Renewables 2020 is out!

This new @IEA report shows renewable power is still growing strongly despite the Covid crisis – unlike all other fuels.

Renewable electricity generation will rise 7% in 2020, & capacity additions will set records this year & next iea.li/2Ijuop4

This new @IEA report shows renewable power is still growing strongly despite the Covid crisis – unlike all other fuels.

Renewable electricity generation will rise 7% in 2020, & capacity additions will set records this year & next iea.li/2Ijuop4

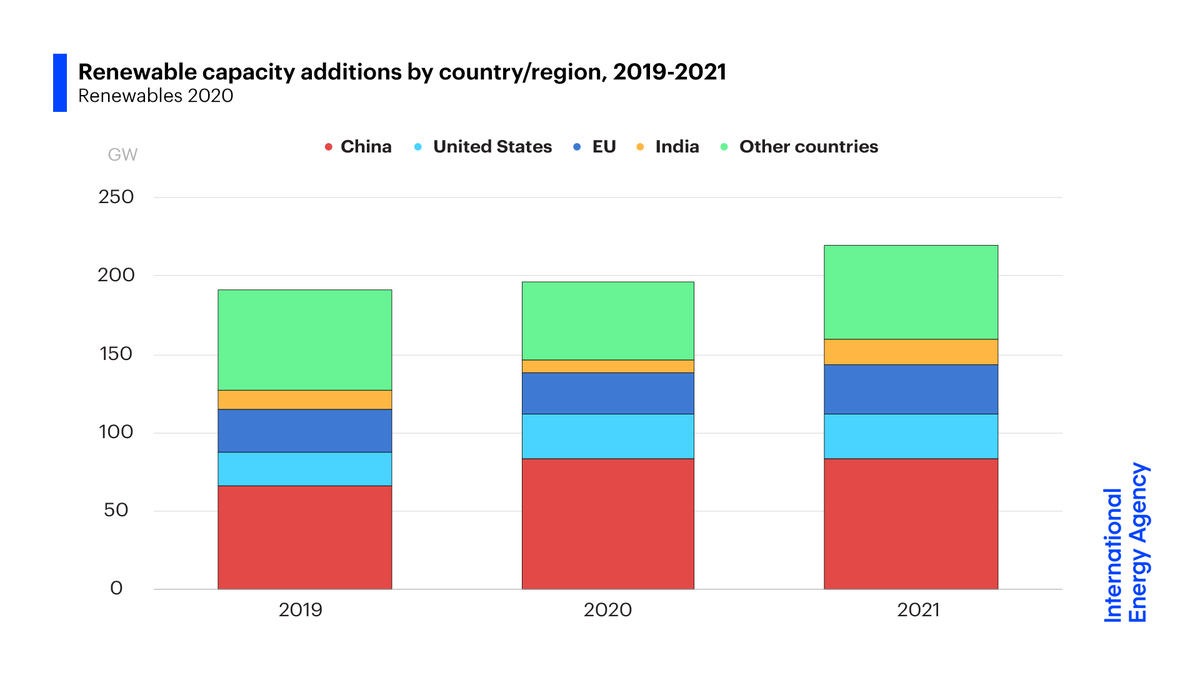

After a 4% rise in renewable capacity in 2020 driven by 🇨🇳 & 🇺🇸, @IEA forecasts that additions will jump 10% in 2021, led by 🇮🇳 & 🇪🇺

This would be the fastest rate of growth since 2015, but policy action is needed to keep up momentum into 2022

Read more: iea.li/2IqAUKM

This would be the fastest rate of growth since 2015, but policy action is needed to keep up momentum into 2022

Read more: iea.li/2IqAUKM

The bright prospects of the sector are reflected by continued strong appetite from investors.

This is made clear by shares of solar & wind energy companies outperforming the rest of the energy sector, and by the record level of renewable power capacity auctioned in 2020.

This is made clear by shares of solar & wind energy companies outperforming the rest of the energy sector, and by the record level of renewable power capacity auctioned in 2020.

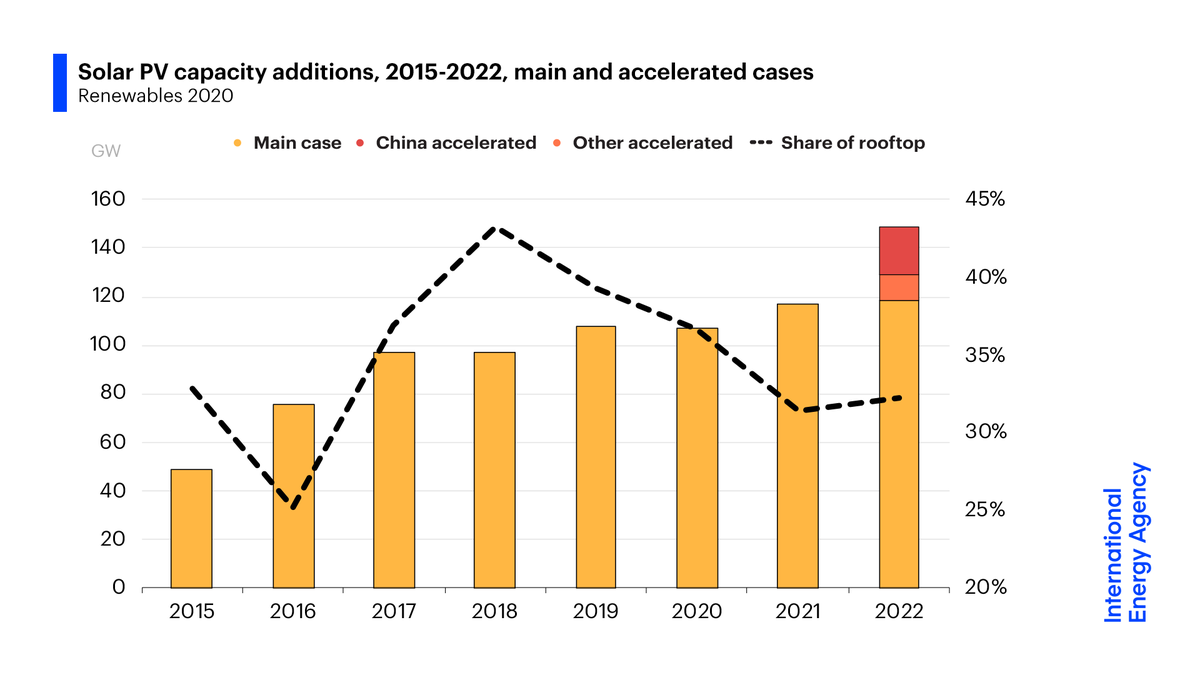

Solar is becoming the new king of 🌍 electricity markets, ascending thanks to its constantly improving competitiveness.

Even faster deployment is possible from 2022 onward, hinging on new policies in 🇨🇳 & 🇺🇸, and rooftop solar developments.

Read more ➡️ iea.li/32qX4Dt

Even faster deployment is possible from 2022 onward, hinging on new policies in 🇨🇳 & 🇺🇸, and rooftop solar developments.

Read more ➡️ iea.li/32qX4Dt

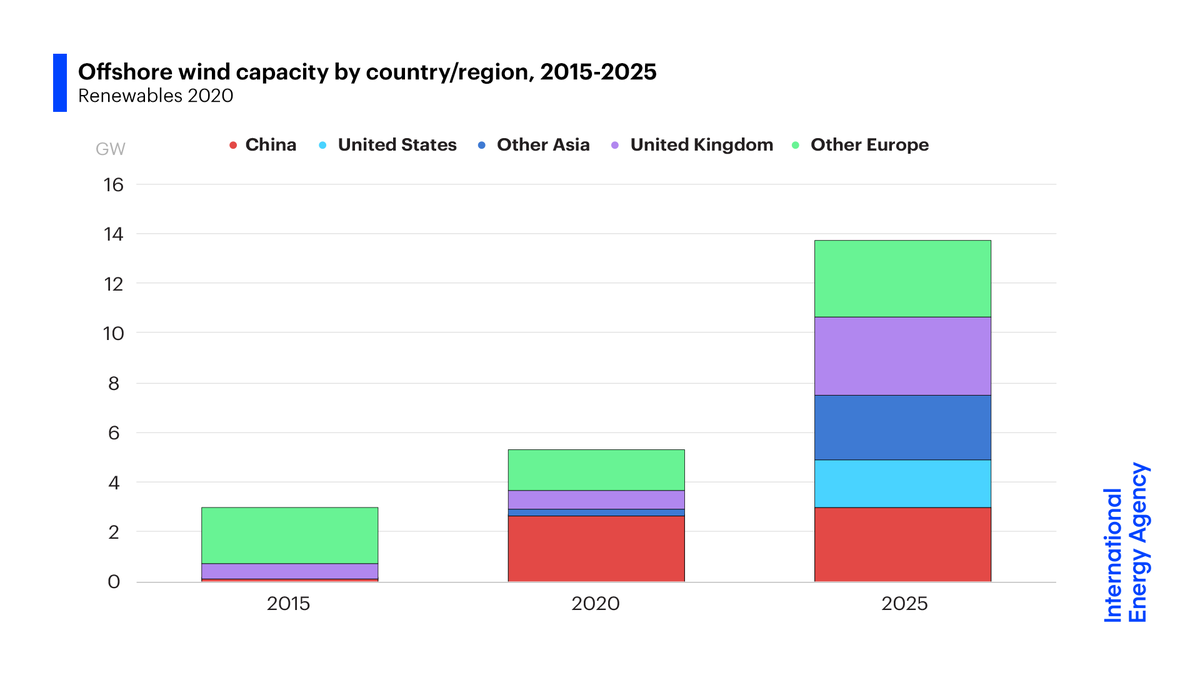

Wind power generation is forecast to grow by 80% in the next 5 years, driven by 🇨🇳, 🇺🇸 & 🇪🇺

The annual offshore wind market is set to more than double by 2025 thanks to rapid cost declines, with expansion shifting to Asia and the US.

More on wind 👉 iea.li/2ImXHan

The annual offshore wind market is set to more than double by 2025 thanks to rapid cost declines, with expansion shifting to Asia and the US.

More on wind 👉 iea.li/2ImXHan

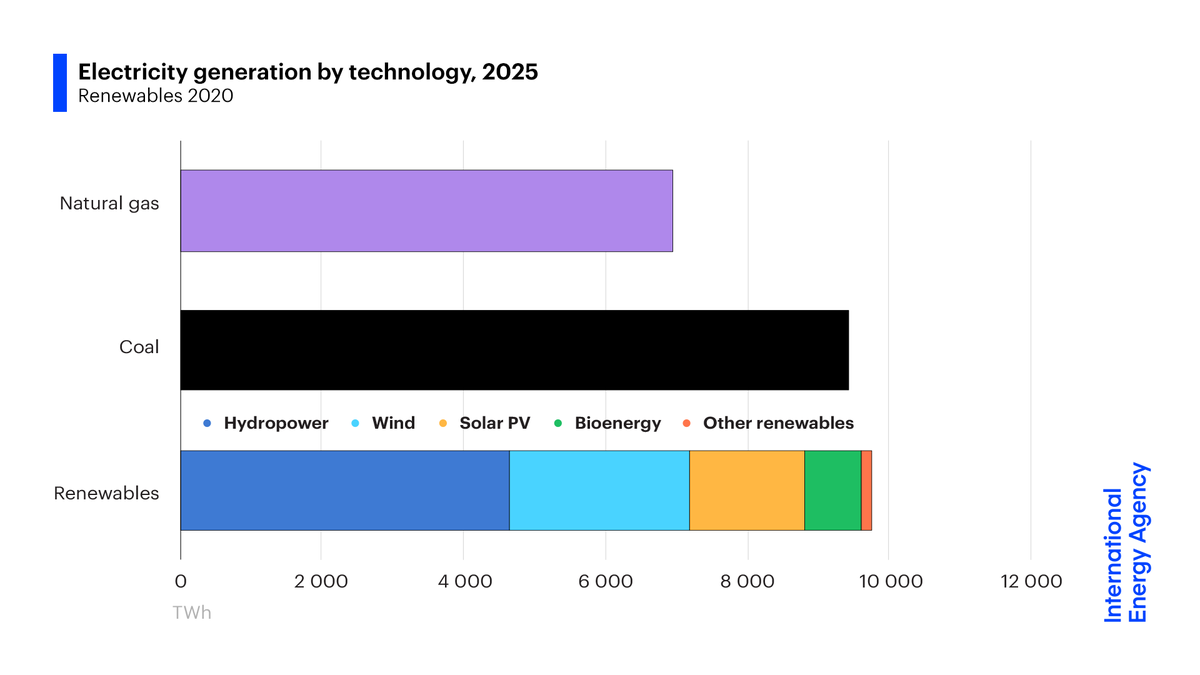

In 2025, renewables are set to become the 🌍's largest source of electricity generation, ending coal’s 5 decades at the top of the power mix

By then, renewables should supply a third of global electricity. Their total capacity will be twice the entire power capacity of 🇨🇳 today

By then, renewables should supply a third of global electricity. Their total capacity will be twice the entire power capacity of 🇨🇳 today

Countries can accelerate renewables' growth by giving them a larger share of economic recovery spending, especially hard hit areas like biofuels.

In the US, the proposed clean electricity policies of the next administration could lead to much more rapid solar & wind deployment.

In the US, the proposed clean electricity policies of the next administration could lead to much more rapid solar & wind deployment.

For the 1st time, @IEA's annual Renewables market report includes a dynamic data dashboard enabling users to explore historical data & forecasts for all sectors & technologies.

You can explore it here ➡️ iea.li/2IlVFHg

You can explore it here ➡️ iea.li/2IlVFHg

For more on the key findings & forecasts from the report, join me & lead author @heymibahar at the launch press conference at 10:30am CET.

You can watch it live here on Twitter or on our website ➡️ iea.li/36iGg2V

You can watch it live here on Twitter or on our website ➡️ iea.li/36iGg2V

• • •

Missing some Tweet in this thread? You can try to

force a refresh