CALABRIA CLAIMS THAT THE PSPA ARE NOT LINES OF CREDIT

The name doesn't matter: line of credit, borrowing right,funding commitment

We know it can't be tapped to leverage FnF but to fund a negative Net Worth(Equity) issuing SPS(obligations/Equity)#Fanniegate @TheJusticeDept @Scotus

The name doesn't matter: line of credit, borrowing right,funding commitment

We know it can't be tapped to leverage FnF but to fund a negative Net Worth(Equity) issuing SPS(obligations/Equity)#Fanniegate @TheJusticeDept @Scotus

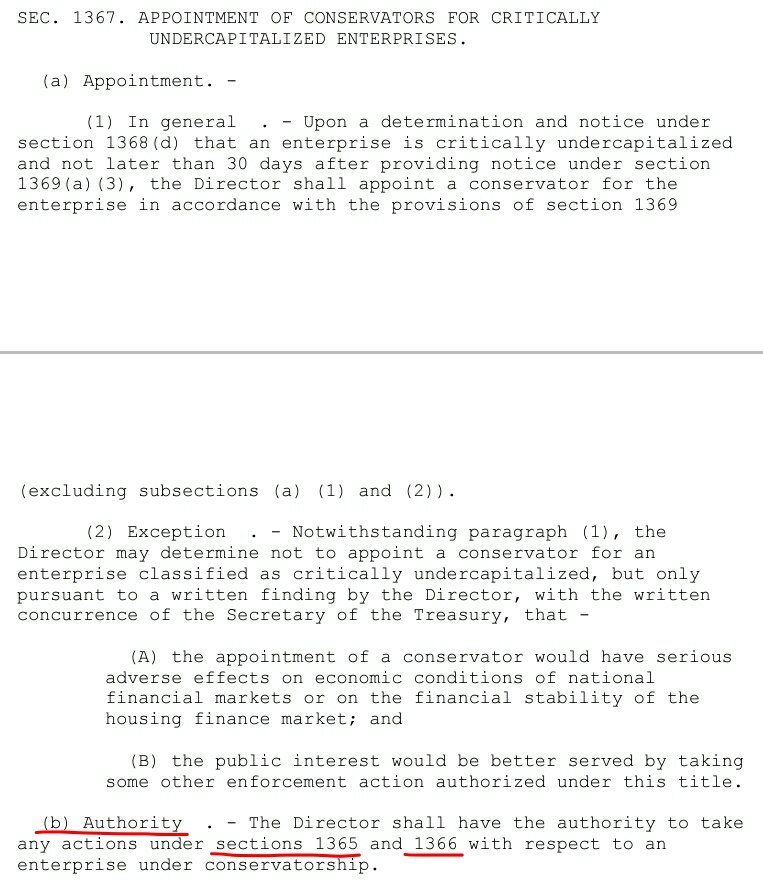

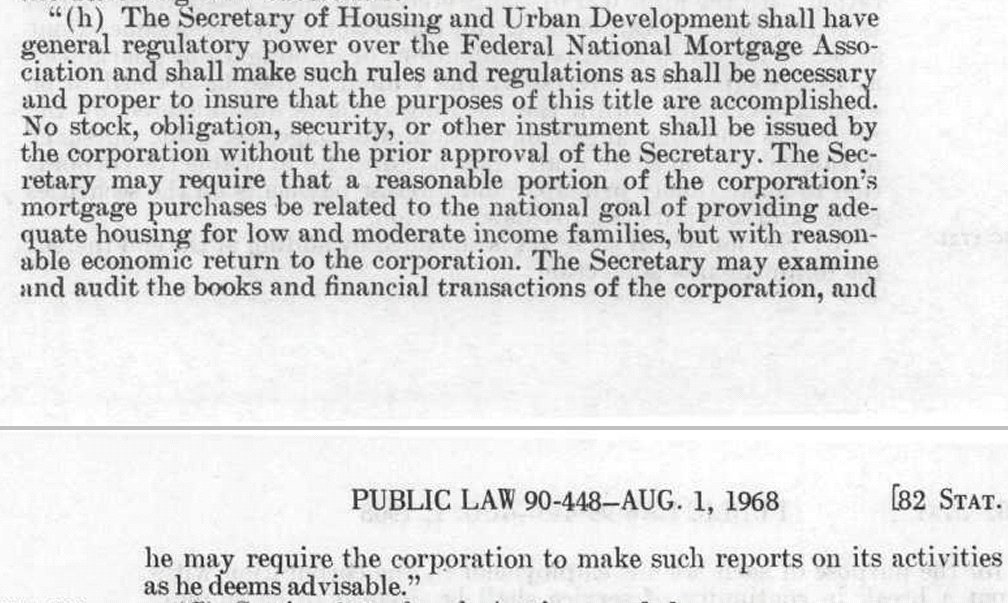

The key is that it emanates from the provision in the Charter Act called: Authority of UST to Purchase Obligations.Terms and Conditions.

There are 2:

-The original low cost

-The one added by HERA w/ UNLIMITED yield.

@USTreasury can't buy anything w/o an authorization by Congress.

There are 2:

-The original low cost

-The one added by HERA w/ UNLIMITED yield.

@USTreasury can't buy anything w/o an authorization by Congress.

HERA's was used for the 10%/NWS div,but it wasn't needed if there is the original,limited to $2.25b because it was set more than 50yrs ago,w/ FNMA only 15b in debt vs $800b in 2008.

The original is called "special borrowing right from UST" by Prof.Nielson(Scotus-appointed amicus)

The original is called "special borrowing right from UST" by Prof.Nielson(Scotus-appointed amicus)

The fact that it was limited to $2.25b is a non-issue since we are talking about vested rights and the PSPA's funding commitment is deemed to have tacitly updated the "credit facility".

An obligation is a compromise of repayment. So,@USTreasury is Equity holder but also creditor.

An obligation is a compromise of repayment. So,@USTreasury is Equity holder but also creditor.

I guess you know that Preferred Stocks are obligations(debenture)recorded as Equity or,as the UST signals in the PA,"obligations in respect of capital stock".The key for the exception(B) to the FHEFSSA's Restriction on Capital Distributions: reduce the obligations by redeeming...

...stocks or ownership interest,i.e.,reduce the SPS,otherwise the capital distributions are restricted when FnF are undercap.

Anyway,Calabria's statement confronts Rosner:"FnF contracted lines of credit".

No one cares. Let's talk about rights and the provision that authorizes it.

Anyway,Calabria's statement confronts Rosner:"FnF contracted lines of credit".

No one cares. Let's talk about rights and the provision that authorizes it.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh