak lain tak bukan, akan follow sebijik harga gold dunia.

97.50% duit kita dilaburkan di gold. Jadinya portfolio ni tak lain tak bukan, akan follow sebijik harga gold dunia.

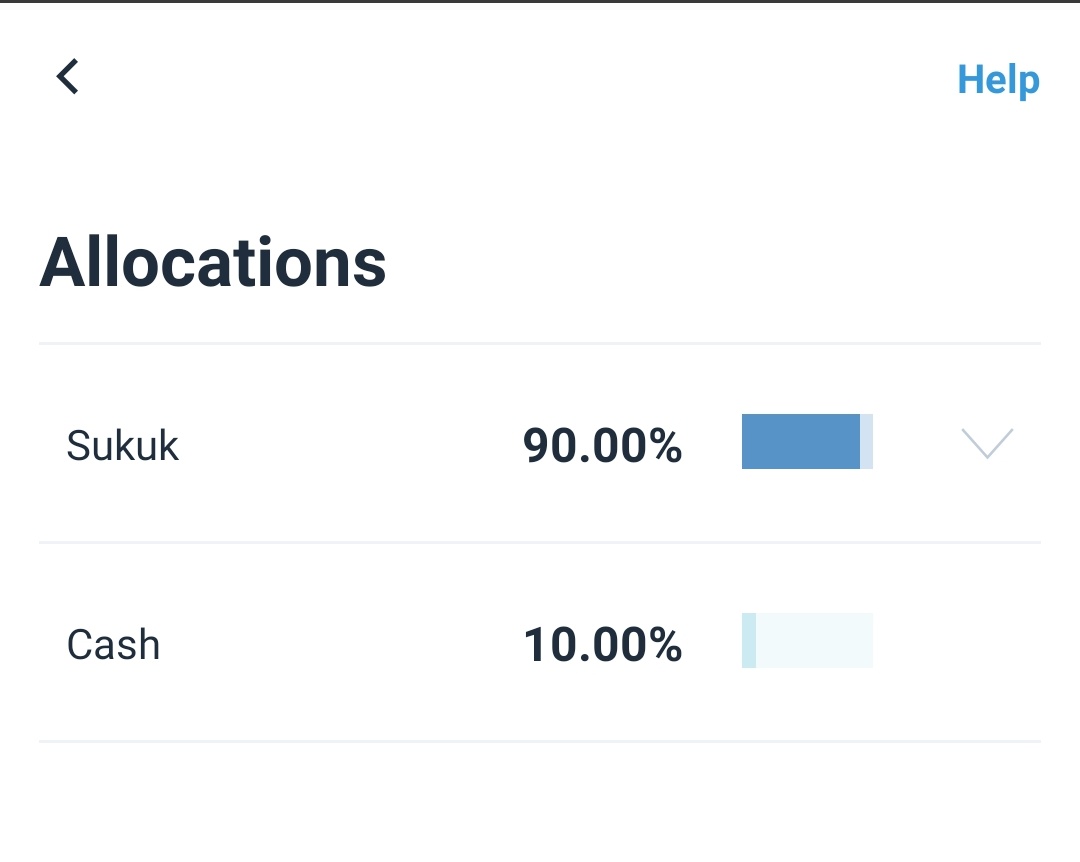

2. Very conservative

Very conservative berbeza dengan gold tadi. Untuk portfolio ni, duit kita dilaburkan sebanyak 90% di sukuk dan 10% cash.

Kejap lagi kita akan go through apa maksud sukuk.

Very conservative berbeza dengan gold tadi. Untuk portfolio ni, duit kita dilaburkan sebanyak 90% di sukuk dan 10% cash.

Kejap lagi kita akan go through apa maksud sukuk.

3. Moderately conservative

Okay this one dah mula diversify. Pegangan sukuk makin kecil jadi 75%.

12.50% diletakkan di US Stocks, 5% di gold, 4% di Malaysia stocks dan selebihnya cash.

But this portfolio, sukuk masih menjadi driver utama.

Okay this one dah mula diversify. Pegangan sukuk makin kecil jadi 75%.

12.50% diletakkan di US Stocks, 5% di gold, 4% di Malaysia stocks dan selebihnya cash.

But this portfolio, sukuk masih menjadi driver utama.

4. Moderate

Perasan tak? Sukuk punya portion makin kecil jadi 55% sahaja.

US stocks 22.50%, Malaysia stocks 12.50%, gold 7.50% dan selebihnya cash.

Perasan tak? Sukuk punya portion makin kecil jadi 55% sahaja.

