Today's a big day for long-duration (12 hour+) energy storage. ESS Inc (@ESS_info) - which makes a low-cost, iron-sodium flow battery with unlimited cycle life - is going public via a SPAC merger, with $465m of fresh capital to help them scale. essinc.com/2021/05/07/ess… 1/n

I'm personally very excited. One of the very first angel investments in clean energy I made was to ESS, at the time a tiny company in Oregon, who had technology that showed promise to bring the cost of 12 hour storage down to pennies per kwh. 2/n

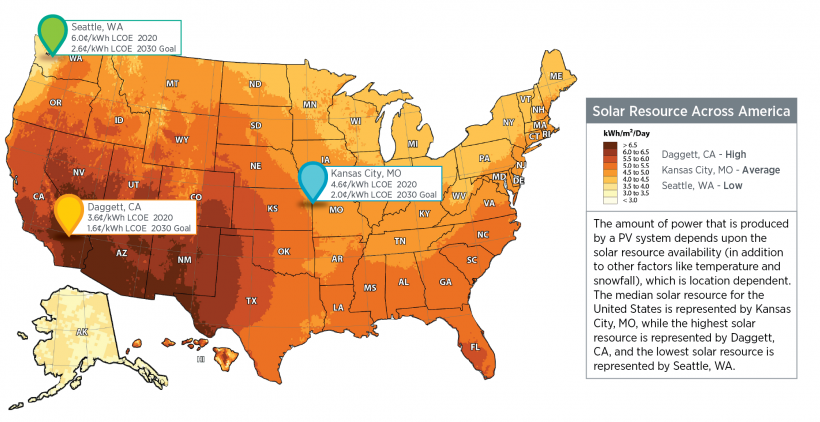

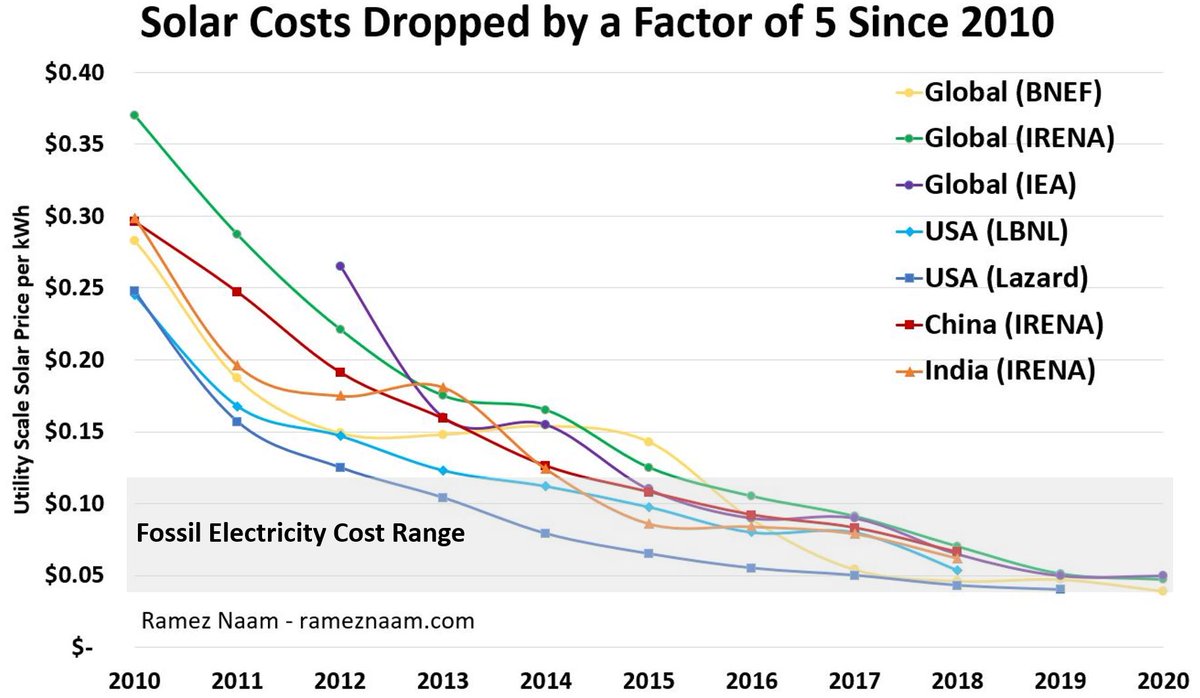

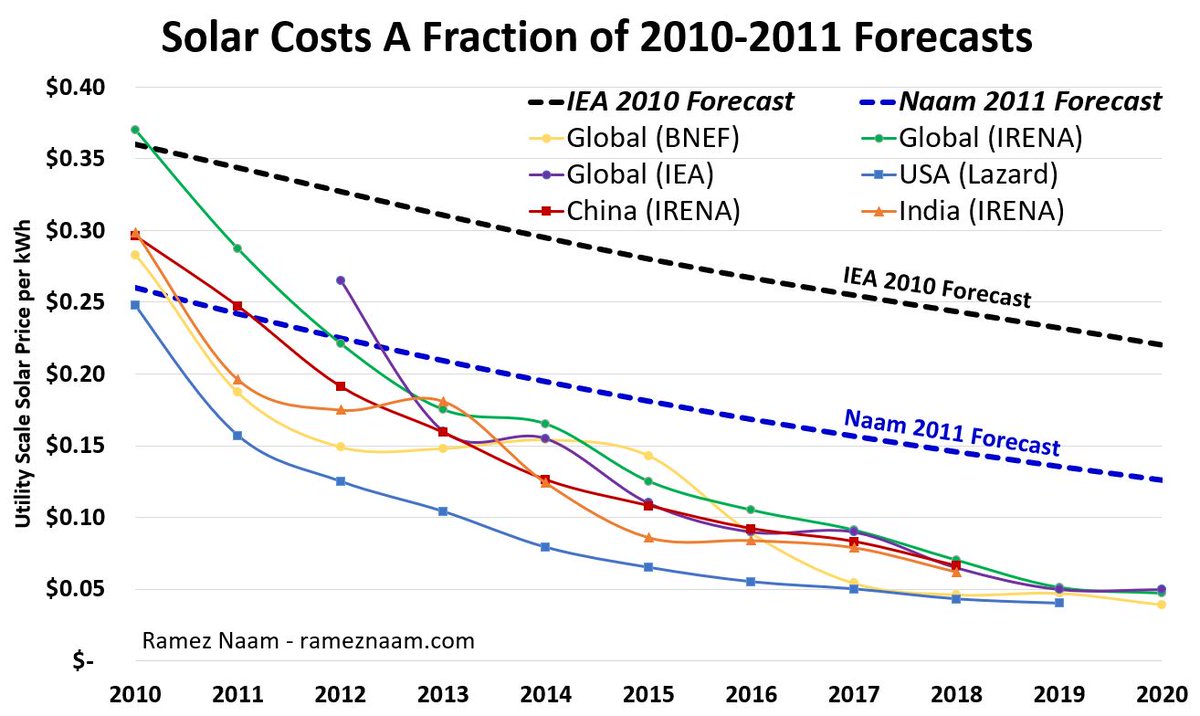

Based on what they showed me in 2015, I believed that ESS could make grid energy storage cheap enough to solve the day/night cycle - that some combination of solar, wind, and ESS's flow batteries would be cheaper than coal or gas almost everywhere. 3/n

That future of cheap 12 hour storage, coupled w cheap solar/wind, is now being realized. There are still hard storage problems to solve (like multi-day), but this is a very substantial step forward for decarbonizing electricity.

Congrats @ESS_info! essinc.com/2021/05/07/ess…

Congrats @ESS_info! essinc.com/2021/05/07/ess…

• • •

Missing some Tweet in this thread? You can try to

force a refresh