Alright, T+15 days since shot 2 and we’re doing indoor dining again. To start: a 2014 Egon Müller Scharzhofberger Spätlese

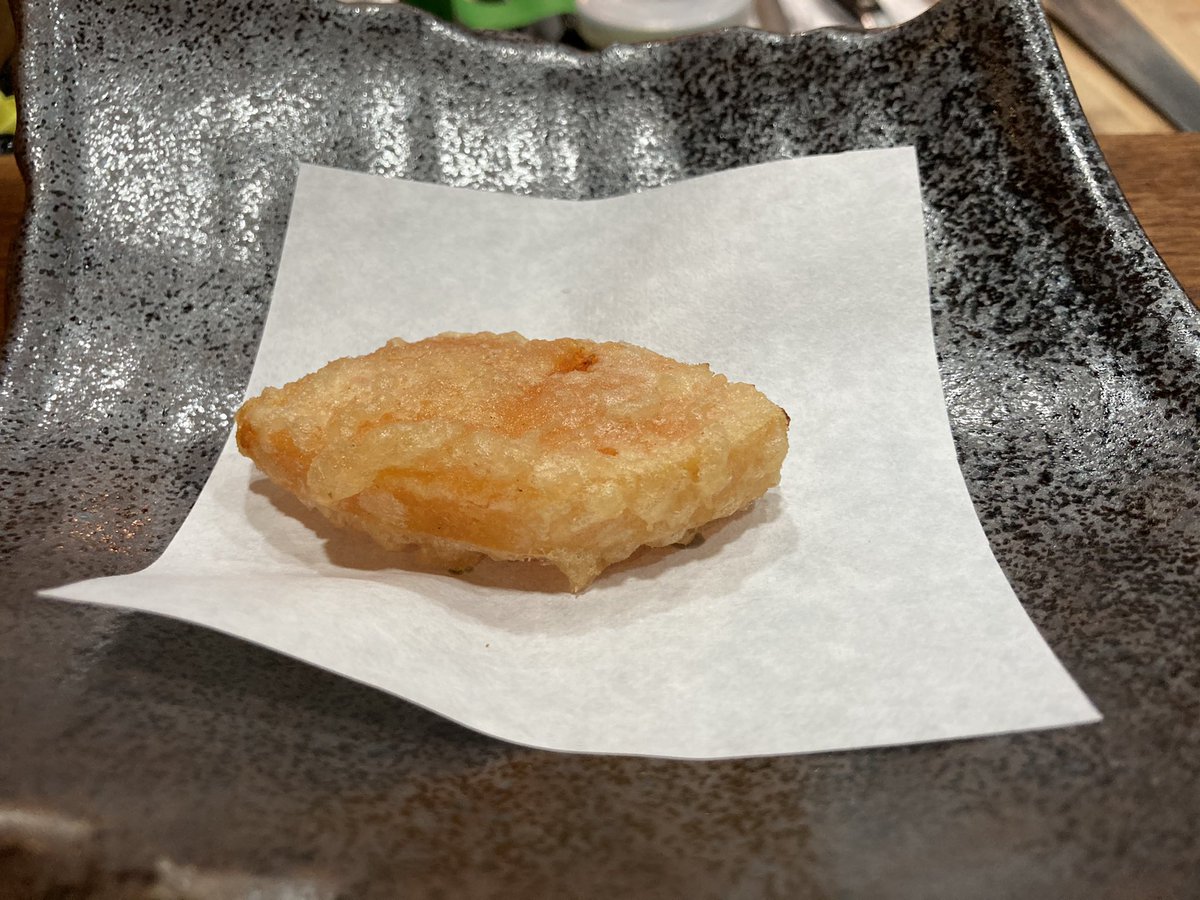

Clockwise from top: blistered shishito peppers, tuna inari pockets, grilled @macrocephalopod, hijiki seaweed salad, and sea trout crudo.

Finishing up: trout roe nori cracker, spicy black cod and miso soup, and a shiso leaf sherbet. God I have missed this so badly.

• • •

Missing some Tweet in this thread? You can try to

force a refresh