US stocks 22.50%, Malaysia stocks 12.50%, gold 7.50% dan selebihnya cash.

5. Moderately aggressive

This one more interesting di mana US stocks dah mula jadi pegangan terbesar sebanyak 37.50%.

Sukuk 35%(masih banyak), Malaysian stocks 15% , Gold 10% dan selebihnya cash.

This one more interesting di mana US stocks dah mula jadi pegangan terbesar sebanyak 37.50%.

Sukuk 35%(masih banyak), Malaysian stocks 15% , Gold 10% dan selebihnya cash.

6. Aggressive

Wahhh, US stocks dah mula jadi 45% of total portfolio.

Sukuk 25%, Malaysia stocks 17.50%, Gold 10% dan selebihnya cash.

Wahhh, US stocks dah mula jadi 45% of total portfolio.

Sukuk 25%, Malaysia stocks 17.50%, Gold 10% dan selebihnya cash.

7. Very aggressive

This one paling menarik di mana US stocks dah jadi 65%.

Malaysia stocks 20%, sukuk 12.50% dan selebihnya cash. No more gold dalam portfolio.

This one paling menarik di mana US stocks dah jadi 65%.

Malaysia stocks 20%, sukuk 12.50% dan selebihnya cash. No more gold dalam portfolio.

Perasan tak, Wahed punya tempat pelaburan ada 4 sahaja yakni :

1. Sukuk

2. Gold

3. Malaysia stocks

4. US Stocks

Beza setiap portfolio hanyalah % setiap komponen. Jom kita fahamkan setiap 1 komponen tu pulak.

1. Sukuk

2. Gold

3. Malaysia stocks

4. US Stocks

Beza setiap portfolio hanyalah % setiap komponen. Jom kita fahamkan setiap 1 komponen tu pulak.

1. Sukuk - RHB Islamic Bond Fund

Fund ini bersikap lebih protective dan selalunya akan bergerak berlawanan dengan stock market.

Cuba tengok the return every year, average around 4% dan year to date 2021 -10%.

Fund ini bersikap lebih protective dan selalunya akan bergerak berlawanan dengan stock market.

Cuba tengok the return every year, average around 4% dan year to date 2021 -10%.

Why is it so? Anda kena faham bahawa sukuk/bond bergerak berlawanan arus dengan stock market. Sekarang stock market bullish, ianya membuatkan pasaran bond kurang mendapat demand.

That's why portfolio yang ada bigger exposure on Sukuk keep on dropping or stagnate.

That's why portfolio yang ada bigger exposure on Sukuk keep on dropping or stagnate.

2. Gold- Tradeplus Shariah Gold Tracker

Harga emas juga merudum jatuh from $2000 tahun lepas ke $1776 as of today.

Gold is good to fight against inflation but adakah gold bagus untuk maksimumkan pulangan? Kejap lagi kita akan tengok perbandingan gold dan stock market.

Harga emas juga merudum jatuh from $2000 tahun lepas ke $1776 as of today.

Gold is good to fight against inflation but adakah gold bagus untuk maksimumkan pulangan? Kejap lagi kita akan tengok perbandingan gold dan stock market.

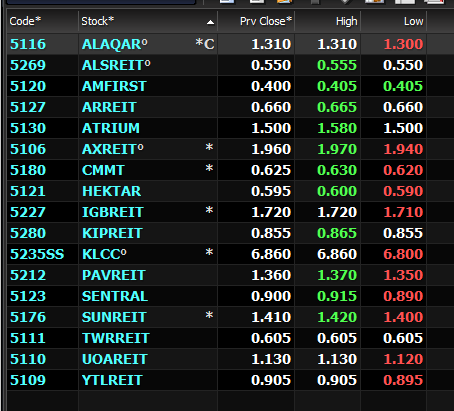

3. MyETF MSCI Malaysia Islamic Dividend

This one track stock market Malaysia. Kalau kita tengok from Wahed wujud di Malaysia around November 2019, this ETF dah naik sekitar 38%

This one track stock market Malaysia. Kalau kita tengok from Wahed wujud di Malaysia around November 2019, this ETF dah naik sekitar 38%

4. US Stocks - Wahed FTSE USA SHARIAH Exchange Traded Fund (HLAL)

Duit kita sebenarnya dilaburkan di saham-saham US patuh syariah contohnya seperti Apple, Tesla, Johnson & Johnson, Pfizer, Home Depot, Intel, Merck.

Duit kita sebenarnya dilaburkan di saham-saham US patuh syariah contohnya seperti Apple, Tesla, Johnson & Johnson, Pfizer, Home Depot, Intel, Merck.

Paling menarik sebenarnya adalah US stocks di mana pegangan mereka focus more on growth sotcks. Jadinya kita boleh expect bigger return from US stocks compared to others.

Anda sendiri boleh tengok return from HLAL around 42.94% since Wahed wujud di Malaysia. Paling best siapa masuk Wahed in Mac dan pegang portfolio very aggressive, return around 80% jugak tu.

But well, kita bukan expert nak detect market crash and rebound etc.

But well, kita bukan expert nak detect market crash and rebound etc.

Okay semua dah faham fungsi portfolio masing-masing kan?

Saya nak bagi sedikit insight lah tentang pros and cons setiap komponen tu supaya kita lebih jelas tentang apa yang kita buat.

Saya nak bagi sedikit insight lah tentang pros and cons setiap komponen tu supaya kita lebih jelas tentang apa yang kita buat.

1. Sukuk - very good kalau kita nak be conservative, boleh expect potential positive return regardless the market condition but mungkin return agak low

2. Gold - kalau kita ambil portfolio purely gold, takda beza pun macam kita beli emas biasa.

2. Gold - kalau kita ambil portfolio purely gold, takda beza pun macam kita beli emas biasa.

3 & 4. Stocks - This one sebenarnya yang sepatutnya jadi driving component portfolio anda sekiranya nak kejar big return. Surely, come with bigger risks but still manageable if you know what you do.

Look at this graph, 1$ invested in 1800 and now apa jadi.

Clearly here that stocks memang for growth and higher expected return meanwht bond/sukuk comes second.

Gold? It's there to fight against inflation but not a good place to invest your money.

Clearly here that stocks memang for growth and higher expected return meanwht bond/sukuk comes second.

Gold? It's there to fight against inflation but not a good place to invest your money.

This is the reason why saya pilih very aggresive portfolio sebab saya nak more exposure to US market. Ada yang tanya, kalau saya nak stocks market, kenapa saya tak invest terus di saham yang wahed invest, kan?

You must understand that Wahed is an investment platform. Bila kita go through Wahed, kita boleh beli saham-saham tu at lower capital dan juga surely lower cost(cheapest fees in town).

As pelabur, apa yang anda perlu buat?

1. Pilih portfolio berdasarkan risk appetite anda.

2. Faham peranan setiap portfolio yang Wahed suggest. Nanti tak pasal kita marah Wahed cakap kenapa return aku slow/stagnate/negatif.

1. Pilih portfolio berdasarkan risk appetite anda.

2. Faham peranan setiap portfolio yang Wahed suggest. Nanti tak pasal kita marah Wahed cakap kenapa return aku slow/stagnate/negatif.

3. Focus long term. Cuba perhatikan, semua tempat yang Wahed labur menunjukkan pergerakan menaik in a long run. Why bother short term fluctuation?

4. Last but not least, know what you do. Now banyak resources available online. Read and try to digest.

Hit me up if you've any question🙌

Salam 5 Ramadhan...

Hit me up if you've any question🙌

Salam 5 Ramadhan...

I've nothing more to promote than just a simple referral code of Wahed Invest. Sesiapa yang baru nak buka account, boleh guna code ni : MUHBIN215

Just download the apps and register.

Make sure pilih portfolio yang betul, boleh gunakan my explanation as guidance.

Just download the apps and register.

Make sure pilih portfolio yang betul, boleh gunakan my explanation as guidance.

Sumber rujukan :

1. wahedinvest.com

2. RHB Bond Islamic Fund -my.morningstar.com/my/report/fund…

3. MyETF Islamic Dividend Fund - bursamalaysia.com/trade/trading_…

4. HLAL ETF - etf.com/HLAL#overview

5. Trading View

6. Investing.com

1. wahedinvest.com

2. RHB Bond Islamic Fund -my.morningstar.com/my/report/fund…

3. MyETF Islamic Dividend Fund - bursamalaysia.com/trade/trading_…

4. HLAL ETF - etf.com/HLAL#overview

5. Trading View

6. Investing.com

Done topup Wahed Invest. Saya tak buat monthly transfer but saya cuba untuk transfer regularly whenever I've extra money.

#retirementfund

#retirementfund

Something that I'll never forget to do : Invest Regularly 🙌

Sikit demi sikit, lama-lama jadi bukit...

Sikit demi sikit, lama-lama jadi bukit...

• • •

Missing some Tweet in this thread? You can try to

force a refresh