A thread on #Mucormycosis :

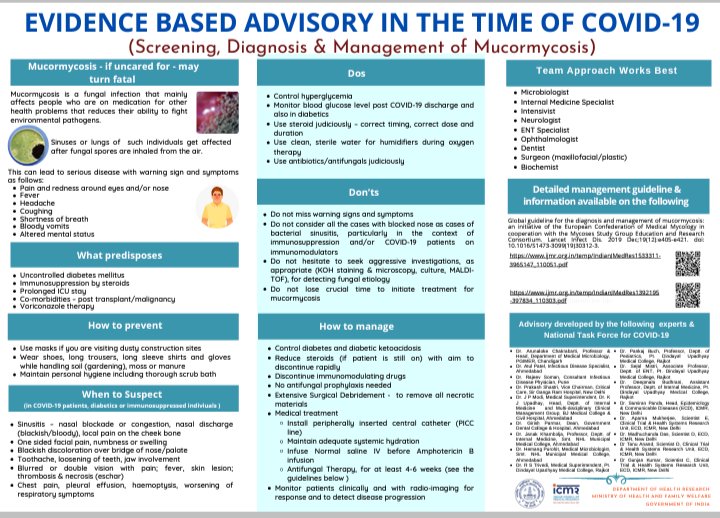

One of the lethal complications of Covid is Mucormycosis, also known as ‘Black fungus’ #infection. This dangerous fungal infection affects the nose, eye and sometimes the brain. My colleagues in ENT and Ophthalmology told me that previously (1/n)

One of the lethal complications of Covid is Mucormycosis, also known as ‘Black fungus’ #infection. This dangerous fungal infection affects the nose, eye and sometimes the brain. My colleagues in ENT and Ophthalmology told me that previously (1/n)

...this disease was rare and they used to get only 1-2 cases per year but now they are getting 2-3 cases/day.Diabetics are more prone to suffer from this disease as high sugar levels are favourable for mucor’s growth. Excess use of steroids in Covid also increases...(2/n)

....the chances of developing mucormycosis as steroids tend to increase blood sugar levels. My colleagues told me that when sugar level crosses 200 mg/dl (Normal range: 70-140), there are higher chances of developing mucormycosis. (3/n)

An #antifungal drug which is effective against the mucor is Amphotericin-B. This drug has to be given for longer period (few months) as all the fungal infections take time to cure. As one dose costs around 3000 rs. ,the overall cost of the treatment is around 5-10 lacs.(4/n)

Inspite of the treatment the disease may spread in eye, jaw, nose etc. and the affected organ has to be removed to save the life of a patient. (5/5)

#CovidComplication

#CovidComplication

• • •

Missing some Tweet in this thread? You can try to

force a refresh