Something I've been thinking about with DeFi recently is how you could use yield farming & staking to diversify your investments across L1s / L2s while making some money along the way

👇👇👇

👇👇👇

Say you're bullish on @0xPolygon, but you also don't want to stop buying into Ethereum.

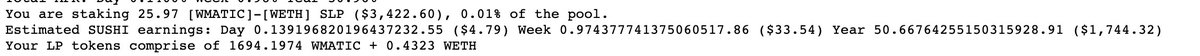

Well one option would be to move some money over to the Polygon network, buy a combination of Matic and Ether, provide those as liquidity on @SushiSwap, and then stake your LP tokens.

Well one option would be to move some money over to the Polygon network, buy a combination of Matic and Ether, provide those as liquidity on @SushiSwap, and then stake your LP tokens.

By doing this you're buying a combination of Ether / Matic so you have upside if either or both go up.

You also have some hedge if one goes up but the other doesn't.

And you're earning Sushi / Matic along the way by providing liquidity to SushiSwap.

You also have some hedge if one goes up but the other doesn't.

And you're earning Sushi / Matic along the way by providing liquidity to SushiSwap.

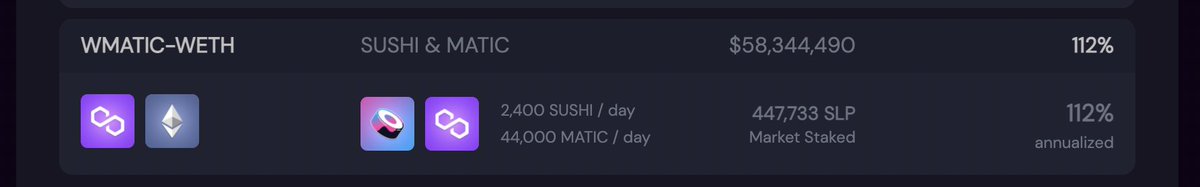

The MATIC/ETH stake on Sushi on Polygon right now is earning ~100% annualized.

It probably won't stay that high, but even if it's 10-20% that's some bonus upside you can earn for holding tokens you were interested in anyway.

Especially if you're bullish on Sushi (I am).

It probably won't stay that high, but even if it's 10-20% that's some bonus upside you can earn for holding tokens you were interested in anyway.

Especially if you're bullish on Sushi (I am).

Not investment advice and do your own research of course.

Obviously there are other platform risks and such, but this is a neat way to get some extra upside and get more involved in DeFi pretty passively.

And it's fun to watch your numbers in @vfat12 and @zapper_fi

Obviously there are other platform risks and such, but this is a neat way to get some extra upside and get more involved in DeFi pretty passively.

And it's fun to watch your numbers in @vfat12 and @zapper_fi

• • •

Missing some Tweet in this thread? You can try to

force a refresh