1/ $IAC/ $ANGI 1Q’21 Update

“The IAC Way pairs scrappiness and big ambition with the rational patience of permanent capital.”

Joey Levin is an excellent communicator. Another young CEO in early 40s who can work for shareholders hopefully for decades.

Here are my notes.

“The IAC Way pairs scrappiness and big ambition with the rational patience of permanent capital.”

Joey Levin is an excellent communicator. Another young CEO in early 40s who can work for shareholders hopefully for decades.

Here are my notes.

2/ “Whatever the relative point of reference: we’re back where we need to be: building”

16% CAGR since 1995 is an awesome track record in the public markets. That’s ~4x of S&P 500 over the same period.

16% CAGR since 1995 is an awesome track record in the public markets. That’s ~4x of S&P 500 over the same period.

3/ Vimeo

“Vimeo became part of IAC in 2006 through the $26 million acquisition of Connected Ventures, a collection of businesses whose main attraction for IAC was a business called College Humor.”

Incredible story on the early years of Vimeo.

“Vimeo became part of IAC in 2006 through the $26 million acquisition of Connected Ventures, a collection of businesses whose main attraction for IAC was a business called College Humor.”

Incredible story on the early years of Vimeo.

4/ “Nearly every stat we laid out in 2017 to rationalize the strategy shift has doubled and continues to increase”

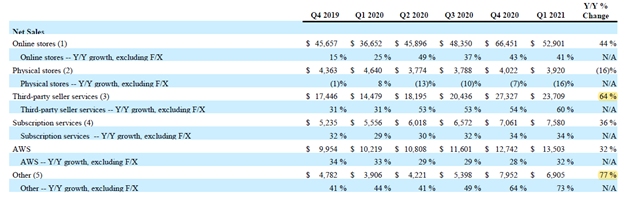

5/ $ANGI

Fixed price is now ~$250 mn run-rate business (vs $160 mn in 2020). This is probably the most interesting chart on ANGI which shows why the fixed price model is of paramount importance.

See the second image to understand what the chart shows.

Fixed price is now ~$250 mn run-rate business (vs $160 mn in 2020). This is probably the most interesting chart on ANGI which shows why the fixed price model is of paramount importance.

See the second image to understand what the chart shows.

6/ ANGI will invest quite heavily on fixed price model.

I like the honesty when Joey said “slightly scary”

Although I’m long, I continue to think ANGI’s success is far from guaranteed, but risk-reward seems lucrative.

My deep dive here (paywall): mbi-deepdives.com/angi/

I like the honesty when Joey said “slightly scary”

Although I’m long, I continue to think ANGI’s success is far from guaranteed, but risk-reward seems lucrative.

My deep dive here (paywall): mbi-deepdives.com/angi/

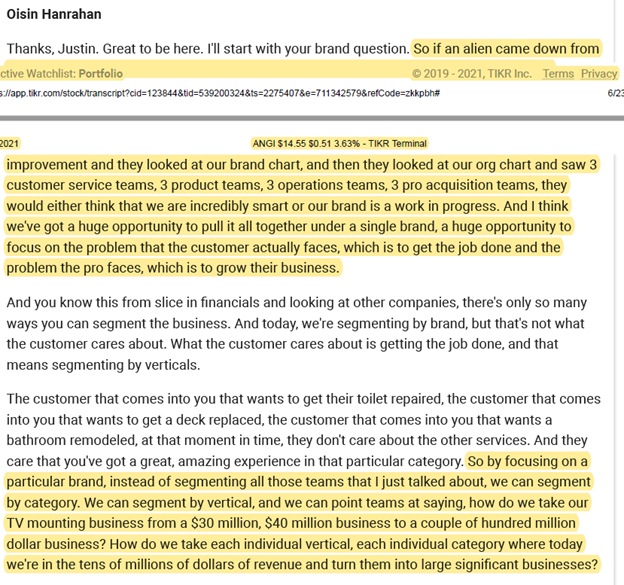

7/ I understand and agree with the rationale of focus of one brand: ANGI, but I wonder whether a completely new brand would be a better option here.

If anything, ANGI brand may not have the most positive connotation in the market.

If anything, ANGI brand may not have the most positive connotation in the market.

8/ ANGI is going to focus on 2 things: get the job done for the customers, and help the pros to grow their business.

Oisin Hanrahan, ANGI’s new CEO in his 30s, sounds more focused and methodical. It’s a difficult business, so the execution needs to be really top-notch.

Oisin Hanrahan, ANGI’s new CEO in his 30s, sounds more focused and methodical. It’s a difficult business, so the execution needs to be really top-notch.

10/ ANGI payments is already doing $100 mn run rate. Pros that use payments have much higher retention.

Really strange thing is in many cases Pros are doing customer acquisition for ANGI.

Really strange thing is in many cases Pros are doing customer acquisition for ANGI.

11/ When customers use the app, the data is really mind boggling. They basically do all of their home related jobs via ANGI.

If they can just get this going, oh boy… (again, not an easy business)

If they can just get this going, oh boy… (again, not an easy business)

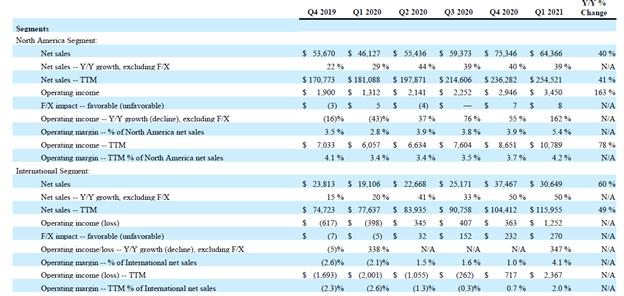

12/ Dotdash

It is probably the most exciting business in IAC post-Vimeo spin-off.

“Advertisers now put a premium on high quality, safe content that connects them directly with a contextual user need, and have realized that “promoted content” is neither promoted nor content.”

It is probably the most exciting business in IAC post-Vimeo spin-off.

“Advertisers now put a premium on high quality, safe content that connects them directly with a contextual user need, and have realized that “promoted content” is neither promoted nor content.”

13/ In post-IDFA world, Dotdash can possibly accelerate its growth.

The setup looks pretty good for them. Expect more investments into content. I endorse.

The setup looks pretty good for them. Expect more investments into content. I endorse.

14/ Care dot com

Care@work is growing 100% YoY. Nothing significant now, but long-term ambition seems much bigger.

Care@work is growing 100% YoY. Nothing significant now, but long-term ambition seems much bigger.

15/ “We don't have to buy things at low multiples. We have to buy things where we have a very clear vision for a very large future, and that can exist in any market.”

Preach.

Preach.

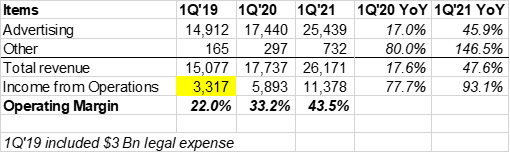

16/ Levin says, Lumber is no $MGM, bro (paraphrasing) 😉

Monthly metrics attached here (second image)

Monthly metrics attached here (second image)

End/ I’ll publish my deep dive on $OTIS Tuesday next week.

Subscribe here: mbi-deepdives.com/plans/subscrib…

All my twitter threads can be found here: mbi-deepdives.com/twitter-thread…

Subscribe here: mbi-deepdives.com/plans/subscrib…

All my twitter threads can be found here: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh