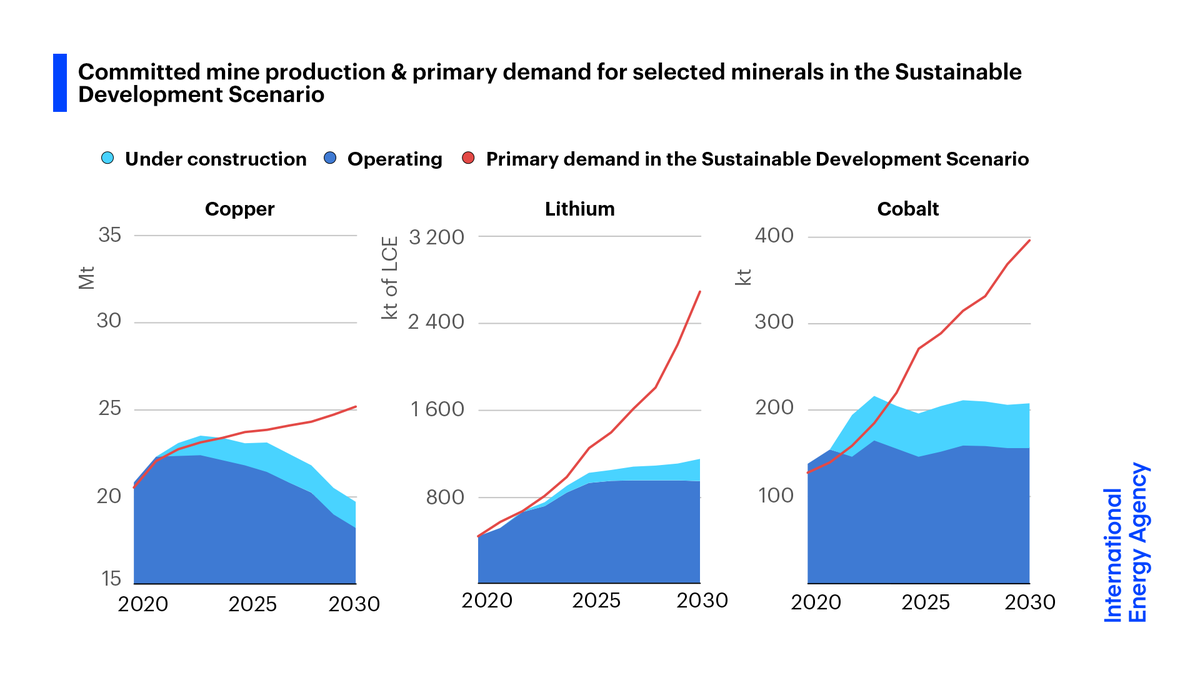

Demand for critical minerals is set to soar as the world pursues net zero goals, our new @IEA report shows.

The energy sector’s needs for minerals could rise by as much as 6 times by 2040. Insufficient supplies would risk delays & extra costs.

More ➡️ iea.li/3ef1vrw

The energy sector’s needs for minerals could rise by as much as 6 times by 2040. Insufficient supplies would risk delays & extra costs.

More ➡️ iea.li/3ef1vrw

The mineral requirements of an energy system powered by clean energy are profoundly different from one that runs on fossil fuels.

For example, an offshore wind plant needs 13 times more mineral resources than a similar sized gas power plant.

Read more ➡️ iea.li/3eWVcYP

For example, an offshore wind plant needs 13 times more mineral resources than a similar sized gas power plant.

Read more ➡️ iea.li/3eWVcYP

Our report shows a looming mismatch between the world’s strengthened climate ambitions & the availability of critical minerals that are essential to realising those ambitions

Governments need to act now & act together to reduce the risks of price volatility & supply disruptions

Governments need to act now & act together to reduce the risks of price volatility & supply disruptions

Production & processing of many minerals – such as nickel, cobalt & rare earths – are concentrated in a handful of countries. In some cases, the top 3 producers generate over 75% of supplies.

Producers need to meet stricter environmental & social standards.

Producers need to meet stricter environmental & social standards.

The challenges are not insurmountable, & critical minerals don’t undermine the case for clean energy.

Though mineral extraction is relatively emissions-intensive, the lifecycle emissions of EVs today are about 1/2 those of a traditional car & only 1/4 with clean electricity.

Though mineral extraction is relatively emissions-intensive, the lifecycle emissions of EVs today are about 1/2 those of a traditional car & only 1/4 with clean electricity.

The @IEA is committed to helping governments ensure that mineral supplies don’t hinder global clean energy transitions.

For this report, we set up a unique database of future mineral requirements in varying scenarios. And we're providing 6 key recommendations for policy makers.

For this report, we set up a unique database of future mineral requirements in varying scenarios. And we're providing 6 key recommendations for policy makers.

To learn more, explore the findings of this free report on our website ➡️ iea.li/3ef1vrw

And join IEA Head of Energy Supply and Investment @tgouldao, report lead author @tae100 & me for the live launch event at 11am CEST ➡️ iea.li/3egk6TV

And join IEA Head of Energy Supply and Investment @tgouldao, report lead author @tae100 & me for the live launch event at 11am CEST ➡️ iea.li/3egk6TV

• • •

Missing some Tweet in this thread? You can try to

force a refresh