Fun change I've went through in the past 6 months or so as my portfolio grew bigger:

I used to care more about missing out on gains than losing money itself. The opposite is now true.

I rather protect my capital and miss out on potential gains than take unecessary risks.

I used to care more about missing out on gains than losing money itself. The opposite is now true.

I rather protect my capital and miss out on potential gains than take unecessary risks.

Of course you will still see me ape into small caps and go big on $alts etc.

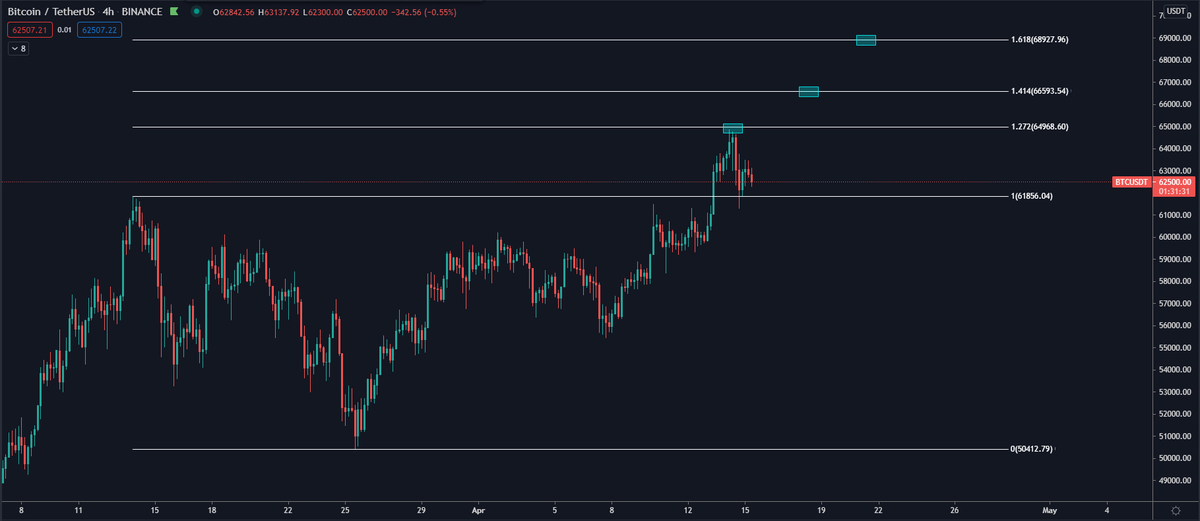

The difference being that I pick the risks I take more carefully. I also focus on hedging my spot holding a lot more when I think there is a high probability of potential downside.

The difference being that I pick the risks I take more carefully. I also focus on hedging my spot holding a lot more when I think there is a high probability of potential downside.

This change in mindset probably has to do with the fact that with a relatively smaller portfolio I was ready to take bigger risks to try and make the maximum amount of gains I could, within the current cycle.

When my portfolio grew bigger I started play it more conservative to make sure I wouldn't give it back just as fast as I made it in the first place.

Bear market PTSD definitely plays a big role in this but I'm very happy to have gone through this experience and learned from it.

Bear market PTSD definitely plays a big role in this but I'm very happy to have gone through this experience and learned from it.

Of course this is a personal preference and a different mindset everyone has.

I just found it interesting to see this change happening to myself as time went on.

Have a good day 🔥

I just found it interesting to see this change happening to myself as time went on.

Have a good day 🔥

• • •

Missing some Tweet in this thread? You can try to

force a refresh