🚨This is How The US Dollar Dies –

Lots of talk of the USD losing reserve status, and an entire global currency collapse

Few realize we are in the middle of it right now, watching it happen, but most fail to realize because

they don’t understand the signs

Time for a thread 👇

Lots of talk of the USD losing reserve status, and an entire global currency collapse

Few realize we are in the middle of it right now, watching it happen, but most fail to realize because

they don’t understand the signs

Time for a thread 👇

first, we have to understand why currencies die and yes, all currencies, either devalue or die. Since the 1700's we've seen 750 different currencies and only 20% remain, and all of them have been devalued. This means they buy less today than they did originally

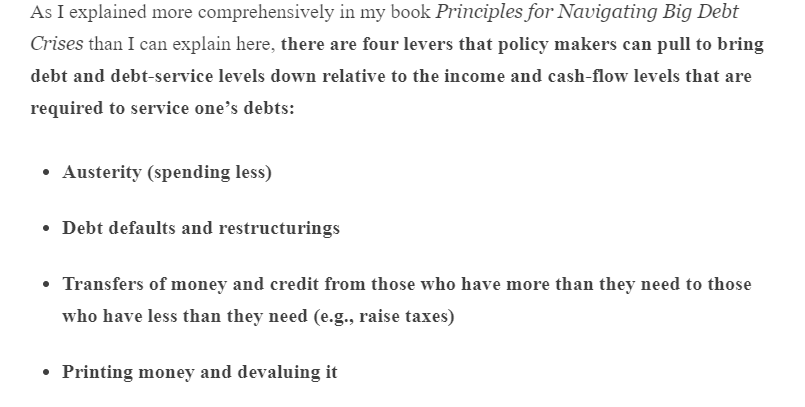

This is always because the country racks up too much debt. To pay it back, their options are limited to only 4 options.

1. Austerity, 2. Debt Default, 3. Raise Taxes, or... 4. Printing Money and Devaluation...

#1 is too hard, 2 and 3 have limitations, so 4 is always chosen

1. Austerity, 2. Debt Default, 3. Raise Taxes, or... 4. Printing Money and Devaluation...

#1 is too hard, 2 and 3 have limitations, so 4 is always chosen

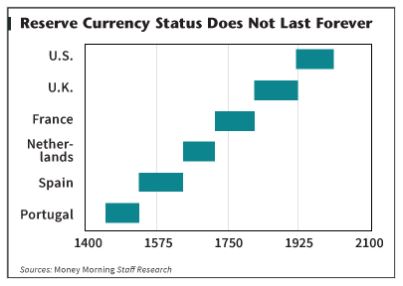

Reserve currencies never last, and the transition takes time and is rough, to understand this, let's get some historical perspective

Let's quickly look at 2 transitions for the clarity we need to know where we are in the cycle and where things are going, stick with me here....

Let's quickly look at 2 transitions for the clarity we need to know where we are in the cycle and where things are going, stick with me here....

First, The Transition To USD - during WWI European countries abandoned gold to print money for the war The US became the lender, allowing the US to amass 2/3rds of the world's gold and the position of power.

The US took the lead and a global gold standard in 1944 @ Bretton Woods

The US took the lead and a global gold standard in 1944 @ Bretton Woods

This was a 30yr transition, so when people want to know when the next transition happens, I say, "We are watching it happen right now"

the world is de-dollarizing, and events happening over the last 12 months and ongoing are spreading this up, but... just wait, it gets better...

the world is de-dollarizing, and events happening over the last 12 months and ongoing are spreading this up, but... just wait, it gets better...

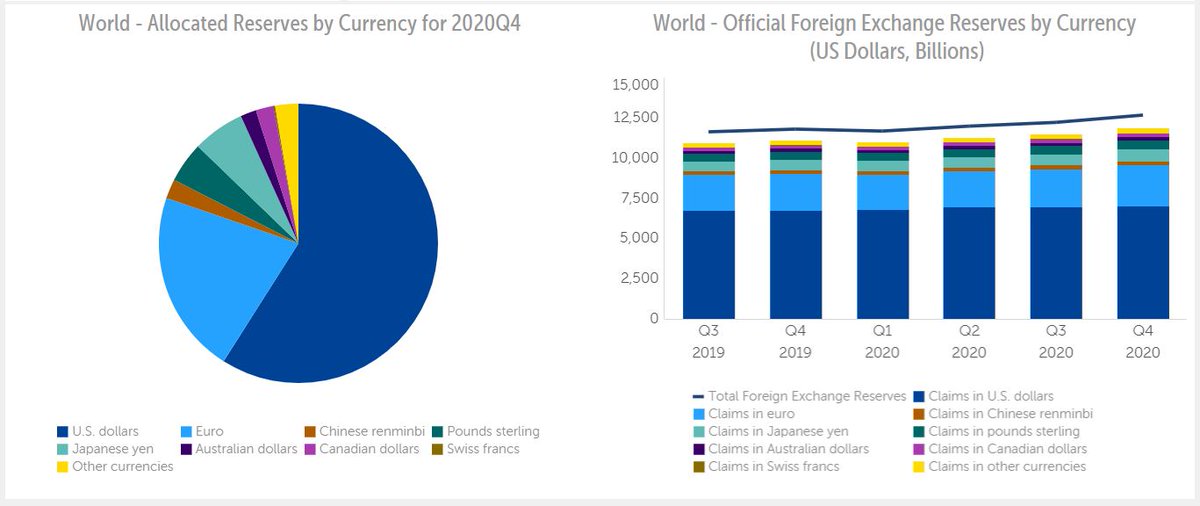

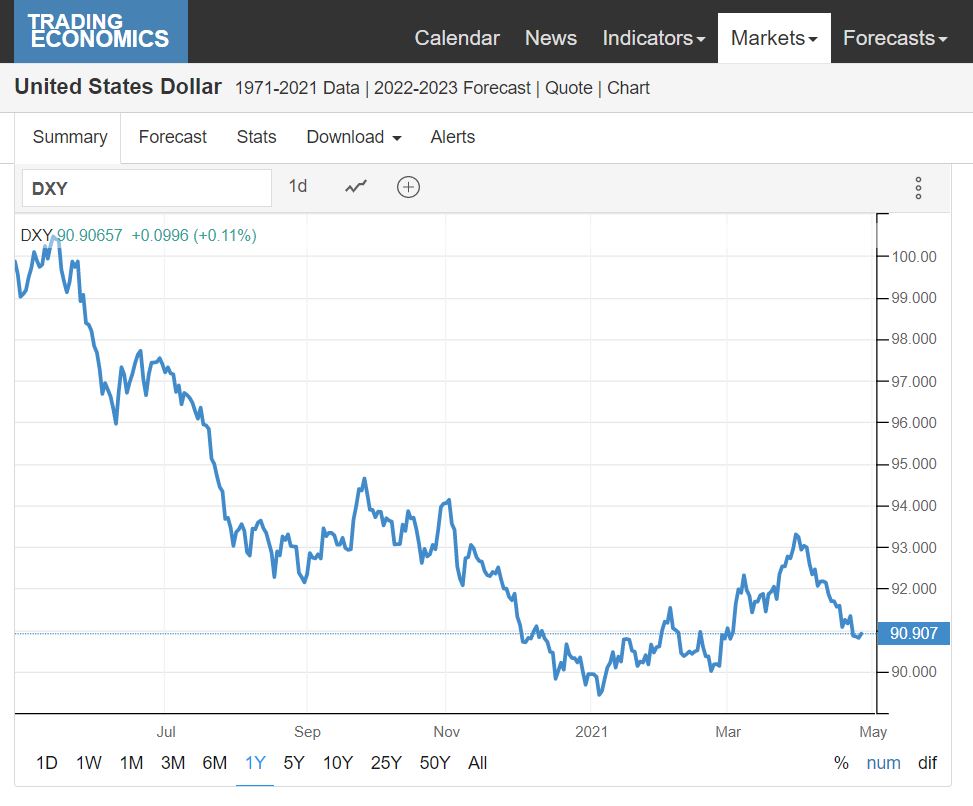

It’s not “when” it’s now, per the IMF, the USD dominance is declining, falling from 64% in 2017 to 59% in 2020, but it's about to accelerate. Also, per the DXY index, we can also see the USD is down 10% this year, but... these are very misleading indicators, stick with me...

Everyone's looking at wrong metrics because they are comparing prices to fiat currencies. Instead of looking at these in comparison to what money is used for = purchasing goods and services. So, we must compare the money to the purchasing power, let me show you a few examples

Starting with the obvious, GOLD. We can see it was $20/oz, then jumped in 1933 to $35/oz, and then in 71' after removing the dollar/gold peg, it went haywire. With no forced peg, the purchasing power of the dollar has declined to $1750/oz gold. Is this holding purchasing power?

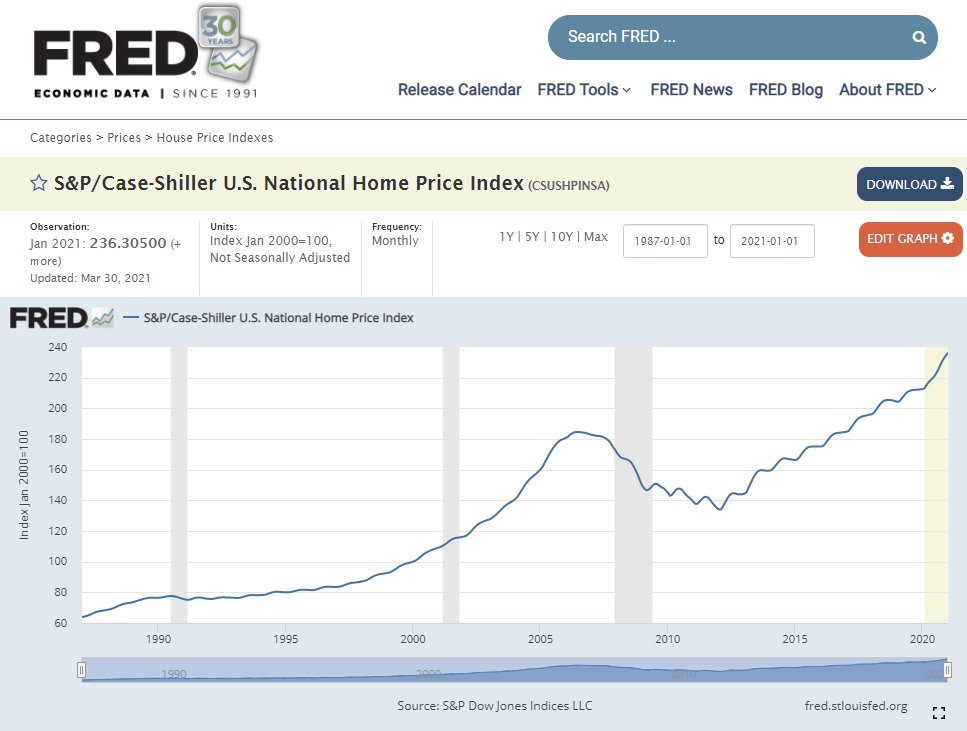

what about Real Estate? Always a great investment right? How has the USD held its purchasing power when compared to RE? This index highlights the loss of USD purchasing power when priced in RE. Home prices are not just going up, It just takes more dollars to buy those things...

We can take a look at oil. Oil is also wealth. It's goods, it services, right? And we can see that it's held strong ever since. And then we can see how much it's come up as, as well was, was oil, a good investment, or did it just maintain its purchasing power?

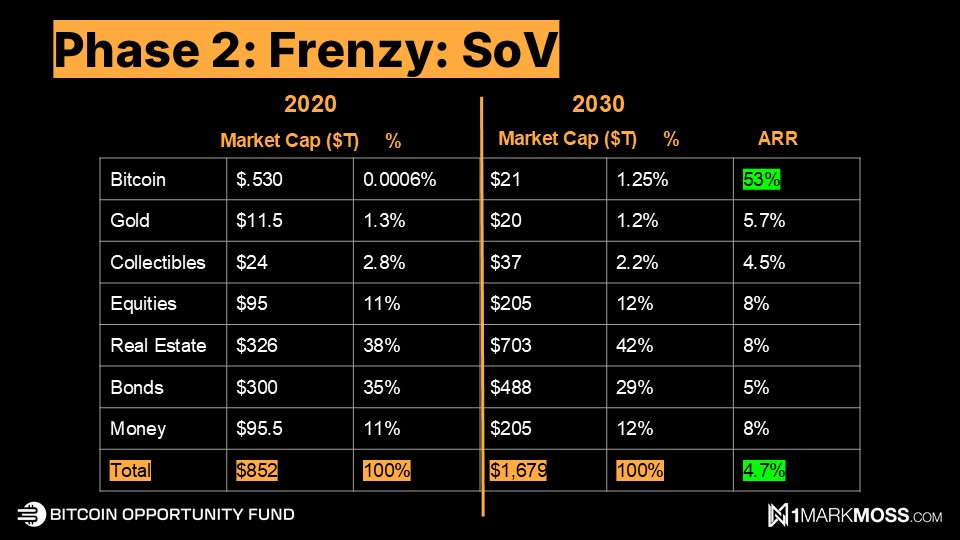

And sure you have seen my favorite chart, it's one of my favorites. This is the price of #Bitcoin compared to USD. So... is #BTC going up in value or is the dollar coming down? how is it holding up in terms of purchasing power?

Now for an even better more telling historical perspective, ready for this one? It will bring everything together and flip your entire mindset...

Let's look at German, the Weimar Republic.

Let's look at German, the Weimar Republic.

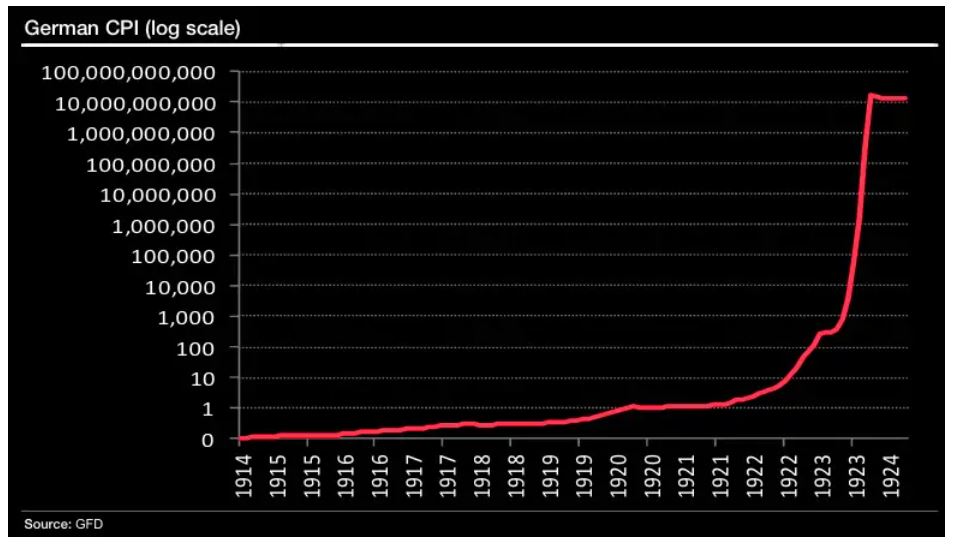

in 1922 Germany defaulted on debts to repay war reparations so France and Belgium invaded in order to recoup their funds. Germany ordered workers to a “passive resistance” which meant they asked workers to "not work" and Germany would "pay them for not working" How did they pay?

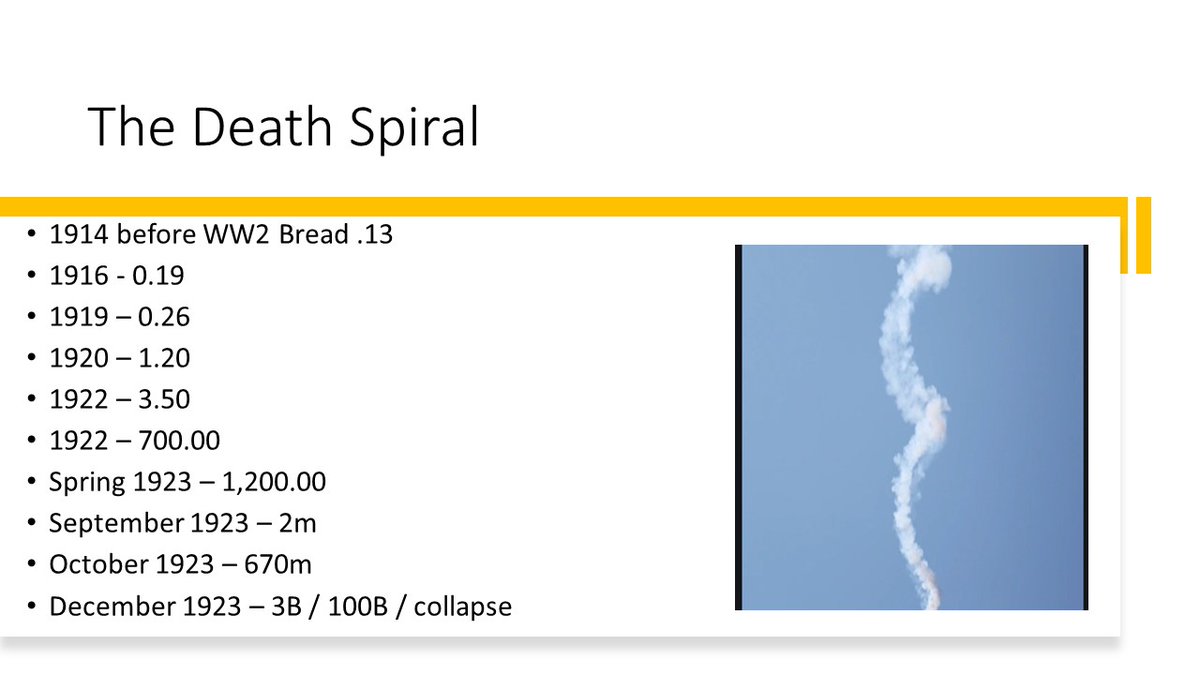

They paid workers for not working by "printing" money, of course, option #4 when nations can't pay their debts. Look at this slide to see what the price of bread did during this time.

Note: the first 5 years, bread doubled, what has the price of bread done now over last 5 years?

Note: the first 5 years, bread doubled, what has the price of bread done now over last 5 years?

How could people pay $100B for bread, at a time with no debit or credit cards, only cash?

They literally needed wheelbarrows to move their cash around for paychecks and groceries. Eventually, the currency was worth less than wood, and so they burned cash to heat their homes.

They literally needed wheelbarrows to move their cash around for paychecks and groceries. Eventually, the currency was worth less than wood, and so they burned cash to heat their homes.

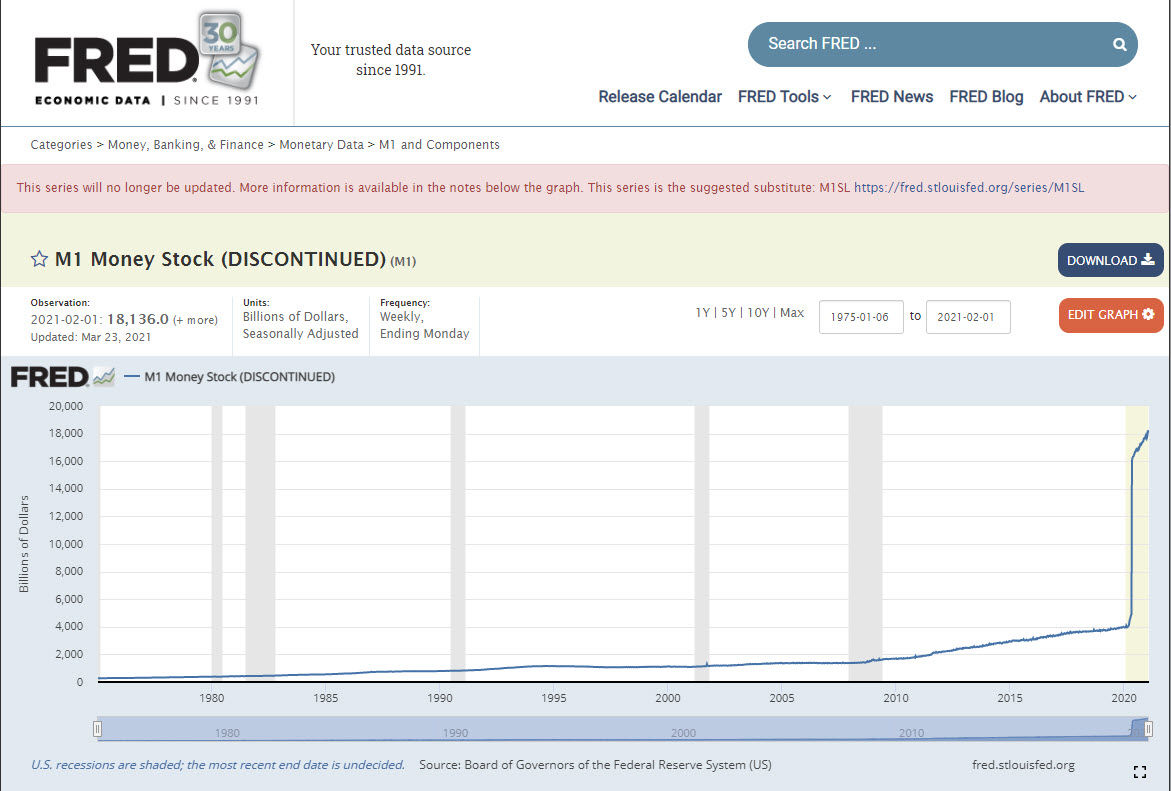

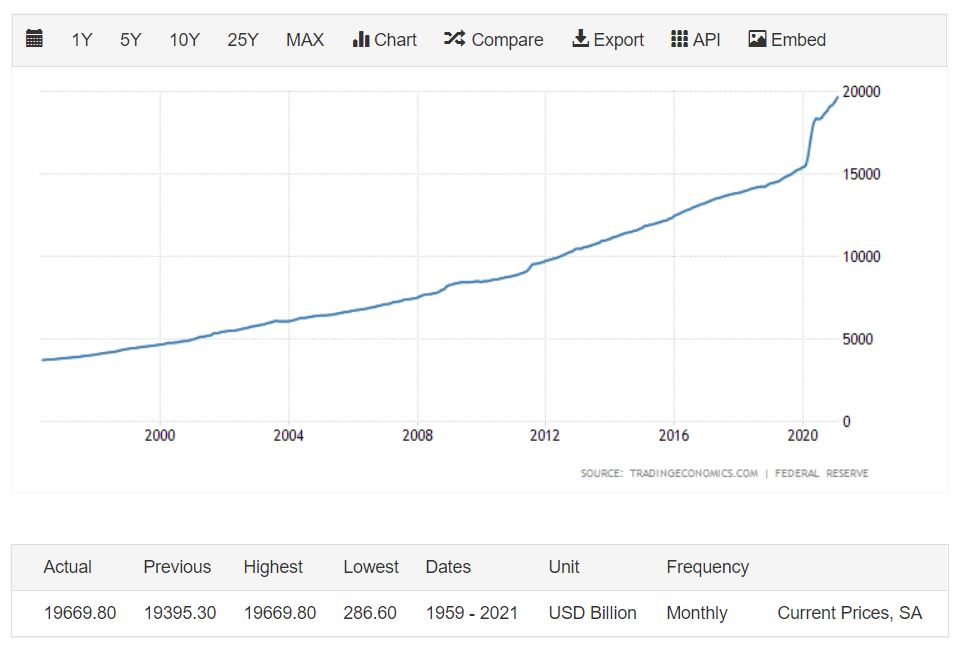

Let's compare what the US is doing right now compared to what Germany did.

the first thing is they printed lots of money. The black chart is Germany's inflation chart, the other 2 are the US's inflation of the money supply, any similarities?

the first thing is they printed lots of money. The black chart is Germany's inflation chart, the other 2 are the US's inflation of the money supply, any similarities?

then... remember the key piece, Germany paid the workers to "not" work... any similarities to what the US is doing right now?

Doing the same things will always lead to the same results... For perspective, the book "when money dies" stated people in Germany thought they were getting rich as asset prices shot higher so they "cashed in" Consider this before you sell RE or #bitcoin because its ATH prices

If you like this overview, you might want to watch the full video to get the full content of what was said.

There are tremendous lessons in history that tell us where we are going and how they will work.

watch the video here 👇

Like, Comment and RT 🙏

There are tremendous lessons in history that tell us where we are going and how they will work.

watch the video here 👇

Like, Comment and RT 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh