1/ $PUSH, EPNS @epnsproject

The 1st decentralised notifications protocol on Ethereum

>Partnerships with @Uniswap, @AlphaFinanceLab, @AaveAave, @gnosisPM...

>Backed by @BinanceLabs (you know what this usually means…),@AaveAave, @0xPolygon, former Coinbase CTO...

The 1st decentralised notifications protocol on Ethereum

>Partnerships with @Uniswap, @AlphaFinanceLab, @AaveAave, @gnosisPM...

>Backed by @BinanceLabs (you know what this usually means…),@AaveAave, @0xPolygon, former Coinbase CTO...

2/ This whole thread could be filled with just the incredible list of backers and partnerships EPNS has in place, but let’s start with the product.

I suspect this is a product that will get so much adoption that a year from now it will be hard to believe it didn’t always exist.

I suspect this is a product that will get so much adoption that a year from now it will be hard to believe it didn’t always exist.

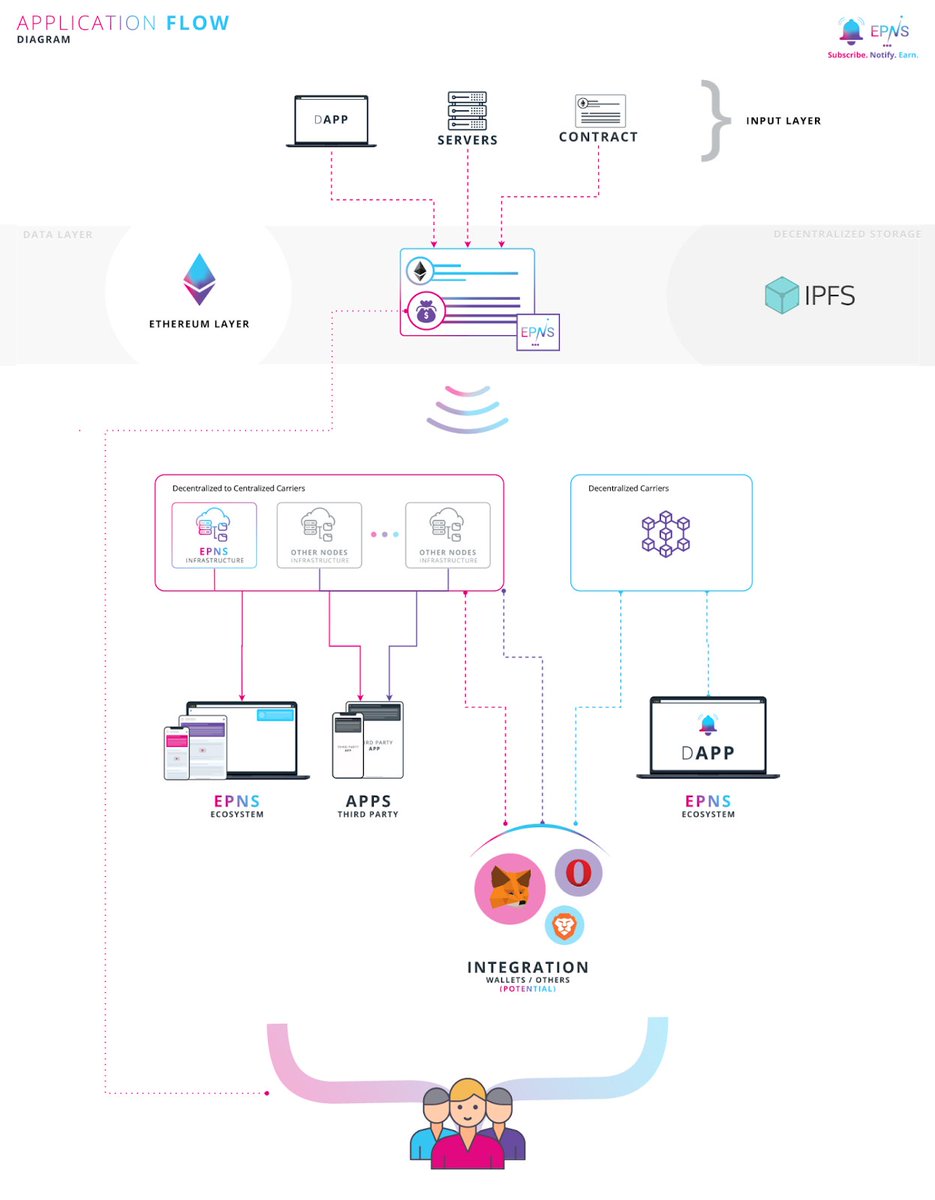

3/ EPNS, or “Ethereum Push Notification Service”, is a decentralised notification protocol that enables users (wallet addresses) to receive notifications directly from decentralised or centralised services in a privacy preserving manner.

4/Today, communication between web3 providers and consumers often occurs through email, social media, Telegram, etc. This defeats the purpose of web3, as it depends on centralised providers and sacrifices user privacy, especially for communications specific to the users’ wallets

5/ And to preserve decentralisation and privacy, major DeFi platforms don’t even have user logins or notifications. So today if a loan is liquidated on Aave or Compound, there is no way to notify the wallet owner. Users need to actively monitor their wallets for such events.

6/ With EPNS, this issue is solved, as Web3 providers will now be able to send notifications to users in a completely decentralised and privacy preserving manner.

Thanks to EPNS’s integration of IPFS, notifications can include not only text, but also images, audio and video.

Thanks to EPNS’s integration of IPFS, notifications can include not only text, but also images, audio and video.

7/ A few examples of possible notification types are:

- Wallet crypto movement tracker

- ENS domain expiry

- Loan liquidation alert

- Limit order triggered on DEX

- Communication of urgent information to token holders (protocol exploit, token swap deadlines, etc)

- Wallet crypto movement tracker

- ENS domain expiry

- Loan liquidation alert

- Limit order triggered on DEX

- Communication of urgent information to token holders (protocol exploit, token swap deadlines, etc)

8/ EPNS has a well-thought of set of incentives including token rewards for subscribers of different channels.

Basically, in order to create a notification channel a provider must deposit a minimum of 50 $DAI into the protocol pool…

Basically, in order to create a notification channel a provider must deposit a minimum of 50 $DAI into the protocol pool…

9/ And the total $DAI in the pool will get staked on Aave, where it will accrue value. Accrued DAI will then be distributed to all channel subscribers in proportion to the amount staked by the channel’s creator and to how long each user has subscribed to the channel.

10/ So channels that wish to attract more users will stake higher amounts of DAI and pay higher rewards.

Noting that subscribing to a channel involves an on-chain tx with gas costs, these incentives will also help making sure that gas costs don’t hurt user adoption.

Noting that subscribing to a channel involves an on-chain tx with gas costs, these incentives will also help making sure that gas costs don’t hurt user adoption.

11/ Protocol revenues will come from a small fee charged from each notification sent + from channel closing fees. When a channel is closed, the channel creator will receive his deposited $DAI back minus a fee (currently set at 20 DAI), also helping avoid spam.

12/ In order to support protocol adoption, EPNS built not only the protocol, but also a Mobile App (already available for iOS and Android) and a web browser compatible Dapp, providing an easy solution for users to access their notifications. But that is just one possibility..

13/ EPNS has also built the entire infrastructure and code libraries to facilitate projects natively integrating their notifications.

This means users could eventually be able to receive notifications directly to their @MetaMask wallet or to their @brave browser.

This means users could eventually be able to receive notifications directly to their @MetaMask wallet or to their @brave browser.

14/ $PUSH is the native token for the EPNS protocol, which will provide holders with two primary benefits: governance rights (for decisions on protocol fees, staking structure, rewards distribution, etc) and reward accruals from the protocol’s fee pool.

15/ The protocol fees (from notifications and channel closes) will go to a fee pool, and 70% of the fee pool will go to $PUSH token holders, while the remaining 30% will go to an ecosystem development fund. The fee pool will be activated approx. 1y after main net launch.

16/ Max supply of $PUSH will be 100M, split as follows:

- 53% community allocation (incl. IDO, LP and staking rewards, airdrops)

- 20.5% early investors (3m cliff)

- 16% Team (9-12m cliff)

- 7% for the Foundation

- 3.5% for advisors (6-9m cliff)

See below the supply unlock chart:

- 53% community allocation (incl. IDO, LP and staking rewards, airdrops)

- 20.5% early investors (3m cliff)

- 16% Team (9-12m cliff)

- 7% for the Foundation

- 3.5% for advisors (6-9m cliff)

See below the supply unlock chart:

17/ As for the current supply, note that both the numbers on Coingecko (14.3M circ supply) and on CMC (2.1M circ supply) are inaccurate. According to the team communication on telegram, current circulating supply is 4.1M, which puts current circulating mcap at $13.6M.

18/ A staking and liquidity farming program has also just been launched through incentives.epns.io.

APYs are currently super high (3600% for ETH-PUSH, 415% for $PUSH) but note this will likely decrease as TVL increases, since the liq program was launched just yesterday.

APYs are currently super high (3600% for ETH-PUSH, 415% for $PUSH) but note this will likely decrease as TVL increases, since the liq program was launched just yesterday.

19/ In addition to the collaborations already mentioned (UniSwap, Aave, Alpha, Matic, Gnosis), EPNS has also announced collaborations with @Superfluid_HQ, @realmaskbook, @unstoppableweb, @PoolTogether_ all projects we should expect to see adopting EPNS notifications soon...

20/The EPNS team looks super impressive, with strong experience in entrepreneurship and blockchain, and including former Consensys and Matic contributors.

Early backers include Binance Labs 👀, Aave, Matic, major funds and venture DAOs, and guidance from the Ethereum Foundation

Early backers include Binance Labs 👀, Aave, Matic, major funds and venture DAOs, and guidance from the Ethereum Foundation

21/ Individual backers also include the former Coinbase CTO & a16z General Partner @balajis, founders & team members of the Ethereum Foundation, Aave, Polygon, Gnosis, Gitcoin… @sassal0x, @DeFi_Dad… the list goes on.

22/ In short, everything points to EPNS being an absolute game changer for the space. With major #DeFi bluechips adopting the protocol, an impressive list of backers, and an innovative and useful product ready to go, I can see EPNS joining the crypto bluechip club very soon.

23/ A few links:

- Litepaper: epns.io/LitepaperEther…

- Detailed documentation: whitepaper.epns.io

- Medium: medium.com/ethereum-push-…

- Token metrics / release schedule: medium.com/ethereum-push-…

- Litepaper: epns.io/LitepaperEther…

- Detailed documentation: whitepaper.epns.io

- Medium: medium.com/ethereum-push-…

- Token metrics / release schedule: medium.com/ethereum-push-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh