New Position:

Hello Fresh Group $HFG

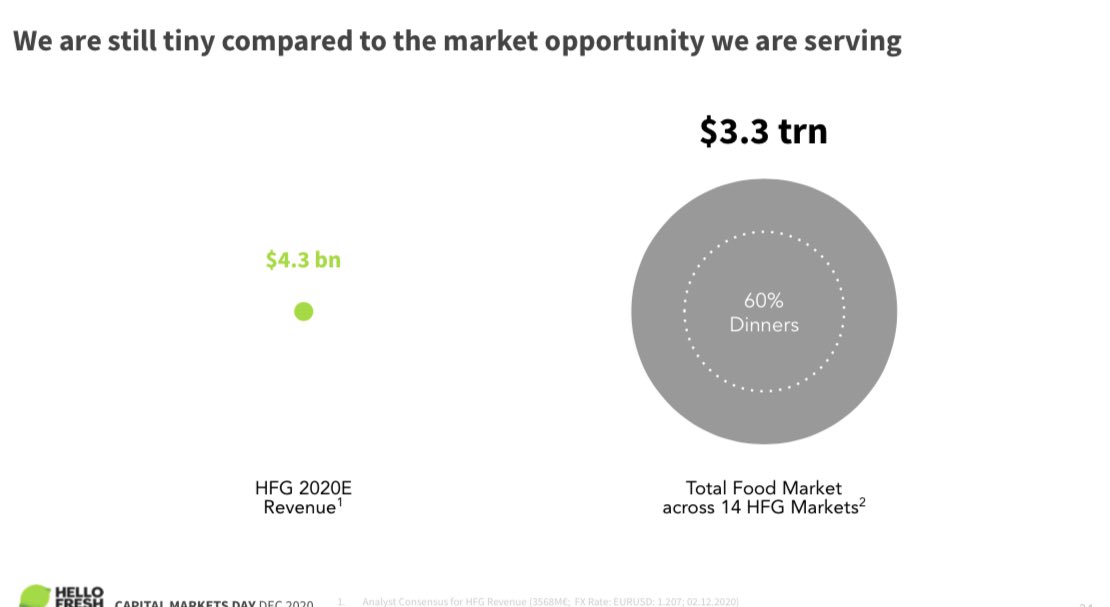

A great business with a long growth runway at a (very) reasonable valuation.

• trades at 24x 2020 FCF

• guides for 40% growth this year

• 2021 price sales of 2.3

• targets ebitda margins of 15%, up to 20% long term.

Hello Fresh Group $HFG

A great business with a long growth runway at a (very) reasonable valuation.

• trades at 24x 2020 FCF

• guides for 40% growth this year

• 2021 price sales of 2.3

• targets ebitda margins of 15%, up to 20% long term.

Grew 56% prior to Covid, clear COVID winner with 100% growth in 2020, but based on preliminary Q1 numbers it’s clear they don’t stop here. Based on very strong Q1 data $HFG guides for 35-45% growth this year (they used to underpromise and overdeliver)

The business model is very sticky. Not like saas, but much better than traditional e-commerce. I have friends in Germany where $HFG originated that use it non-stop since 4ys and are very happy.

Hello Fresh is the clear leader in its category and it’s gaining share. If Germans are good at one thing, it’s grocery logistics and execution (see what Aldi and Lidl did to incumbents)

The business model fits perfectly into the convenience economy. Saves a lot of time to think about what to cook and to buy the stuff. Tastes great. Makes life’s of hard working people much simpler (and healthier).

€5.13 per meal per person in Germany currently. Good value IMO

€5.13 per meal per person in Germany currently. Good value IMO

A good meal kit is essentially online grocery +.

Pure online grocery = access to a gym

Meal kits = personal trainer

Pure online grocery = access to a gym

Meal kits = personal trainer

• • •

Missing some Tweet in this thread? You can try to

force a refresh