I've looked at 30k+ pitches, and when ppl have asked me in the past which one stood out the most, I've never had a great answer.

But today I do. A short thread >>

But today I do. A short thread >>

1) But first -- to be clear, you do NOT need a super creative / unusual incredible pitch to get funding.

A simple deck that is clear and concise will do!

More on that here: elizabethyin.com/2016/07/10/wha…

A simple deck that is clear and concise will do!

More on that here: elizabethyin.com/2016/07/10/wha…

2) So what was the pitch that really stood out?

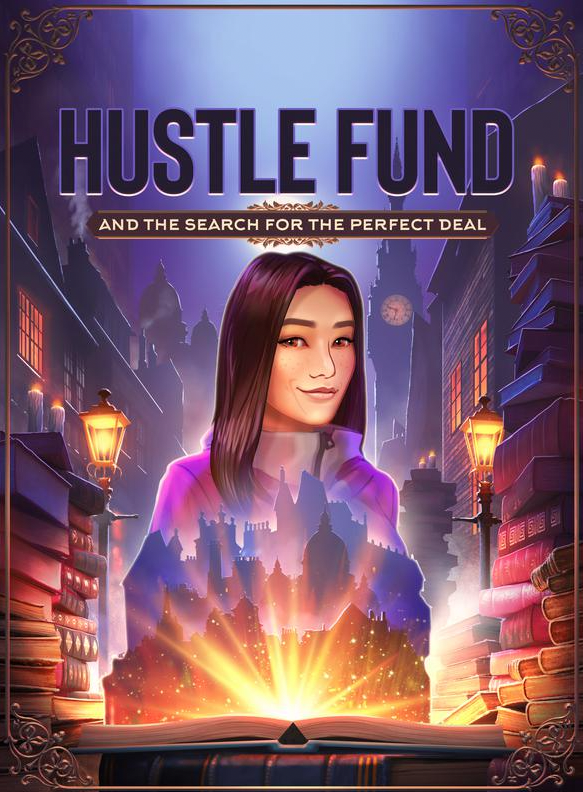

It was a new book publishing product called Tales:

taleswriter.com

They created a story for me on what they did in a fun & easy way to read. And personalized it.

It was a new book publishing product called Tales:

taleswriter.com

They created a story for me on what they did in a fun & easy way to read. And personalized it.

4) In the story, they talked about what Tales was trying to achieve w their mission & business.

You could double click into subplots around aspects of their business -- from the business model to the product etc. (Pretty meta to learn about the product within the product)

You could double click into subplots around aspects of their business -- from the business model to the product etc. (Pretty meta to learn about the product within the product)

5) The story also showed they had done their homework on @HustleFundVC & what we believe in & how they tie into that.

They talked about removing gatekeepers in publishing and increasing access to more aspiring writers.

And, the "bad guy" in the story was a stodgy VC!

They talked about removing gatekeepers in publishing and increasing access to more aspiring writers.

And, the "bad guy" in the story was a stodgy VC!

6) Lastly, like a "typical pitch", they talked about key pts that are interesting about the business in the story.

Traction / notable partners they have brought in to date. Experiments they've done w/ unit economics and initial set of users. Etc...

Traction / notable partners they have brought in to date. Experiments they've done w/ unit economics and initial set of users. Etc...

7) It was a great all-around blend of pitching the business in the product. It was informative & creative. It was unique & clever.

If your product / company doesn't have natural ties to a pitch, don't worry about it.

But if you do, a bit of creativity can make you stand out.

If your product / company doesn't have natural ties to a pitch, don't worry about it.

But if you do, a bit of creativity can make you stand out.

8) And yes! I did offer to invest :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh