#Bitcoin works in a very peculiar way. Our everyday experience doesn't map onto it nicely. Which is one of the reasons why I believe that trying to shoehorn it into concepts we are familiar with is a fool's errand. 🧵👇

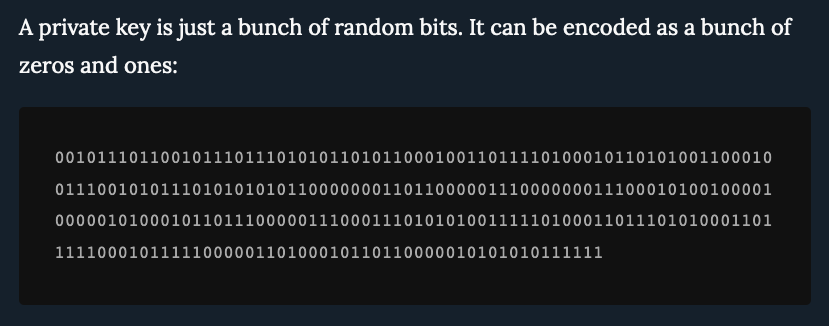

First of all: public keys, private keys, addresses - even the software it self - it's all just numbers, which is to say information. Outlawing information gets very weird very quickly.

https://twitter.com/dergigi/status/1338074886837821440?s=20

Second of all: on a technical level, every bitcoin transaction is a smelting process. Multiple inputs go in, multiple inputs go out. You can only connect inputs to outputs *heuristically*, never definitely.

Thus, any kind of "taint" is always an external property, never an internal property of bitcoin. Someone needs to come up with a heuristic that will tell you that this bitcoin is "bad." It is IMPOSSIBLE to do this precisely. You will always have false positives.

Also: who decides what is "good" and what is "bad"? What is legitimate use and what isn't? What is legal - in all jurisdictions, mind you - and what is not?

Laws change. Society evolves. Bitcoin knows no borders.

Laws change. Society evolves. Bitcoin knows no borders.

One interesting side-effect of Bitcoin's transaction mechanic is that there is no "from address" in Bitcoin. There just isn't. There are only heuristics.

en.bitcoin.it/wiki/From_addr…

en.bitcoin.it/wiki/From_addr…

Another side-effect: since every input of a tx must be spent in its entirety, most bitcoin transactions will have change. Due to the "smelting" described above, you can only *guess* what was payment, and what was change. It's heuristics all the way down!

en.bitcoin.it/wiki/Privacy#C…

en.bitcoin.it/wiki/Privacy#C…

In Bitcoin, the concept of ownership is a heuristic as well. We are dealing with information and control, not physical ownership. Bitcoins are not physical.

Thought experiment: I give a copy of my private key to 21 different entities. Who owns the bitcoin?

Thought experiment: I give a copy of my private key to 21 different entities. Who owns the bitcoin?

Another thought experiment: I put my "KYC'd" bitcoin on an @OPENDIME, and give it to my friend, as a gift. Are the KYC ownership heuristics still accurate? Can you infer the identity of the owner from existing data?

Again: a tx is just a series of inputs and outputs. The transaction data tells you how to unlock existing packages of sats (from previous transactions), and how to lock them up again into new packages. Nothing more, nothing less.

learnmeabitcoin.com/technical/tran…

learnmeabitcoin.com/technical/tran…

Various transaction types and other ways to use bitcoin (e.g. sneakernet) completely destroy these ownership and input/output heuristics.

Some do so accidentally, some do so on purpose.

Some do so accidentally, some do so on purpose.

It's a bit like trying to mark water molecules with a sharpie to save people from drowning. If you think this is a good idea, you don't understand water very well, nor do you understand sharpies. And I seriously doubt that your true intention is to save people in the first place.

• • •

Missing some Tweet in this thread? You can try to

force a refresh