A2 Milk $A2M $A2M.AX is a scientific-based dairy company specialising in infant formula, liquid milk and social marketing. Is there life left in this once-quality now bargain-basement company? Let’s take a deep dive.

1. Investment Thesis: Turnaround of a fast grower. A2M has been beaten up due to poor FY21 results, with investors seeking to buy quality at a wonderful price with possibly a low left tail risk. #ASX #NZX

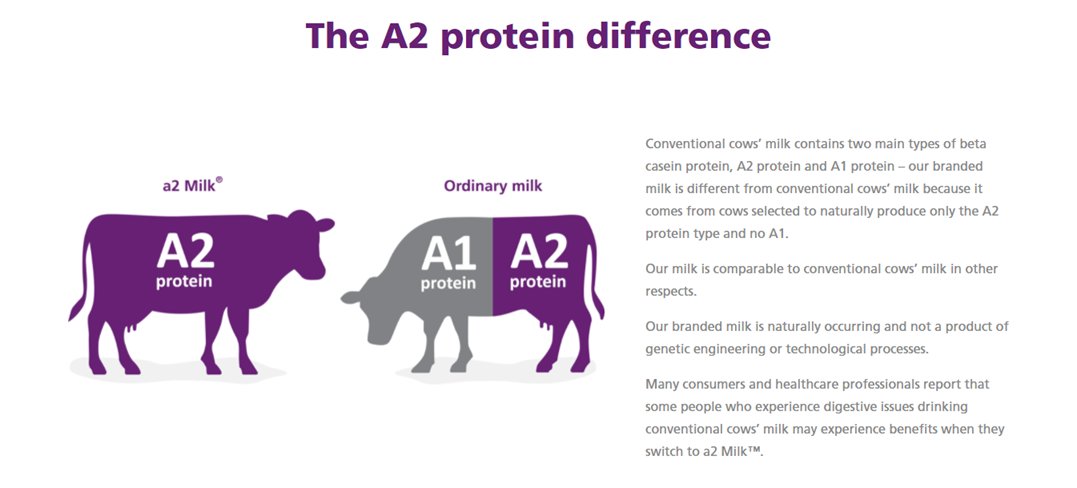

2. Scientific Edge. A2 Milk markets itself on the A2 protein as a healthier option (improved gut health, helps lactose intolerant people, etc). This is a “super premium product” which plays strong in the infant nutrition market.

3. “Scientific” Edge? To help navigate marketing vs science, I refer you to @DoctorKarl .. at best, one could say the science is ‘unsettled’ – no doubt this will rile the A2M bulls on #NZX FinTwit...

abc.net.au/news/science/2…

abc.net.au/news/science/2…

4. A2M commands a price premium up to 65%. However, it's likely new competition may eat into this premium as you can’t patent the A2 protein (it's naturally occurring, and the way milk used to be) - only the marketing is trademarked.

5. The macro tailwinds for infant formula (7.3% CAGR) and A2 (11.8% CAGR) are greatest in China, where A2M has grown from 1.3% (2019) to 2.4% (2021) market share.. huge potential runway still ahead, requiring growing market and taking market share.

6. A2M’s China strategy is omni channel using Daigou/resellers (sales recorded in the ANZ region), online footprint (6th largest cross-border brand on Alibaba), and +22k physical stores…

7. A2M’s foundation is in marketing and branding, using “one brand, two labels” for English/Mandarin in China, complemented by social media, roadshows, etc. This is the real value underpinning A2M's success.

8. Horizon scanning, the US market for fresh milk is only in it's infancy for A2M. While revenue was only $66m in 1H21, that’s +91% from 2H20. Still a loss maker, it's likely to hit inflection point in the near term..

9. Mooo-ve over Fonterra $FSF $FCG.NZ , the result of A2M's business strategy leaves legacy dairy companies in their wake. A2M has gross profit margin of ~56% compared to Fonterra’s ~15%, which flows all the way to the bottom of the financial statements.

10. Fast forward, and Australia and NZ’s #covid19 elimination strategy impacted A2M severely.

Initially a tailwind in FY20 as people stocked up, the FY21+ impacts of the Daigou/China sub-segment coming to a halt is now seen in the stock price 60% down on June 20 highs..

Initially a tailwind in FY20 as people stocked up, the FY21+ impacts of the Daigou/China sub-segment coming to a halt is now seen in the stock price 60% down on June 20 highs..

11. What’s a daigou, some of you ask? They're an overseas personal shopper, where often a syndicate purchases luxury goods, sells it via we-chat $TCEHY or $BABA or directly carries it back to China to circumvent taxes..

12. A wee bit dodgey you may say... and relying on quasi-legal/illegal distribution channels is risky business. A2M is seeking alternatives like Mandarin labelled formula and undertaking direct to consumer e-commerce, though this may squeeze margins.

13. In the short term, the trans-Tasman travel bubble of Australia & New Zealand are a sign of reawakening the diagou market and potentially things returning to normalcy (in FY22+ that is..)

14. In the long term, the real risk is loss of premium pricing. First, super profits draw competition from behemoths like Nestle $NESN.SW and Danone $BN.PA and the A2 protein is not something that can be patented for a moat.

15. Second, consumer preferences could shift from A2 to.. Organic? Plant-based like soy, almond and oat? Breast feeding instead of formula? With all their investments in the brand "A2 Milk", hard to change away from the A2 protein.

16. Balance sheet remains strong with no debt and $774m cash – market cap of AUD$6.07bn, and EV of $5.3bn. ROE of ~29%. 13% insider holding - though noticeably no insider buying since April 2020 despite the rundown in the stock price.

16. Valuation still factors in a lot of FY22+ growth.

PE is ~20 (TTM) and ~27 on Forecast FY21 (EPS=NZD$0.31), still below 5yr average .

A better metric may be EV/EBITDA ~11.4 (TTM) and ~16.3 forecast FY21 (NZD$350m EBTIDA).

Relatively expensive, but historically cheap

PE is ~20 (TTM) and ~27 on Forecast FY21 (EPS=NZD$0.31), still below 5yr average .

A better metric may be EV/EBITDA ~11.4 (TTM) and ~16.3 forecast FY21 (NZD$350m EBTIDA).

Relatively expensive, but historically cheap

17. Discounted cash flow provides potential value of $15.40 if return to FY16-20 growth rates.

Flipping it, current share price assumes A2M returns to 17% growth from a high base in FY20 and low-base in FY21.

Flipping it, current share price assumes A2M returns to 17% growth from a high base in FY20 and low-base in FY21.

18. Top line may grow at quite rapid levels from a low point in FY21, though increased competition and losses from the daigou channel may dampen bottom line growth permanently.

Therefore my assumption is 15% FCF growth ex Covid FY20 tailwinds / FY21 headwinds - $7 of value.

Therefore my assumption is 15% FCF growth ex Covid FY20 tailwinds / FY21 headwinds - $7 of value.

19. Overall, this is a quality business that still factors in high growth. For me personally, I don’t buy the A2 “science” but I do buy the A2 Milk branding – this however is not very moaty and is unlikely to justify current growth rates and margins.

It's a hard pass.

It's a hard pass.

If you enjoyed this, bash the like / retweet / follow buttons.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR.

Disclaimer, I have no A2M position.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR.

Disclaimer, I have no A2M position.

• • •

Missing some Tweet in this thread? You can try to

force a refresh