THREAD: Construction output in March 2021 was 5.8% higher than in rain-affected February & 6.0% higher than in March 2020 according to the ONS. Output was also higher than pre-Covid-19 & at its highest level since September 2019...

#ukconstruction

ons.gov.uk/businessindust…

#ukconstruction

ons.gov.uk/businessindust…

... On a monthly basis, construction output in March 2021 was 5.8% higher than rain-affected February with increases in almost every construction sector & the largest rises public housing (+16.7%), private housing (+9.4%) & private housing rm&i (+7.7%) whilst...

#ukconstruction

#ukconstruction

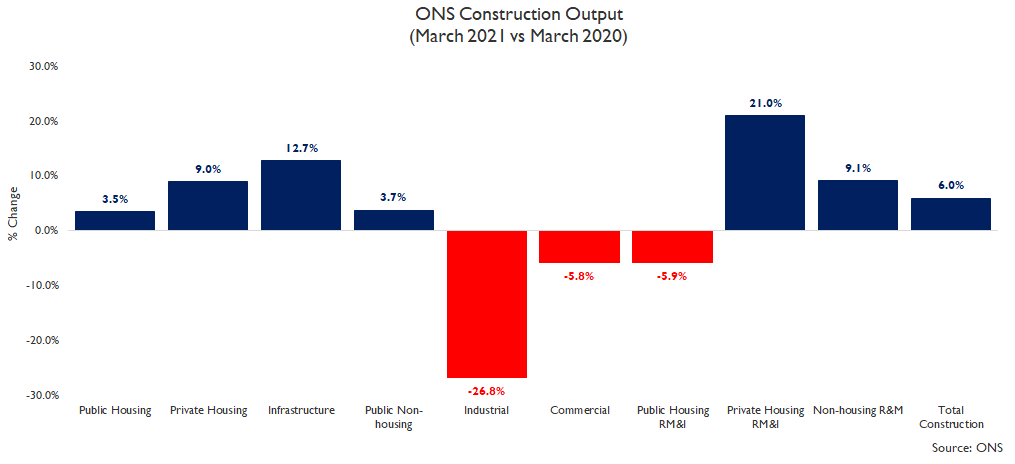

... on an annual basis, construction output in March 2021 was 6.0% higher than a year earlier although it is worth noting that construction output from 23 March 2020 was affected by the social distancing restrictions during the initial lockdown...

#ukconstruction #construction

#ukconstruction #construction

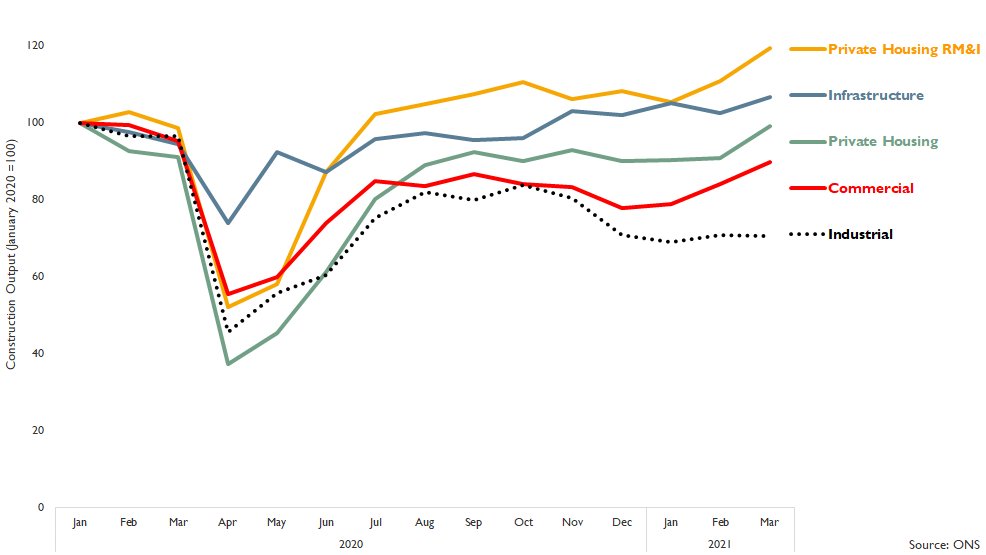

... & it is useful to see how key sectors have evolved since January 2020 (pre-Covid-19). Total construction output in March 2021 was 1.7% higher than in January 2020 with the sharpest recoveries in private housing rm&i, infrastructure & private housing whilst...

#ukconstruction

#ukconstruction

... construction output in commercial & industrial during March 2021 remained double-digit percentages lower than in January 2020 according to the ONS. Looking at individually at the key sectors...

#ukconstruction

#ukconstruction

... private housing output in March 2021 was 9.4% higher than in rain-affected February & was 9.0% higher than a year ago but it was 0.8% lower than in January 2020 (pre-Covid-19), which sounds counter-intuitive given the buoyant housing market but...

#ukhousing #ukconstruction

#ukhousing #ukconstruction

... housing starts & completions (new build homes) were above pre-Covid-19 levels at the end of last year, housing output also includes conversions (e.g. a house changed into flats) & changes in use (e.g. offices changed to flats), which are subdued...

#ukhousing #ukconstruction

#ukhousing #ukconstruction

... Overall, house builders reported that demand was strong in March & that the extensions to the current Help to Buy & the Stamp Duty holiday plus the mortgage guarantee scheme will help to sustain demand for the majority of the year...

#ukhousing #ukconstruction

#ukhousing #ukconstruction

... Private housing repair, maintenance & improvement in March 2021 was 7.7% higher than in rain-affected February, 21.0% higher than in March 2020 (affected by the initial lockdown towards from 23 March 2020) & 19.3% higher than in January 2020 (pre-Covid-19)...

#ukconstruction

#ukconstruction

... & SME contractors I spoke to in March 2021 stated that there was a sharp increase in rm&i activity from the start of March with work focusing on home-office facilities for working from home & making better use of (& improving the quality of) outdoor space...

#ukconstruction

#ukconstruction

... Infrastructure output in March 2021 was 4.0% higher than in February 2021, 12.7% higher than in March 2020 & 6.5% higher than in January 2020 (pre-Covid-19). Infrastructure activity rose in March 2021 due to...

#ukconstruction #ukinfrastructure

#ukconstruction #ukinfrastructure

... work on major projects, such as HS2 (despite further delays & cost overruns), Thames Tideway & Hinkley Point C as well as programmes & frameworks in regulated sectors such as Highways England roads projects...

#ukconstruction #ukinfrastructure

#ukconstruction #ukinfrastructure

... Commercial (offices, retail & leisure) output in March 2021 was 6.7% higher than in February 2021 & it has risen for 3 consecutive months due to mainly fit-out work on existing units preparing for opening/reopening as social distancing restrictions ease & ...

#ukconstruction

#ukconstruction

... remodelling existing facilities to be used with social distancing but output in March 2021 remained 5.8% lower than a year ago (note activity in March 2020 was affected by the initial lockdown) & 10.3% lower than in January 2020 (pre-Covid-19) due to...

#ukconstruction

#ukconstruction

... lower productivity on towers projects (where social distancing is more difficult due to different groups of trades mixing in tight spaces) so towers are taking longer & costing more plus fewer new large towers to replace those projects finishing...

#ukconstruction

#ukconstruction

Overall, looking back to the nadir of construction output in the initial lockdown in April 2020, in which output was 45% lower than a year ago, it is remarkable that construction output surpassed pre-Covid-19 levels of output in less than one year (March 2021)...

#ukconstruction

#ukconstruction

... & output in some construction sectors, such as private housing repair, maintenance & improvement (rm&i) & infrastructure, had already surpassed pre-Covid-19 levels of output by Autumn 2020 (pent-up demand) just a few months after the April nadir. END OF THREAD

#ukconstruction

#ukconstruction

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh