My investing style: Buy and hold high-quality businesses

Here are 15 traits that tell me I've found a great business ⬇️

Here are 15 traits that tell me I've found a great business ⬇️

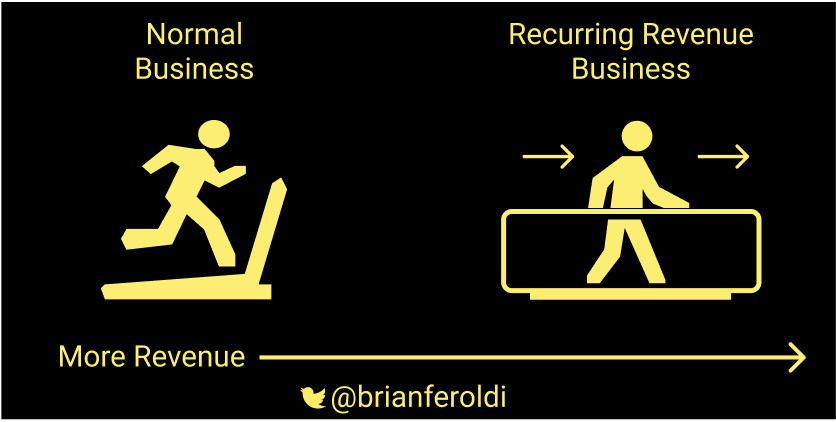

1/ Recurring Revenue

Types:

Business Services $MCO

Contracts $AMT

Consumables $MNST

Exchange $MKTX

Franchise $WINA

Membership $TDOC

Platform $ETSY

Razor/blade $DXCM

Real Estate $STOR

SaaS, PaaS, IaaS $TWLO, $NOW, $FSLY

Subscription $NFLX

Tollbooth $BIP

Types:

Business Services $MCO

Contracts $AMT

Consumables $MNST

Exchange $MKTX

Franchise $WINA

Membership $TDOC

Platform $ETSY

Razor/blade $DXCM

Real Estate $STOR

SaaS, PaaS, IaaS $TWLO, $NOW, $FSLY

Subscription $NFLX

Tollbooth $BIP

2/ Recession-Proof Demand

Great companies sell products/services that are in-demand in good times and bad

That allows them to grow regardless of what is happening in the broader economy

Great companies sell products/services that are in-demand in good times and bad

That allows them to grow regardless of what is happening in the broader economy

3/ Organic Growth

"Organic" growth: Growing by increasing sales of internally developed products/services

"Inorganic" growth: Growing from mergers & acquisitions

Organic Growth > Inorganic Growth

"Organic" growth: Growing by increasing sales of internally developed products/services

"Inorganic" growth: Growing from mergers & acquisitions

Organic Growth > Inorganic Growth

4/ High & Expanding Gross Margin

Indicates that the company’s products/services create a huge amount of value for the customer

Rising gross margin also indicates pricing power

Indicates that the company’s products/services create a huge amount of value for the customer

Rising gross margin also indicates pricing power

5/ Widening moat

Capitalism is brutal

A widening moat will protect a company's profits from competition

Sources:

Network effects: $FB

Switching costs: $ADBE

Durable Cost Advantage: $WMT

Premium Brand: $PTON

Patents: $OLED

Counter-Positioning: $TSLA

Capitalism is brutal

A widening moat will protect a company's profits from competition

Sources:

Network effects: $FB

Switching costs: $ADBE

Durable Cost Advantage: $WMT

Premium Brand: $PTON

Patents: $OLED

Counter-Positioning: $TSLA

6/ Operating Leverage

If a company can grow its costs at a slower rate than revenue then its profits will grow at a FASTER than revenue

This concept was visualized beautifully by @10kdiver

If a company can grow its costs at a slower rate than revenue then its profits will grow at a FASTER than revenue

This concept was visualized beautifully by @10kdiver

https://twitter.com/BrianFeroldi/status/1369806693882814470?s=20

7/ Low-cost customer acquisition

The best marketing is no marketing

Great companies create demand through word of mouth and spend little on sales & marketing

The best marketing is no marketing

Great companies create demand through word of mouth and spend little on sales & marketing

8/ Diversified Revenue

Companies that depend on a few customers for most of their revenue are fragile

One customer leaving can ruin the investing thesis

Great businesses serve thousands of customers, not just a few big ones

Companies that depend on a few customers for most of their revenue are fragile

One customer leaving can ruin the investing thesis

Great businesses serve thousands of customers, not just a few big ones

9/ Great Management

Management matters

Here is a thread I wrote in what I look for in a great CEO

Management matters

Here is a thread I wrote in what I look for in a great CEO

https://twitter.com/BrianFeroldi/status/1391395614500532230?s=20

10/ Reinvestment Opportunities

Great businesses can reinvest profits back into themselves at high rates of return for long periods of time

This continuously grows the profit stream, which will eventually lead to share price appreciation

Great businesses can reinvest profits back into themselves at high rates of return for long periods of time

This continuously grows the profit stream, which will eventually lead to share price appreciation

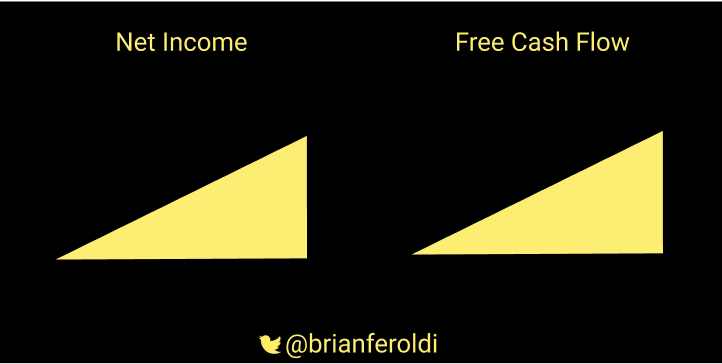

11/ Profits

Companies that produce profits have far more control over their destiny than companies that don’t

I want to see that both net income & free cash flow are positive & growing

Companies that produce profits have far more control over their destiny than companies that don’t

I want to see that both net income & free cash flow are positive & growing

12/ Optionality

Great companies create new revenue opportunities for themselves by launching new products/services that open up new markets

Ex:

$AMZN -> AWS

$MELI -> Payments

$TSLA -> Energy Storage

Great companies create new revenue opportunities for themselves by launching new products/services that open up new markets

Ex:

$AMZN -> AWS

$MELI -> Payments

$TSLA -> Energy Storage

13/ Huge Total Addressable Market (TAM)

I want to own companies that have only captured a small fraction of their opportunity

That creates a long runway for continued growth

I want to own companies that have only captured a small fraction of their opportunity

That creates a long runway for continued growth

14/ Price Maker

Companies that sell commodities have no control over the price of their product

I want to own price makers, not price takers

Companies that sell commodities have no control over the price of their product

I want to own price makers, not price takers

15/ Anti-Fragile Balance Sheet

Cash-rich companies get stronger in downturns

Debt-laden companies get weaker in downturns

Cash-rich companies get stronger in downturns

Debt-laden companies get weaker in downturns

Enjoy this thread?

I regularly tweet about money, investing, and self-improvement

If those topics interest you, follow me

@BrianFeroldi

I regularly tweet about money, investing, and self-improvement

If those topics interest you, follow me

@BrianFeroldi

Want to see me & @tmfstoffel show you how we research a business in real-time?

We do so weekly on my YouTube channel

youtube.com/c/brianferoldi…

We do so weekly on my YouTube channel

youtube.com/c/brianferoldi…

To summarize, I want:

✔️Recurring Revenue

✔️Recession-Proof

✔️Organic Growth

✔️High GM

✔️Widening moat

✔️Operating Leverage

✔️Low-cost Marketing

✔️Diversified Customers

✔️Great Management

✔️Reinvestment

✔️Profits

✔️Optionality

✔️Huge TAM

✔️Price Maker

✔️Strong Balance Sheet

✔️Recurring Revenue

✔️Recession-Proof

✔️Organic Growth

✔️High GM

✔️Widening moat

✔️Operating Leverage

✔️Low-cost Marketing

✔️Diversified Customers

✔️Great Management

✔️Reinvestment

✔️Profits

✔️Optionality

✔️Huge TAM

✔️Price Maker

✔️Strong Balance Sheet

• • •

Missing some Tweet in this thread? You can try to

force a refresh