14 Reasons $ETH is a higher upside treasury reserve asset than #Bitcoin 👇

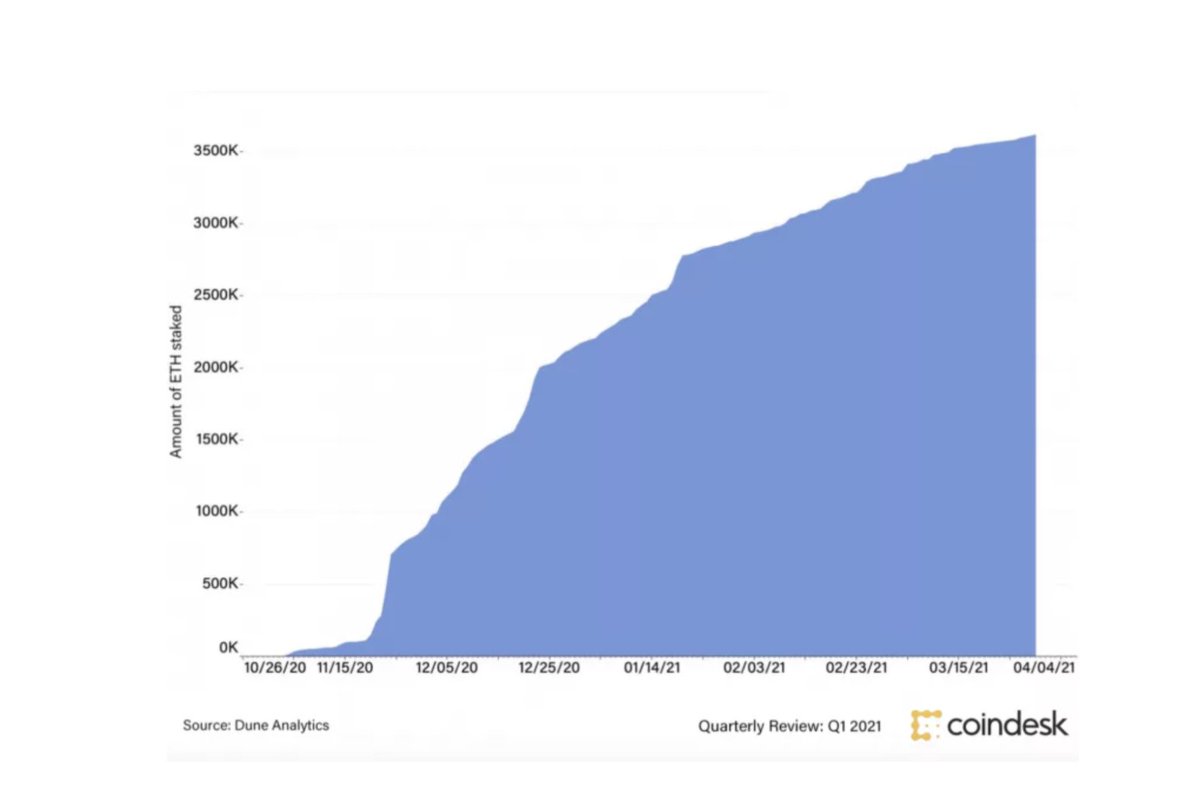

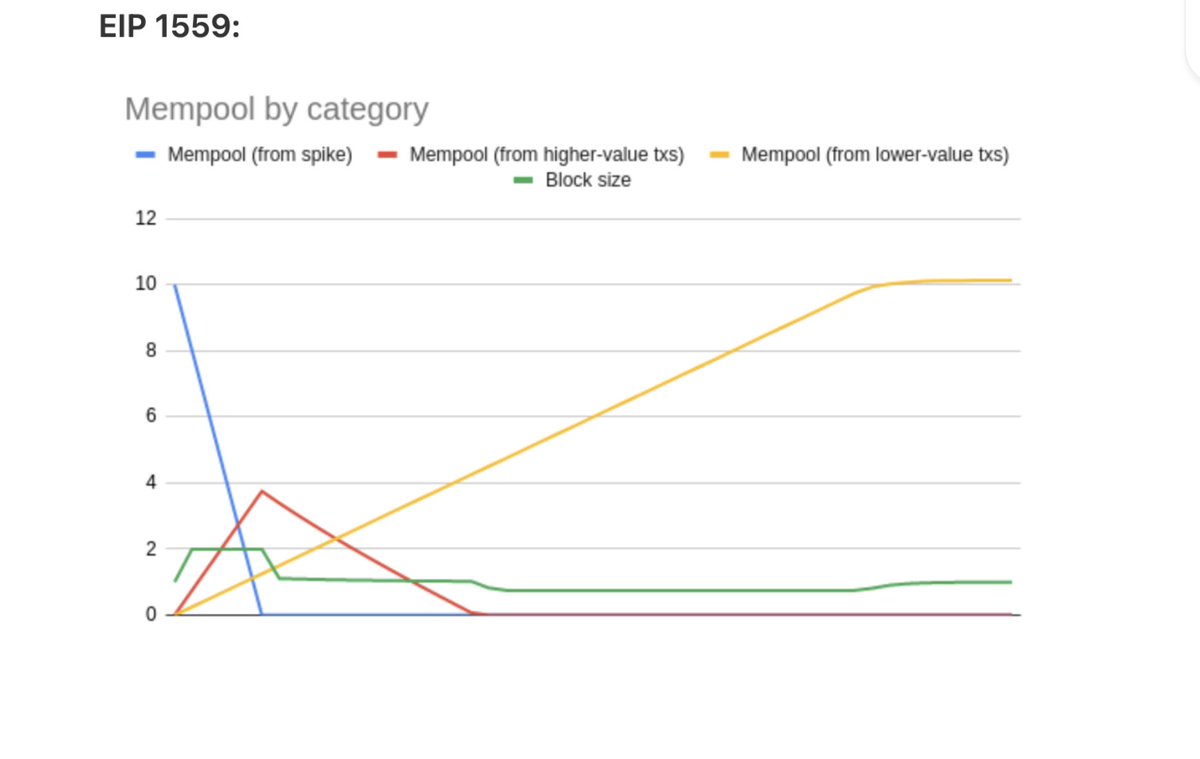

4) Scarcity is Here – EIP 1559 effectively cancels out ETH’s inflation rate of 4.37% decreasing total supply

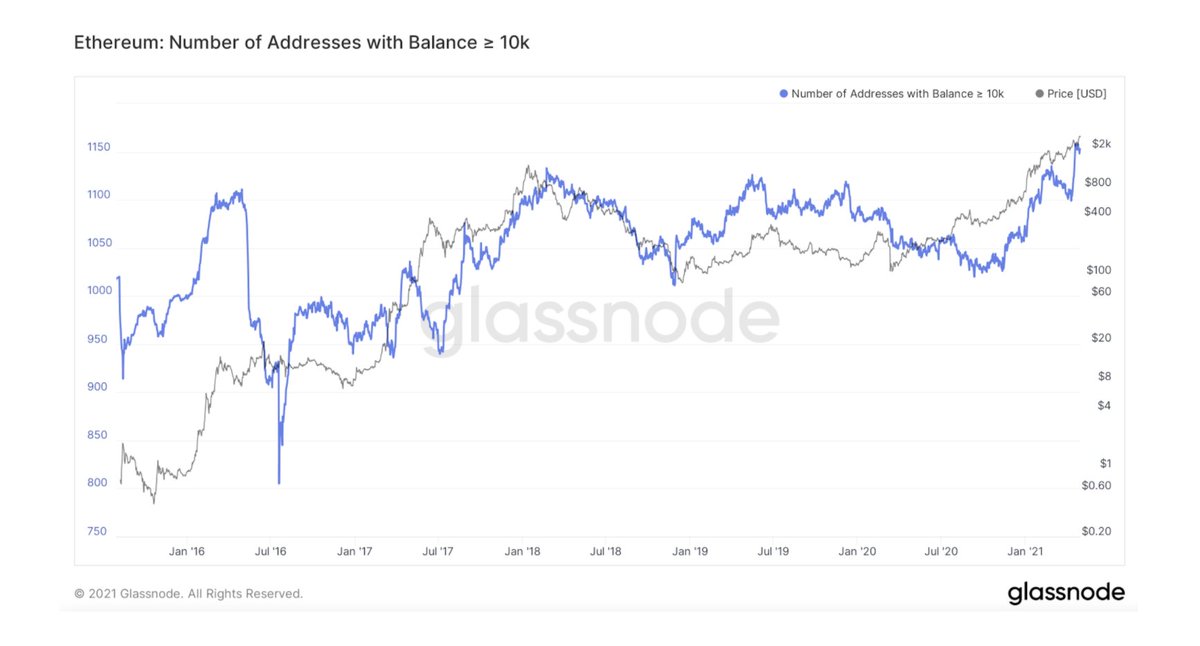

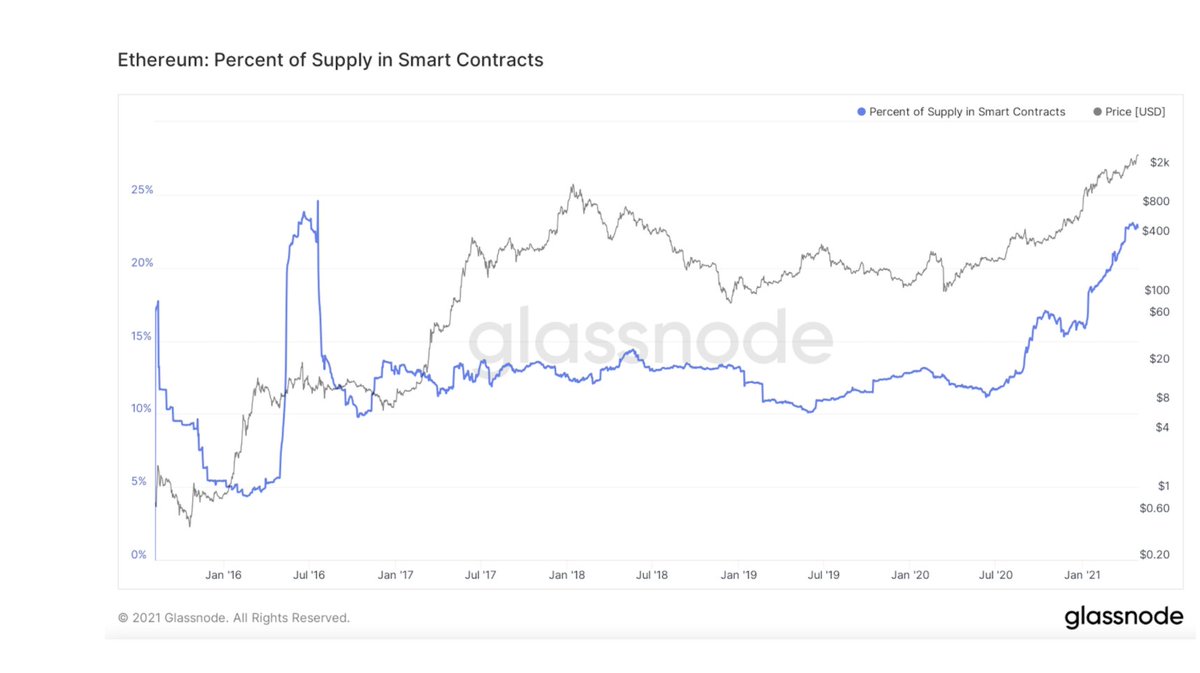

5) 22.5% of $ETH supply is illiquid locked up in smart contracts, and this number will only grow over time as use cases accelerate

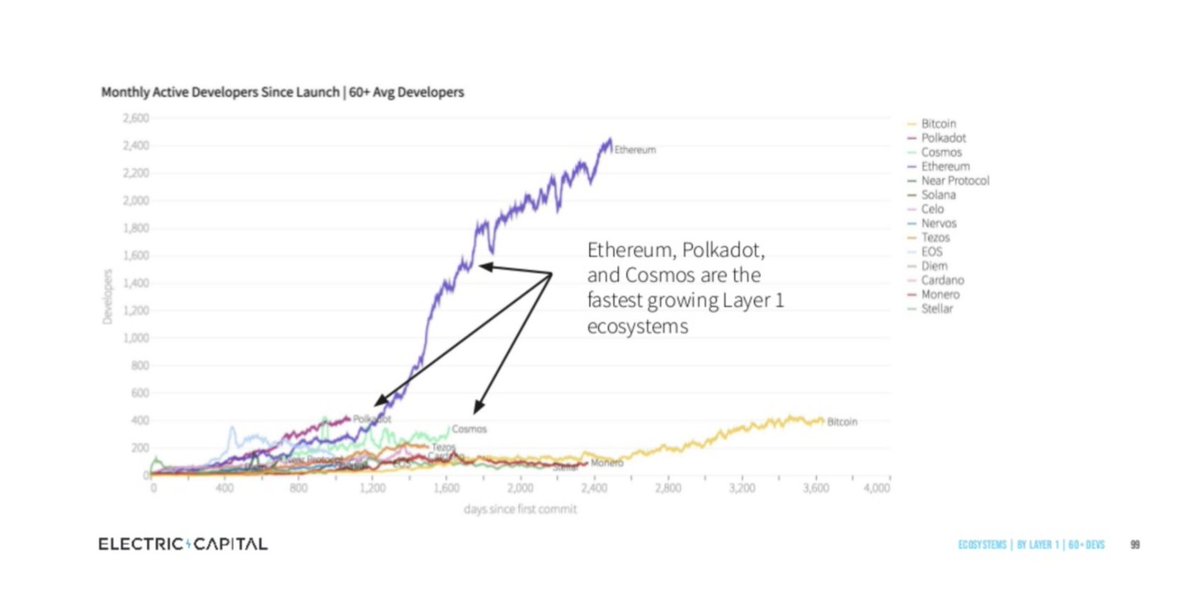

9) Ethereum has 2,325 active monthly developers compared to #Bitcoin 361 – Development leads to more Dapps, more innovation, more disruption, more mass adoption, and higher $ETH prices

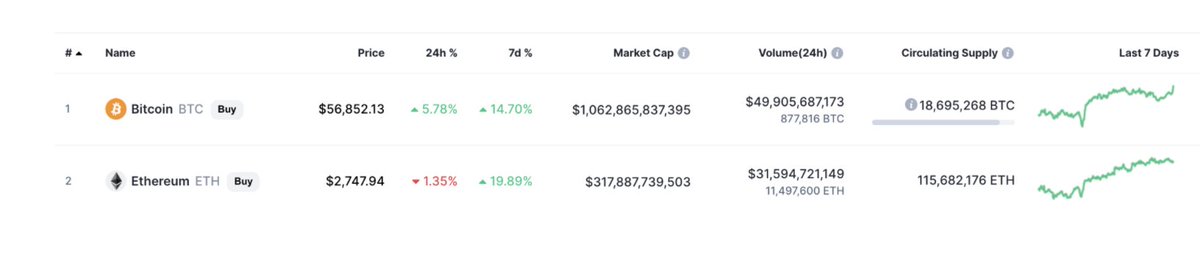

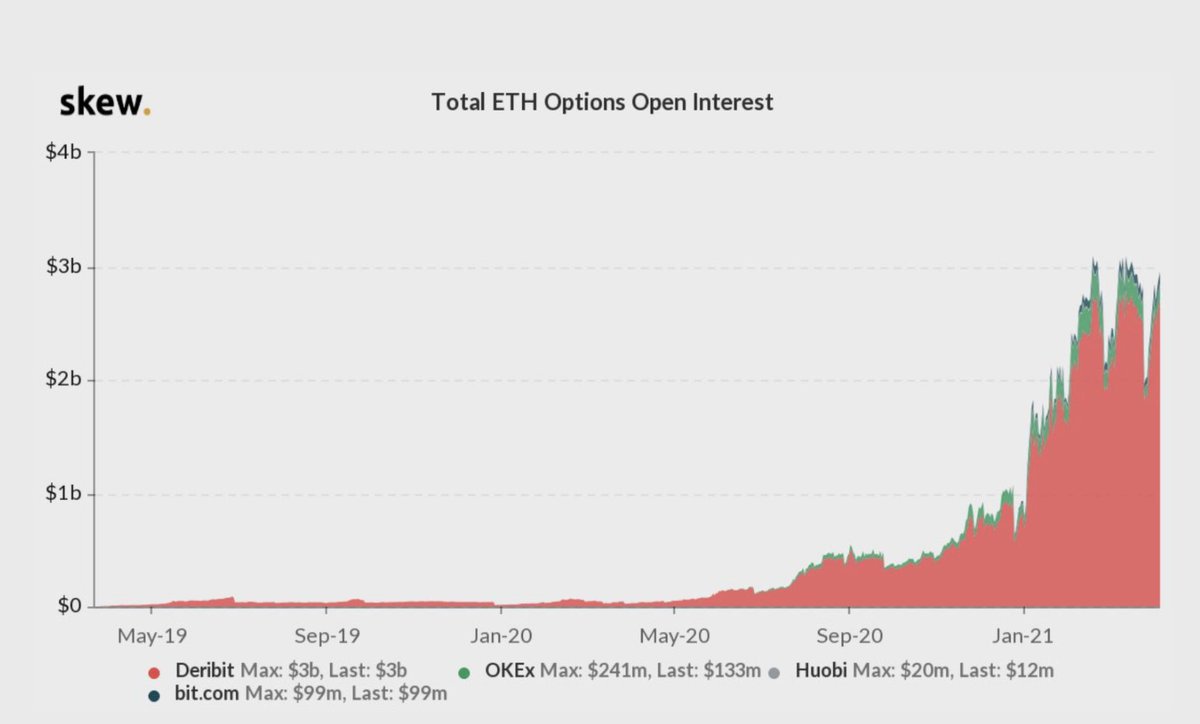

10) $ETH derivatives have gone from $50mm in April 2020 to $3 billion in total open interest– institutional adoption signal

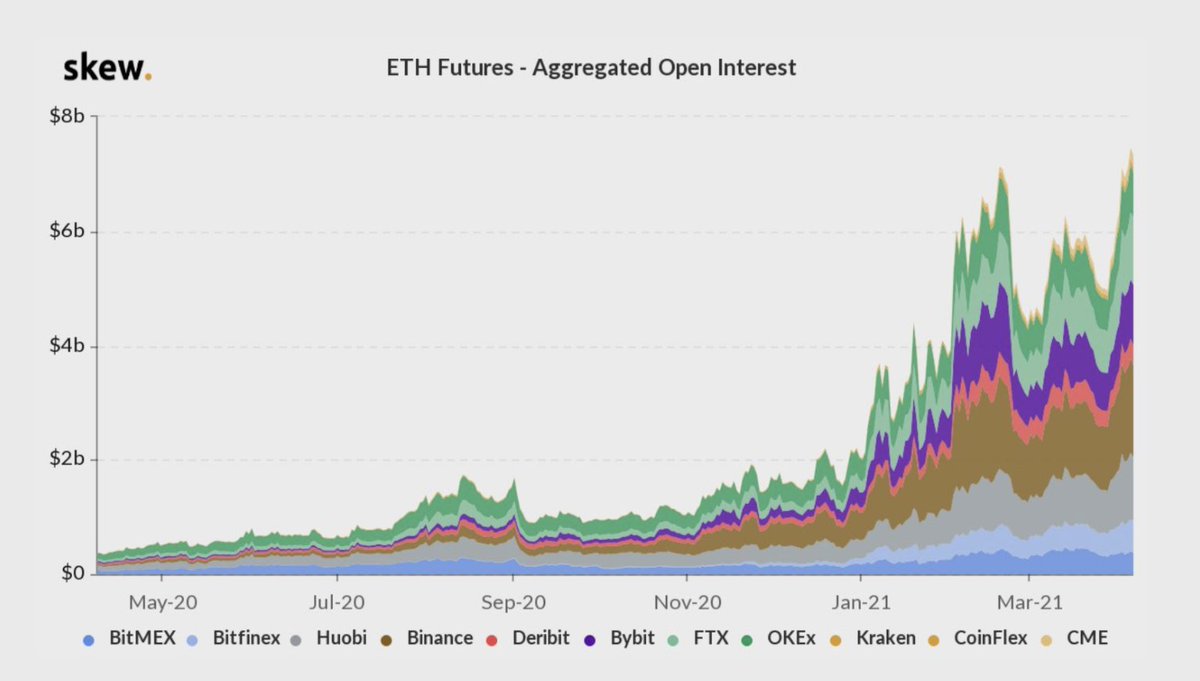

11) $ETH Futures Positions have seen a 20x increase and now sits at $7.5 billion open interest – institutional adoption signal

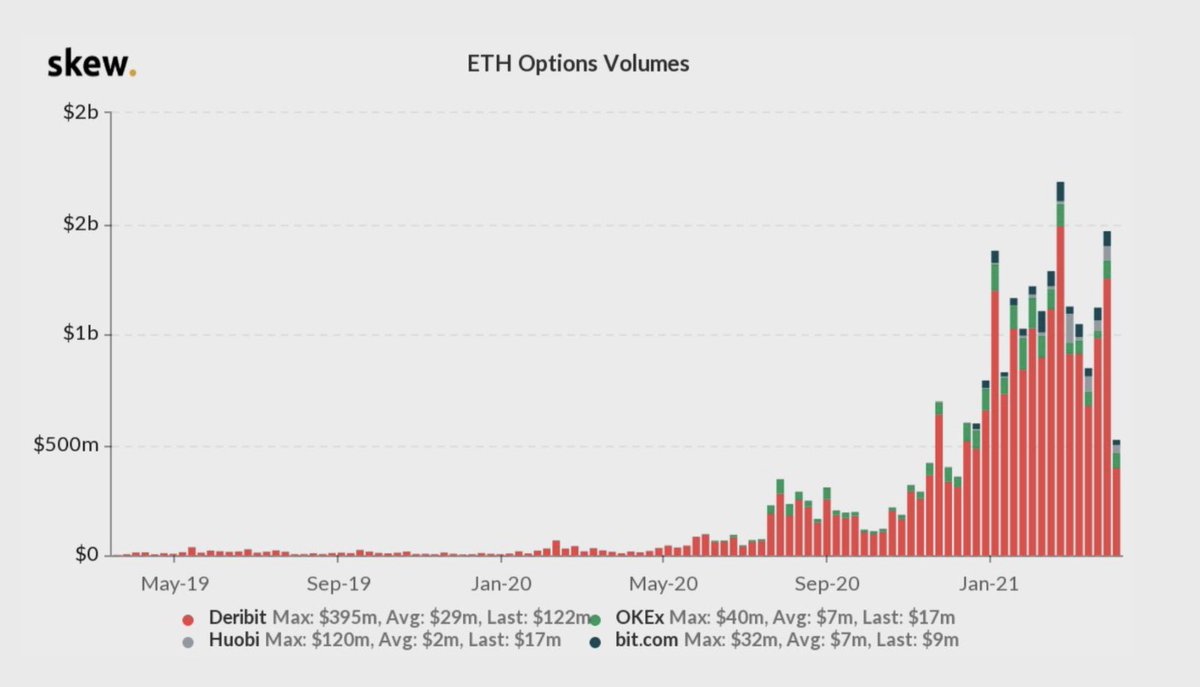

12) 24-hour $ETH options trading volumes have gone from USD 1MM in May 2019 to exceed $1 Billion in daily open interest – institutional adoption signal

13) 3 #Ethereum ETFs recently approved in Canada, and CME futures began trading earlier this year signals maturing asset with lots of upside to go – institutional adoption signal

@CoinDesk

coindesk.com/purpose-invest…

@CoinDesk

coindesk.com/purpose-invest…

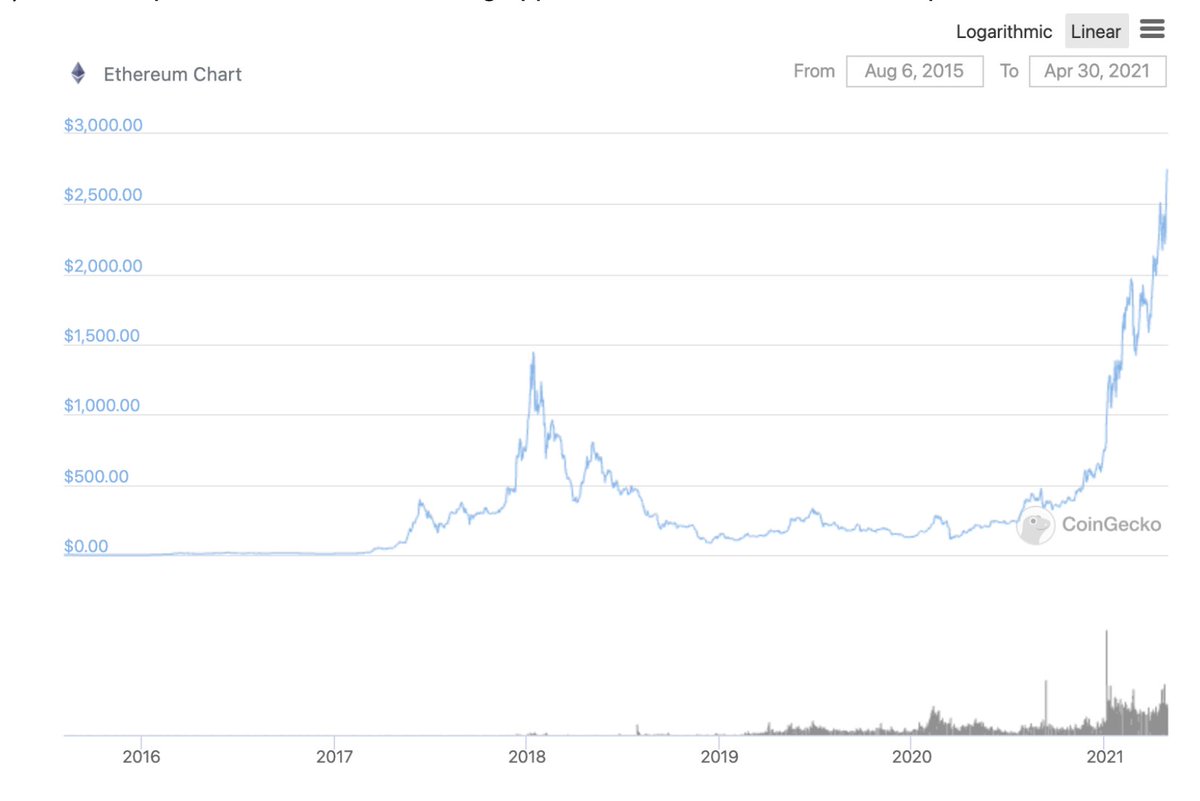

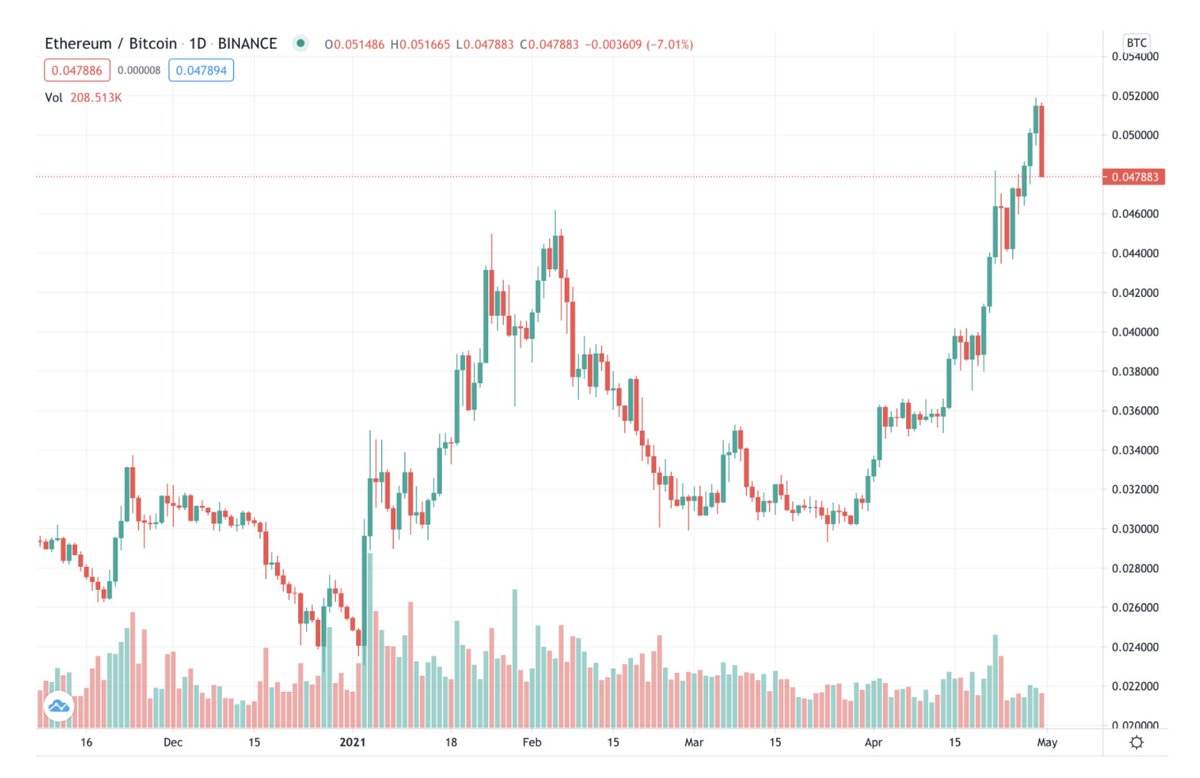

14) $ETH is starting to gain and decorrelate with #Bitcoin, and this will continue as developer activity rises and more use cases are created

Price projections for $ETH currently range from $10,000 (inevitable) - $100,000 (best case scenario)

There is more incentive to hold $ETH than Bitcoin due to Ethereum’s growing use cases

Ethereum leads all innovation and disruption in digital assets and is responsible for igniting the most mass adoption of any other network

When you buy $ETH for your treasury reserve you have exposure to the upside of innovation and disruption that comes from the Ethereum network

Instead of having to gamble on individual projects, you can buy ETH and have exposure to them all

twoprime.io/insights/ether…

twoprime.io/insights/ether…

Based on @two_prime analysis of ETH’s price performance, derivatives markets, and on-chain data, we believe that $ETH has earned a place, alongside BTC, as an institutional-grade investment, store of value, and treasury reserve asset.

twoprime.io/the-rise-of-in…

twoprime.io/the-rise-of-in…

@mcuban gets it

@elonmusk 👀 What do you think?

• • •

Missing some Tweet in this thread? You can try to

force a refresh