1/ Thread: $SHOP 1Q’21 Update

Shopify is a special company trying to solve the ABC of commerce on the internet for everyone. And it is run by deeply competent leader(s).

I’m not a shareholder, so it must be true.

Here are my highlights from the latest quarter.

Shopify is a special company trying to solve the ABC of commerce on the internet for everyone. And it is run by deeply competent leader(s).

I’m not a shareholder, so it must be true.

Here are my highlights from the latest quarter.

2/ “A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it. Then it’s a platform.”-Bill Gates

Merchants generated $307B, and its partners made $12B. SHOP’s revenue in 2020 was $2.9B. Like I said, it’s a special company.

Merchants generated $307B, and its partners made $12B. SHOP’s revenue in 2020 was $2.9B. Like I said, it’s a special company.

3/ Both GMV and revenue more than doubled as broader e-commerce penetration remains elevated.

Subscription Solution +71% YoY

Merchant solution +137% YoY

Gross Payments Volume (GPV) 46% of GMV (vs 42% in 1Q’21)

Subscription Solution +71% YoY

Merchant solution +137% YoY

Gross Payments Volume (GPV) 46% of GMV (vs 42% in 1Q’21)

4/ As mentioned in my recent deep dive, take rates remain the bigger piece of the puzzle to make the stock work in the long term.

Unless take rates ramp up 2-3x of what it is today in 10 years, it can be difficult to make sense of the current stock price.

Unless take rates ramp up 2-3x of what it is today in 10 years, it can be difficult to make sense of the current stock price.

5/ Okay, back to Shopify adulation.

“The number of shops actively selling on Facebook shops has more than quadrupled since Q1 a year ago as well as the GMV through Facebook.” 😍😍

Also, partnership with Tiktok and Pinterest.

“The number of shops actively selling on Facebook shops has more than quadrupled since Q1 a year ago as well as the GMV through Facebook.” 😍😍

Also, partnership with Tiktok and Pinterest.

6/ “More merchants join our fulfillment network in Q1, and we fulfilled similar volumes as in Q4”

“In 1Q'21, we funded over $300 million to our merchants, up 90% year-over-year”

“It took 4 years to fund the first $1 billion and just 1 quarter of that time to fund the second.”

“In 1Q'21, we funded over $300 million to our merchants, up 90% year-over-year”

“It took 4 years to fund the first $1 billion and just 1 quarter of that time to fund the second.”

7/ On Shop app:

“At the end of Q1 2021, Shop had more than 107 million registered users, including buyers using Shop Pay as well as the Shop App, of which more than 24 million were Monthly Active Users.”

“At the end of Q1 2021, Shop had more than 107 million registered users, including buyers using Shop Pay as well as the Shop App, of which more than 24 million were Monthly Active Users.”

8/ Outlook: Despite significant consensus beat, SHOP maintained its outlook because of different variables continue to be at play.

9/ However, SHOP played down the role of stimulus during the call, highlighting how international has outpaced US growth.

10/ Will e-commerce penetration take a backseat once things open up?

If Australia and NZ is any guide, the answer is no. Don’t expect any surge in e-commerce, but penetration is likely to remain elevated.

If Australia and NZ is any guide, the answer is no. Don’t expect any surge in e-commerce, but penetration is likely to remain elevated.

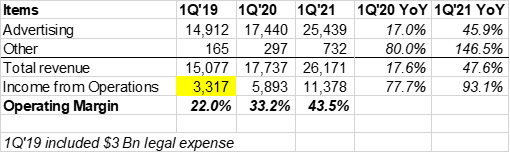

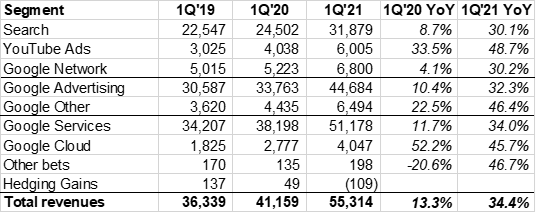

End/ I will cover $FB earnings tonight. Expect a thread by 10-11 pm ET.

You can also access all my twitter threads here: mbi-deepdives.com/twitter-thread…

You can also access all my twitter threads here: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh