1/6 During yesterday's mini-dip, I saw unrest in my feed & some people were pinging me if I was still bullish on #Bitcoin

To me this was nothing but another shake-out of weak hands and leverage, while nothing changed regarding the big picture 🤷♂️

A short 🧵 on (not) getting rekt

To me this was nothing but another shake-out of weak hands and leverage, while nothing changed regarding the big picture 🤷♂️

A short 🧵 on (not) getting rekt

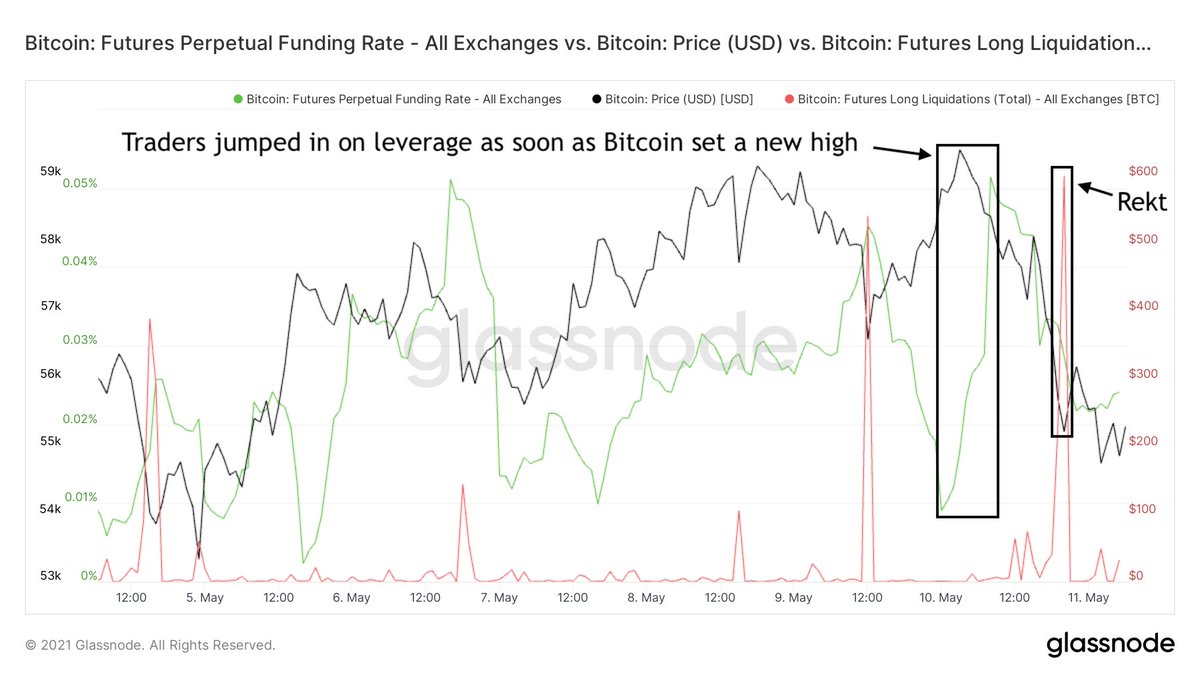

2/6 So, what happened?

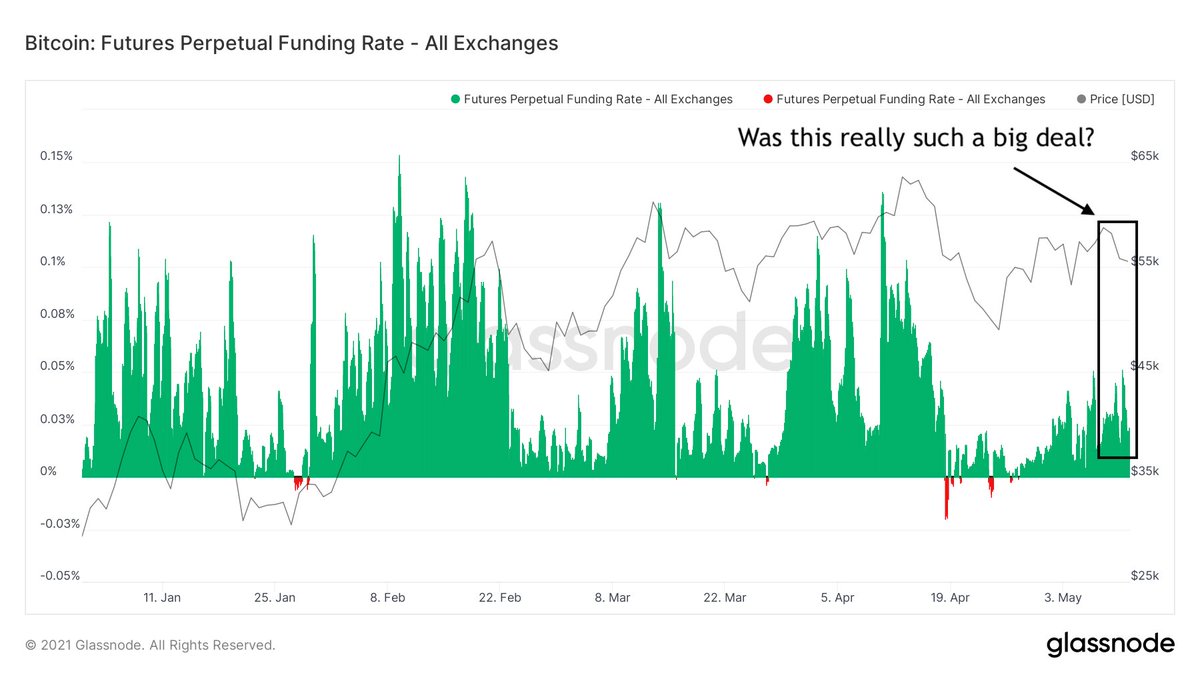

Simple: as soon as #Bitcoin set a new local high and dipped a bit, there was a steep uptick in people aping in long on leverage again 🦍

As always, this is a recipe for getting rekt - which is exactly what happened a few hours later 🤦

Simple: as soon as #Bitcoin set a new local high and dipped a bit, there was a steep uptick in people aping in long on leverage again 🦍

As always, this is a recipe for getting rekt - which is exactly what happened a few hours later 🤦

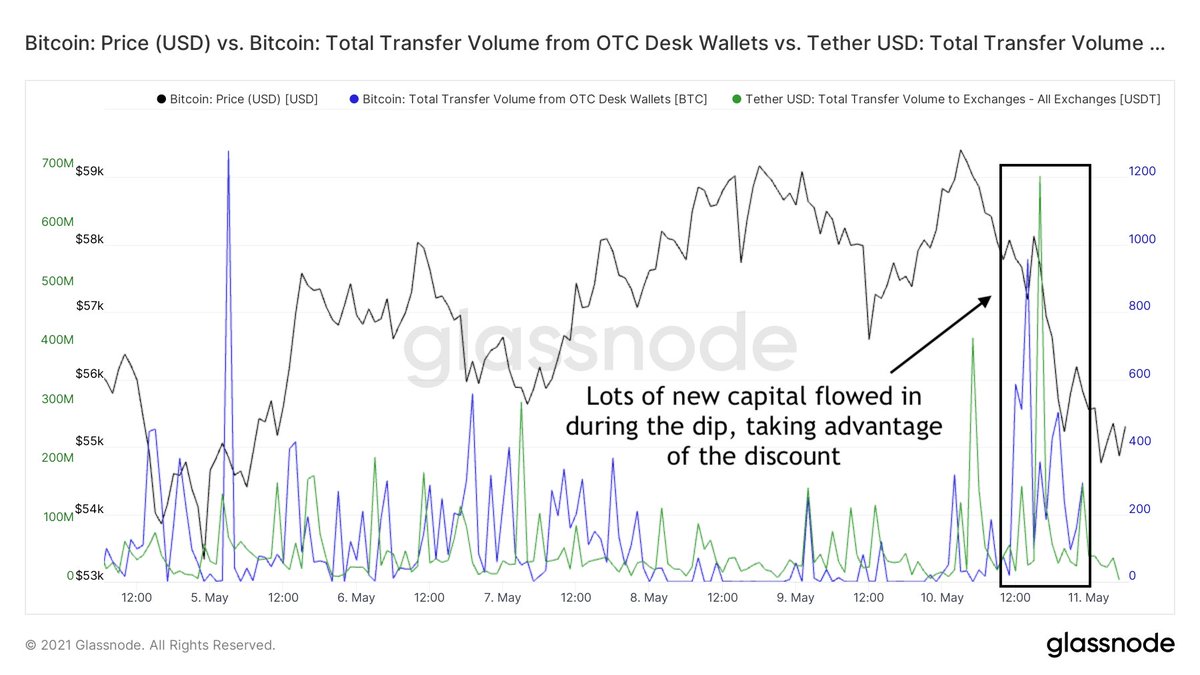

3/6 Meanwhile, there were large stablecoin inflows to exchanges and large #bitcoin outflows from OTC desks - both signs that there is some serious dip buying going on

"Thanks for the liquidity, (rekt) apes!" 🐳🎩

"Thanks for the liquidity, (rekt) apes!" 🐳🎩

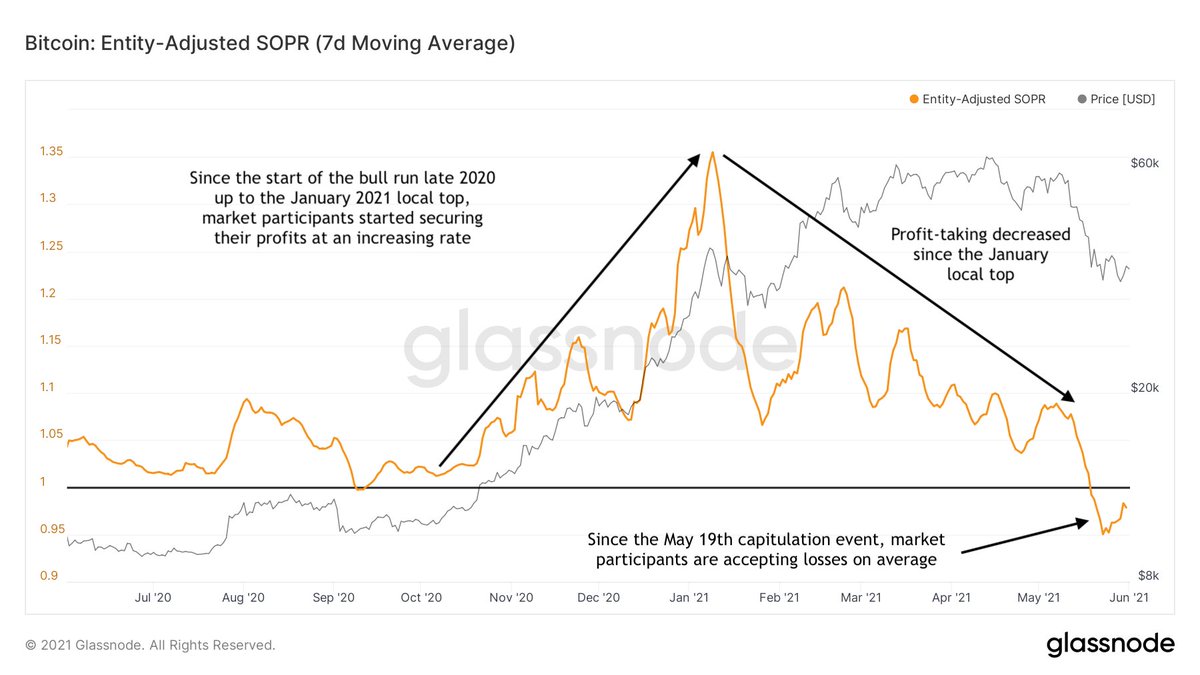

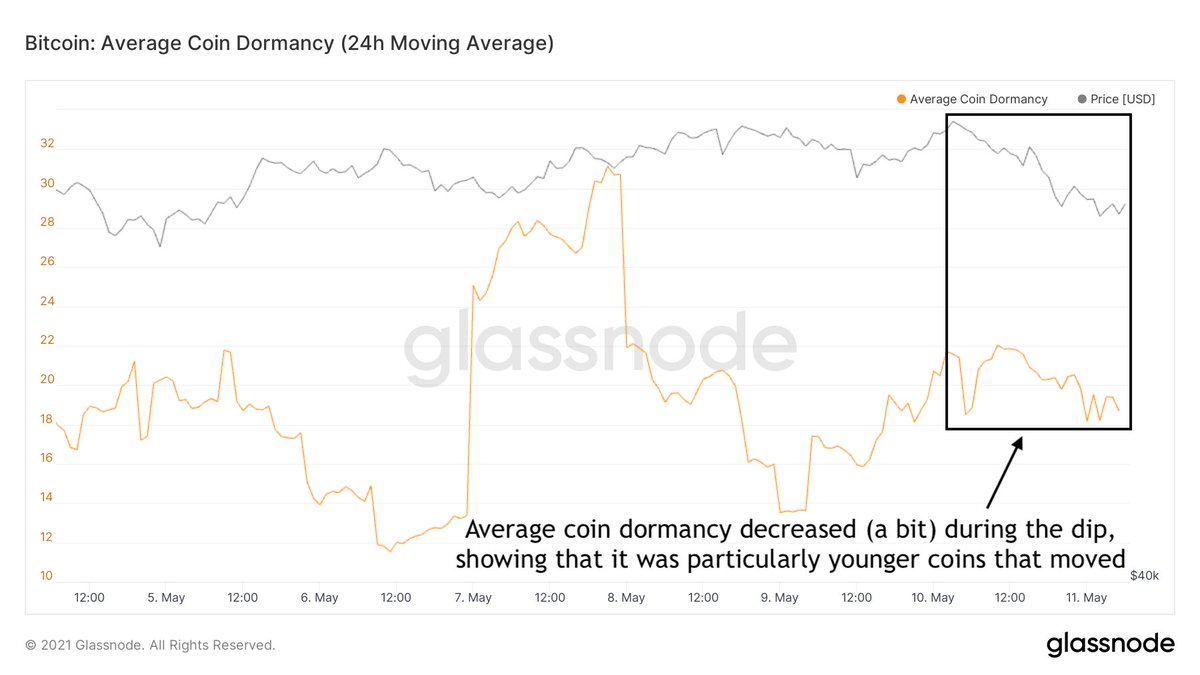

4/6 During this dip, the average coin dormancy decreased (a bit), which means that relatively young coins made up an increasingly large part of the on-chain volume

Another sign that it was particularly the less experienced market participants that were triggered by the dip

Another sign that it was particularly the less experienced market participants that were triggered by the dip

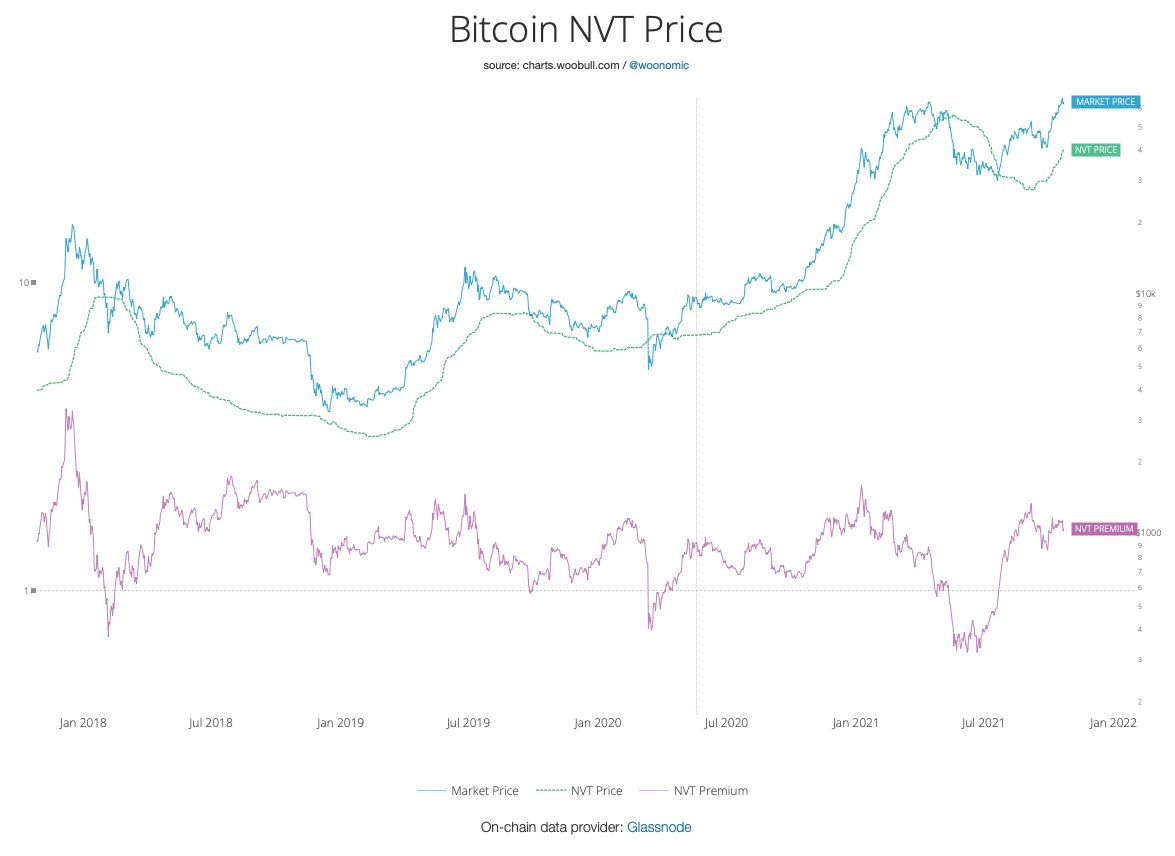

5/6 The irony is that if you zoom out (even just a little bit), none of this was a big deal at all 🤏

Unless you're an experienced, professional trader that consciously chooses to trade small timeframes: zoom out & slow down (lower your time preference)

Unless you're an experienced, professional trader that consciously chooses to trade small timeframes: zoom out & slow down (lower your time preference)

6/6 That is why I am personally not looking at intra-day charts and on-chain flows but particularly focus on the larger (4-year) market cycle

If you're curious about my current thoughts on the bigger picture and why I am not worried, this 🎩 might help:

If you're curious about my current thoughts on the bigger picture and why I am not worried, this 🎩 might help:

https://twitter.com/dilutionproof/status/1390994566686314496

• • •

Missing some Tweet in this thread? You can try to

force a refresh