$BTC $BTCUSD #BTC

🅼🅴🅶🅰 Thread on several Models / indicators / On Chain Analysis

Part 4

Update at $btc=57k, May 2020

🅼🅴🅶🅰 Thread on several Models / indicators / On Chain Analysis

Part 4

Update at $btc=57k, May 2020

https://twitter.com/Yodaskk/status/1337060555966844932

200 week moving average heatmap now in yellow

advanced in the cycle -similar to q2/q3 2017-but probably not a top yet

advanced in the cycle -similar to q2/q3 2017-but probably not a top yet

Puell multiple

After the higher low, now in a consolidation between 2 & 3 like previous cycles -similar to q2/q3 2017-

After the higher low, now in a consolidation between 2 & 3 like previous cycles -similar to q2/q3 2017-

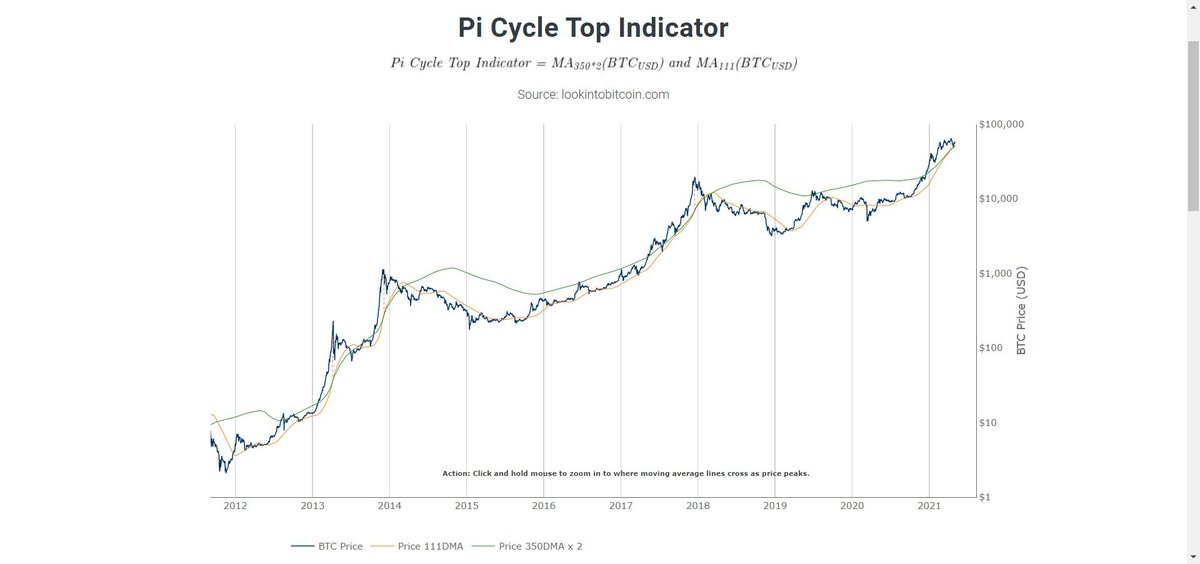

Pi cycle top indicator gave a pretty good signal at 60k+

This one would be the most bearish signal as of yet

This one would be the most bearish signal as of yet

Bitcoin log growth curves

Similar as previously, seems advanced in the cycle, but doesnt look as a top -probably like q2/q3 2017-

Similar as previously, seems advanced in the cycle, but doesnt look as a top -probably like q2/q3 2017-

MVRV Z-Score made a Parabolic advance starting like previous bull markets

now doing a consolidation between 2 & 6 similar to q2/q3 2017

now doing a consolidation between 2 & 6 similar to q2/q3 2017

Relative Unrealized profit/loss

consolidating in the greed zone -like q2/q3 2017- but didnt touched yet the euphoria area

consolidating in the greed zone -like q2/q3 2017- but didnt touched yet the euphoria area

Miner capitulation, similar to previous cycle

Lol it actually looks so similar, with the halving kicking the hyperspeed

Lol it actually looks so similar, with the halving kicking the hyperspeed

Based from their lows, this cycle seems on track compared to 2 previous ones - and also ~~like q2/q3 2017

Conclusion:

Some over heating signs start to appear, but overall it seems we are at the equivalent of q2/q3 2017, and that there is still 3-6 months of bull market and at least a last leg up imo

SOURCES:

stats.buybitcoinworldwide.com

charts.woobull.com

lookintobitcoin.com/charts/

Some over heating signs start to appear, but overall it seems we are at the equivalent of q2/q3 2017, and that there is still 3-6 months of bull market and at least a last leg up imo

SOURCES:

stats.buybitcoinworldwide.com

charts.woobull.com

lookintobitcoin.com/charts/

Previous thread

Part 1

$btc= 5k, March 17th 2020, post corona drop

Part 1

$btc= 5k, March 17th 2020, post corona drop

https://twitter.com/Yodaskk/status/1239928982784610305?s=20

Previous Thread

Part 2

Update at $btc=9300, July 2020

Part 2

Update at $btc=9300, July 2020

https://twitter.com/Yodaskk/status/1285562878146338816?s=20

Previous thread

Part 3

Update at $btc=18k, Dec 2020

Part 3

Update at $btc=18k, Dec 2020

https://twitter.com/Yodaskk/status/1337060555966844932?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh