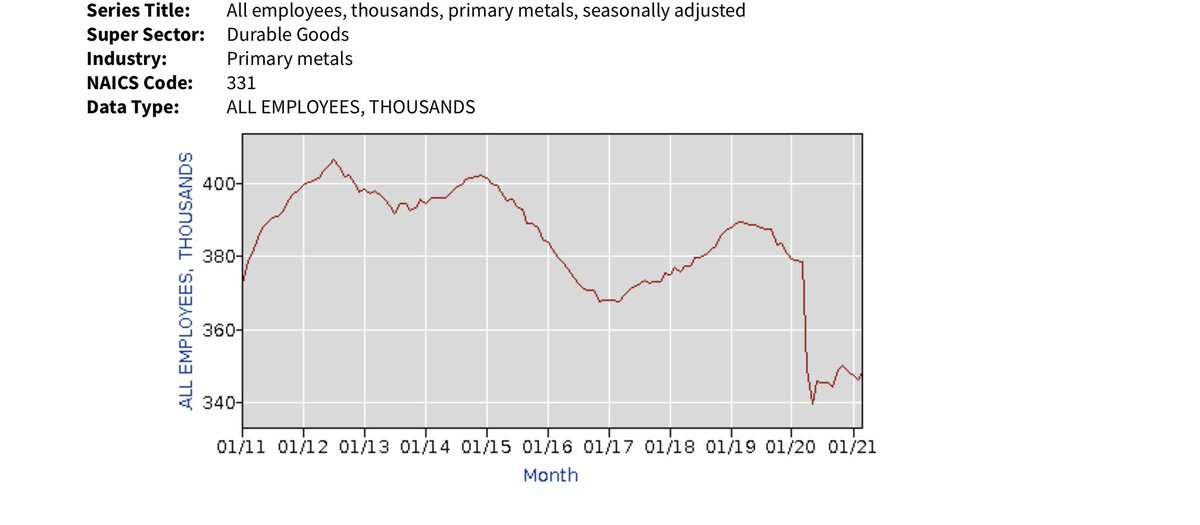

One of the fascinating things is how rarely people challenge those who say that the Trump steel and aluminum tariffs created/saved jobs in that industry... The American steel industry was shedding jobs even before this pandemic... data.bls.gov/timeseries/CES…

In January 2020 the US primary metals industry employed 5,000 fewer people than it did in January 2016, When Trump took office...

The primary metals industry in March of this year employed 30k fewer people than in March of last year.

One reason for that is a slashing of capacity that has happened in the steel industry.

One reason for that is a slashing of capacity that has happened in the steel industry.

That lack of capacity and supply has driven up domestic steel prices. Which means even with the tariffs it’s cheaper to import steel than buy domestically-produced metal, as @JoeDeaux wrote here:

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

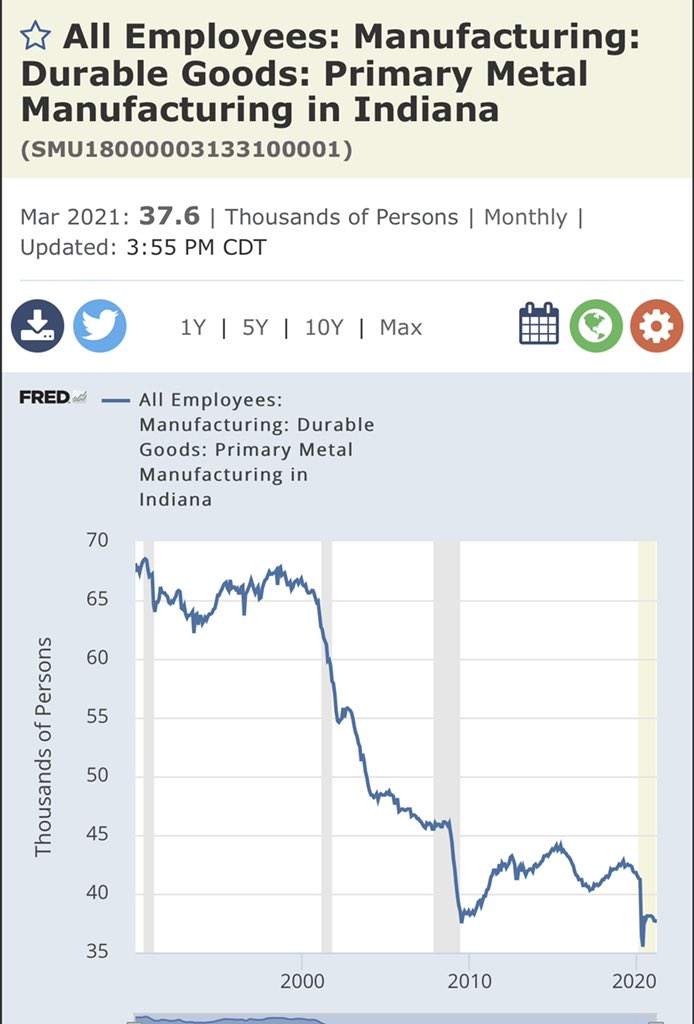

It’s also worth pointing out that it’s very unlikely that jobs are going to come back in a hurry at big legacy steel mills in places like Indiana and Michigan that US Steel has shut down in recent years.

Oops. Got that wrong... Trump took office in January 2017, of course...

Obviously got that wrong re comparison to Jan 2016. But the relevant period is really what happened after tariffs went into place in 2018.

• • •

Missing some Tweet in this thread? You can try to

force a refresh