#Bitcoin analyst & writer Nostr: #npub1tlnmatnpznq4djxysleje5247kumu9hw7k3frqs6qh7e0yaf3kksvltsg5

2 subscribers

How to get URL link on X (Twitter) App

2/5 The first concept to grasp is that of Realized Value (RV), introduced by @nic__carter & @khannib in 2018

2/5 The first concept to grasp is that of Realized Value (RV), introduced by @nic__carter & @khannib in 2018

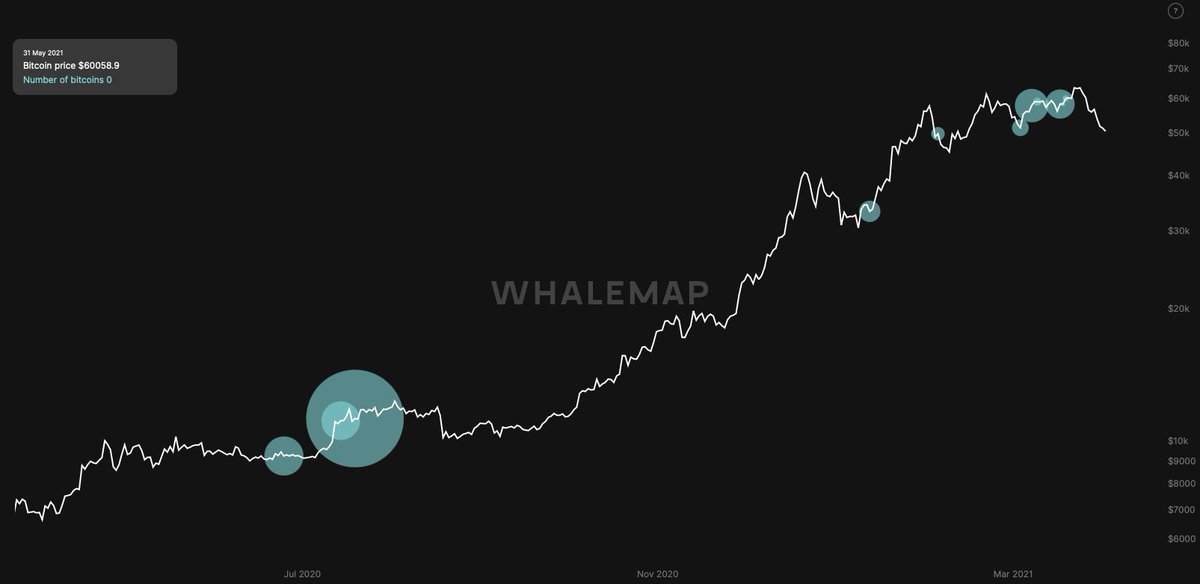

2/17 Last year, @Glassnode learned that when an Unspent Transaction Output (UTXO) is >155 days old, its has a relatively low probability of being spent

2/17 Last year, @Glassnode learned that when an Unspent Transaction Output (UTXO) is >155 days old, its has a relatively low probability of being spent

https://twitter.com/elonmusk/status/13926020410258432032/9 First, there's the inconsistency:

2/7 As a result of the hash rate drop, block interval times increased, which means that blocks were temporarily being produced at a (much) slower pace than the normal 10 blocks/min

2/7 As a result of the hash rate drop, block interval times increased, which means that blocks were temporarily being produced at a (much) slower pace than the normal 10 blocks/min

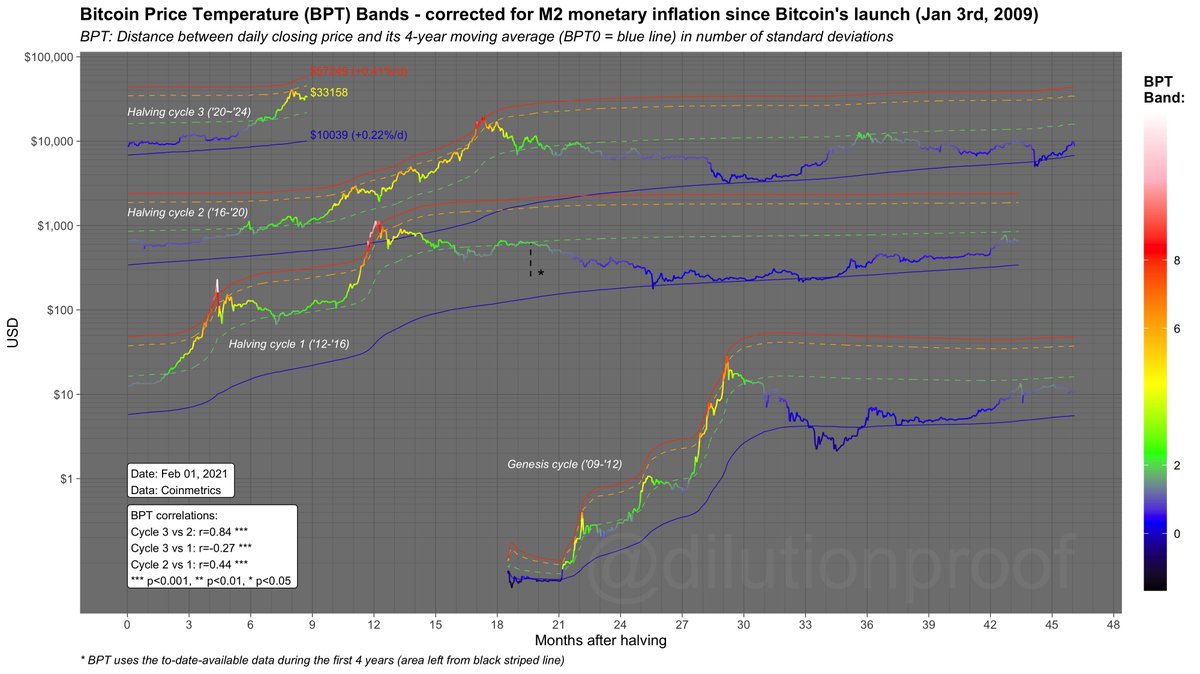

https://twitter.com/dilutionproof/status/1345327702212046849Februari 2021:

https://twitter.com/dilutionproof/status/1356339471357276161

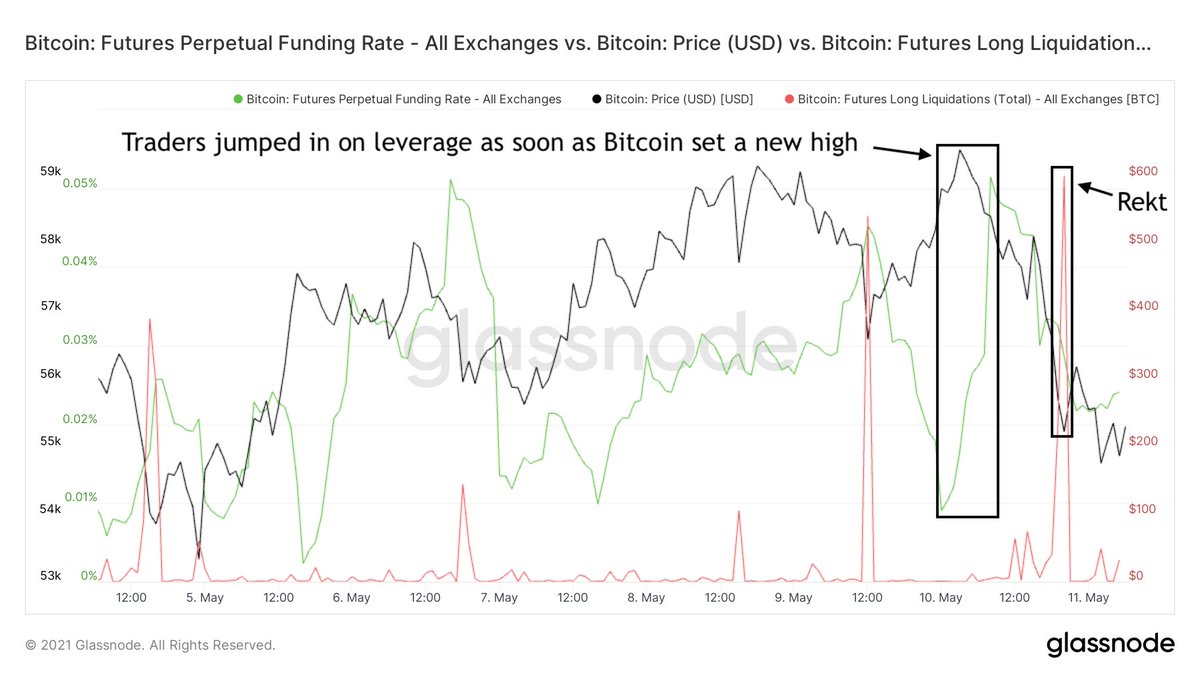

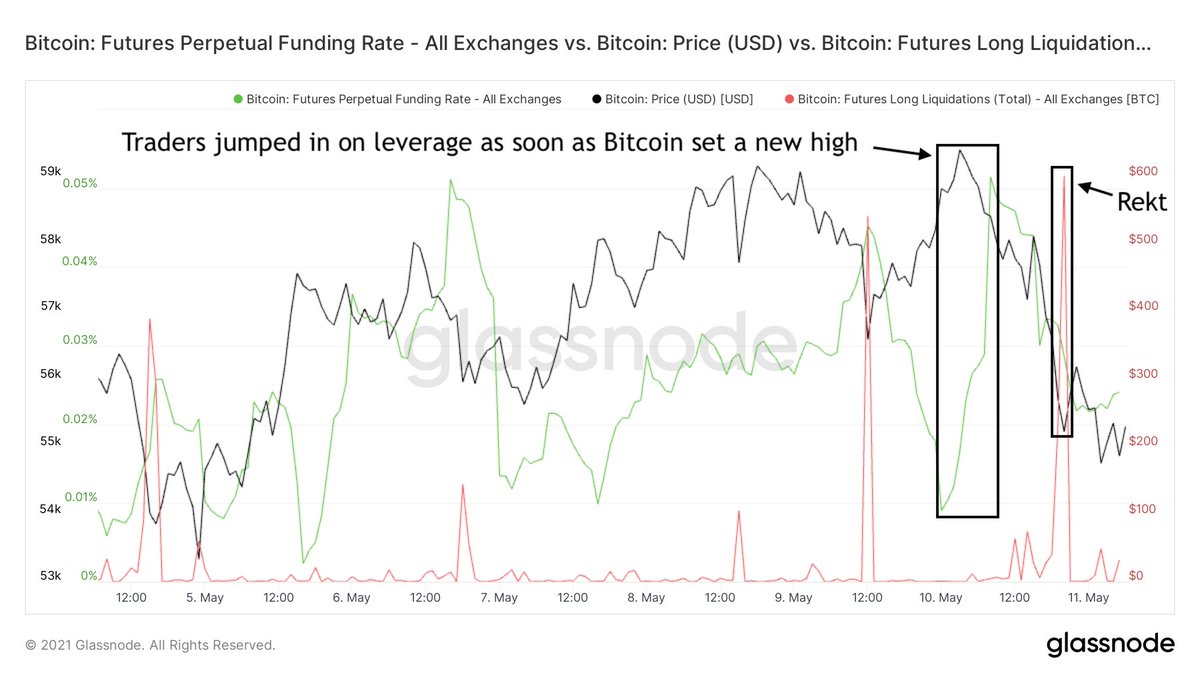

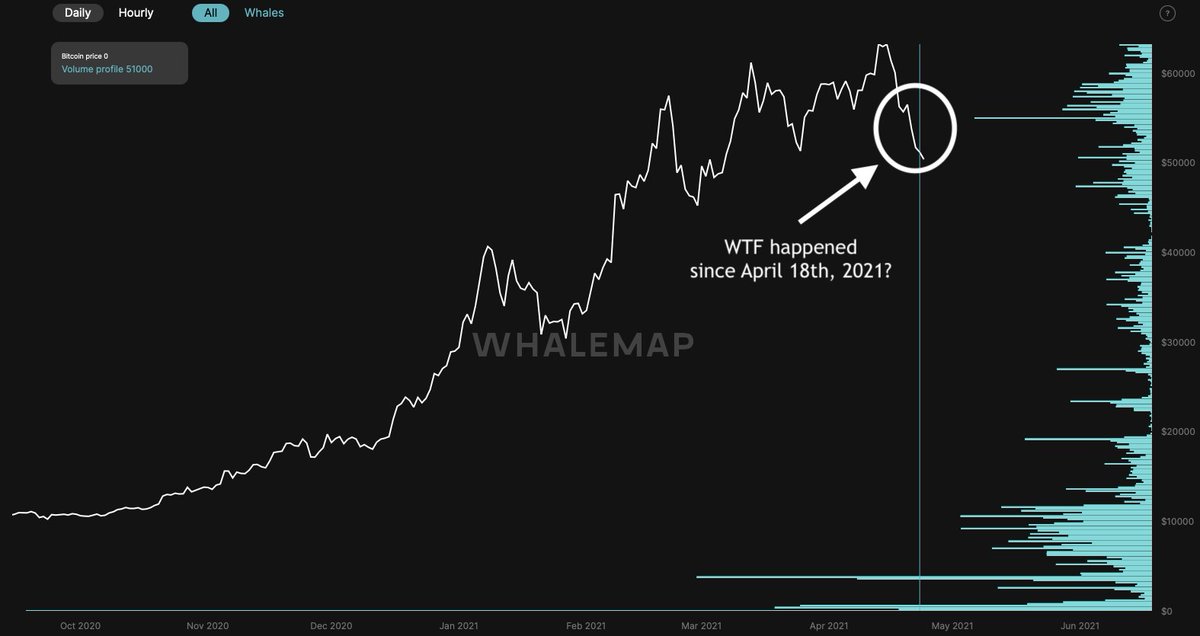

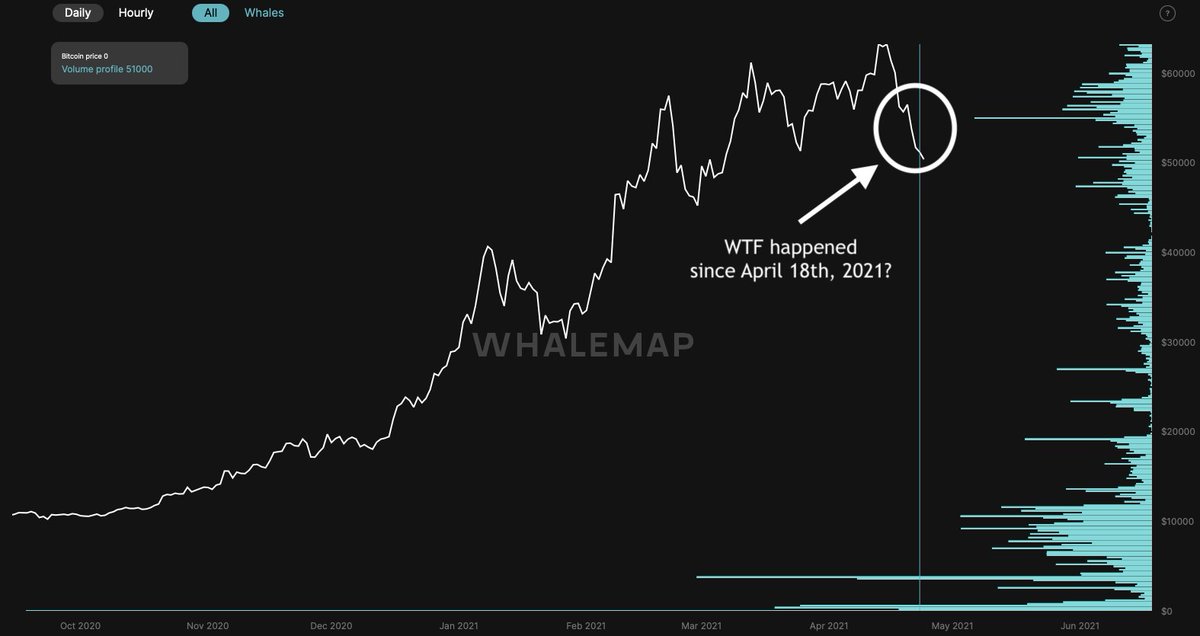

2/6 The market turnaround started last Sunday (April 18th), when price broke through $60k with increased volume

2/6 The market turnaround started last Sunday (April 18th), when price broke through $60k with increased volume

https://twitter.com/dilutionproof/status/1356218323835506690

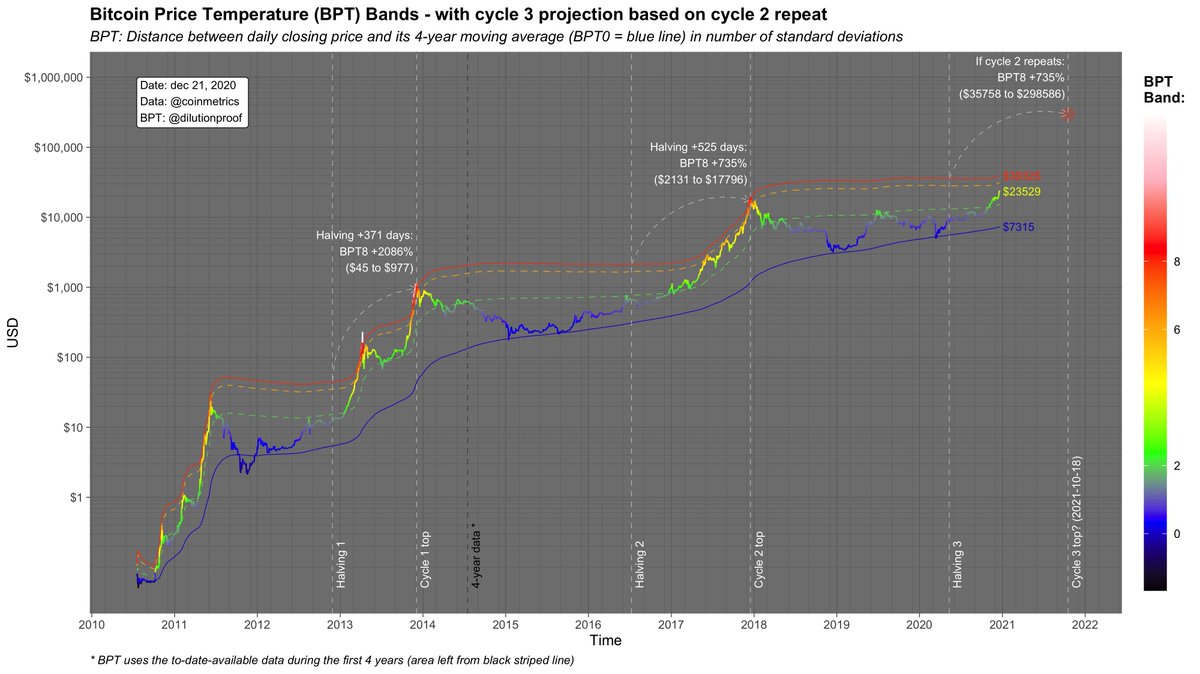

https://twitter.com/dilutionproof/status/1344031257974501376?s=20

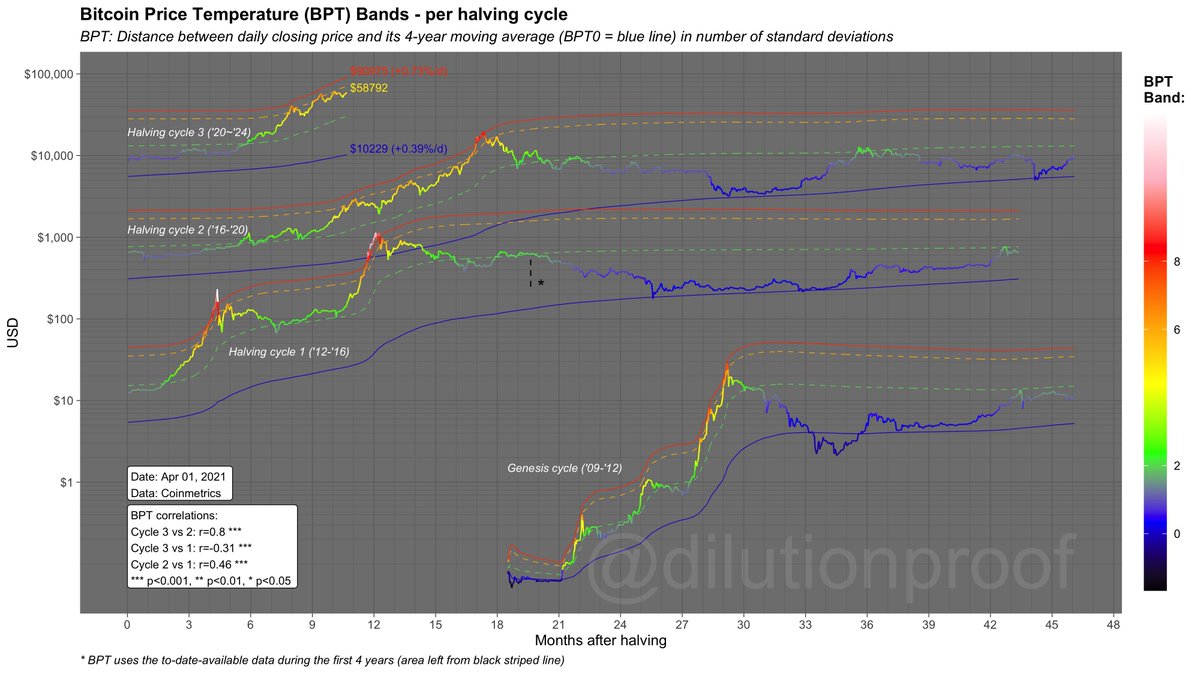

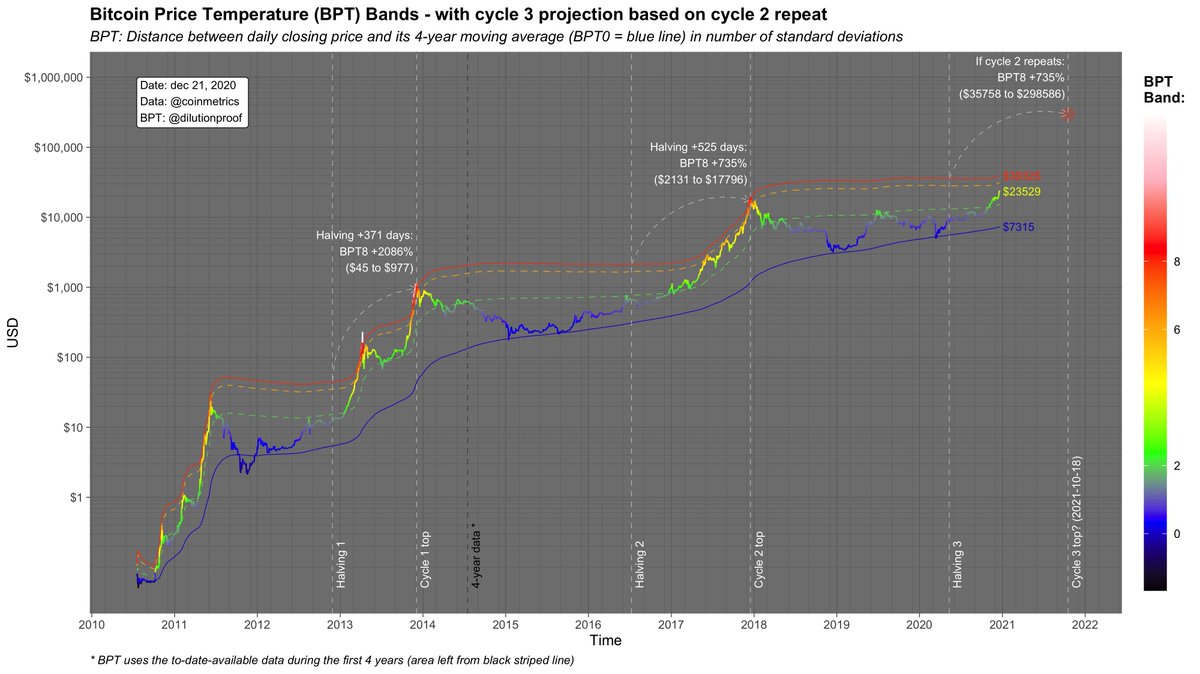

2/6 Based on yesterday's daily closing price, the current #Bitcoin Price Temperature (BPT) is 4.58, which is comparable to the temperatures reached during 2013-Q1 & 2017-Q2 during the previous halving cycles.

2/6 Based on yesterday's daily closing price, the current #Bitcoin Price Temperature (BPT) is 4.58, which is comparable to the temperatures reached during 2013-Q1 & 2017-Q2 during the previous halving cycles.

2/10 Q: What Is the #Bitcoin Price Temperature (BPT)?

2/10 Q: What Is the #Bitcoin Price Temperature (BPT)?https://twitter.com/dilutionproof/status/1338942312437706756?s=20

https://twitter.com/btconometrics/status/13406463332799242292/16 #Bitcoin's largest and most well-known cycle is the halving cycle, which is the result of the block rewards (the newly minted coins that miners receive when they win the rights to create a new block) being cut in half every 210.000 blocks (~4 years).